Table Of Contents

- Key Trends that Shaped Chemical and Materials Industry in 2024:

- Adopting Digitalization to Drive Innovation in the Chemical Industry

- In the last few years, digital technology has transformed industries worldwide, and the chemical sector is no exception. Advances like artificial intelligence, the Internet of Things, sensors, and data systems, along with ongoing research, are changing how chemical companies operate.

- Decarbonization – Need of the hour

- Advanced Materials and Nanotechnology

- Regional Outlook

- North America

- Europe

- Asia-Pacific

- In 2024, Asia-Pacific continued to lead the global chemical and materials sector, emerging as one of the fastest-growing regions. This growth was driven by increasing consumer demand, rapid industrialization, and supportive government policies promoting sustainable chemical production. The region's strong production infrastructure and a rising focus on specialty chemicals for various industries further boosted market expansion. Additionally, the use of advanced technologies like artificial intelligence and the Internet of Things in manufacturing processes significantly contributed to the sector's growth.

- Latin America and Middle East & Africa

- In 2024, the Latin America and MEA regions experienced rapid growth in the chemical industry, driven by the booming oil and gas sector and rising construction activities. This growth was primarily attributed to countries like Brazil, Chile, South Africa, Saudi Arabia, and Egypt, which emerged as key markets for chemicals. The Middle East, including nations such as Saudi Arabia, UAE, Oman, and Kuwait, held around half of the world’s crude oil reserves and nearly a third of its natural gas reserves. This abundance of resources led to a higher demand for oilfield and industrial chemicals. The availability of feedstock in the Middle East, combined with its strategic location, encouraged major companies to set up manufacturing plants in the region. Additionally, ongoing construction projects in countries like UAE, Saudi Arabia, and Qatar further boosted the chemical industry's growth.

- Supply Chain Analysis

- The disruption of shipping routes in the Red Sea and Suez Canal, which began in late 2023 due to Houthi attacks in Yemen, continued to affect supply chains in the chemical industry throughout 2024, particularly in Europe and Asia. Ships were forced to reroute around the southern tip of Africa, significantly increasing travel time and costs.

- Verdict and Outlook

Yerukola Eswara Prasad

Koyel Ghosh

2024 Analysis of the Chemicals and Materials Industry

The chemical industry holds immense growth potential due to its diverse applications across numerous global sectors, rising disposable incomes, rapid urbanization, and supportive government initiatives for manufacturing worldwide. Backed by consistent revenue growth and robust profit margins, the global chemical industry is expected to witness remarkable expansion in the future. While the sector experienced moderate growth in 2024 compared to 2023 production levels, forecasts suggest a steady upward trend as inventory reductions slow down and product demand rises. To sustain revenue growth, chemical and materials manufacturers have implemented cost-cutting strategies and focused on boosting profit margins, all while continuing investments in decarbonization and innovation to ensure long-term success.

As 2025 approaches, it's essential to reflect on the key events of 2024 and their impact on shaping future trends in the chemical and materials industry. This article explores the major developments of 2024 and how they pave the way for future advancements.

Key Trends that Shaped Chemical and Materials Industry in 2024:

Adopting Digitalization to Drive Innovation in the Chemical Industry

In the last few years, digital technology has transformed industries worldwide, and the chemical sector is no exception. Advances like artificial intelligence, the Internet of Things, sensors, and data systems, along with ongoing research, are changing how chemical companies operate.

AI and IoT are at the core of this digital transformation. AI is particularly useful in the chemical industry because it can process and analyze large amounts of data. One of its biggest benefits is improving safety. By using data from sensors and equipment, AI helps companies perform timely maintenance, reducing risks and preventing accidents.

Predictive maintenance, powered by AI, is a major breakthrough for the industry. It allows companies to predict equipment failures before they happen, reducing downtime and avoiding costly or dangerous incidents. This not only improves efficiency but also highlights AI's role in shaping the future of chemical manufacturing. For example, companies like Tata Chemicals and BASF are using AI and IoT sensors to monitor their operations in real time, optimizing production and boosting overall performance. Digitalization is clearly driving innovation and safety in the chemical sector.

