Table Of Contents

Yerukola Eswara Prasad

Koyel Ghosh

Bioplastics: Understanding its Future Incorporation in Packaging Industry

Bioplastics are a type of plastic derived from renewable biological sources, such as vegetable fats and oils, corn starch, straw, woodchips, sawdust, recycled food waste, etc. Unlike traditional plastics, which are made from petroleum, bioplastics are made from renewable feedstock. Bioplastics, derived from renewable sources, typically produce fewer greenhouse gas emissions than conventional plastics. Additionally, they contain fewer harmful chemicals, thereby minimizing the release of toxins into the environment. According to a study by AMR, the global bioplastics market is anticipated to register a CAGR of more than 11% between 2022 and 2031.

Bioplastics have the potential to reduce carbon dioxide emission by 30%-70%, as compared to conventional synthetic plastic. Its production is a cost-effective & efficient process and requires 65% less energy than conventional plastic. It does not harm the environment, as these materials do not have any toxicity and can degrade easily. Moreover, its greenhouse gas emission is minimal during the time of degradation, representing a 42% reduction in carbon footprints. Also, an increase in consumer awareness about the usage of sustainable products coupled with rapid environmental concerns, such as global warming drives consumer’s acceptance of bio-based and biodegradable plastic materials. Consumers prefer to use bioplastic packaging over synthetic plastic packaging, since it is capable of being decomposed. The growing consumer acceptance of biodegradable plastics is driving their widespread use in catering applications. This rising demand for these plastics is particularly evident in developed regions like North America and Europe, where there is an increasing preference for these materials across various industries, including catering, packaging, agriculture, and automotive.

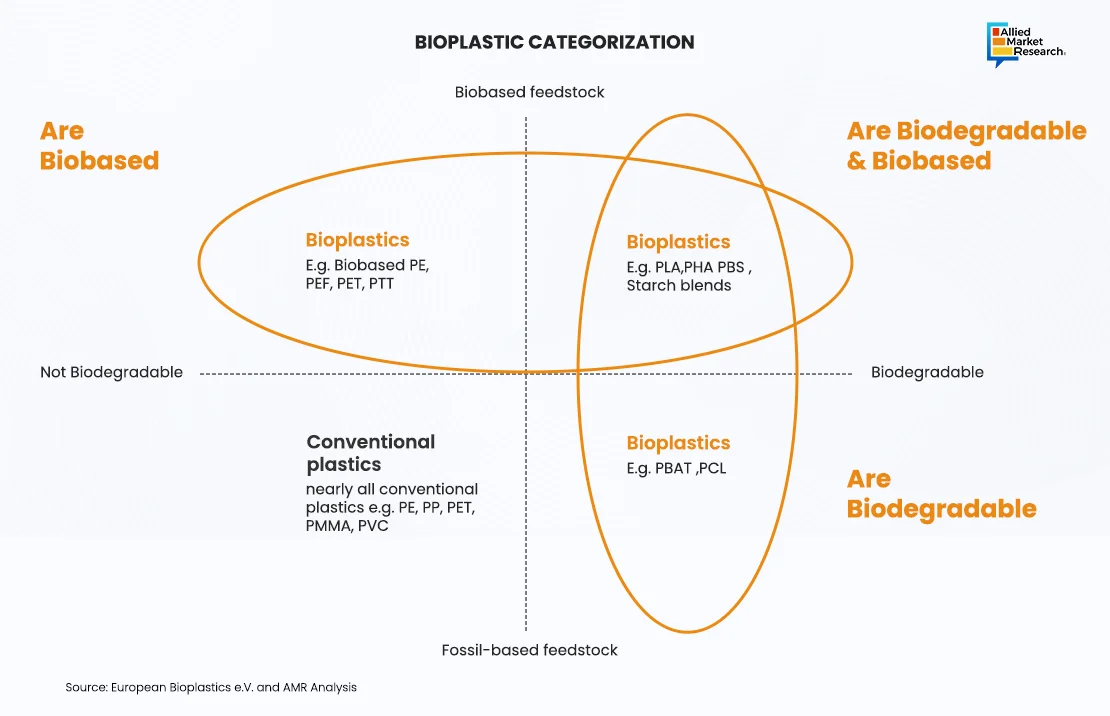

From the above figure, we can understand that bioplastics are biodegradable and non-biodegradable in nature, depending on the polymer used. Like conventional plastics, bioplastics produced from biopolymers such as PE, PET, PEF, and so on are non-biodegradable. On the other hand, Bioplastics, which can be produced from biopolymers like PLA, PHA, starch blends, and others, as well as from fossil-based polymers like PBAT and PCL, are biodegradable by nature. Plastics made from these materials are classified as bioplastics.

