Yerukola Eswara Prasad

Koyel Ghosh

Energy and Power Domain: Role of Emerging Markets in Helping the Sector Flourish in Q1 2025

The growing electricity consumption from the residential, commercial, and industrial sectors across the globe has transformed the energy and power domain in recent times. Furthermore, the shift toward renewable energy sources such as solar, wind, nuclear, and hydropower has played an important role in expanding the scope of the sector in the past few years. In addition, the electrification of transport services with the advent of electric vehicles has impacted the sector positively. On the other hand, geopolitical tensions and supply chain disruptions have restricted the growth of the domain. Nonetheless, the growing emphasis on the digitalization of different services has created numerous profitable opportunities in the sector. Apart from this, certain markets contributed to the growth of the energy and power landscape in the first quarter of 2025. This newsletter comprehensively covers the major factors behind the rise of these industries in Q1 2025.

Low Carbon Building Market

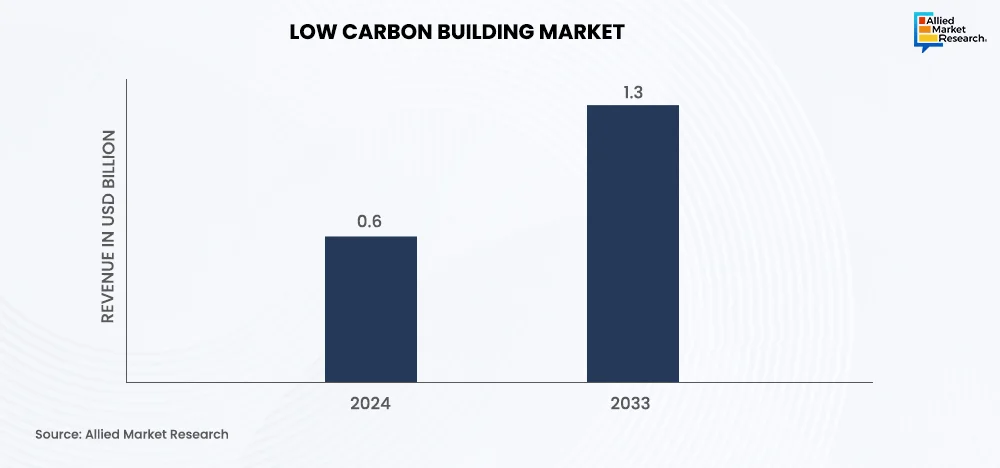

The low carbon building market accounted for $0.6 trillion in 2023 and is predicted to gather a revenue share of $1.3 trillion by 2033, rising at a CAGR of 9.1% during 2024-2033. In the last few years, several developed and developing countries across the globe have announced net zero targets and highlighted the measures they are likely to take to reduce the pace of global warming and climate change. As part of these steps, governments have enacted laws and legislations that make it compulsory for real estate developers to opt for raw materials and processes that have minimal impact on the environment. These initiatives are anticipated to bring in numerous growth opportunities in the near future.

The AMR report provides a comprehensive regional analysis to help companies study the performance of the industry in various regions across the globe, including North America, Europe, Asia-Pacific, and LAMEA. The main reason for providing this study is to aid businesses in making the right investment decisions in the long run. As per the report, the Asia-Pacific region held the highest revenue share in 2023 and is expected to witness significant growth in the next few years. The growing pace of urbanization in India, China, South Korea, Japan, and Australia helped the industry flourish in the first quarter of 2025.

