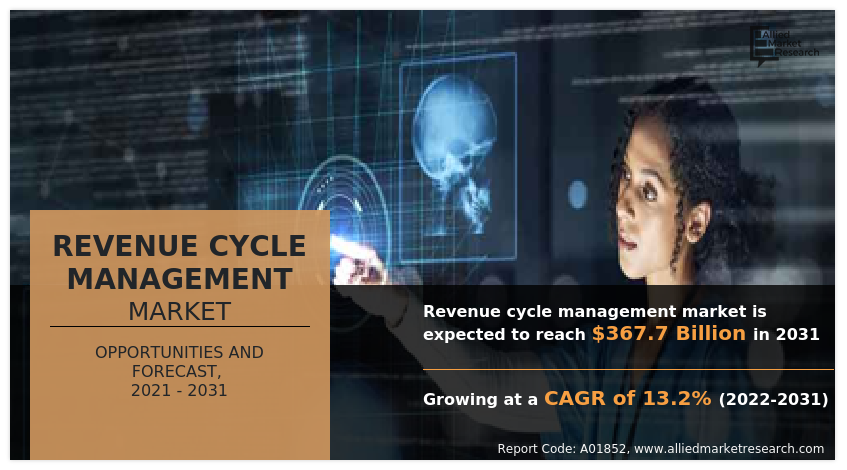

Revenue Cycle Management Market Statistics, 2031

The global revenue cycle management market was valued at $109.5 billion in 2021, and is projected to reach $367.7 billion by 2031, growing at a CAGR of 13.2% from 2022 to 2031.

The supportive growth through regulatory compliance has increased the need for revenue cycle management. In addition, the growing demand for workflow optimization in healthcare organizations coupled with innovative synchronized management software systems is benefiting the growth of the revenue cycle management market. Furthermore, the rise in demand for cloud-based solutions factor notably promotes the growth of revenue cycle management market. However, high costs associated with RCM deployment, and the scarcity of trained professionals are the issues that are limiting the industry expansion.

On the contrary, the increasing outsourcing services in developing countries are expected to create lucrative opportunities for the market in the upcoming years. Moreover, a rise in developments & initiatives toward revenue cycle management is anticipated to provide a potential growth opportunity for the market.

Revenue cycle management (RCM) is the process used to track the revenue from patients, from their initial appointment or encounter with the healthcare system to their final payment of the balance. This process helps streamline the business operations of healthcare organizations and private practices. RCM solutions help providers manage and enhance revenue cycle functions such as medical coding & billing, patient insurance eligibility verification, electronic health records, clinical documentation, and claims & denials management. The revenue cycle management market is segmented into End-User, Deployment Mode, Type and Component.

Segment Review

The revenue cycle management market is segmented into type, component, deployment mode, end user, and region. By type, the market is differentiated into standalone and integrated. By component, the market is segmented into software and services. Depending on deployment mode, it is fragmented into cloud and on-premise. Depending on end user, it is segmented into hospitals, physicians, diagnostic laboratories, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Component

The services segment is anticipated to grow at a significant rate due to rise in professional and managed services for smooth operations of RCM Software.

By Component, the software segment acquired a major share in the revenue cycle management industry in 2021. This is attributed to the wide adoption of the RCM software to avoid healthcare fraud and decrease administrative costs. However, the services segment is anticipated to register the highest growth rate during the forecast period due to the rise in cloud based RCM and increased demand for professional services.

By Region

The revenue cycle management market was dominated by North America in 2021, owing to presence of key players in the region.

Region wise, North America dominated the market in revenue cycle management market size in 2021 due to the presence of key players and surge in demand for IT solutions in the healthcare sector. However, Asia-Pacific is anticipated to register the highest growth rate in the revenue cycle management market forecast due to the rise in healthcare spending and technological advancements in the healthcare sector.

