Table Of Contents

- Exploring the 2024 Consumer Goods Landscape: Insights and Projections

- Regional Insights on the Consumer Goods Industry in 2024

- Roadblocks and Solutions in the Consumer Goods Industry

- Roadblocks

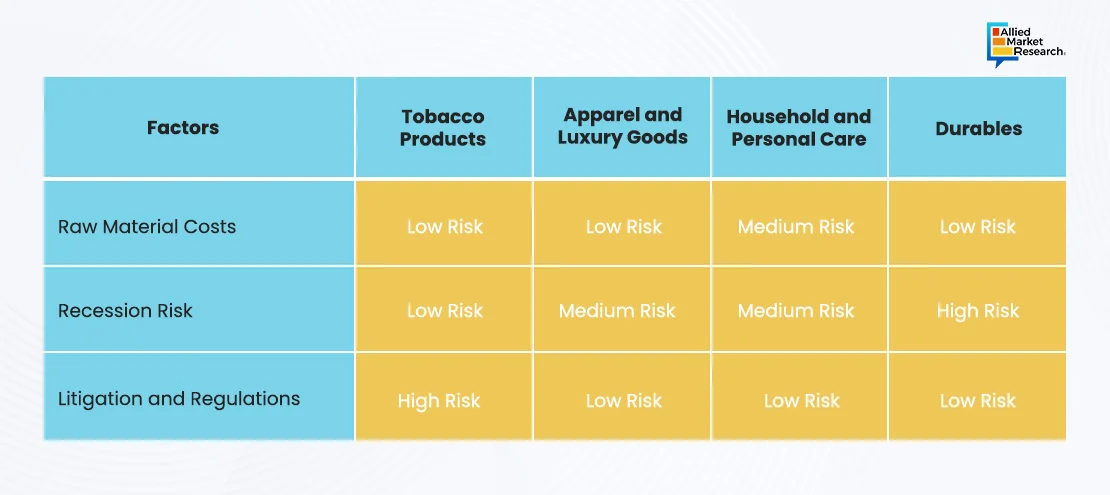

- Raw material cost: Rising raw material charges provide substantial hurdles to the household and personal care goods sector. Prices for critical resources such as chemical compounds, plastics, and natural components have increased owing to global supply chain interruptions, inflation, and rising demand. These growing costs have resulted in greater manufacturing charges, causing businesses to either endure the expenditure or transfer it to customers, thereby diminishing volume and profitability.

- Recession risk: Emerging recession risks are causing substantial obstacles in household and personal care products, fashion and goods, and durables industries. As consumer confidence falls during economic uncertainty, many people are reducing discretionary spending and prioritizing needed products over unnecessary purchases. This has brought about decreased consumer demand for expensive products, harming sectors such as clothes and consumer goods, while enterprises in the household and personal care markets are under additional pressure to sustain sales despite slower economic development.

- Litigation and Regulations: Rising lawsuits and increased regulation are posing substantial challenges in the tobacco-related products sector. Governments throughout the world are enacting stronger rules governing advertisements for tobacco, packaging, and public smoking, while tobacco businesses face increasing legal risks from cases including health and environmental concerns. These concerns lead to increased compliance expenses, restrictions on marketing techniques, and significant financial liabilities, eventually limiting business growth.

- Solutions

- Low-cost procuring: Companies have the opportunity to explore several solutions. Implementing cost-effective production procedures, such as employing sustainable and regionally obtained raw materials, can help in reducing escalating prices. Furthermore, incorporating innovation in consumer formulations, such as reducing the use of costly ingredients while preserving quality, proves to be an effective strategy. Partnering with companies to achieve long-term contracts at set rates can also assist in keeping expenses stable. Moreover, increasing the use of digital technology for improved management of supply chains can result in cost savings and higher operational efficiency.