Temporary Power Market

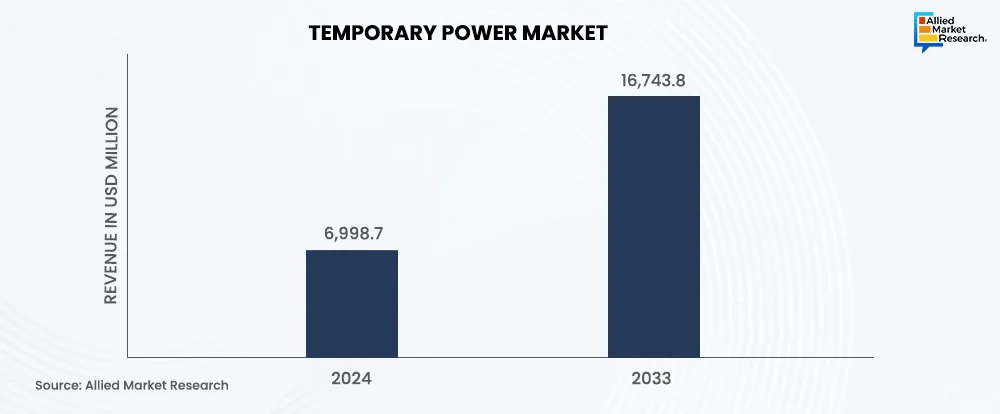

Temporary power systems such as battery systems, grid connections, and portable generators are used to fulfill short-term energy requirements, in cases where permanent or fixed electricity sources are not available. The rising demand for sustainable and fuel-efficient generators is anticipated to create numerous growth opportunities in the temporary power market. The industry accounted for $6.4 billion in 2023 and is predicted to gather a revenue of $16.7 billion by 2033, citing a CAGR of 10.2% during 2024-2033. The integration of renewable energy sources such as solar and wind impacted the sector positively in Q1 2025.

The segmental analysis provided in the AMR report studies the market based on power source and end-use. By power source, the diesel segment held the highest revenue share in 2023 and is predicted to continue its dominance in the coming period. The rising use of diesel generators in construction sites, disaster relief operations, outdoor events, and remote industrial projects has augmented the growth rate of the temporary power industry in the last few years. Furthermore, the portability and scalability offered by these tools and equipment accelerated sectoral growth in Q1 2025.

Capacitor Bank Market

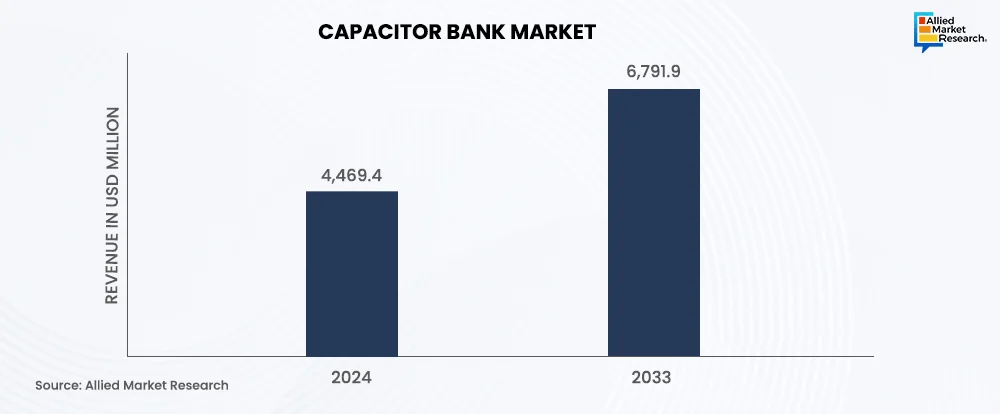

A capacitor bank is an electrical device consisting of multiple capacitors of the same rating, connected in series or parallel, to enhance power efficiency and performance. These capacitors are used to store electrical energy; thus, the greater the number of capacitors, the higher the storage capacitor of the device. Over the years, the applicability of capacitor banks has increased significantly in various end-use industries such as steel, cement, paper and pulp, power generation, and mining. The growing integration of renewable power sources is anticipated to assist the capacitor bank industry in gathering a revenue of $6.8 billion by 2033. The industry accounted for $4.3 billion in 2023 and is estimated to grow at a CAGR of 4.8% during 2024-2033.

The AMR report classifies the industry into various segments based on voltage, type, installation, application, and connection type. By type, the internally fused segment held the largest revenue share in the market and is expected to make significant gains in the near future. The rising usage of internally fused capacitor banks for power factor correction, reactive power compensation, and voltage stabilization is anticipated to bring numerous lucrative opportunities in the next few years.

