Table Of Contents

- Key Technologies Defining the Aerospace and Defense Landscape in 2024

- Some key technological developments

- Ten Key Drivers of Transformation in the Aerospace and Defense Sector

- Regional Market Dynamics

- North America

- Europe

- Asia-Pacific

- Key Events and Milestones in the Aircraft Industry, 2024

- Industry Growth and Forecasts

- Leading manufacturers Airbus and Boeing projected a demand for over 40,000 new commercial jets over the next two decades. Boeing had estimated that the commercial aircraft market would reach $3.9 trillion by 2032, reflecting strong future growth despite the uncertainties faced in the present.

- Technological Innovations

- Notable Incidents in 2024

- Measures to Prevent Aviation Incidents and Enhancing Safety in the Aerospace Industry

- Verdict and Outlook

- For detailed insights on these trends, refer to our below trending reports related to the aerospace and defense industry:

- https://www.alliedmarketresearch.com/in-space-manufacturing-servicing-and-transportation-market-A10134

Lalit Janardhan Katare

Koyel Ghosh

An Overall Review of the Aerospace and Defense Industry in 2024

In 2024, the aerospace and defense industry witnessed remarkable growth and advancements driven by rapid global developments. Air travel demand fully rebounded to pre-pandemic levels, while heightened geopolitical tensions led to increased defense spending in many nations. Furthermore, evolving security challenges and the growing demand for advanced capabilities compelled organizations to adapt at an unprecedented pace.

To address the growing demand amidst the uncertainty and rapid changes seen in 2024, aerospace and defense organizations took recourse to emerging technologies. Innovations such as artificial intelligence, digital twin technology, automation, and advanced manufacturing transformed operations fundamentally. These technologies enhanced efficiency, strengthened supply chain resilience, and accelerated product development, enabling companies to remain competitive and deliver greater value to their customers.

Key Technologies Defining the Aerospace and Defense Landscape in 2024

Artificial Intelligence played a pivotal role in 2024, powering autonomous weapons, predictive maintenance, real-time decision-making, and cybersecurity solutions. It also supported intelligence gathering, military simulations, and situational awareness, significantly improving operational effectiveness. Additive manufacturing (3D printing) revolutionized production by enabling lightweight components for aircraft, vehicles, and structures like shelters and bridges, all while conserving materials and addressing supply chain challenges.

The year also witnessed advancements in defense equipment such as directed energy weapons, hypersonic technologies, and space militarization, alongside innovations like self-healing armor. Green initiatives, including electric propulsion systems and alternative fuels, gained momentum, reducing carbon emissions. The Internet of Military Things (IoMT) connected soldiers, vehicles, and devices, enabling real-time data sharing and faster decision-making.

Immersive technologies like virtual and augmented reality transformed training and mission planning, creating realistic, adaptable environments. Meanwhile, cybersecurity remained critical in countering evolving threats. Together, these innovations ensured the A&D industry remained agile, resilient, and prepared for future challenges.

Some key technological developments

- In June 2024, Safran acquired Preligens, a leader in artificial intelligence for aerospace and defense. This potential acquisition represented a unique opportunity for Safran to add state-of-the-art AI capabilities to its product offering and to accelerate its digital transformation roadmap, particularly for Manufacturing 4.0.

- In August 2024, QuickLogic Corporation announced a strategic partnership with CTG, a division of Blue Raven Solutions, appointing CTG as the sole distributor for its eFPGA Hard IP in the Aerospace & Defense sector. This partnership aimed to utilize CTG’s experience to connect QuickLogic's eFPGA IP solutions with key industry players.

- In February 2024, Boeing selected BAE Systems to upgrade and modernize the vehicle management system computer (VMSC) for the U.S. Navy's MQ-25 unmanned aerial refuelling system. The technology refresh will boost computer power and address obsolescence issues, giving the unmanned aerial tanker an integrated solution that increases aircraft performance while allowing for future capability expansion.

