Table Of Contents

- Global Crisis of Waste Management: A Call for Waste-to-Energy Expansion

- Future of Waste-to-Energy

- Regulatory and Security Concerns in Waste-to-Energy Projects

- Summing up

- Waste-to-energy technology provides a sustainable way to manage waste and produce energy. However, the industry faces challenges like strict environmental laws, public opposition, cybersecurity risks, and operational issues. To ensure long-term success, WTE projects need better policies, advanced technology, and stronger security measures.

Yerukola Eswara Prasad

Koyel Ghosh

Growing Adoption of Waste-to-Energy Technologies

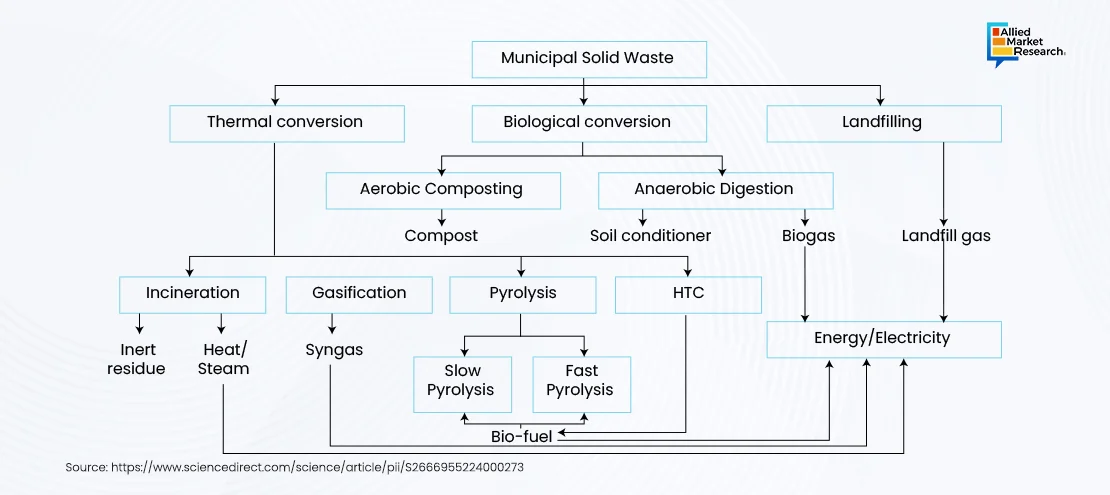

Waste-to-Energy technologies are growing faster due to rising waste generation and the need for cleaner energy alternatives. Governments and industries are investing in advanced processes such as gasification, pyrolysis, and anaerobic digestion to convert municipal solid waste into electricity and biofuels. Waste-to-energy reduces landfill waste, cuts methane emissions, and contributes to circular economies. Innovations in thermal and biological conversion are improving energy efficiency, making waste-to-energy a viable solution for sustainable urban development. With support for renewable energy, waste-to-energy is becoming a popular eco-friendly solution for managing waste and generating power.

Modern waste-to-energy plants utilize various advanced technologies such as incineration, gasification, pyrolysis, and anaerobic digestion to maximize energy recovery while minimizing environmental impact. Plasma gasification, for example, is an emerging technology that breaks down waste at extreme temperatures, significantly reducing hazardous residues.

Japan’s Mihama-Mikata plasma gasification facility processes over 14,000 tons of waste annually, generating synthetic gas for energy production. Anaerobic digestion is another promising method that efficiently converts organic waste into biogas, with Germany’s Biogas Nord Group leading the development of large-scale digesters that transform food waste and agricultural residues into clean energy. Pyrolysis technology, particularly in the U.S. and China, is gaining traction for converting plastic waste into synthetic fuels, with companies like Brightmark Energy developing large-scale facilities to process over 100,000 tons of plastic waste annually starting in 2025.

Emerging innovations such as artificial intelligence and blockchain technology are also transforming waste-to-energy efficiency. AI-driven automation in waste sorting enhances material recovery and optimizes energy output. Blockchain applications in waste-to-energy plants are improving waste traceability and transaction transparency, attracting increased investor confidence in the sector.

Global Crisis of Waste Management: A Call for Waste-to-Energy Expansion

The global waste management crisis reveals that 70% of waste worldwide is either openly dumped (33%) or disposed of in landfills (37%), contributing to environmental pollution, land degradation, and greenhouse gas emissions. Only a small portion of waste is efficiently managed: 13.5% is recycled, 11% is treated through incineration, and 5.5% is composted. This highlights the urgent need for Waste-to-Energy solutions, which can reduce landfill dependency and generate sustainable energy. Expanding waste-to-energy technologies like incineration, gasification, and anaerobic digestion helps countries turn waste into energy, reduce pollution, and support a circular economy.

Leading nations such as Sweden, Singapore, China, India, the U.S., and several EU countries have implemented innovative policies and technologies to advance waste-to-energy adoption.

Sweden has established itself as a global leader by integrating advanced incineration and recycling systems, even importing waste from neighboring countries to generate electricity and district heating. In 2022, Sweden’s waste-to-energy plants turned over 2 million tons of waste into enough energy to heat 1.25 million homes. The country aims to become a zero-waste society by 2040. Similarly, Singapore’s Tuas Nexus Integrated Waste Management Facility, expected to be operational by 2025, will generate 120 MW of electricity, supplying power to 300,000 households through a unique integration of solid waste treatment and water reclamation.

