Table Of Contents

- Key developments and industry updates accelerating the sector’s growth and success

- A brief overview and analysis of the aerospace industry

- Studying the impact of regional variations on the growth of the industry in Q4 2024

- Investments by industry leaders like Boeing and Roketsan strengthening the foothold of the defense industry

- Recent trends and updates in supply chain management offering new investment opportunities

- Winding up

Lalit Janardhan Katare

Koyel Ghosh

Aerospace and Defense in Q4 2024: Reviewing the Innovations, Investment Decisions, and Supply Chain Updates in the Domain

The aerospace and defense sector has witnessed huge growth in the past few years owing to the increasing number of global geopolitical tensions such as the Russia-Ukraine war, the Israel-Palestine conflict, the China-Taiwan crisis, etc. Moreover, the growing threat of terrorism has led to a surge in demand for different defense technologies to counter this menace. Along with these factors, the last quarter of 2024 experienced certain key developments and trends that played an important role in the growth of the aerospace and defense domain. This newsletter outlines all such significant factors that impacted the landscape in Q4 2024 and analyzes each aspect of the sector in detail. The performance of the domain in different regions is also studied comprehensively. The major restraints creating hurdles in the industry’s growth are highlighted in this newsletter, along with solutions and measures taken by leading companies in the sector.

Key developments and industry updates accelerating the sector’s growth and success

In Q4 2024, several multinational giants invested heavily in R&D activities and launched innovative products to boost their revenue share in the long run. For instance, in December 2024, Rocket Lab, a publicly traded aerospace company, announced the launch of a private Earth-observing radar satellite to the planet’s orbit. The launch marked the start of the "Owl the Way Up" mission which involves the deployment of Strix satellites developed by Synspective, a Japanese space enterprise. On the other hand, in December 2024, Pratt & Whitney, an American aerospace manufacturing business, released a press statement reporting that it had received FAA certification for using a GTF engine to power the Airbus A321XLR model. GTF engine is known for its high fuel efficiency and low carbon emissions, which makes it an ideal solution in modern aircraft.

Similarly, in December 2024, Joby Aviation, a US aircraft manufacturing company, reported that it had completed several static tests, including the study of the structural integrity of its electric air taxi’s tail components. The press release stated that these tests will help the enterprise gain certification approval from the Federal Aviation Administration (FAA). In the same month, Boom Supersonic, a supersonic passenger airplane developer, conducted the ninth test flight of its XB-1 technology, reaching a new top speed of 0.87 Mach. The company has declared its aim of crossing the 1 Mach barrier in 2025. Moreover, NASA, a US federal space agency, issued a press release highlighting that its Parker Solar Probe broke the record for speed at 430,000 mph and closest approach to the Sun (6.1 million kilometers).

A brief overview and analysis of the aerospace industry

The growth of the aerospace industry, in the fourth quarter of 2024, was primarily due to the increasing consumer preference for air travel. The growing disposable income of people in developed and developing countries across the globe led to a surge in air passenger traffic. At the same time, the substantial decrease in aircraft ticket fares improved the growth rate of the commercial aerospace market. Along with this, technological advancements in aircraft engines played an important role in the growth of the industry. Many companies were engaged in R&D activities to design fuel-efficient engines and innovative machines such as turbofan propulsion systems. In addition, the rising investments in aviation infrastructure from public and private enterprises contributed to the expansion of the industry in Q4 2024.

As per a study done by the International Air Transport Association, the global airline industry has made substantial gains in the last few years. In 2023, the landscape had a net profit of $27.4 billion with a 3% margin. In 2024, its profit increased to $30.5 billion with a 3.1% margin. The same survey highlighted that the total number of air passengers rose to 4.96 billion passengers globally. This helped the industry gather a total revenue of $996 billion, out of which passenger revenue was valued at $744 billion. As per many industry experts, despite facing challenges in the COVID-19 pandemic period due to lockdowns and travel restrictions, the global airline industry made a stunning comeback. The increasing focus on supply chain resilience and logistics was the main reason behind the revival of this market. While certain challenges persist, the industry is anticipated to flourish in the coming period.

