Table Of Contents

Roshan Deshmukh

Koyel Ghosh

An Overview of the Life Sciences Industry in Q4 2024: Growth, Challenges, and Innovations

The fourth quarter of 2024 represented a remarkable period for the life sciences industry, driven by substantial funding rounds, regional growth, and notable advancements in healthcare. Through its newsletter, Allied Market Research throws light on all the notable progress the sector experienced during the period. The study also covers major challenges such as supply chain disruptions, geopolitical instability, and labor shortages and respective solutions to overcome these hurdles, contributing to a dynamic landscape in life sciences development.

Notable Fundings made by key companies in the life sciences industry in Q2’24

In the fourth quarter of 2024, the funding initiatives significantly impacted the life sciences industry accelerating innovation, enhancing clinical research, and enabling companies to introduce transformative therapies to the market. The funding rounds of companies, such as AusperBio, Ottimo Pharma, and SiteOne Therapeutics exemplified how such financial support promotes progress in drug development and broadens the therapeutic landscape. Here are some key findings that boosted the landscape during the quarter:

On December 26, 2024, AusperBio announced it raised $73 million in a Series B funding round led by HanKang Capital, with participation from Sherpa Capital and others. This funding advanced the development of its lead therapy, AHB-137, aimed at achieving a functional cure for chronic hepatitis B, supporting clinical trials in China and globally.

Simultaneously, on December 20, 2024, Ottimo Pharma announced that it raised over $140 million in a Series A funding round to accelerate the development of its lead drug, Jankistomig. It is a first-of-its-kind PD1/VEGFR2 bifunctional antibody for solid tumors. The funding also supported the development of both IV and SC forms of the drug and additional therapies in the pipeline.

Furthermore, on December 23, 2024, SiteOne Therapeutics announced it raised $100 million in a Series C funding round led by Novo Holdings, with participation from OrbiMed and others. The funding is expected to advance the development of selective small molecule ion channel modulators for treating sensory hyperexcitability disorders, such as pain and chronic cough, through human clinical trials.

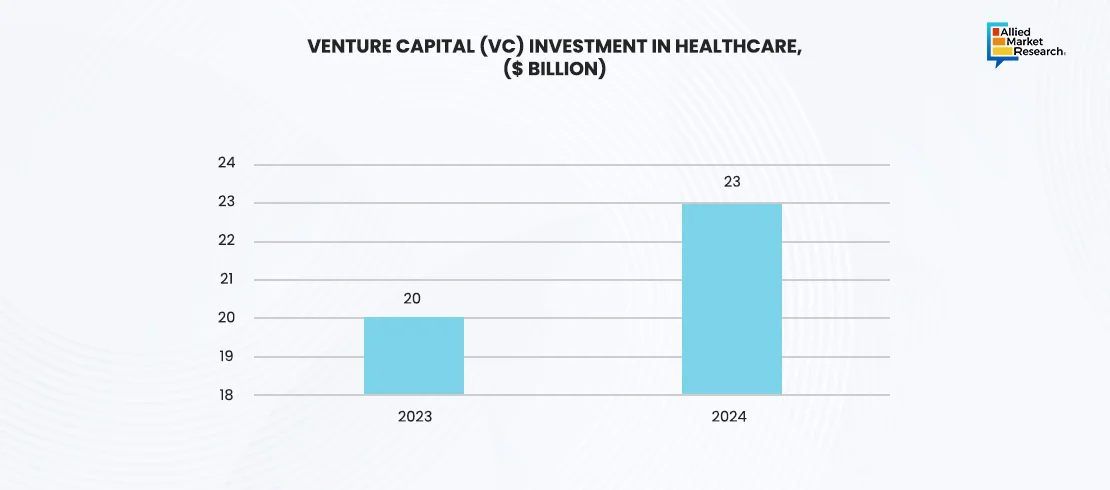

Based on the data presented in the graph, venture capital (VC) investment was directed toward boosting growth in the life sciences industry. The increased VC funding accelerated breakthroughs in biotechnology, medical devices, and drug discovery. In 2024, biopharma AI received approximately $5.6 billion in VC funding, highlighting its transformative potential to enhance healthcare outcomes and drive industry growth.

Regional snapshots fueling the growth of the industry in Q4 2024

The life sciences industry showcased prominent growth across different geographical areas in Q4 2024, driven by strategic mergers and acquisitions made by key players and initiatives for robust healthcare infrastructure development.

The North America region gained the dominant share in the global life sciences sector in the quarter due to the significant FDA approvals, substantial investments in AI, and contributions from top-tier companies. In the fourth quarter of 2024, the FDA approved 16 new drugs, highlighting a strong drug development pipeline that addresses various medical needs, including oncology and rare diseases. These regulatory milestones enhance patient outcomes and reinforce the United States' position as a pioneer in pharmaceutical innovation.

The emphasis on AI in healthcare by key companies played a key role in driving the region’s growth. For instance, In October 2024, OpenAI secured $6.6 billion in funding, which boosted its valuation to $157 billion. This investment strengthens the increasing role of AI in drug discovery and personalized medicine. Additionally, Abridge AI Inc. raised $250 million to enhance clinical documentation and decision-making tools. The presence of major players like Gilead Sciences and Amgen further reinforces North America's position as a hub for groundbreaking healthcare solutions.

The European life sciences industry experienced notable growth in Q4 2024, reinforcing its global leadership in pharmaceutical innovation. Despite macroeconomic challenges, the region benefited from regulatory approvals and significant investments. A key highlight was the European Commission's approval of Novo Holdings' $16.5 billion acquisition of Catalent. This agreement enhances drug development capabilities and addresses the need for scalable production within Europe's biopharmaceutical sector.