China, as the world’s largest waste-to-energy producer, operates over 400 WASTE-TO-ENERGY plants and has recently announced plans for 50 new facilities under its carbon neutrality goal, with a $5 billion investment to enhance energy efficiency and reduce emissions.

India, under the ‘Waste-to-Wealth’ initiative, is planning to set up 10 large-scale waste-to-energy plants by 2025, with companies like Tata Power and Reliance Energy actively investing in this sector. Meanwhile, the U.S. has allocated $1.2 billion toward renewable energy projects, with significant funding directed at waste-to-energy initiatives. Companies such as Covanta are investing in waste-to-energy developments, including a state-of-the-art facility in Florida that will process 1.5 million tons of waste annually by 2026.

The European Union is also reinforcing green energy policies by supporting waste-to-energy projects through grants and subsidies, with nations like Germany and the Netherlands integrating carbon capture technologies into their new plants.

Future of Waste-to-Energy

Governments and private companies are investing heavily in waste-to-energy development. Leading global corporations such as Veolia and Suez from France have pledged $2.2 billion for waste-to-energy expansion across Europe and Asia.

Hitachi Zosen Inova of Switzerland has invested $500 million in Japan and the U.S. to build high-efficiency waste-to-energy plants. The UK-based Renew ELP is developing a plastic-to-fuel waste-to-energy plant that will process 80,000 tons of waste annually starting in 2025.

Meanwhile, Saudi Arabia has allocated $3 billion toward waste-to-energy projects, with major plants planned in Riyadh and Jeddah. Australia is also investing $1 billion in waste-to-energy, with new gasification plants under development in Sydney and Melbourne.

Also, several upcoming projects showcase the sector's growth. Tokyo is currently developing an AI-driven waste-to-energy plant to enhance waste segregation and energy production. Germany is building a waste-to-energy plant in Berlin, launching in 2026, with carbon capture to cut emissions by 40%. São Paulo, Brazil, is investing $700 million in a facility to process 1.2 million tons of waste annually. Vancouver, Canada, is constructing a waste gasification plant to produce 250 GWh of electricity per year. India is also planning to establish decentralized waste-to-energy plants in major urban centers to address rising waste volumes and meet renewable energy targets.

Regulatory and Security Concerns in Waste-to-Energy Projects

Waste-to-energy sector faces numerous regulatory and security challenges that impact its growth and operational efficiency. A key concern in the WTE industry is meeting environmental emission standards. Governments worldwide are enforcing strict regulations to limit pollutants such as dioxins, furans, nitrogen oxides (NOx), and particulate matter, which can be released during waste incineration.

For instance, the European Union's Industrial Emissions Directive (IED) and the U.S. Clean Air Act have mandated stringent emission control measures, requiring WTE plants to adopt advanced filtration and carbon capture technologies. Additionally, waste classification laws restrict the types of materials allowed for incineration. Many countries emphasize the importance of segregating hazardous waste, ensuring that non-recyclable materials are prioritized for energy recovery while recyclable and compostable waste is diverted. Germany’s Circular Economy Act, for example, promotes recycling before incineration, limiting the volume of waste available for WTE plants.

Another regulatory challenge lies in the permitting and approval processes, which often involve extensive environmental impact assessments (EIAs) and public consultations. Many communities resist the establishment of WTE plants due to concerns over air pollution, odors, and potential health risks, leading to project delays and increased costs. The UK has witnessed several WTE projects being stalled due to strong public opposition and legal battles. Additionally, Government policies on renewable energy affect the financial success of WTE facilities. Countries like China encourage waste-to-energy generation with incentives like feed-in tariffs and renewable energy certificates, but changing subsidies create uncertainty for investors.

Beyond regulatory barriers, security risks also threaten WTE operations. As modern plants are relying more on automation and AI for waste sorting, cybersecurity threats have become a major concern. A cyberattack, like ransomware on waste management software, could disrupt operations and endanger safety. This growing risk shows the need for stronger digital security measures, such as encrypted data and secure access controls.

Another challenge that affects the WTE industry is supply chain disruptions. A consistent and predictable waste supply is essential for maintaining operational efficiency. However, events such as the global pandemic disrupted waste collection systems, leading to fluctuations in feedstock availability and energy production. This volatility, on the other hand, features the need for resilient waste management strategies and diversified waste sourcing.

Summing up

Waste-to-energy technology provides a sustainable way to manage waste and produce energy. However, the industry faces challenges like strict environmental laws, public opposition, cybersecurity risks, and operational issues. To ensure long-term success, WTE projects need better policies, advanced technology, and stronger security measures.

Allied Market Research (AMR) provides in-depth insights into waste-to-energy technologies, policy trends, and investment opportunities. Through tailored reports and case studies, AMR helps vendors and energy firms explore the evolving landscape of waste-to-energy solutions effectively. AMR’s latest reports offer detailed analysis on market size, growth projections, key industry players, emerging waste-to-energy technologies, regulatory policies, and strategic recommendations for businesses looking to enter or expand in the waste-to-energy sector. By utilizing AMR’s expertise, industry stakeholders can enhance efficiency, comply with regulations, and capitalize on emerging opportunities in the waste-to-energy sector.

For more insights into waste-to-energy technology, contact our specialists today!