Table Of Contents

- Exploring the 2024 Life Science Landscape: Insights and Projections

- Regional Insights on the Life Sciences Industry in 2024

- Roadblocks and Solutions in the Life Sciences Industry

- Roadblocks

- Regulatory complexity: Diverse and stringent global regulatory frameworks create delays and inflate compliance costs. For example, approval timelines for medical devices in the European Union increased significantly after the implementation of the Medical Device Regulation (MDR) in 2021.

- High R&D costs: The financial strain of research and development remains a significant challenge, particularly for early-stage innovations. Developing a single new drug costs over $2.6 billion on average, as per a study by the Tufts Center for the Study of Drug Development. The significant cost is attributed to prolonged clinical trials, intricate regulatory processes, and the high likelihood of failure in developing new therapies.

- Supply chain disruptions: Interruptions in the supply of raw materials and components disrupt production schedules and inflate costs. the global semiconductor shortage, have significantly impacted the production of critical medical devices. Chips, often called the "brains" of modern technology, are essential in life-saving equipment like ultrasound machines, defibrillators, and ICU patient monitors. These devices rely on real-time data to detect health deterioration promptly. Koninklijke Philips N.V. warns that failing to address this shortage will adversely affect patients worldwide, highlighting the urgent need for solutions.

- Data security risks: Growing reliance on digital platforms increases the industry’s vulnerability to cyberattacks. Nearly 60% of respondents from all sectors reported an attack in the 2024 survey, where Healthcare has the second-highest rate of ransomware attacks globally.

- Lack of skilled professionals: The life sciences sector faces a persistent shortage of skilled professionals, particularly in specialized areas such as biomanufacturing and data analytics. This talent gap poses a challenge to sustaining innovation and operational efficiency.

- Solutions

- Regulatory technology (RegTech): The adoption of AI-driven tools streamlines compliance, reducing approval timelines by 15-20% for some companies. These technologies automate regulatory tasks, improving efficiency and reducing costs.

- Collaborative R&D models: Partnerships with academia, startups, and government agencies distribute the financial burden of innovation. Programs like the UK’s Biomedical Catalyst offer grants to support collaborative R&D efforts.

- Diversified supply chains: Enhancing resilience through sourcing materials from multiple regions and leveraging real-time tracking systems. For instance, 37% of suppliers have been prioritizing technology investments in 2024, with many respondents saying their organization has been making investments in technology capabilities for a decade.

- Cybersecurity enhancements: Employing advanced encryption methods and AI-driven threat detection systems reduces exposure to cyber risks. These measures add to data protection and enhance patient trust.

- Workforce training initiatives: Expanding skill development programs and fostering industry-academia collaborations address the talent gap. For example, India’s National Skill Development Corporation has trained over 100,000 biotech professionals since 2020.