Decarbonization – Need of the hour

The chemical sector is witnessing a growing demand for sustainable solutions, offering companies a chance to secure a larger market share. The rise in electric vehicle (EV) production has boosted the need for battery-grade materials and high-performance plastics. However, the demand for sustainability has also brought challenges, with companies facing high costs for decarbonization and increasing pressure from stakeholders.

Chemicals play a crucial role in various industries, from fertilizers and plastics to construction and automotive. However, the sector heavily relies on fossil fuels, making it a major contributor to global greenhouse gas emissions. Primary chemical production alone generates about a billion tons of carbon dioxide annually, with significant emissions coming from processes like hydrogen production. Overall, the chemical industry is responsible for 2-3% of global carbon emissions.

Decarbonization in this context refers to adopting strategies and technologies to reduce carbon emissions while maintaining industry growth.

Challenges in the path of decarbonisation include

- The current infrastructure is heavily revolving around the use of fossil fuels.

- Basic chemicals production such as ethylene, ammonia, and benzene contribute heavily to the carbon emissions, with ammonia production alone contributes to nearly half a billion ton of carbon dioxide annually.

- A paradigm shift to renewable energy sources presents both economic and technological challenges.

- However, there are certain challenges in the path of decarbonization. For instance, earlier this year, Shell plc announced it would focus on emission reduction for this decade, citing a growing demand for energy. However, during the mid-year, it was revealed that the company silently backed out from a pledge to increase its use of chemical recycling of plastics, it was admitted that the plan was not feasible due to lack of available plastic waste feedstock, regulatory uncertainty, and slow technological development.

Decarbonization efforts gained momentum in 2024 through impactful actions

- Successful transitioning from fossil-based hydrogen to green hydrogen, produced through renewable energy powered electrolysis process.

- Adoption of recycling processes to convert semi-processed products and waste materials into valuable goods.

- Rising consumption of bioplastics and bio-based chemicals to replace traditional petrochemical products.

- Carbon capture and utilization paved a path to use captured carbon dioxide and utilizing them in the production of useful chemicals and fuels.

- Adoption of AI powered applications and digital tools to optimize processes in production to successfully attaining decarbonisation.

Advanced Materials and Nanotechnology

The development of advanced materials is a fascinating aspect of new technologies in the chemicals and materials sector. Nanotechnology, in particular, is driving the creation of materials with unique properties that have a wide range of applications. For example, advancements in nanotechnology are enabling the production of lighter yet stronger composites and highly efficient catalysts, which are in high demand across various industries.

One notable example is graphene—a material made up of a single layer of carbon atoms arranged in a hexagonal pattern. Its exceptional strength, flexibility, and conductivity make it ideal for applications like energy storage, medical devices, and electronics. As research in nanotechnology progresses, we can expect the discovery of more groundbreaking materials that will reshape the chemical industry.

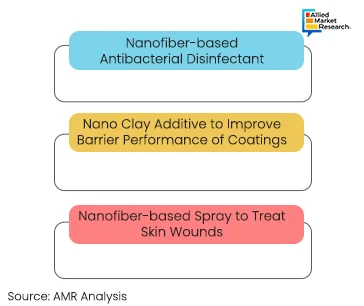

Few of the innovations that shaped the nanotechnology and advanced materials industry in 2024

- Development of nanofiber-based antibacterial disinfectant, developed by the researchers at The American University in Cairo. They used electrospinning technique to develop a disinfectant that transform natural polysaccharides such as chitosan into antibacterial nanofibers. This is anticorrosive and antibacterial, at the same time, it is suitable to use on various surfaces.

- Incorporating nano clay additive to improve barrier performance of coatings, developed by researchers at Portland State University. The nano clay additive can be modified into nanoparticles using widely available additives, that translating into reduced water absorption while maintaining optimum transparency.

- Development of nanofiber-based spray to treat skin wounds, developed at the University of Southern Mississippi. According to the WHO, skin injuries due to burns accounts for nearly 180,000 deaths annually. This innovation is a breakthrough in healing severe skin wounds and burns. It can be applied through spray, can deliver growth factors directly to the wounds and accelerating tissue repair.