- Cost effective solutions: In the household and personal care industries, offering low-cost product lines or value packages can help maintain sales. Clothing and product firms can create more affordable and adaptable options to appeal to recession-conscious consumers. Businesses in the durables industry can highlight value by focusing on product durability and offering guarantees or repair services.

- Compliance focused innovation: Tobacco companies often use compliance-focused technologies to ensure their products and advertisements meet stricter regulations. Shifting toward lower-risk products, like e-cigarettes or smokeless tobacco, which face different rules, can help reduce some restrictions. Companies also build partnerships with public health organizations to enhance their reputation and adapt to regulatory changes.

- The Future Scope of the Consumer Goods Industry

- The Bottom Line

Roshan Deshmukh

Koyel Ghosh

The Consumer Goods Industry in 2024: Resilience and Innovation Redefined

The consumer goods industry in 2024 has grown more slowly than in 2023, as companies are focusing on boosting volume growth while keeping revenue steady. Differences in consumer spending are becoming more pronounced as the majority of the population strives to demonstrate resilience amid global economic uncertainties, including recession risks and the rapid rise in product prices. Consumer behavior has shifted in favor of health-conscious and sustainable goods, resulting in a rise in the "better-for-you" (BFY) category and eco-friendly goods. Demand for expensive and personalized products has increased, aided by technological innovations such as AI, as customers prioritized relevance and quality over pricing in certain categories. Simultaneously, the changing purchasing pattern has fueled innovation and competitiveness in the consumer products business, helping preserve market share and relevance.

Exploring the 2024 Consumer Goods Landscape: Insights and Projections

In 2024, the branded consumer goods companies have increased their average annualized price to stabilize within the low to mid-single-digit range. This moderation marks a departure from the price increases that have become aggressive in recent years due to inflationary pressures on raw materials, logistics, and labor costs. With supply chain issues easing and input prices stabilizing, companies are adopting a more balanced pricing strategy to stay competitive and keep customer loyalty. Furthermore, greater price sensitivity among customers and a greater market share of privately labeled products are putting greater strain on branded goods corporations to prevent future price increases. This tendency shows a shift in pricing approaches, with an emphasis on steady expansion and volume stabilization rather than profit maximization through unsustainable price hikes.