- The Future Scope of the Life Science Industry

- The Bottom Line

Roshan Deshmukh

Koyel Ghosh

Life Sciences Industry 2024: Adopting Resilience and Fostering Innovation

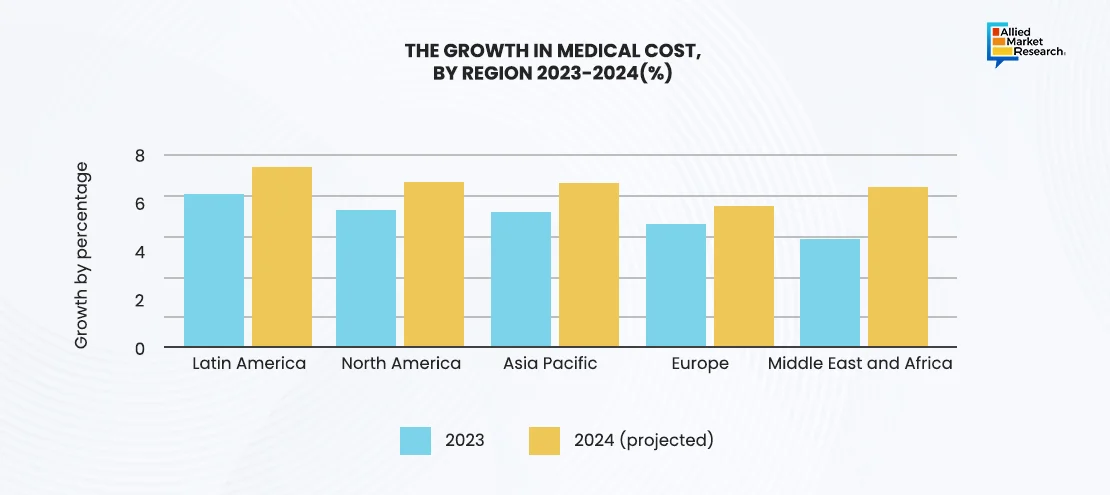

The life sciences industry in 2024 has demonstrated remarkable resilience and innovation amidst evolving global challenges. With an aging population driving higher healthcare demands, health expenditures are expected to reach $5.3 trillion by 2025, according to the Centers for Medicare & Medicaid Services (CMS). This surge in healthcare costs aligns with theWHO's projection that by 2050, the number of people aged 60 years and older will double to 2.1 billion, with those over 80 years expected to triple to 426 million. In response, the industry has accelerated investments in digital health technologies, personalized medicine, and sustainable healthcare solutions. These investments, combined with advancements in AI, telemedicine, and biotechnology, are driving growth in the lifestyle sector while adapting to the needs of an aging global population. With these trends on board, 2024 stands out as a key year for the industry's transformation through innovation.

Exploring the 2024 Life Science Landscape: Insights and Projections

The life sciences industry in 2024 witnessed transformative growth, particularly in medical devices and digital therapeutics, fueled by technological advancements and increasing global healthcare needs. The medical device market is a key part of the industry, with the United States leading it. According to the Advanced Medical Technology Association, the U.S. accounts for over 40% of the global medtech market, strengthening its position as the world’s largest medical device market. This dominance is attributed to a robust ecosystem of innovation, significant investment in R&D, and a strong regulatory framework.

Globally, the medical device industry is set for sustained growth. Annual sales are projected to rise by over 5% annually, reaching nearly $800 billion by 2030. This growth is driven by the rising demand for innovative devices such as wearables and advanced diagnostic tools, which cater to the increasing prevalence of lifestyle diseases like diabetes and cardiovascular conditions. Emerging markets, especially China and India, are unlocking immense potential as economic development and healthcare reforms expand access to medical technologies. These regions are rapidly adopting medtech solutions to address growing health concerns and aging populations.

Parallel to this, digital therapeutics (DTx) is revolutionizing healthcare delivery. Digital therapeutics are evidence-based, software-driven interventions that provide therapeutic benefits, either independently or in conjunction with traditional treatments. The sector is experiencing significant growth due to the rising burden of chronic diseases, increasing smartphone penetration, and advancements in artificial intelligence and machine learning. The digital therapeutics market is anticipated to reach $22 Billion by 2031 and is driven by demand for remote patient monitoring, personalized health solutions, and preventive care.

Moreover, the convergence of medical devices and digital therapeutics is creating unprecedented opportunities. For instance, smart wearables equipped with sensors can monitor real-time health data, which is then analyzed by DTx platforms to deliver tailored interventions. Such integration is empowering patients to manage their health proactively while enabling healthcare providers to offer precision medicine.

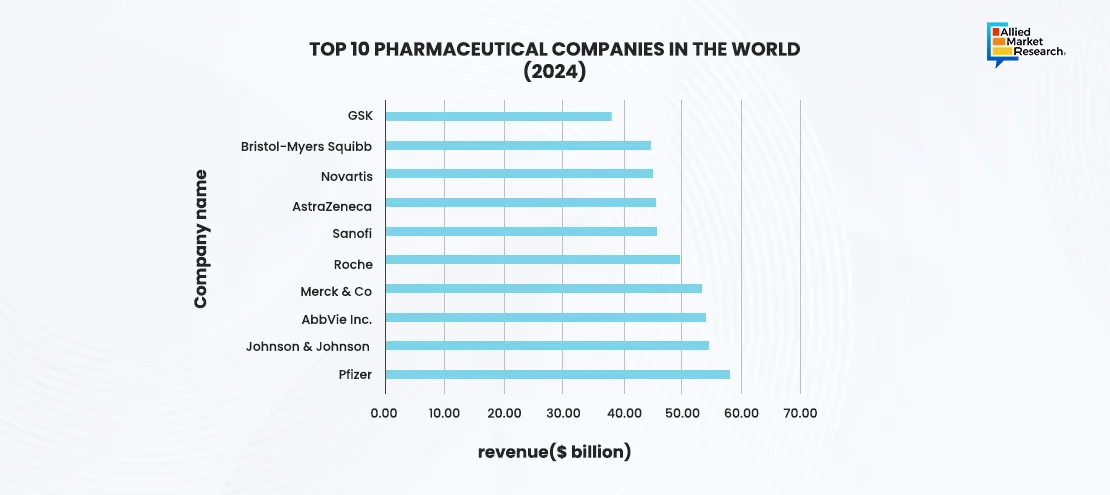

Regional Insights on the Life Sciences Industry in 2024

The life sciences industry exhibited dynamic growth across regions in 2024, driven by rising healthcare expenditures, government investments, and a focus of key players on advanced research technologies. Prominent players such as Pfizer, Novartis, Roche, Johnson & Johnson, and AstraZeneca played a signifiant role in driving innovation, shaping industry standards, and fostering collaborations for drug discovery, clinical trials, and manufacturing excellence. Their contributions to R&D, along with partnerships with academic and research institutions, have significantly accelerated the development of breakthrough therapies and cutting-edge medical technologies.