LNG Engine Market

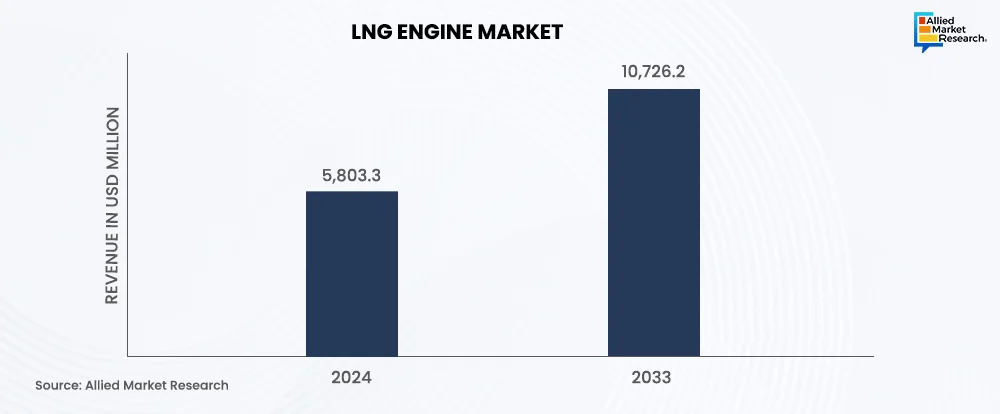

The LNG engine market is predicted to reach a revenue of $10.7 billion by 2033. The industry accounted for $5.4 billion in 2023 and is anticipated to rise at a CAGR of 7.1% during 2024-2033. The increasing emphasis on reducing carbon emissions has led to a rise in the adoption of cleaner fuels and energy sources. This has surged the demand for LNG engines, thereby opening new avenues for the growth of the sector. Additionally, the growing deployment of these engines in transportation, marine, and power generation industries became a major factor in the expansion of the market in the first quarter of 2025.

The AMR report highlights the various demographic, administrative, socioeconomic, cultural, political, and legal factors impacting the market in various regions across the globe, including North America, LAMEA, Europe, and Asia-Pacific. As per the report, the Asia-Pacific region is expected to be the most profitable in the coming period owing to the rapid pace of industrialization and urbanization in countries like China, South Korea, Japan, and India. Furthermore, the rising adoption of LNG-powered trucks and buses in these nations has created favorable conditions for the growth of the industry in recent times. In addition, the governments and private companies in these sovereign states have made substantial investments in LNG engines and pioneered several R&D activities in the last few years. These initiatives and programs were a major growth driver of the landscape in the first quarter of 2025.

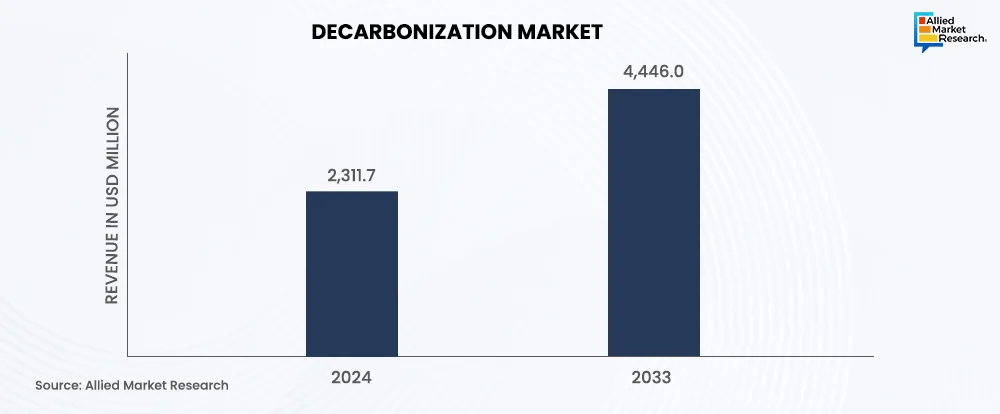

Decarbonization Market

The rising awareness regarding environmental sustainability among people around the world has been the most important factor behind the growth of the decarbonization market. Furthermore, growing investments in hydrogen and alternative fuels like biofuels and synthetic fuels are expected to widen the scope of the sector in the coming period. The surge in the adoption of cleaner energy sources in transportation and power generation applications is anticipated to help the decarbonization market gather a sum of $4.7 trillion by 2033. The landscape was valued at $2.2 trillion in 2023 and is estimated to grow at a CAGR of 8.1% during 2024-2033.

The emergence of carbon capture, utilization, & storage (CCUS) solutions has also generated several investment opportunities in the market. The presence of multinational giants such as Schneider Electric SE., Siemens A.G., Tesla Inc, Nippon Yusen Kabushiki Kaisha, etc., and the expansion strategies adopted by them have benefited the industry on the whole in the past few years.

In summary

To sum it up, the exponential rise in the consumption of electricity in various countries across the globe due to industrialization, urbanization, and globalization helped the energy and power sector flourish in the first quarter of 2025. The shift toward renewable energy sources, the advent of new power storage systems, and technological advancements in the field of electricity generation and distribution are expected to drive the market in the coming period. In addition, governmental initiatives and investments from private players are anticipated to escalate the growth rate of the sector in future.

Reach out to our experts for valuable insights on key growth factors and investment opportunities in the sector!