Table Of Contents

- Industry analysis of the automotive sector in Q4 2024

- Promising developments in the automotive sector in the timeframe

- Insights into the transportation industry in Q4 2024

- Regional snapshots driving the sector’s growth in Q4 2024

- Supply chain challenges and solutions in the AT sector in Q4 2024

- The essence

Lalit Janardhan Katare

Koyel Ghosh

Automotive and Transportation Industry in Q4 2024: Key Innovations and Supply Chain Resilience

In Q4 2024, the automotive and transportation industry experienced prominent growth driven by advancements in EVs, autonomous technologies, and sustainable practices. During the period, EV adoption grew rapidly worldwide, led by China and North America, while innovations in lightweight materials and AI-powered systems redefined urban mobility. Despite facing supply chain challenges, including chip shortages and geopolitical tensions, key players utilized modern technologies and made strategic collaborations to foster resilience. Allied Market Research attempts to highlight all important determinants, developments, and regional dynamics that enabled the sector to flourish during the term.

Industry analysis of the automotive sector in Q4 2024

In the fourth quarter of 2024, global production of internal combustion engine (ICE) vehicles experienced a notable decline, due to the rapid expansion of the EV market. The International Energy Agency (IEA) reported that over 7 million electric cars were sold globally in the first half of 2024, marking a 25% increase compared to the same period in 2023. China was a significant contributor, accounting for nearly 80% of this growth, with EV sales rising from over 3 million in early 2023 to more than 4 million by mid-2024. This surge in EV adoption led to a corresponding decrease in demand for ICE vehicles, making manufacturers adjust production levels accordingly. Additionally, the growing preference for plug-in hybrid electric vehicles (PHEVs) over traditional ICE models further influenced production trends over the duration.

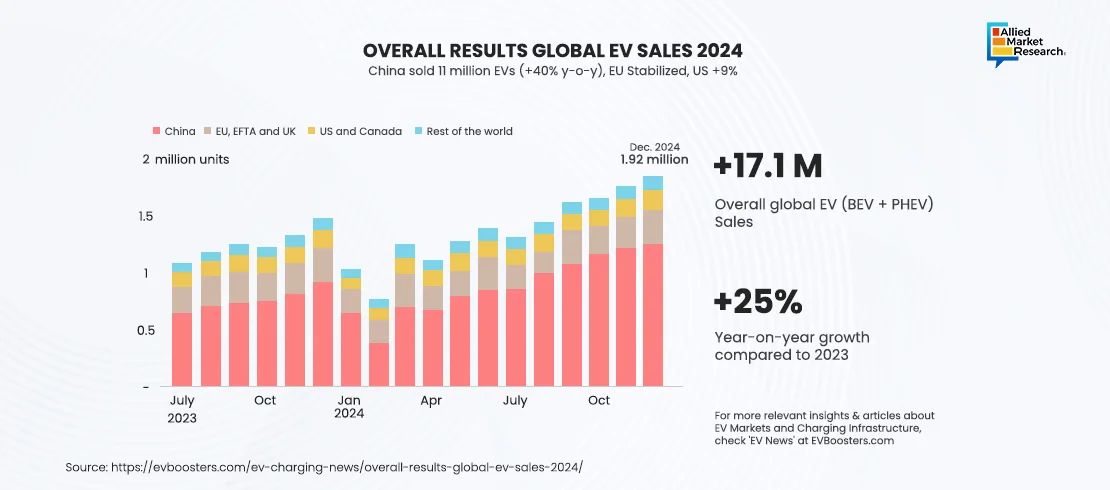

On the other hand, the global electric vehicle market witnessed prominent growth in Q4 2024, representing a 25% year-over-year growth and culminating in 17.1 million EVs sold worldwide. In December 2024, EV sales reached a record 1.9 million units, showcasing a 26% increase from the previous year. While growth in Europe stabilized, China experienced a remarkable 40% surge, totaling 11 million plug-in cars sold. Key factors driving this growth included subsidies, tax credits, and strict emission standards. Moreover, regulatory frameworks, China's trade-in scheme and Europe's emission pooling strategies notably influenced consumer and manufacturer behavior across regions.