In April 2024, national health spending in North America reached a seasonally adjusted annual rate of $5.05 trillion, according to the Altarum Health Sector Economic Indicators. National health spending saw a slight increase in its year-over-year growth rate in April 2024, rising from 7.0% in March to 7.1%. This growth rate outpaced GDP growth by 1.2%. This highlights the substantial investments in healthcare services, pharmaceutical advancements, and biotechnology research. These expenditures foster a robust ecosystem for biopharmaceutical companies and medical device manufacturers, enabling innovations in areas like precision medicine and regenerative therapies. Further, Canada, with its strong academic and research infrastructure, also contributed to regional growth by focusing on partnerships to advance clinical research and drug development.

Europe showcased significant strides in genomics and personalized medicine. The UK, a key player in this space, invested $222.87 million in genomics research, emphasizing the diagnosis and treatment of genetic diseases and cancers. Major companies like GlaxoSmithKline (GSK) and AstraZeneca have spearheaded projects focused on next-generation oncology and rare disease treatments. This funding aims to strengthen the region's biotech sector and establish it as a leader in life sciences innovation. Similarly, countries like Germany and Switzerland focused on expanding their pharmaceutical manufacturing capacities, while the European Union collectively pursued regulatory harmonization to facilitate cross-border research and drug approvals.

In Asia-Pacific, rapid economic development and increasing healthcare investments are reshaping the life sciences landscape. India, for instance, witnessed its government healthcare expenditure rise to 1.9% of GDP in 2023-24, up from 1.28% in 2018-19, according to the Economic Survey 2023-24. This increase reflects the government’s commitment to expanding healthcare access, boosting medical research, and promoting domestic pharmaceutical production. China maintained its focus on biotech innovation, emphasizing artificial intelligence in drug discovery and expanding its clinical trial networks. Japan and South Korea also invested heavily in R&D for regenerative medicine and immunotherapies, leveraging their advanced technological capabilities.

Market growth in Latin America was driven by advancements in healthcare infrastructure and better access to essential medicines. Brazil and Mexico emerged as key contributors, focusing on local pharmaceutical production and partnerships with global life sciences companies to bring innovative therapies to market. Government initiatives to combat infectious diseases and chronic conditions further supported the industry’s development.

The Middle East and Africa (MEA) region is gaining traction as governments prioritize healthcare modernization. Investments in biotech research and the expansion of diagnostic capabilities, particularly in the Gulf Cooperation Council (GCC) countries, are noteworthy. South Africa’s efforts to localize vaccine manufacturing and expand healthcare infrastructure have also drawn attention.

Regional dynamics of the life sciences industry, in 2024, were shaped by varying degrees of healthcare expenditure, government policies, and research priorities. While developed markets emphasized innovation in advanced therapies, emerging economies focused on enhancing healthcare accessibility and fostering local manufacturing capabilities. Top companies like Pfizer, Roche, Novartis, and Johnson & Johnson are leading global advancements, boosting regional ecosystems, and meeting healthcare needs. This placesb the life sciences industry for ongoing growth and innovation.

Roadblocks and Solutions in the Life Sciences Industry

In the dynamic landscape of the life sciences industry in 2024, numerous challenges have surfaced, testing the adaptability of companies and stakeholders. Overcoming these roadblocks calls for innovative strategies and solutions to drive sustainable growth and foster high-end advancements in healthcare and biotechnology.

Roadblocks

Regulatory complexity: Diverse and stringent global regulatory frameworks create delays and inflate compliance costs. For example, approval timelines for medical devices in the European Union increased significantly after the implementation of the Medical Device Regulation (MDR) in 2021.

High R&D costs: The financial strain of research and development remains a significant challenge, particularly for early-stage innovations. Developing a single new drug costs over $2.6 billion on average, as per a study by the Tufts Center for the Study of Drug Development. The significant cost is attributed to prolonged clinical trials, intricate regulatory processes, and the high likelihood of failure in developing new therapies.

Supply chain disruptions: Interruptions in the supply of raw materials and components disrupt production schedules and inflate costs. the global semiconductor shortage, have significantly impacted the production of critical medical devices. Chips, often called the "brains" of modern technology, are essential in life-saving equipment like ultrasound machines, defibrillators, and ICU patient monitors. These devices rely on real-time data to detect health deterioration promptly. Koninklijke Philips N.V. warns that failing to address this shortage will adversely affect patients worldwide, highlighting the urgent need for solutions.