Regional Outlook

North America

In 2024, the Federal Reserve’s interest rate cuts helped reduce the risk of a recession, keeping the U.S. economy stable. However, industrial production in the U.S. stalled during the year, following minimal growth in 2023. Nearly 80% of specialty and basic chemicals are consumed by the industrial sector, but demand was affected by supply chain disruptions, strikes, and natural disasters. As a result, overall industrial production remained flat for a second consecutive year.

In contrast, the U.S. chemical and materials industry performed well in 2024, benefiting from lower energy and feedstock prices. This cost advantage gave U.S. chemical producers an edge over competitors in Asia and Europe. Despite these positives, the industry faced significant uncertainty, a trend expected to continue into 2025 due to the emergence of a new political administration in the U.S. and ongoing geopolitical tensions.

Europe

The European chemical industry played an important role in the region's economy in 2024, contributing over half a trillion dollars. However, it faced challenges such as rising energy costs, strict regulations, and supply chain disruptions due to geopolitical tensions. Despite these hurdles, the industry witnessed growth opportunities in areas like green chemicals, digital transformation, and exports to emerging markets. Major companies, including BASF, LyondellBasell Industries, Covestro, and INEOS, led efforts to promote sustainability and drive innovation.

According to AMR research, Europe accounted for nearly 15% of global chemical sales in 2024, with Germany holding the largest share at about 30%. Other key contributors to chemical production included the Netherlands, Belgium, France, and Italy. The industry's transition to green energy and adoption of advanced technologies like automation, AI, and analytics provided opportunities for progress. Furthermore, Europe positioned itself as a leader in sustainability and green chemistry initiatives, aiming to meet global demands while reducing its environmental impact.

Asia-Pacific

In 2024, Asia-Pacific continued to lead the global chemical and materials sector, emerging as one of the fastest-growing regions. This growth was driven by increasing consumer demand, rapid industrialization, and supportive government policies promoting sustainable chemical production. The region's strong production infrastructure and a rising focus on specialty chemicals for various industries further boosted market expansion. Additionally, the use of advanced technologies like artificial intelligence and the Internet of Things in manufacturing processes significantly contributed to the sector's growth.

China, Japan, India, and South Korea remained key players in the Asia-Pacific chemical market due to their strong production capacities, abundant raw materials, and high domestic consumption. China led the region with its vast industrial infrastructure and strategic investments in research and development. India's fast industrial growth and growing need for specialty chemicals made it an important contributor, while Japan's emphasis on innovation kept its chemical sector competitive. Southeast Asia also showed potential in the chemical industry, particularly in petrochemicals. However, competition from China, along with slow demand and strong supply, created challenges.

Environmental concerns led to stricter regulations across Asia-Pacific, aiming to reduce the ecological impact of chemical production. Japan, in particular, tightened rules on hazardous waste management, encouraging companies to adopt cleaner technologies.

Latin America and Middle East & Africa

In 2024, the Latin America and MEA regions experienced rapid growth in the chemical industry, driven by the booming oil and gas sector and rising construction activities. This growth was primarily attributed to countries like Brazil, Chile, South Africa, Saudi Arabia, and Egypt, which emerged as key markets for chemicals. The Middle East, including nations such as Saudi Arabia, UAE, Oman, and Kuwait, held around half of the world’s crude oil reserves and nearly a third of its natural gas reserves. This abundance of resources led to a higher demand for oilfield and industrial chemicals. The availability of feedstock in the Middle East, combined with its strategic location, encouraged major companies to set up manufacturing plants in the region. Additionally, ongoing construction projects in countries like UAE, Saudi Arabia, and Qatar further boosted the chemical industry's growth.