Promising developments in the automotive sector in the timeframe

The automotive industry evolved rapidly in Q4 2024 with advancements in EVs, autonomous driving technologies, and connected car solutions. Moreover, innovations in lightweight materials, alternative fuels, and AI-driven systems reshaped urban mobility. Additionally, the adoption of sustainable practices by key players, smart manufacturing, and a focus on reducing emissions greatly driven global trends, ensuring a future of efficient and eco-friendly transportation. Here are some key findings that fueled the industry’s growth during the quarter:

In November 2024, NXP Semiconductors introduced the MC33774, an 18-channel analog front-end device designed for electric two-wheeler lithium-ion battery management systems. It offered high-precision cell measurement and robust balancing capabilities, ensuring enhanced performance and safety for high-voltage Li-ion batteries while meeting ASIL-D safety standards for key applications.

Similarly, in October 2024, Bharat Forge acquired AAM India Manufacturing Corp, the Indian subsidiary of American Axle & Manufacturing, for $64.8 million. This move aimed at broadening Bharat Forge’s customer base and manufacturing capabilities in India. On the other hand, American Axle focused on internal combustion, hybrid, and electric vehicle applications globally, gaining financial flexibility from the sale.

In parallel, In October 2024, Bosch collaborated with the U.S. startup Tenstorrent to develop a standardized platform for automotive chips. The company focused on creating a unified approach to utilizing chiplets as a key component of modern semiconductors to address the diverse demands of the automotive industry.

Moreover, in November 2024, Lumax Industries expanded commercial production at its new Pune facility, responding to rising demand for automotive components, especially in the electric vehicle sector. This expansion supported OEMs' transition to e-mobility by providing advanced lighting solutions. These newly manufactured electric vehicles feature energy-efficient LED headlamps and tail lamps, which play a crucial role in improving both safety and sustainability in EV design.

Also, in December 2024, the U.S. Commerce Department reached a preliminary agreement with Bosch for up to $225 million in subsidies. Through this agreement the companies aimed to produce silicon carbide power semiconductors for EVs in California. Bosch planned a $1.9 billion investment to upgrade its Roseville facility, along with $350 million in proposed government loans.

Insights into the transportation industry in Q4 2024

The transportation industry witnessed transformative developments in Q4 2024, driven by advancements in autonomous vehicles, electric mobility, and smart logistics. Innovations in sustainable fuels, high-speed rail systems, and connected technologies redefined efficiency and reduced emissions of modern vehicles. Moreover, the growing adoption of AI, IoT, and renewable energy integration highlighted the sector’s transition toward a smarter, greener future. Following are some notable findings that boosted the industry during the period.:

In October 2024, FedEx partnered with Saudi Arabia's King Salman International Airport Development Company and the Integrated Logistics Zone to transform the logistics sector in Saudi Arabia. This collaboration aimed at enhancing the region's air cargo capabilities, enabling the company to become a leading global logistics and air cargo hub.

In December 2024, Cushman & Wakefield predicted that the demand for leasing of logistics and industrial (L&I) spaces is expected to reach 50-53 million sq feet due to the ongoing demand.

Furthermore, in November 2024, China's logistics sector reported steady growth, with total industry revenue reaching 10 trillion yuan ($1.4 trillion), a 3.7% year-on-year increase. Social logistics also rose by 5.6% year-on-year to 258.2 trillion yuan ($36.22 trillion) during the period.

Regional snapshots driving the sector’s growth in Q4 2024

The AT industry experienced significant growth across multiple regions during Q4 2024. The North American electric vehicle industry grew by approximately 9%, with December sales reaching 190,000 units. The $7,500 federal EV tax credit significantly supported this momentum, although its future remains uncertain under potential policy changes in the upcoming Trump administration. Alongside the Environmental Protection Agency’s emission standards, these factors are expected to shape the North American market’s growth in the coming years.