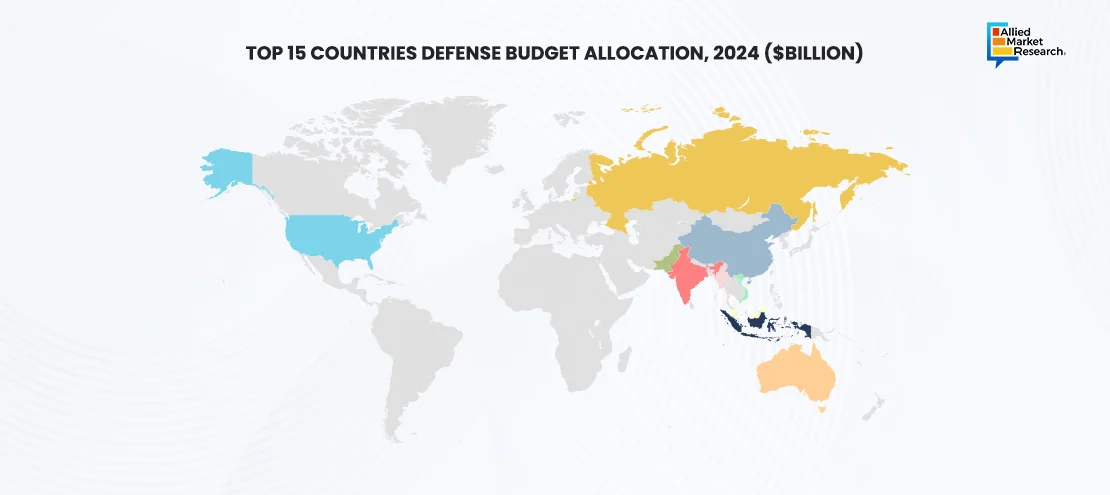

The above image represents the defense budget allocation of top 15 countries across the globe in the year 2024. The continuously increasing budget allocation by leading countries to strengthen their military power boasts the growing trend for defense industry across the globe in future.

Ten Key Drivers of Transformation in the Aerospace and Defense Sector

The aerospace and defense industry experienced significant disruption in 2024, driven by ten interconnected forces that reshaped operations, strategies, and innovation. Emerging technologies such as AI, robotics, additive manufacturing, and immersive tools played a pivotal role in transforming the sector. AI facilitated predictive maintenance and real-time analytics, while robotics and drones revolutionized military operations through autonomy and precision. Additionally, rising geopolitical tensions and the growing demands for defense modernization accelerated advancements in hypersonic weapons, directed energy systems, and self-healing armor.

Simultaneously, external challenges, including supply chain disruptions, economic uncertainty, and cybersecurity threats, have made the industry more complex. In 2024, global shipping delays and semiconductor shortages slowed production, while inflation increased financial pressures. The rise in digitization also increased the risk of cyberattacks, pushing companies to focus more on cybersecurity. Digital transformation through IoT and IoMT improved situational awareness and efficiency. As quantum computing advanced, there was a growing need for stronger encryption methods. Companies also faced pressure to adopt sustainable practices, using electric propulsion, biofuels, and lightweight materials to reduce carbon emissions. Talent shortages required investment in upskilling and training. These challenges have forced the industry to adapt, innovate, and build resilience for a sustainable future.