Studying the impact of regional variations on the growth of the industry in Q4 2024

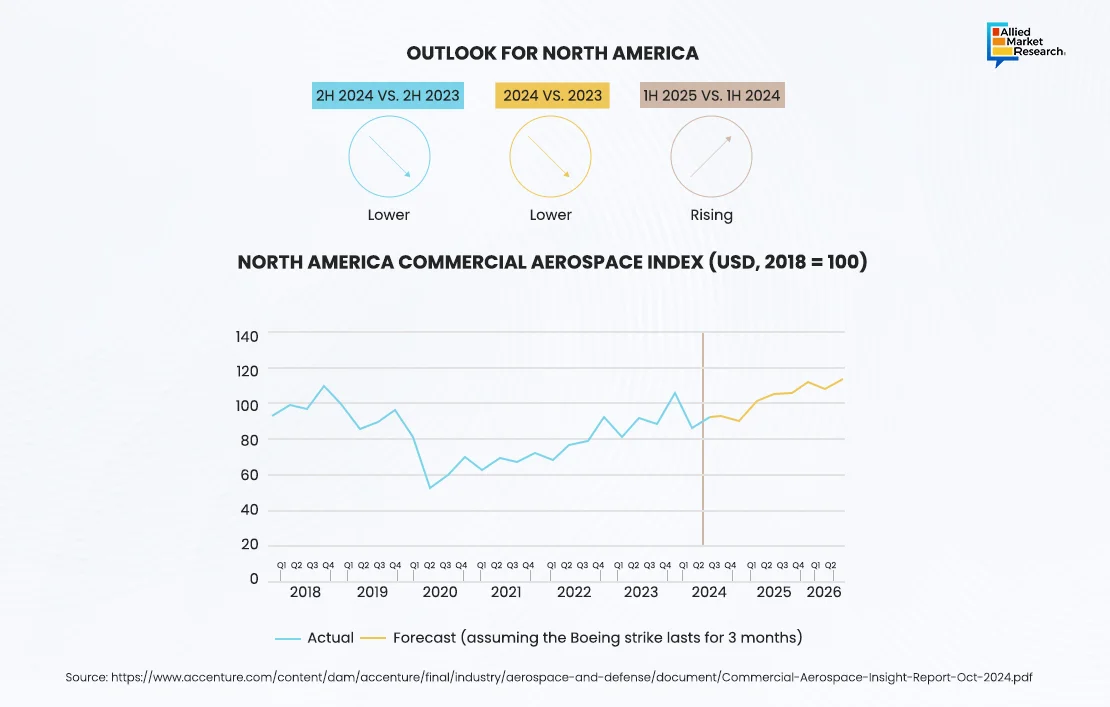

Though the aerospace and defense sector increased its market share globally, the performance of the domain varied across different regions due to various administrative, demographic, legal, political, socioeconomic, and cultural factors. In North America, for instance, the aerospace sector witnessed a fall in its revenue by around 3% compared to 2019 numbers. Several issues such as supply chain disruptions, quality problems, and events like the 2024 Boeing machinists strike restricted the growth of the landscape. As per many high-ranking officials in the company, these challenges have greatly slowed Boeing’s recovery and are expected to hinder its global growth in the future.