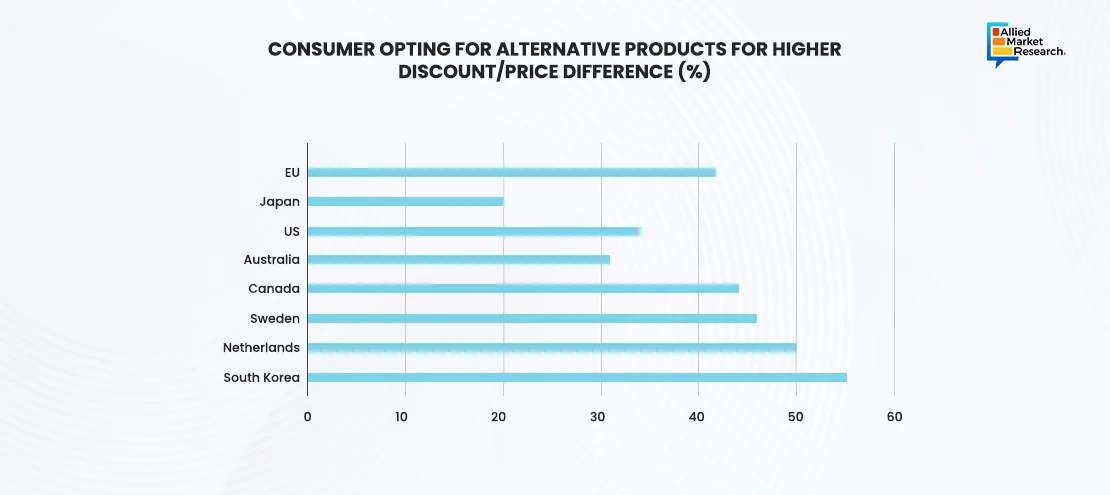

Mature markets have seen volume contraction as customers have concentrated on value and moved their shopping habits toward lower-cost private-label options. Economic uncertainty, constant inflation, and growing inflationary pressures are causing consumers to become more budget conscious. This behavior is especially noticeable in optional categories, where branded items face severe rivalry from private-label options, which frequently deliver identical quality at much-reduced rates. Retailers are capitalizing on this development by diversifying their private-label inventories and increasing advertising expenditure to cater to budget-conscious customers. For branded consumer products firms, this change offers issues in preserving market share since customers are not just dropping down within categories of goods but are additionally reevaluating loyalty to the brand. Companies have the opportunity to innovate, emphasize value-driven propositions, and provide targeted promotions to sustain customer attention which will reduce the impact of diminishing volumes in established industries.

In parallel, the repercussions of geopolitical tensions have remained less serious than expected, contributing to a stable economic situation. However, the risk of another flare-up has remained a major concern, as rising geopolitical tensions could heavily disrupt commodity markets and cause sharp price fluctuations. Such shifts have increased input prices for firms, especially within resource-intensive and raw material-dependent businesses, putting further strain on supply networks that are already aiming for post-pandemic efficiencies. Prolonged conflicts have hindered global commerce flows by implementing trade restrictions, taxes, or sanctions, adding operational complications for multinational firms. Furthermore, uncertainty caused by international turmoil is expected to weaken consumer morale, limiting discretionary expenditure and lowering economic expansion prospects. To address these difficulties, businesses and policymakers are planning for future disruptions by investigating solutions such as widening supply chains, arranging alternate sourcing agreements, and utilizing technological improvements to improve resilience.

Regional Insights on the Consumer Goods Industry in 2024

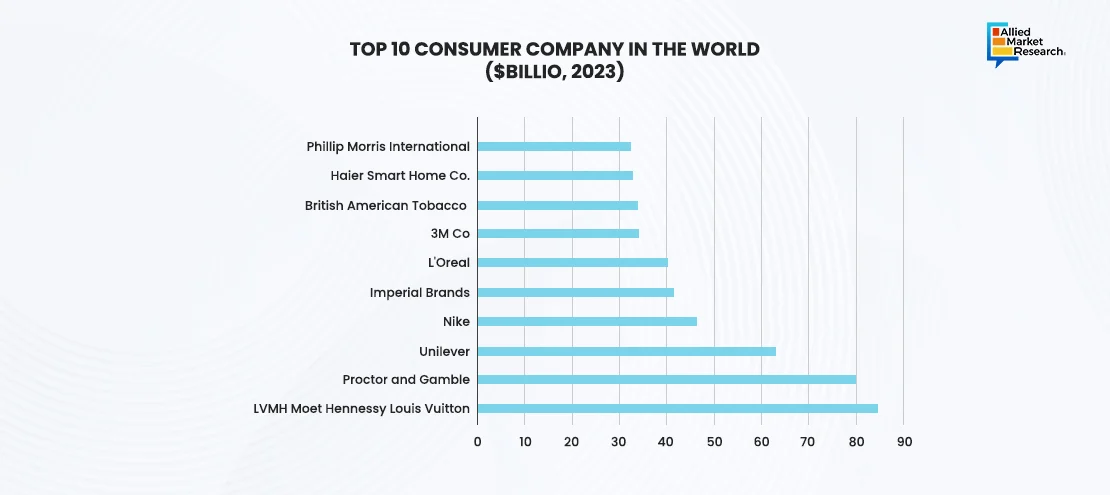

The consumer goods industry has exhibited dynamic growth across regions in 2024, driven by rising demand for goods, consumer-friendly pricing, and a focus of key players on advanced technology. Prominent players such as Proctor & Gamble, Unilever, Nike, and L'Oreal have played a significant role in driving innovation, shaping industry standards, and fostering collaborations for improving the consumer and buying experience.