Regional Market Dynamics

North America

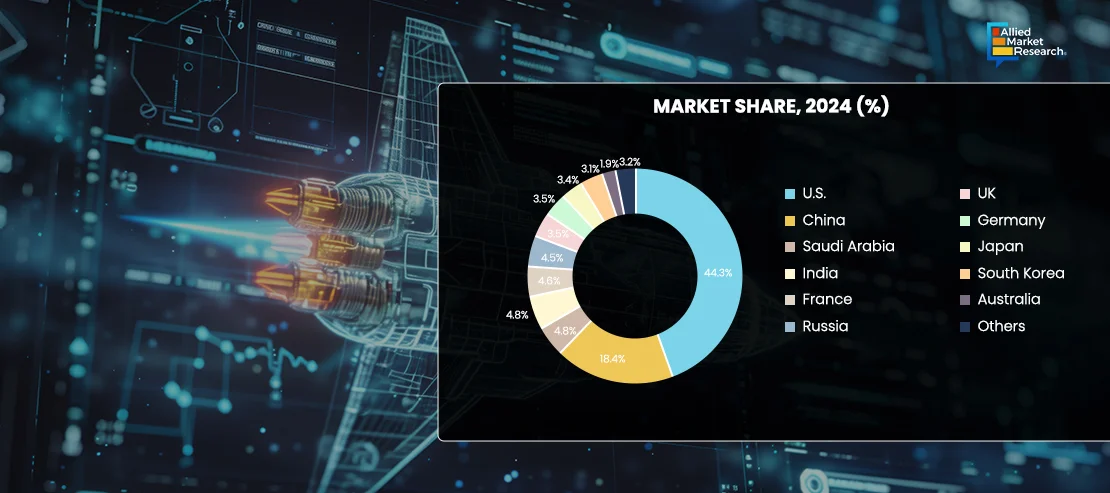

In 2024, the North American defense industry, encompassing the U.S. and Canada, played a crucial role in safeguarding regional security. The sector thrived on technological innovation, strategic procurement, and modernization efforts to address evolving threats. The U.S., the largest contributor, continued its significant investment in research, development, and advanced military equipment. Key areas of focus included next-generation aircraft, advanced cybersecurity, autonomous systems, and missile defense.

The U.S. Air Force and Navy led the charge in innovation, concentrating on technologies such as hypersonic weapons, unmanned systems, and artificial intelligence to maintain global military dominance. The U.S. Army prioritized modernizing its fleet with advanced robotics, energy-efficient systems, and new vehicles to enhance operational efficiency. Notably, in May 2023, the U.S. Air Force had announced plans to award a contract in 2024 for its sixth-generation fighter jet, designed to outpace China's military advancements. Additionally, the ongoing Russia-Ukraine conflict drove significant U.S. arms supplies to Ukraine, further accelerating defense procurements.

Canada, in turn, contributed by participating in joint military exercises and collaborating closely with the U.S., enhancing interoperability and cooperative defense strategies. Through these shared initiatives and cutting-edge advancements, the two nations strengthened North America's overall defense capabilities.

Europe

The European defense market also experienced significant growth as armed forces prioritized the modernization of equipment to address emerging threats. Ongoing conflicts in regions such as Russia, Ukraine, and the Middle East prompted substantial investments in fleet upgrades and the acquisition of advanced aircraft. The European aerospace and defense sector saw rapid advancements, driven by innovations in artificial intelligence, advanced materials, 3D printing, and autonomous systems. Leading companies, including BAE Systems, Dassault Aviation, Leonardo, Fincantieri, and GKN Aerospace, played a pivotal role in this evolution, focusing on research and development to enhance traditional manned platforms while also meeting the increasing demand for unmanned systems, ultimately shaping the future of defense technology.

Asia-Pacific

In 2024, the APAC defense market experienced substantial growth, fueled by increased defense budgets, modernization efforts, and strategic initiatives aimed at enhancing national security. Leading nations such as China, India, Japan, and South Korea were pivotal in fueling regional expansion. Advanced technologies, including stealth, hypersonic capabilities, and AI, played a crucial role in enhancing aerial defense operations, with air forces investing in next-generation systems to improve both efficiency and survivability. For example, Japan's F-X program focused on developing a sixth-generation fighter incorporating AI and stealth features. Meanwhile, India’s HAL Tejas and South Korea’s KF-21 Boramae demonstrated efforts toward indigenous aircraft development, reducing reliance on foreign technology. Strong government funding further supported these advancements, contributing to the robust growth of the defense sector.

Key Events and Milestones in the Aircraft Industry, 2024

In 2024, the aircraft industry experienced notable developments and challenges, showcasing its dynamic nature and the complexities of global aviation.

Industry Growth and Forecasts

Leading manufacturers Airbus and Boeing projected a demand for over 40,000 new commercial jets over the next two decades. Boeing had estimated that the commercial aircraft market would reach $3.9 trillion by 2032, reflecting strong future growth despite the uncertainties faced in the present.