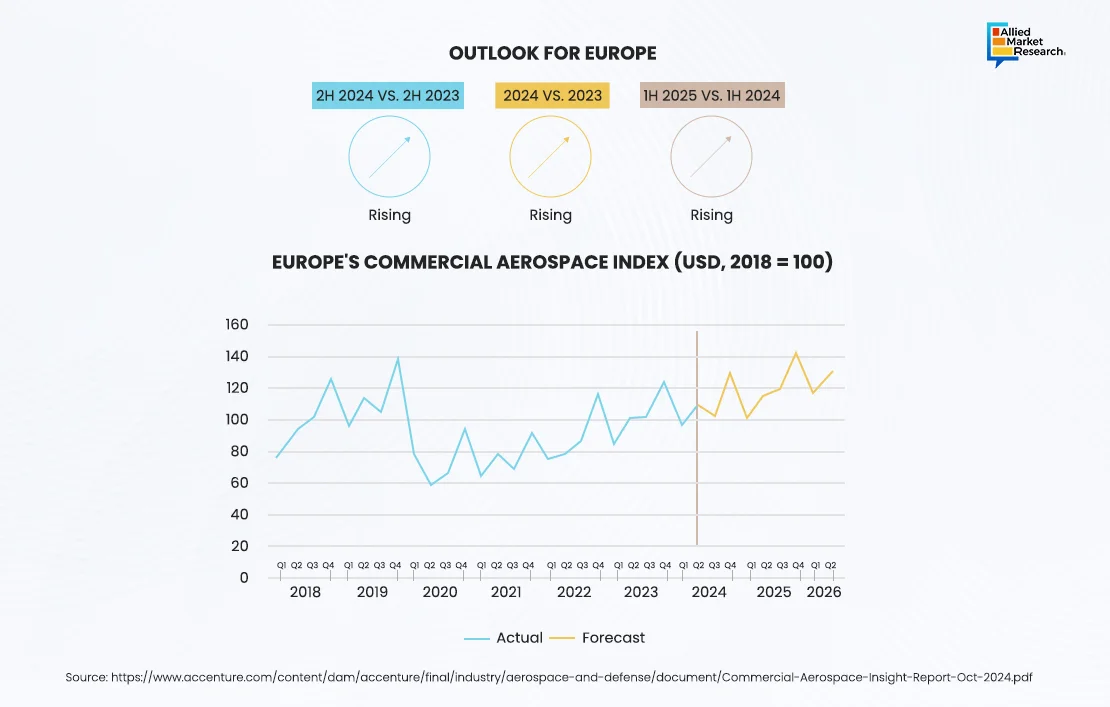

In the European region also, the aerospace and defense sector faced with supply chain and logistical issues. Despite these problems, the domain managed to secure a 7% increase in its YoY growth in 2024. While the revenue share was still 9% short of its 2019 numbers, many industry leaders expect the landscape to make full recovery to its pre-pandemic levels by the end of 2025. On the other hand, the Asia-Pacific market emerged as one of the fastest-growing regions in the sector. The domain grew by 12% YoY in 2024, thereby registering a 54% rise in the 2019 numbers. The increasing number of aerospace suppliers and the growing emphasis on maintenance, repair, and operations (MRO) activities by airline companies created favorable conditions for the growth of the industry in Q4 2024.

Investments by industry leaders like Boeing and Roketsan strengthening the foothold of the defense industry

In October 2024, Boeing announced that it had been awarded a $600-million contract by the US Air Force for the testing and integration of Joint Direct Attack Munition (JDAM) and Laser JDAM technologies. The JDAM system is designed to transform conventional bombs into precision-guided munitions using inertial navigation systems with GPS receivers. As per the top management in the company, the assigned project is expected to be completed by late 2035.