In 2024, the North American consumer goods industry had significant advances. According to the United States Census Bureau, retail trade transactions in the U.S. climbed by 0.4% between September and October 2024, representing a 2.6% increase over the same time last year. This rise demonstrates consistent consumer interest in goods. However, corporations are struggling to preserve price power. The proportion of U.S. items sold on promotion increased to 28.6% last year, compared with 25.1% three years before, showing increased price sensitivity among customers.

In 2024, the consumer goods industry in Europe faced a complicated environment filled with both problems and resilience. Supply chain disruptions hit 88% of EU FMCG (Fast Moving Consumer Goods) businesses, forcing 35% to cut or halt production. Labor shortages impacted 40% of manufacturers, with nearly 20% of enterprises reporting disruptions to up to 20% of their product lines. Inflationary pressures were substantial, with 94% of firms seeing cost increases, notably in labor, transportation, and raw materials. These economic pressures prompted 36% of businesses to reduce research and development expenditures and 38% to slash capital spending. Despite these challenges, the sector remained committed to the EU's Single Market, allowing the trade of €276 billion inside the EU, accounting for 61% of all FMCG traded.

The Asia-Pacific (APAC) consumer products business has shown a mix of development and problems. The FMCG industry had a 3.5% gain in early 2024, outperforming the previous year. This increase was fueled by consumers' deliberate spending, with 65% expecting greater grocery expenditures, 54% on beauty and health items, and 52% on apparel and footwear. Despite this upward trend, the sector experienced challenges. Persistent inflation and labor market slackness prompted cautious consumer behavior, with many focusing on necessary purchases and looking for value using promotions or discounts. Furthermore, just 36% of APAC shoppers reported financial stability, indicating a careful approach to purchasing.

In 2024, the market for consumer goods business in Latin America, the Middle East, and Africa (LAMEA) had a combination of growth and problems. In Latin America, the industry witnessed a boost from rising customer spending, with retail sales in Brazil increasing by 2.4% in early 2024 compared to the same period in 2023. This increase was fueled by an expanding middle class and improving economic conditions.

The United Arab Emirates (UAE) experienced a 5% growth in retail sales throughout the first quarter of 2024, owing to strong consumer demand and a growing tourist industry. Saudi Arabia's consumer product market expanded by 4.2%, driven by diversification of economy efforts and rising disposable incomes.

Roadblocks and Solutions in the Consumer Goods Industry

In the dynamic landscape of the industry in 2024, numerous challenges have come up, testing the adaptability of companies and stakeholders. Overcoming these roadblocks demands innovative strategies and forward-thinking solutions to drive sustainable growth and foster expansion opportunities in the global market.

Roadblocks

Raw material cost: Rising raw material charges provide substantial hurdles to the household and personal care goods sector. Prices for critical resources such as chemical compounds, plastics, and natural components have increased owing to global supply chain interruptions, inflation, and rising demand. These growing costs have resulted in greater manufacturing charges, causing businesses to either endure the expenditure or transfer it to customers, thereby diminishing volume and profitability.

Recession risk: Emerging recession risks are causing substantial obstacles in household and personal care products, fashion and goods, and durables industries. As consumer confidence falls during economic uncertainty, many people are reducing discretionary spending and prioritizing needed products over unnecessary purchases. This has brought about decreased consumer demand for expensive products, harming sectors such as clothes and consumer goods, while enterprises in the household and personal care markets are under additional pressure to sustain sales despite slower economic development.

Litigation and Regulations: Rising lawsuits and increased regulation are posing substantial challenges in the tobacco-related products sector. Governments throughout the world are enacting stronger rules governing advertisements for tobacco, packaging, and public smoking, while tobacco businesses face increasing legal risks from cases including health and environmental concerns. These concerns lead to increased compliance expenses, restrictions on marketing techniques, and significant financial liabilities, eventually limiting business growth.