Various governments across the world have adopted favorable regulations and policies to promote sustainability and biodegradability of these plastics. These are some of the key factors that boost the growth of the market. The European Union is one of the major political advocates of the bioplastics market. In Europe, policy makers formulate environmental policies to create awareness among consumers. Governments in Asia and Europe have now formulated certain stringent policies, which are expected to favor the growth of the bioplastic industry material. The EU Commission has set a target that by 31st December 2025, individuals should use no more than 40 plastic bags each per year. Additionally, in Latin American countries such as Brazil and Chile, governments have banned the use of lightweight plastic bags. They have imposed a $370 fine for non-compliance, a move supported by major retailers, including Walmart. However, ambiguity in the industry standards is still a big issue for the industry players as some of these standards are not globally recognized and accepted.

Analyzing Key Parameters to Observe Bioplastic Growth Patterns

Incorporation in the Packaging Industry

In 2024, the packaging industry is worth USD 1.2 trillion and growing over 3% annually. The demand for a circular economy and sustainable materials is driving innovation. Bioplastics are replacing synthetic polymers due to higher fossil fuel prices and increased social awareness. These bioplastic films are widely used for packaging in agriculture, household, and hygiene products. Both biodegradable and non-biodegradable bioplastics are used in a range of flexible packaging applications. Rise in environmental awareness among the customers primarily drives the adoption of these plastics in flexible packaging applications. They possess some unique physical properties, such as gloss, barrier effect, antistatic behavior, printability, and touch that makes it best suited for flexible packaging applications. It is a feasible flexible packaging material, as it helps increase the shelf life of fresh and perishable food products.

Bioplastics are still in the early stages of use in the packaging industry, making up only 0.56% in 2024. Despite their potential, they have a long way to go before they can significantly replace conventional plastics in various applications. They were primarily developed to replace single-use plastics in packaging, a major source of pollution. In addition to packaging, bioplastics are also used in the consumer goods and textile industries.

Metals and plastics still dominate the packaging materials used in the packaging industry, mainly due to their pricing structure and ease of use. Metal based packaging materials increase the shelf life of the product stored, while plastic packaging is used due to its flexibility and ease of handling. For instance, Coca-Cola uses PET bottles which also uses plant-based material, while TetraPak uses caps and films made from bioplastics. The first PLA water bottles were launched in the U.S., in 2005, and now various types of bottles are used across by different end-users. In addition, several countries such as Thailand, and others have exempted import duty on bioplastics and associated packaging products. They are projected to play a significant role in the packaging industry as technology is advancing and sustainability is becoming an increasingly important factor in consumer choices.

Price Comparison Analysis

The prices of plastics have been relatively low as compared to other packaging materials in general. Plastics, though derived from petroleum products, have showcased relative price stability as compared to metals, paper and glass. This is mainly attributed to constant raw material supply, growing demand, and advancements in production technologies.