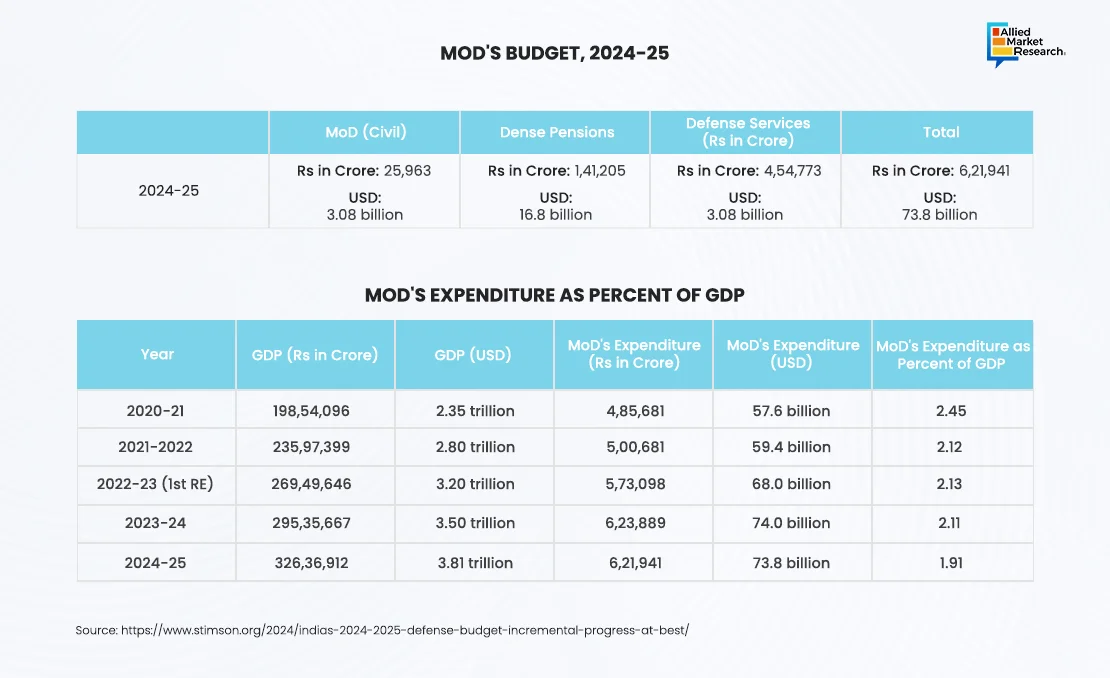

On the other hand, Rokestan, a Turkish defense contractor, in October 2024, announced the expansion of its product portfolio by launching three new laser-guided solutions. Designed to improve the accuracy and precision of conventional missile systems, these products are developed to seek and neutralize ground targets. The launch is expected to help Rokestan to establish itself as the leader of the precision guided munitions industry. Along with this, developing countries such as India have consistently increased their budgetary defense spending over the last few years. The investments in R&D activities and procurement of advanced defense technologies by the Indian Government accelerated the sector’s growth and success in Q4 2024.

Recent trends and updates in supply chain management offering new investment opportunities