Solutions

Low-cost procuring: Companies have the opportunity to explore several solutions. Implementing cost-effective production procedures, such as employing sustainable and regionally obtained raw materials, can help in reducing escalating prices. Furthermore, incorporating innovation in consumer formulations, such as reducing the use of costly ingredients while preserving quality, proves to be an effective strategy. Partnering with companies to achieve long-term contracts at set rates can also assist in keeping expenses stable. Moreover, increasing the use of digital technology for improved management of supply chains can result in cost savings and higher operational efficiency.

Cost effective solutions: In the household and personal care industries, offering low-cost product lines or value packages can help maintain sales. Clothing and product firms can create more affordable and adaptable options to appeal to recession-conscious consumers. Businesses in the durables industry can highlight value by focusing on product durability and offering guarantees or repair services.

Compliance focused innovation: Tobacco companies often use compliance-focused technologies to ensure their products and advertisements meet stricter regulations. Shifting toward lower-risk products, like e-cigarettes or smokeless tobacco, which face different rules, can help reduce some restrictions. Companies also build partnerships with public health organizations to enhance their reputation and adapt to regulatory changes.

The Future Scope of the Consumer Goods Industry

The consumer products business is expected to increase steadily, owing to several major causes, including growing demand for necessities, competitive pricing, and others. This boom is likely to be especially noticeable in the region of Asia-Pacific, where retail e-commerce sales are projected to exceed $5.8 trillion by 2023, with a 39% increase predicted in succeeding years. In the U.S., real retail volatility is expected to increase from -0.4% in 2024 to 2.3% in 2025, reflecting a change in consumer purchasing patterns. Furthermore, the global FMCG industry is expected to develop at a CAGR of 4.9% between 2024 and 2031, with a market volume of $18.9 trillion by 2031.

However, the sector faces issues such as growing raw material costs, greater regulatory demands, and altering customer tastes. To address these concerns, businesses are implementing initiatives such as investing in environmentally conscious practices, diversification of product lines, and using digital technology to improve operational efficiency.

With major corporations integrating ESG (environmental, social, and governance) goals into their business strategies, sustainability initiatives are expected to play a key role in reshaping the consumer goods space in the years to come. From sustainable sourcing and production practices, consumers demand more transparency in how products are made. Brands are investing in sustainable raw materials, reducing energy consumption, and in general, taking to manufacturing processes that have less impact on the environment. This includes using renewable energy, saving water, and reducing waste. Packaging is also evolving to meet environmental goals by replacing single-use plastics with biodegradable, recyclable, or renewable materials. Furthermore, the rising relevance of the circular economy models is encouraging firms to create items that can be readily recycled or reused, hence expanding their lifespans and reducing waste.

Furthermore, there is a greater emphasis on sustainable supply chains, with ethical procurement and fair labor standards becoming important concerns for customers. Companies are also matching their aims with international guidelines for sustainability, which include the United Nations Sustainable Development aims (SDGs), therefore promoting a good influence on the economy and the environment. As these trends gain traction, the consumer products industry is expected to not only minimize its environmental impact but also strengthen ties with more eco-conscious customers, promoting innovative thinking and long-term profitability.

The Bottom Line

Wrapping up, despite global economic uncertainties, the consumer goods industry has demonstrated resilience and successfully managed the challenges of the past year. The industry's strategic investments and price point set for budget-conscious consumers have provided an opportunity for a promising future of growth and sustainability. As we look toward 2025, the consumer goods sector is anticipated to experience a considerable expansion and innovation. This growth is driven by business-friendly regulations, rapid technological integration, and a strong focus on sustainability and efficiency. Moving into 2025, digital transformation and environmental sustainability are essential to unlocking opportunities and exploring the changing landscape with resilience. Contact AMR analysts for personalized industry insights and strategic analysis of the consumer goods industry.

Refer to our below trending reports: