Table Of Contents

- Notable M&A and funding creating wide opportunities across the MC sector in Q4 2024

- Digital technologies and sustainability driving the growth of the MC industry in 2024

- Regional snapshots propelling the industry growth in Q4 2024

- Supply chain insights impacting the domain’s growth in Q4 2024

- Final words

Yerukola Eswara Prasad

Koyel Ghosh

A Comprehensive Look at the MC Industry in Q4 2024: Key Trends and Technological Innovations

The materials and chemicals (MC) sector witnessed transformative developments in 2024, driven by notable mergers, acquisitions, and funding activities that expanded opportunities globally. Q4 2024 showcased significant growth of the sector fueled by the integration of modern technologies, sustainable innovations, and regional advancements. Many leading players in the domain emphasized producing bio-based chemicals and nanomaterials to meet the increasing demand for sustainable solutions across industries. Additionally, regulatory changes, technological advancements, and evolving market dynamics across key regions played a key role in boosting the industry’s growth during the period. This newsletter by AMR highlights all promising happenings in Q4 2024 that significantly drove the industry’s growth.

Notable M&A and funding creating wide opportunities across the MC sector in Q4 2024

ADNOC, the UAE's state-owned oil company, acquired Covestro for $15.18 billion to enhance its petrochemical operations and drive future growth in gas, LNG, and renewable energy. This acquisition enabled ADNOC to strengthen its foothold in performance materials and specialty chemicals, aligning with its vision to become one of the leading chemical companies in the coming years.

Similarly, iMicrobes, a California-based bio-based chemical manufacturer, secured approximately $10 million in funding from First Bight Ventures and Universal Materials Incubator Co. (UMI). Through this investment, iMicrobes aimed to accelerate the development of renewable chemicals derived from ethanol and methane. The company envisioned facilitating the transition from petrochemicals to sustainable, high-performance materials by focusing on scalable bioprocesses. This is expected to address the increasing global demand for eco-friendly solutions across various industries.

Furthermore, Sunthetics, an AI technology company based in San Marcos, TX, raised $4 million in seed funding. The company utilized a machine-learning platform that integrates traditional AI with physical insights to innovate new chemical products and processes.

Simultaneously, Westlake Innovations Inc. invested in Burlington and Ontario-based Universal Matter Inc., which aimed to become a leading supplier of sustainable graphene and advanced materials for decarbonization. Universal Matter developed patented Flash Joule Heating technology, enabling the cost-effective upcycling of carbon waste into high-quality graphene and graphitized carbon. This funding is projected to support a transition toward environmentally friendly materials.

In addition, Meridian Adhesives Group acquired PAS Bangkok Co. Ltd., an adhesive specialist in Thailand. This strategic acquisition enhanced Meridian's presence in the Asia-Pacific region and complemented its existing operations, reinforcing its vision to deliver high-quality adhesive solutions across the market.

Digital technologies and sustainability driving the growth of the MC industry in 2024

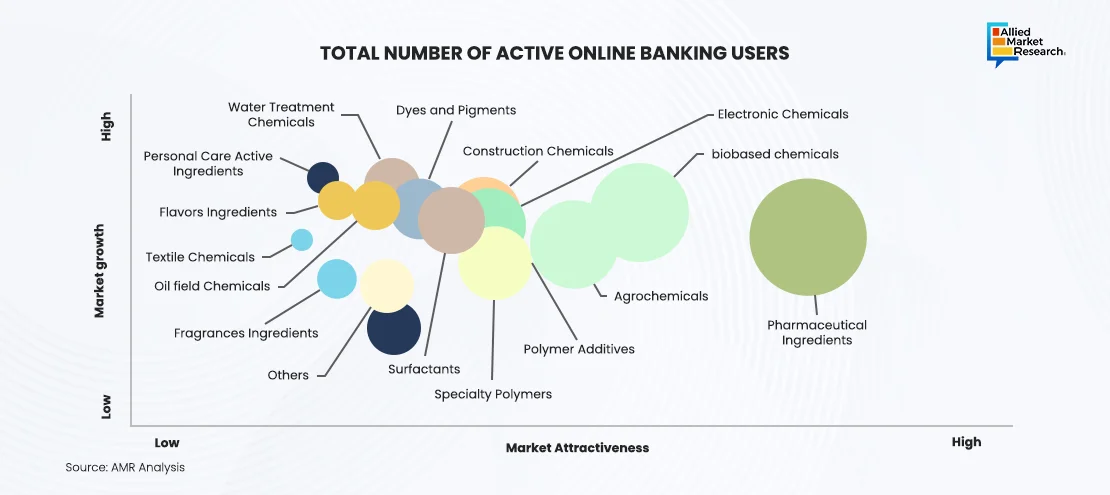

The materials and chemicals industry observed significant growth during Q4 2024 due to the integration of digital technologies and the increased significance of bio-based alternatives. The surge in the need to reduce carbon emissions and enhance sustainability increased the demand for bio-based products across several industries during the quarter. These alternatives decreased dependency on fossil fuels, resulting in decreased emissions and improved biodegradability. Biodegradable chemicals rapidly break down in the environment, preventing harmful substance accumulation in soil, water, and air, thus minimizing long-term pollution and supporting ecological balance. In the specialty chemicals sector, notable bio-based options include biofuels such as green hydrogen, bioplastics, and biochemicals. All these alternatives contributed to a more sustainable future by offering eco-friendly solutions that aligned with global sustainability goals.

On the other hand, digital transformation reshaped chemical procurement in the sector by enhancing efficiency, transparency, and agility. Platforms like DKSH Discover provided manufacturers and procurement professionals with seamless access to diverse ingredients and materials. Many businesses streamlined sourcing, assessed technical specifications, and collaborated with suppliers in real-time by utilizing digital tools during the quarter. With the increasing number of industries adopting smart procurement practices, AI-driven solutions and real-time data analytics empowered companies through innovative ways. These solutions helped them forecast demand accurately, optimize inventory management, and reduce procurement cycles, ultimately improving cost efficiency and supporting sustainable practices across the supply chain. This evolution showed procurement as a strategic asset that helped the industry to flourish during the quarter.

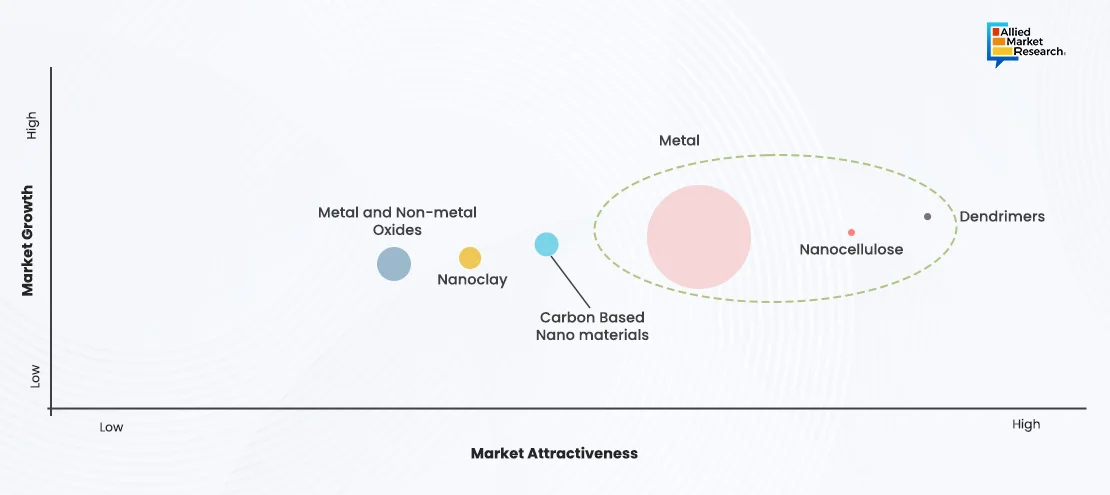

Further, the rise of nanomaterials created huge opportunities across the MC domain in Q4 2024. They possess unique properties such as high strength, hardness, elasticity, electrical conductivity, and antibacterial characteristics. Their resistance to scratches and chemicals made them essential in high-performance industries. Carbon nanomaterials were particularly valuable in medicine for detecting biological molecules, imaging diseased tissues, and developing innovative therapies due to their mechanical and optical properties. Additionally, emerging nanomaterials and nanosystems offered promising sensing applications such as environmental monitoring and food safety. These nano-sensors provided advantages such as low detection limits and rapid response times. This led to increased research into the synthesis and integration of nanomaterials for practical applications across multiple sectors.