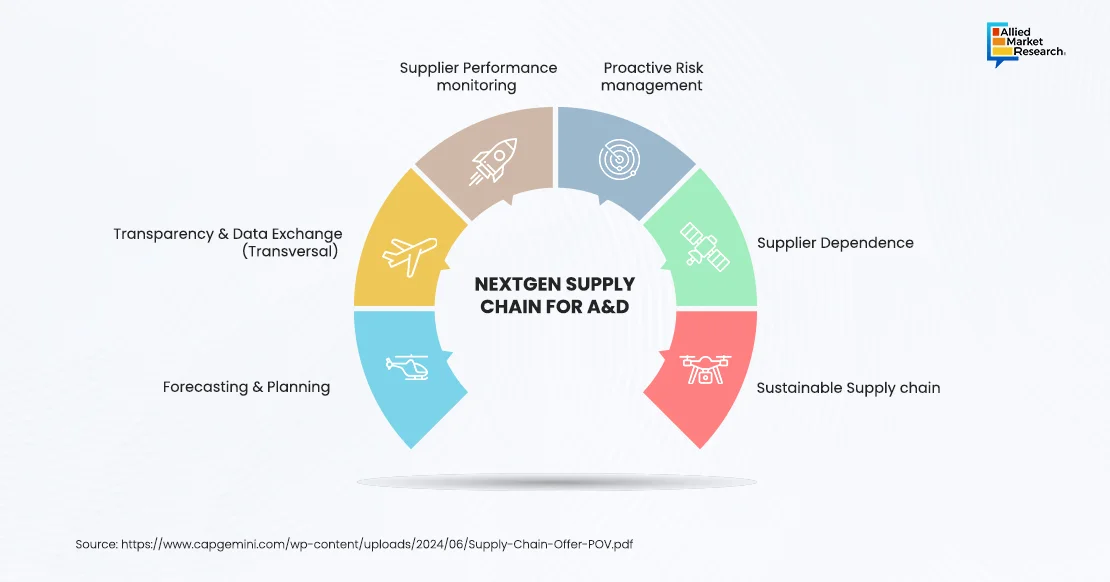

In the last few years, especially since the COVID-19 pandemic, the disruption in global supply chains has been a major hurdle in the growth of the aerospace and defense sector. The lockdowns, social distancing norms, and travel restrictions enacted by countries around the world during the pandemic seriously affected the demand for air travel, thereby reducing the competitiveness of airline companies. Along with this, businesses faced forecasting and planning issues due to certain inherent challenges such as long development cycles, industrial footprint complexity, and frequent technological shifts. Furthermore, disorganized logistical operations of aerospace enterprises reduced transparency in the sector and created challenges for proactive risk management and supplier performance monitoring.

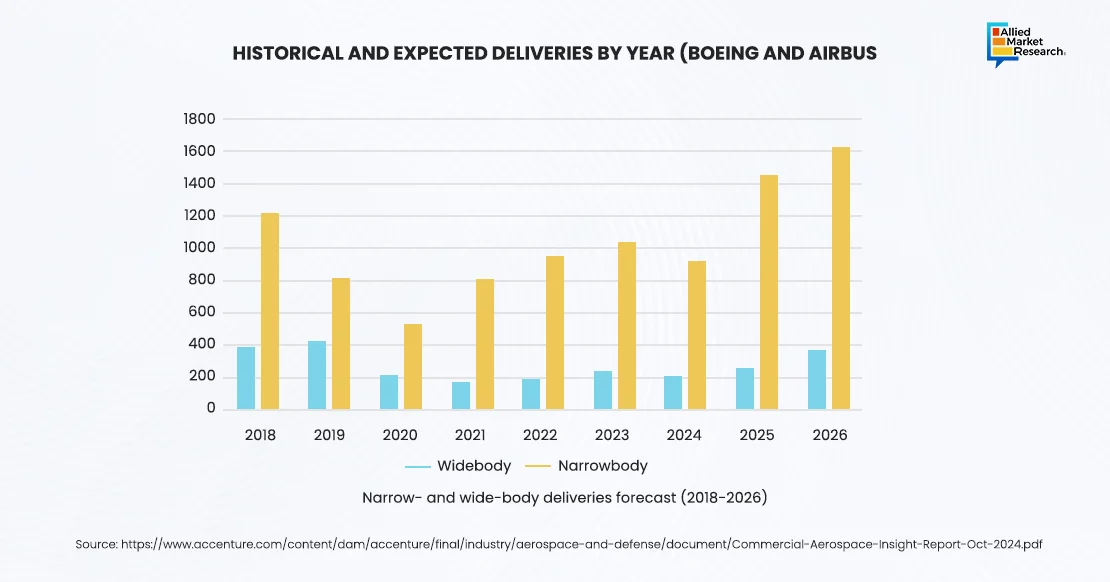

Nonetheless, in the post-pandemic period, aerospace companies experienced an increase in demand for air travel as countries lifted lockdowns and restrictions. As per a study, aircraft orders surpassed pre-pandemic levels and are expected to grow by 30% in the next five years. Many industry experts have opined that businesses in this domain should focus on the optimized execution of supply chains. Furthermore, the growing emphasis on predictive and collaborative logistics brought numerous growth opportunities to the sector in 2024. Along with this, increasing integration of Tier 1 and Tier 2 suppliers expanded the footprint of the landscape in Q4 2024.

Winding up

The growth of the aerospace and defense sector in the fourth quarter of 2024 is attributed to increasing investments by leading companies in the domain. In addition, despite certain supply chain challenges, the sector increased its revenue share in 2024 due to the increasing focus on the integration of advanced technologies and innovations. Furthermore, the growing expanse of the landscape in the Asia-Pacific region is predicted to create favorable conditions for the growth of the aerospace industry in the coming period.

For more insights on the latest developments, technological advancements, and upcoming trends in the aerospace and defense sector, feel free to contact our esteemed analysts here!