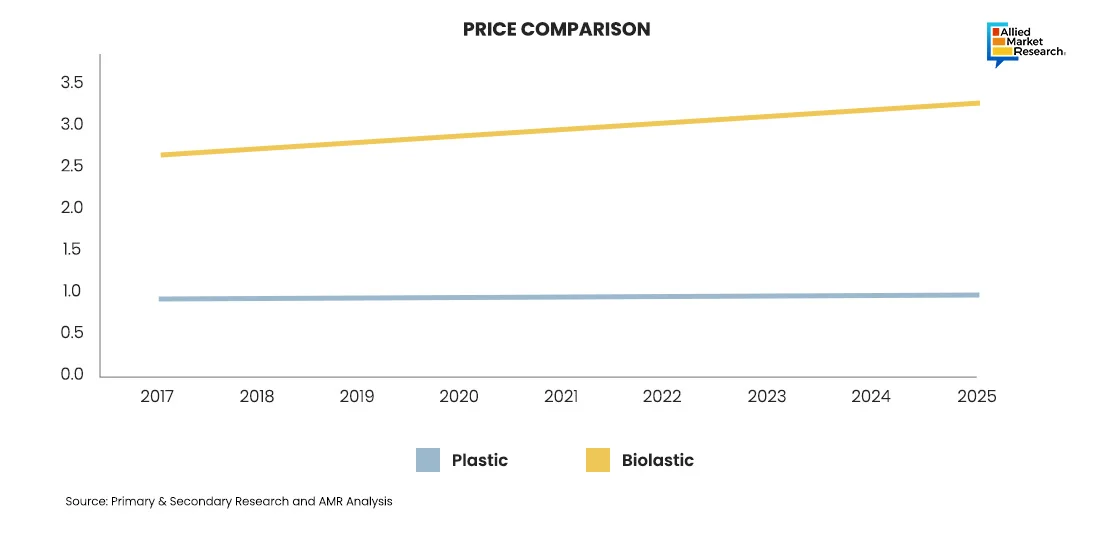

Historically, bioplastics were significantly more expensive than conventional plastics due to limited production capacity and high raw material costs. On the other hand, bioplastics are derived from renewable sources like corn, sugarcane, and other plant materials. Fluctuations in the prices of these commodities significantly impact the production costs. Bioplastic production is often more expensive due to newer technologies and smaller scales of production compared to traditional plastics.

The figure showcases the price trend of bioplastics as compared to regular plastics from 2017 and forecasted till 2025. In 2023, these plastics cost about $3.20 per kilogram, while regular plastics were priced at around $0.90 per kilogram. Their prices are roughly 3.5 times higher than plastics, and this trend is expected to continue till 2025.

However, bioplastics are currently too expensive to be widely used as their production costs are high. To make them more affordable and competitive with traditional plastics like PET, PE, and PP, which are commonly used in packaging for food, pharmaceuticals, and cosmetics, technological innovations are important. Research and development must focus on making bioplastics more cost-effective and suitable for various applications.

For instance, Praj Industries, in April 2024, launches their pilot scale polylactic acid (PLA), polyhydroxyalkanoates (PHA) and polyhydroxybutyrate (PHB) plant using feedstock. Such an approach by the company will help the PLA, PHA and PHB based bioplastics help in bulk production, thus decreasing the production cost and making them commercially viable and sustainable alternatives as compared to plastics. Also, in March 2024, Bpack launched bark-based biodegradable bioplastics. The company created this product by turning bark from timber production, used coffee grounds, and other bio-based materials into sheets, pellets, and granules. Bpack says their bioplastic can be used in food, beverage, and cosmetics. It's made from production waste using the same equipment as regular plastic, so no new machinery is needed.

Bioplastics are sustainable products and hence their incorporation in different end-use industries needs to be increased. With a reduction in prices, i.e., mainly through decreased production cost and easy availability of raw materials, the incorporation of these plastics can be increased considerably. Since bioplastics are primarily utilized in the packaging industry, their incorporation needs to advance significantly. By addressing these factors, we can boost the demand for this material and generate a positive momentum in their adoption.

Looking ahead

Winding up, while bioplastics have historically been more expensive than traditional plastics, ongoing advancements and increasing demand are driving prices down, fostering market growth. The future of bioplastics looks promising, with expanding applications and increasing adoption expected to sustain their growth trajectory.

Allied Market Research delves deeply into the bioplastic industry, offering in-depth insights for vendors seeking to explore this expanding sector. Our meticulously developed reports examine the latest technological advancements, market trends, and relevant government initiatives, providing businesses with the essential knowledge needed to integrate bioplastics to their product offerings effectively. By staying informed on these key areas, companies can make strategic decisions and capitalize on emerging opportunities in the market. For expert guidance on materials and chemicals related to bioplastics, don’t hesitate to reach out to our team today!