Data security risks: Growing reliance on digital platforms increases the industry’s vulnerability to cyberattacks. Nearly 60% of respondents from all sectors reported an attack in the 2024 survey, where Healthcare has the second-highest rate of ransomware attacks globally.

Lack of skilled professionals: The life sciences sector faces a persistent shortage of skilled professionals, particularly in specialized areas such as biomanufacturing and data analytics. This talent gap poses a challenge to sustaining innovation and operational efficiency.

Solutions

Regulatory technology (RegTech): The adoption of AI-driven tools streamlines compliance, reducing approval timelines by 15-20% for some companies. These technologies automate regulatory tasks, improving efficiency and reducing costs.

Collaborative R&D models: Partnerships with academia, startups, and government agencies distribute the financial burden of innovation. Programs like the UK’s Biomedical Catalyst offer grants to support collaborative R&D efforts.

Diversified supply chains: Enhancing resilience through sourcing materials from multiple regions and leveraging real-time tracking systems. For instance, 37% of suppliers have been prioritizing technology investments in 2024, with many respondents saying their organization has been making investments in technology capabilities for a decade.

Cybersecurity enhancements: Employing advanced encryption methods and AI-driven threat detection systems reduces exposure to cyber risks. These measures add to data protection and enhance patient trust.

Workforce training initiatives: Expanding skill development programs and fostering industry-academia collaborations address the talent gap. For example, India’s National Skill Development Corporation has trained over 100,000 biotech professionals since 2020.

The Future Scope of the Life Science Industry

The future of the life sciences industry looks promising, fueled by technological advancements, shifting healthcare needs, and escalating investments in research and innovation. The aging global population and rising prevalence of chronic diseases are increasing the demand for new therapies, diagnostics, and medical devices. According to WHO, over 35 million new cancer cases are projected by 2050. This dramatic rise in cases offers immense opportunities for companies to develop groundbreaking treatments, enhance patient outcomes, and address global healthcare disparities, thus driving the industry's future trajectory.

The advancement of digital health technologies is reshaping healthcare delivery by improving accessibility and reducing costs. Telemedicine, remote patient monitoring, and mobile health applications have transformed patient interactions with healthcare providers, enabling more efficient care and increasing the reach of medical services, particularly in underserved areas. Additionally, digital therapeutics, which are software-based treatments for medical conditions, are gaining traction. They provide non-invasive and cost-effective solutions that seamlessly fit into daily life. These innovations expand treatment options and empower patients to manage their health more effectively, aligning with the trend toward more personalized, patient-centered care.

Further breakthroughs in biotechnology and genomics are also expected to redefine healthcare, with advancements in gene therapy, cell therapies, and CRISPR technology at the forefront. These innovations have the potential to cure previously untreatable diseases, offering hope for patients suffering from genetic disorders and certain cancers. The ability to modify genes to correct defects or enhance immune responses could drastically change the treatment landscape, turning once incurable diseases into manageable conditions, if not cures.

The life sciences industry is evolving, and sustainability is becoming an increasingly important factor. Companies are focusing on environmentally responsible practices across the entire supply chain, from reducing waste and improving energy efficiency to sourcing raw materials more sustainably. A notable example of this commitment to sustainability is Amcor's AmSky Recyclable Blister Packaging System, which offers an eco-friendlier packaging solution for pharmaceuticals and nutraceuticals. This packaging replaces traditional PVC/aluminum foil blister packs, which are not compatible with recycling streams. With PVC labeled as a "problematic and unnecessary material" by groups like the U.S. Plastics Pact, this innovation contributes to the broader effort to reduce plastic waste and achieve sustainability goals. Thus, the future of the life sciences industry is one of innovation and growth. With advancements in AI, digital health, biotechnology, and sustainability, the industry is anticipated to make significant moves in improving patient care, reducing costs, and addressing global health challenges.

The Bottom Line

In conclusion, the life sciences industry has successfully navigated a year marked by strong legislative support and technological advancements despite facing various challenges. The industry's resilience and strategic investments point to a promising future for growth and sustainability. As we look toward 2025, the life sciences sector is expected to witness considerable expansion and innovation. This growth is driven by legislative support, rapid technological integration, and a strong focus on sustainability and efficiency. Moving into 2025, focusing on digital transformation and environmental sustainability plays an important role in unlocking new opportunities and adapting to the changing landscape. For personalized industry insights and strategic analysis of the life science industry, contact our expert analysts today!

Refer to some of our trending reports in the life sciences industry-