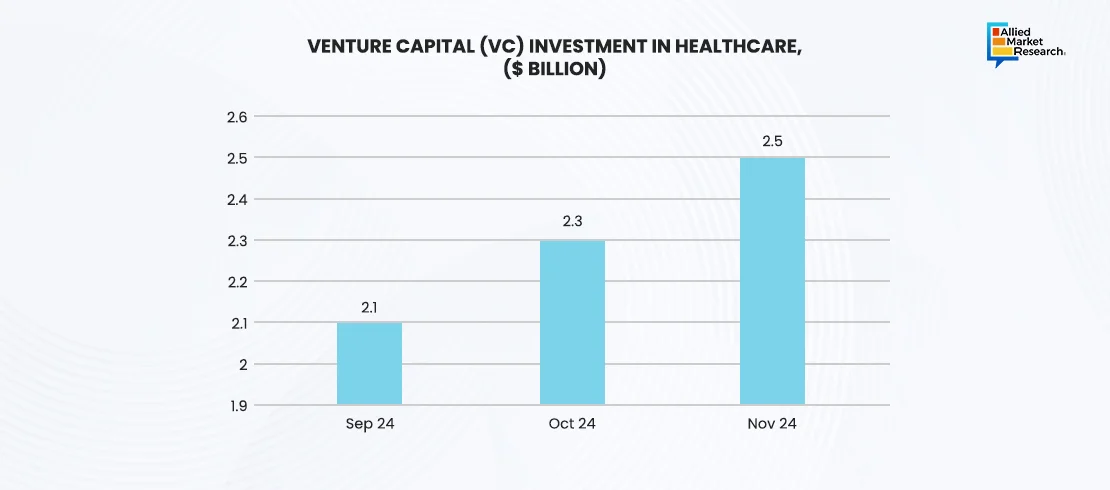

As per the above data, in Q4 2024, the region faced inflationary pressures, with EU annual inflation rising to 2.5% in November, up from 2.3% in October. This significant rise impacted the production and distribution costs of pharmaceutical products. Many companies responded by enhancing efficiency and strategic financial planning, ensuring the sector remains resilient amid challenges.

Furthermore, the Asia-Pacific region experienced notable growth in the life sciences sector, fueled by advancements in healthcare infrastructure, biotechnology, and medical devices. India emerged as a key player, capitalizing on its capabilities in vaccines, biopharmaceuticals, and medical device manufacturing. Significant developments such as improved healthcare access, substantial investments, and government initiatives were the main factors that drove the regional growth in Q4 2024.

According to the data, India emerged as a key player in the pharmaceutical industry, generated $65 billion in 2024, and is expected to garner $450 billion by 2047. With strong manufacturing capabilities, low production costs, and a skilled workforce, India excelled in generic drug and vaccine production. Also, increased government support for R&D and a growing contract research sector further attracted international investments in the region.

The life sciences industry in LAMEA showed mixed progress in Q4 2024. The African Vaccine Manufacturing Accelerator received approval to invest up to $1 billion over the next decade, enhancing vaccine production in Africa and improving pandemic preparedness. However, a UNICEF report revealed that only one in three community health programs in the Middle East and North Africa received government funding, limiting the effectiveness of community health workers. Despite these challenges, key investments have improved healthcare delivery and child survival rates, ultimately benefiting national economies by promoting a healthier and more productive workforce.

Supply chain struggles in the life science domain in Q4’24

In Q4 2024, the life sciences supply chain faced significant disruptions, leading to drug shortages and prompting rapid reorganizations within pharmaceutical companies. Furthermore, geopolitical tensions, cybersecurity threats, and the impacts of climate change were other prominent factors that significantly impacted supply chain operations.

Geopolitical instability, particularly in regions essential for raw material production, resulted in delays and increased costs. For example, on September 13, 2024, the U.S. Trade Representative announced tariff increases on imports from China ranging between 25% and 100%, affecting critical medical supplies.

Additionally, cybersecurity threats emerged as a major concern, with Cipla targeted by the Akira ransomware group in December 2024, resulting in the theft of 70GB of sensitive data. Further, climate change further complicated supply chains, as extreme weather disrupted transportation in Q4 2024, with a World Economic report predicting more weather-related disruptions over the next 15 years.

Challenges and solutions impacting the sector’s growth in Q4 2024

The life sciences industry also witnessed significant challenges, including labor shortages, supply chain disruptions, regulatory hurdles, and economic uncertainty. Labor shortages driven by increased demand for skilled professionals in research, manufacturing, and healthcare hampered productivity and delayed project timelines. To address this, companies invested in workforce development programs, utilized automation and AI to minimize manual processes and offered flexible work arrangements to attract and retain talents.

Moreover, supply chain disruptions resulting from geopolitical tensions and raw material shortages led to delays in product delivery and increased costs. To build resilience, leading companies diversified suppliers, utilized advanced forecasting tools and maintained strategic inventory reserves. In addition, many firms emphasized cost optimization and explored emerging markets to expand revenue streams and overcome economic uncertainty from rising inflation.

In a nutshell

The life sciences industry in Q4 2024 demonstrated remarkable growth driven by strategic funding, regional advancements, and innovative therapies. While experiencing challenges like supply chain disruptions and labor shortages, the sector has exhibited resilience, fortified by investments in AI and robust healthcare initiatives. Also, the domain maintained its dominance throughout the quarter by offering transformative healthcare solutions for mankind.

To attain more insights into the emerging trends in the life sciences industry, get in touch with our industry specialists today!