Supply Chain Analysis

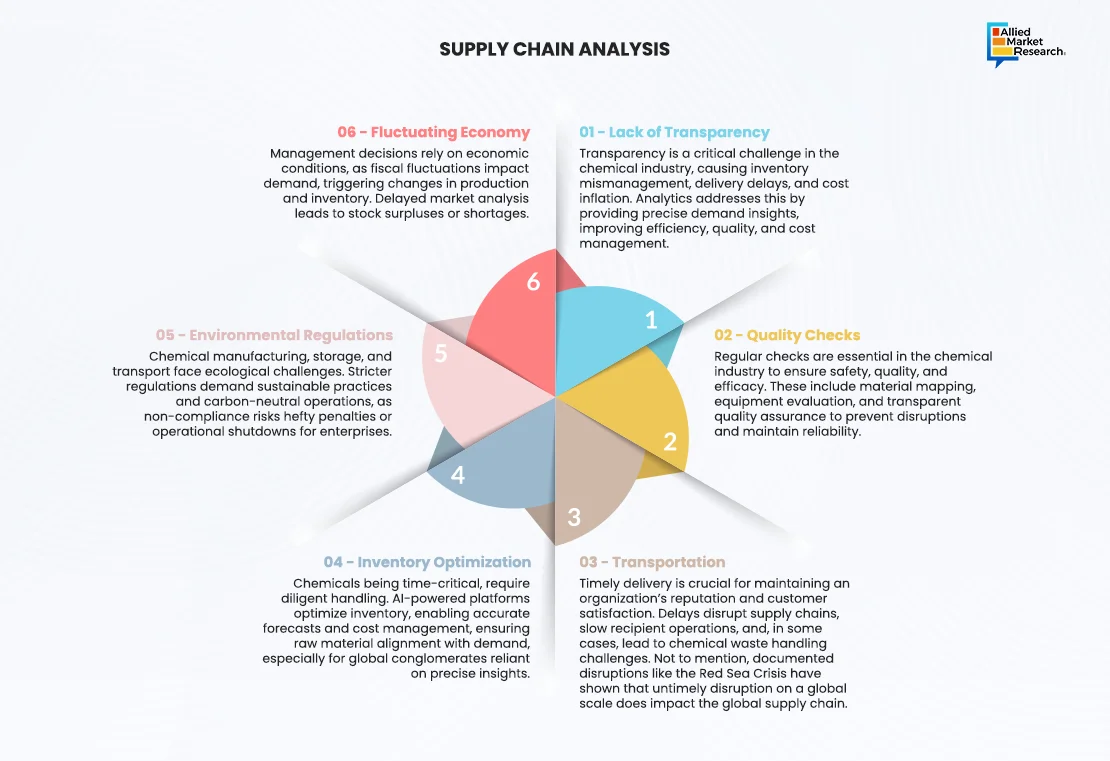

The disruption of shipping routes in the Red Sea and Suez Canal, which began in late 2023 due to Houthi attacks in Yemen, continued to affect supply chains in the chemical industry throughout 2024, particularly in Europe and Asia. Ships were forced to reroute around the southern tip of Africa, significantly increasing travel time and costs.

In the United States, shipping faced additional challenges in 2024 due to an extended drought linked to the El Niño effect, which reduced rainfall and impacted the Panama Canal. This led to a 21% decline in deep-draft vessel transits during the fiscal year compared to 2023, as reported by the Panama Canal Authority. Adding to the strain were port strikes across North America in the latter half of the year, further disrupting supply chains.

The chemical industry also struggled with persistent issues like limited transparency, inadequate quality checks, transportation delays, inventory management inefficiencies, stringent environmental regulations, and an unstable economy. These challenges compounded the supply chain difficulties, making 2024 a particularly tough year for the sector.

Verdict and Outlook

The chemical and materials industry in 2024 experienced significant progress in sustainability and digital innovation. Stricter regulations drove companies to adopt greener processes and improve resource efficiency. Despite economic challenges and supply chain disruptions from geopolitical tensions, demand for specialty chemicals, bio-based materials, and advanced composites remained strong, supported by growth in renewable energy, electric vehicles, and infrastructure projects. Companies focusing on adaptability, transparency, and innovation thrived in this competitive market. Connect with AMR analysts today for in-depth insights into the domain!

Here are some of the key reports trending in the domain-

Always Stay Informed!