Top Impacting Factors

Favorable Government Regulations

The healthcare industry has undergone multiple changes regarding regulatory framework in order to protect patient data and ensure there is a smooth flow of claims management. Health Insurance Portability and Accountability Act of 1996 (HIPAA) is one such regulation that protects electronic protected health information (e-PHI) in order to shield health information privacy rights. Through this act, confidentiality, integrity, and availability of e-PHI are maintained. In addition, there are coding and compliance models such as Current Procedural Terminology codes (CPT), International Classification of Diseases diagnosis codes (ICD), and the Healthcare Common Procedure Coding System (HCPCS). These codes are deployed to integrate the whole healthcare and the insurance industry on one platform.

Furthermore, there are other government mandates such as Affordable Care Act (ACA) 2010 which is also called the ObamaCare and Health Information Technology for Economic and Clinical Health (HITECH) Act. These acts were implemented to improve the quality of healthcare and insurance services at affordable costs and promote the growth of the healthcare IT sector. All these factors collectively drive the growth of the revenue cycle management industry.

Increase in Healthcare Spending

The healthcare sector has witnessed an upsurge in healthcare-related expenditure in the recent past, and this trend is expected to prevail during the forecast period. The healthcare spending growth rate is attributed to the rise in medical prices, growth associated with the insured population, and an increase in demand for advanced healthcare services. In addition, the major factor that contributes to the growth of revenue cycle management in Europe includes, a rise in healthcare expenditure among countries, such as Germany, France, Sweden, UK, and others in this region. Furthermore, high spending patterns of hospitals and physicians among the developing nations of Asia-Pacific and LAMEA are expected to fuel the demand for revenue cycle management.

Rise in the Market for Outsourced RCM Solutions

Healthcare providers have been experiencing problems related to increasing overhead costs, slow growth associated with operating revenues, maintaining profits, denial management, and delay in claims processing. These challenges go hand in hand with the outsourcing of the RCM model from third-party organizations. Additionally, the maintenance of regulatory compliance, reduction in billing errors, improved accuracy over co-pay data, integration with respect to ICD-10 coding requirements, improved service quality, and cost-effectiveness are some of the factors that are expected to create lucrative opportunities for outsourced RCM market growth.

For instance, in October 2019, QuickCred, the credentialing division of MedTrainer, Inc., announced its partnership with athenahealth, the leading provider of network-enabled services for electronic health records (EHR), medical billing, and care coordination. The collaboration enables medical practices to take advantage of QuickCred’s state-of-the-art compliance and credentialing system while optimizing revenue cycle management through athenahealth.

Country Specific Statistics & Information

The growing number of multiple data siloes and unorganized workflows in healthcare settings is paving a path for market development and growth. RCM is a combination of third-party payers, payment models, guidelines, and codes. A practice’s existence depends upon obtaining the right assets. As precise payment for medical services becomes increasingly complex, it increases the value of obtaining an efficient RCM solution. These are some of the trends flourishing the market growth. For instance, in May 2022, Cerner, a leading supplier of healthcare information technology solutions and tech-enabled services aimed to help members achieve revenue cycle automation by providing access to an artificial intelligence (AI)-driven platform through a collaboration with AKASA. The partnership allows Cerner customers to use AKASA’s AI-based Unified Automation platform to automate revenue cycle tasks.

In addition, the platform automates authorization tasks, including identifying authorization requirements, initiating requests, checking statuses, and notifying payers of inpatient admissions. The system also assists in claims processing. Providers can use the platform to receive status information for outstanding claims and make any corrections needed before submitting claims to clearinghouses and payers.

Furthermore, the introduction of new and innovative products in the market by key players is expected to boost the growth of the revenue cycle management market during the forecast period. For instance, Veradigm, a leading provider of healthcare data and technology solutions and a business unit of Allscripts Healthcare Solutions, has launched its Veradigm Payerpath. Veradigm Payerpath is an end-to-end revenue cycle management suite of solutions built to assist medical practices of all sizes and specialties improve revenue, streamline communications with payers and patients, and boost practice profitability. The system’s integrated solutions are practice management (PM) agnostic, interfacing seamlessly with all major PM systems. An innovative claims management platform, Veradigm Payerpath delivers a more than 98% first-pass clean claims rate and reaches a network of over 3,100 payers.