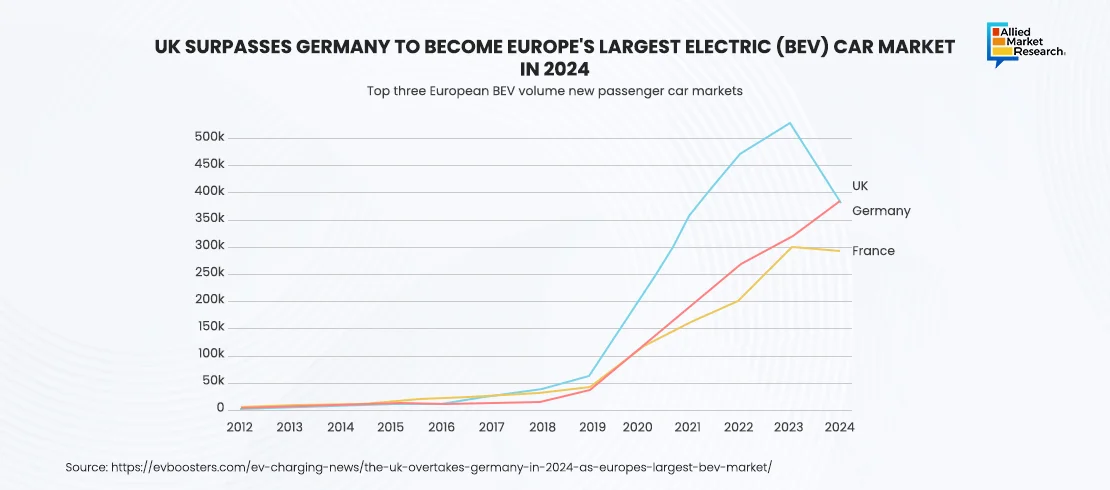

Moreover, Europe's EV market experienced mixed results in 2024, ending the year 3% lower than in 2023. The UK became the top market for battery electric vehicle (BEV) sales, surpassing Germany, largely due to the UK ZEV mandate. With the stricter 2025 emissions standards, automakers announced a collaborative carbon credit pool to reduce regulatory fines. Despite challenges like subsidy cuts in Germany, December 2024 represented a slight stabilization with 310,000 units sold, a 0.7% year-over-year increase.

Furthermore, the Asia-Pacific region stood out as a significant player during the quarter. China maintained its position as the largest EV market, achieving a record 1.3 million EV sales in December 2024. This contributed to an annual total of 11 million units sold, reflecting a remarkable 40% year-over-year increase. The growth was largely driven by domestic automaker BYD, which accounted for one in three EVs sold. Along with this, supportive trade-in schemes and incentives further fueled the expansion of the market.

Apart from these key markets, EV sales increased by 26.4% in December 2024. Regions across Asia-Pacific, Latin America, and Africa experienced the increased adoption of EVs as governments introduced localized incentives and infrastructure improvements to support EV uptake.

Supply chain challenges and solutions in the AT sector in Q4 2024

The final quarter of 2024 witnessed significant disruptions across global supply chains, showcasing another challenging period for industries worldwide. Chip shortages, exacerbated by geopolitical tensions and manufacturing delays in Asia which hindered automobile production. As a result, vehicle delivery timelines were extended further, impacting consumer satisfaction and dealership operations. Moreover, the escalation of conflicts in Eastern Europe and rising tensions in the Indo-Pacific region caused delays and increased transportation costs. Sanctions and trade restrictions imposed by major economies further strained the movement of critical important raw materials, impacting industries such as automotive, electronics, and energy.

In addition, the surge in energy prices intensified supply chain challenges, driven by soaring fuel costs from reduced oil output. Additionally, an unexpected winter in Europe increased energy demand, creating obstructions in energy-intensive sectors like manufacturing and logistics. Natural disasters, including severe flooding in Southeast Asia and hurricanes in the Americas, further disrupted production and port operations. Furthermore, labor strikes in Europe and North America led to supply chain disruptions as workers in transportation, manufacturing, and logistics demanded better pay and conditions. These strikes resulted in temporary shutdowns and freight delays, amplified by ongoing workforce shortages in the logistics sector, further disrupting delivery schedules.

To overcome these significant supply chain hurdles, leading companies increasingly adopted multi-sourcing strategies to diversify their supplier bases and reduce reliance on specific regions. Nearshoring and reshoring initiatives also gained traction as firms aim to mitigate risks associated with long-distance supply chains. Concurrently, investment in advanced technologies like AI-driven demand forecasting, blockchain for transparency, and IoT for real-time tracking enhanced decision-making and supply chain resilience. On the other hand, many businesses implemented green logistics practices and circular economy models to lower emissions and promote material reuse. Collaborative frameworks between governments and private entities significantly addressed systemic issues and facilitated smoother global trade operations during the period.

The essence

The automotive and transportation sector showcased remarkable advancements in Q4 2024 despite various supply chain challenges. The surge in EV adoption, innovative technologies, and sustainable practices propelled the growth of the industry across several regions. Leading businesses faced supply chain strains effectively by embracing resilience strategies and fostering collaboration. These promising initiatives by key players are expected to lead to a greener, smarter, and more efficient future in mobility and logistics.

To gain more insights into the emerging trends in the AT industry, contact our esteemed analysts here!