Aerospace Manufacturing and Design

This optimistic outlook was underpinned by a robust recovery in global travel, particularly in the Asia-Pacific region, which had surpassed pre-pandemic passenger levels, supporting an increase in demand for new aircraft.

Operational Challenges

However, both Airbus and Boeing faced significant operational challenges. Airbus dealt with production delays and supply chain disruptions that hindered its ability to meet delivery targets. Likewise, Boeing struggled with production issues and regulatory scrutiny, which affected its market position and financial stability. These hurdles were a key focus in the industry's 2024 landscape.

Technological Innovations

Concurrently, the industry encountered significant advancements in digitalization, passenger services, regulatory compliance, and aircraft design. These innovations were driven by the need to improve safety, operational efficiency, and environmental sustainability. The focus on sustainability aligns with the global aviation sector's long-term goal of achieving net-zero emissions by 2050.

Notable Incidents in 2024

Several significant incidents occurred in 2024, marking a challenging year for the aviation industry:

- On January 2, a tragic runway collision at Tokyo's Haneda Airport involved a Japan Airlines Airbus A350-900 and a Japan Coast Guard aircraft. The collision resulted in the destruction of both planes and the loss of five lives.

- On January 5, an explosive decompression occurred aboard an Alaska Airlines Boeing 737 MAX 9 shortly after its departure from Portland International Airport. Although the aircraft returned safely, the FAA grounded certain 737 MAX 9 planes for inspection.

- On March 22, Boom Supersonic's XB-1, a prototype supersonic aircraft, successfully completed its inaugural flight, representing a significant step forward in the development of next-generation supersonic airliners.

- On April 23, a mid-air collision between two Royal Malaysian Navy helicopters over Lumut, Malaysia, tragically resulted in the loss of all ten personnel on board.

Measures to Prevent Aviation Incidents and Enhancing Safety in the Aerospace Industry

The aerospace industry has adopted a holistic approach to risk mitigation and safety enhancement, focusing on quality control, supply chain resilience, and regulatory compliance. Advanced inspection technologies, such as AI-driven defect detection and comprehensive testing of critical components, are essential for preventing structural failures and minimizing potential hazards. Digital solutions, including blockchain for supply chain tracking and predictive analytics for disruption forecasting, improve transparency and reduce risks associated with faulty components. Strengthening supply chain resilience through supplier diversification and reshoring of key manufacturing operations is crucial.

Regulatory agencies, including the FAA, EASA, and ICAO, have a vital role in enforcing updated safety protocols, conducting audits, and addressing systemic issues through post-incident reviews. Workforce training, particularly through advanced simulation technologies, ensures that pilots, maintenance teams, and engineers are prepared for emergencies. Regular drills and incident-response training further enhance readiness.

Additionally, the development of advanced air traffic management systems, like ADS-B and collision avoidance technologies, plays a critical role in accident prevention. Proactive safety initiatives, including IoT sensors for real-time monitoring, AI-based predictive maintenance, and digital twin simulations, combined with innovative materials, are helping to minimize failures, improve safety standards, and restore public confidence in aerospace operations.

Verdict and Outlook

The aerospace and defense industry is constantly evolving, playing a vital role in global security, innovation, and technology. In recent years, it has experienced significant growth, driven by advancements in automation, artificial intelligence, cybersecurity, and sustainable aerospace solutions.

Key trends include the development of next-generation aircraft, space exploration, and a stronger focus on digital transformation and sustainability. Partnerships between governments, defense contractors, and private companies are driving innovation in unmanned systems, advanced manufacturing, and satellite technologies. With continued investment and a commitment to innovation, the aerospace and defense sector is essential in shaping the future of security, exploration, and technology.

For detailed insights on these trends, refer to our below trending reports related to the aerospace and defense industry:

https://www.alliedmarketresearch.com/in-space-manufacturing-servicing-and-transportation-market-A10134

https://www.alliedmarketresearch.com/loitering-munition-system-market-A266195

https://www.alliedmarketresearch.com/aircraft-braking-system-market-A06199

https://www.alliedmarketresearch.com/aviation-data-recorder-market-A325332

For more updates on the aerospace and Defense domain, contact our experts today!