Regional snapshots propelling the industry growth in Q4 2024

In the fourth quarter of 2024, the materials and chemicals sector experienced significant growth across various regions worldwide. North America’s MC sector experienced steady growth in the quarter, fueled by rising demand for specialty chemicals in the construction, automotive, and energy industries. The U.S. shale gas boom provided ample feedstock for petrochemicals, while Canada’s innovation in sustainable materials opened new opportunities. Additionally, increased electric vehicle production fueled the need for battery materials and lightweight composites. On October 8, 2024, the USA’s Environmental Protection Agency (EPA) proposed adding 16 individually listed per- and polyfluoroalkyl substances (PFAS) and 15 categories of PFAS to the Toxics Release Inventory. The agency updated reporting rules under the Emergency Planning and Community Right-to-Know Act and the Pollution Prevention Act.

Simultaneously, on December 18, 2024, the U.S. Environmental Protection Agency (EPA) issued a final rule prohibiting the manufacture, processing, distribution, and use of perchloroethylene (PCE), which is expected to be effective on January 17, 2025. The rule is formed to PCE in consumer products and many commercial applications, with phased-out periods for various uses within three years.

On the other hand, in Q4 2024, the MC sector across the European region demonstrated moderate growth, driven by sustainability initiatives and a transition toward green technologies. Countries like Germany, France, and the Netherlands led in specialty chemicals production and innovation. Additionally, the EU's strict carbon emission regulations and commitment to net-zero emissions by 2050 increased demand for bio-based chemicals and recyclable materials. On November 20, 2024, the European Chemicals Agency (ECHA) updated progress on restricting PFAS, evaluating alternatives to full bans while considering conditional use in critical sectors. Additionally, on October 14, 2024, the European Council revised the CLP Regulation as part of the Chemicals Strategy for Sustainability, aiming for a toxic-free environment.

Moreover, the Asia-Pacific region maintained its leadership in the global chemicals and materials sector, driven by robust consumer demand, rapid industrialization, and supportive government policies for sustainable production. The advanced infrastructure of the region and emphasis on specialty chemicals further fueled growth. Additionally, integrating technologies like AI and IoT into manufacturing processes enhanced sector performance. In February 2024, Shanghai authorities issued a notice mandating stakeholders to implement a hazardous chemicals inventory system with QR codes. It was established by stakeholders on December 31, 2024, aimed at improving safety and regulatory compliance in chemical management.

Furthermore, Latin America and the Middle East & Africa regions experienced significant growth in the MC industry, influenced by a booming oil and gas sector and increased construction activities. Infrastructure development in Brazil and Chile drove demand for construction-related chemicals, while government policies encouraged foreign investment across the region. In the Middle East, mega-projects like Saudi Arabia's NEOM City and the UAE’s Expo City heightened the consumption of construction chemicals. On November 15, 2024, Brazil enacted Chemical Management Law No. 15.022, requiring manufacturers to register non-exempt chemicals exceeding one ton annually. This initiative was taken by major players to enhance chemical safety and risk management in the industry.

Supply chain insights impacting the domain’s growth in Q4 2024

The MC sector faced notable global supply chain disruptions in 2024, mainly due to raw material shortages, including feedstocks like lithium and petrochemicals, aggravated by geopolitical tensions and trade restrictions. Also, energy cost volatility, especially in Europe, strained manufacturing, while port congestion and rising freight rates delayed shipments. Stricter environmental regulations were also one of the prime reasons behind the delayed material processing and increased compliance costs during the quarter.

In November 2024, Asia-US ocean freight rates continued to decline. However, the incoming U.S. administration is expected to impose trade barriers and higher tariffs, encouraging shippers to build inventory to minimize rising material costs. Conversely, slight rate increases were noted in the Asia-EMEA route due to constrained supply linked to underutilization of the Suez Canal and equipment shortages.

Final words

In Q4 2024, the materials and chemicals industry stood out firmly amid various supply chain challenges. Promising mergers and acquisitions by key players and funding for sustainable technologies opened lucrative opportunities across the sector. Moreover, regional growth driven by policy and consumer demand, and advancements in nanotechnology and digital transformation promoted the development of eco-friendly solutions and redefined supply chain dynamics during the quarter.

For more information about the emerging trends in the materials and chemicals domain, reach out to our industry analysts today!