COVID-19 pandemic had an unprecedented impact on the majority of the healthcare sectors and brought significant transformations to the normal functioning of healthcare systems. Healthcare providers and healthcare payers struggled through several challenges impacting their revenue earnings and inpatient volume. Furthermore, medical billing complexity and rising healthcare costs created a drastic rise in demand for outsourcing revenue cycle management solutions across the globe. The surge in demand for advanced and innovative RCM solutions drove key participants to develop value-added features such as payer connect, remote coding services, reporting, analytics, and audit and compliance to improve revenue generation and productivity. This, in turn, has become one of the major factors for the revenue cycle management market growth during the global health crisis.

Key Benefits for Stakeholders:

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the revenue cycle management market analysis from 2021 to 2031 to identify the prevailing revenue cycle management market share.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the revenue cycle management market size segmentation assists to determine the prevailing revenue cycle management market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global revenue cycle management market trends, key players, market segments, application areas, and market growth strategies.

Revenue Cycle Management Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 367.7 billion |

| Growth Rate | CAGR of 13.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 271 |

| By End-User |

|

| By Deployment Mode |

|

| By Type |

|

| By Component |

|

| By Region |

|

| Key Market Players | Quest Diagnostics Incorporated, Epic Systems Corporation, Experian Information Solutions, Inc., Athenahealth, Inc., GE HealthCare, Oracle Cerner, eClinicalWorks, GeBBS Healthcare Solutions, Veradigm LLC, McKesson Corporation |

Analyst Review

In accordance with insights from leading CXOs, the utilization of RCM among healthcare facilities has increased due to reduced product cycle time. Moreover, supportive growth through regulatory compliance, increasing healthcare spending, growing demand for cloud-based solutions, and increasing market for outsourced RCM solutions drive the growth of the market. In addition, recent innovations and increase in the adoption of advanced healthcare systems have further fueled the market growth. For instance, in May 2021, Bassett Healthcare Network collaborated with Optum, Inc. for revenue cycle management to improve patient care in Central New York.

The market for revenue cycle management is witnessing a rise, owing to rise in the market for outsourced RCM solutions. Healthcare facilities are outsourcing revenue cycle management software solutions owing to the multiple advantages associated such as easy availability of trained and skilled professionals, compliance and adherence to required regulations, enhanced efficiency, and cost-effectiveness.

Due to the numerous benefits, available healthcare facilities are readily outsourcing RCM solutions and services. According to a Med USA article published in 2020, approximately two-thirds of the healthcare organizations outsource their revenue cycle management solutions and services. The growing adoption rates are anticipated to propel market growth over the forthcoming years.

The COVID-19 pandemic enforced governments to impose lockdowns and travel restrictions which caused inconsistency in patient volume and uncertainties in claim volumes. The rising complexities in RCM positively impacted the outsourcing of RCM solutions. Furthermore, the rising claim denials, constantly changing COVID-19 policies, and the development of new codes led to increased pressure on RCM professionals and staff, which positively impacted the growth of the market during the pandemic.

In addition, the transition of healthcare systems toward value-based care and the adoption of virtual engagement technologies such as telehealth is anticipated to pave the way for lucrative opportunities for the revenue management cycle, thereby accelerating revenue growth.

The global revenue cycle management market was valued at $109.53 billion in 2021, and is projected to reach $367.71 billion by 2031, registering a CAGR of 13.2% from 2022 to 2031.

North America is the largest region for revenue cycle management market.

Revenue cycle management market is driven by the supportive growth through regulatory compliance, and increase in healthcare spending. In addition, rise in demand for cloud-based solutions fosters the growth of the revenue cycle management market.

The key players operating in the global revenue cycle management market include Athenahealth, Inc., eClinicalWorks, Epic Systems Corporation, Experian Information Solutions, Inc., GeBBS Healthcare Solutions, GE HealthCare, McKesson Corporation, Oracle Cerner, Quest Diagnostics Incorporated, and Veradigm LLC.

The key growth strategies include product portfolio expansion, acquisition, partnership, merger, and collaboration.

Loading Table Of Content...

Loading Research Methodology...