Secure Digital Card Market Research, 2031

The global secure digital card market was valued at $8.8 billion in 2021, and is projected to reach $13 billion by 2031, growing at a CAGR of 4.3% from 2022 to 2031.

A Secure Digital (SD) card is a small flash memory card made for high-capacity storage and a variety of portable devices, including GPS navigation systems, cell phones, e-books, PDAs, smartphones, digital cameras, music players, digital video camcorders, personal computers. Secure Digital card is a proprietary non-volatile flash memory card format developed by the SD Association (SDA) for use in portal devices.

A Secure Digital card is about the size of a postage stamp and weighs about two grams. It is similar in size to Multimedia Card (MMC) but smaller than older types of memory cards such as Smart Media or CompactFlash cards. An SD card has high transfer rates and low battery consumption, both of which are essential for mobile devices. An SD card uses flash memory to provide non-volatile memory, which means no power source is required to hold the stored data.

SD cards also come in different sizes, such as micro SD card and mini SD card. SD cards are non-volatile memory cards whose size and performance make them a more popular choice than regular flash storage devices. Durability is another key strength that SD cards offer. SD cards are much more shock resistant than regular storage devices. This means that the SD card can be dropped from a height of 100 feet without any damage. This, along with the metal connectors used on SD cards, are less susceptible to damage.

A major factor driving the growth of the secure digital card market is the need for increased storage capacity in digital cameras, cell phones, and other portable electronic devices. However, the increasing popularity of online streaming, rapid adoption of cloud technology, and increasing use of internal storage in smartphones are expected to hinder the growth of the secure digital card market.

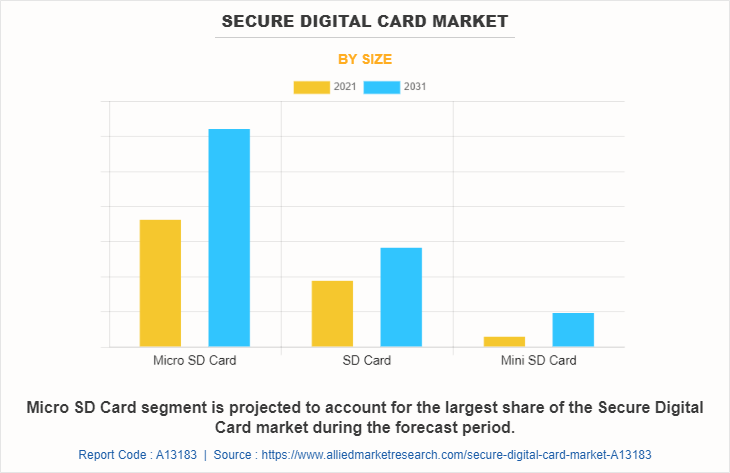

he secure digital card market is segmented into Size and Application.

On the basis of size, the market is divided into mini SD card, micro SD card, and SD card. The micro SD card segment is the highest share contributor to the market.

Types of SD Cards -at first glance, an SD card is a small, flat, rectangular object with a notch along one edge and copper leads, called pins, embedded on one side along another edge. But there are a few different form factors. Here are the physical sizes for SD cards:

32 x 24 millimeters, 2.1 millimeters thick - This is the most common. This size has nine pins and features a write-protection switch on one side to toggle between read-only and read-write states.

20 x 21.5 millimeters, 1.4 millimeters thick - This is the "mini" version with 11 pins, and it's less common than the other two sizes.

15 x 11 millimeters, 1 millimeter thick - This is the "micro" version with eight pins. Because it's so small, this size has become popular in mobile devices like smartphones.

It's not just the physical makeup of the card that's standardized. SD cards also come in different capacities. These are the capacity formats for SD cards listed in order from oldest to newest:

SD - Standard format with up to 2 GB per card, available in all three sizes, under $10

SDHC - High-capacity format with 4 to 32 GB per card, available in all three sizes, $10 to $100

SDXC - eXtended capacity format with 32 GB to 2 TB per card, available in the larger and micro sizes only, starting around $80

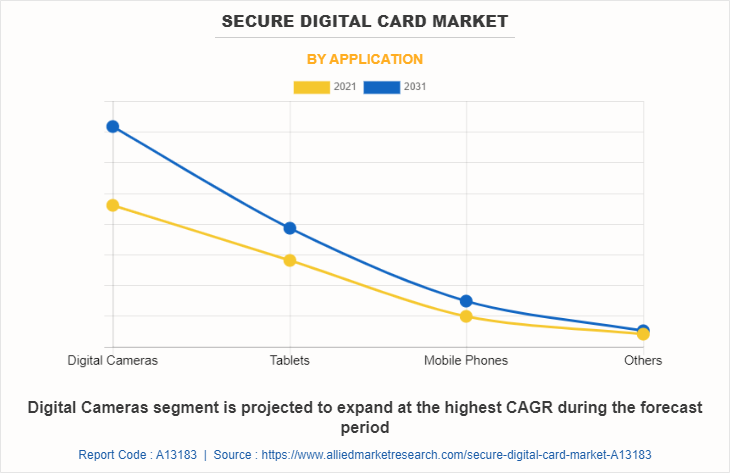

On the basis of application, it is divided into mobile phones, tablets, digital cameras, and others. The digital camera segment is projected as the most lucrative segment in the secure digital card outlook

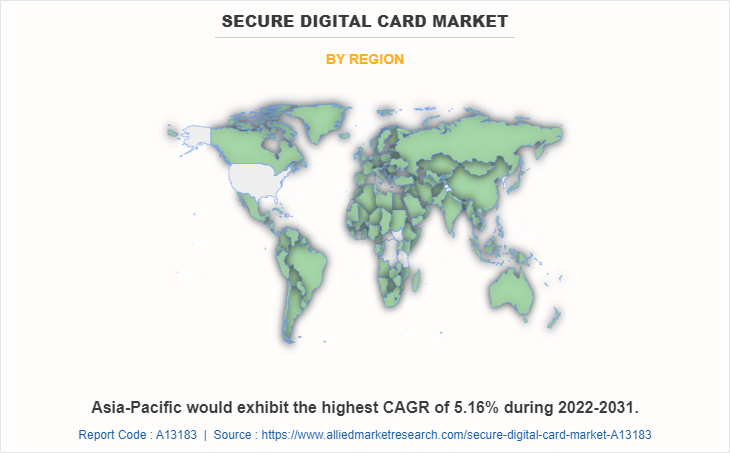

Region-wise, the secure digital card market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, and the rest of Europe), Asia-Pacific China, Japan, India, South Korea, and the rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). Asia-Pacific, specifically the China region, remains a significant participant in the global secure digital card industry. Major organizations and government institutions in the country are intensely putting resources into this industry.

Country-wise, the U.S. acquired a prime share in the secure digital card market share in the North American region and is expected to grow at a significant CAGR during the forecast period of 2019-2031. The U.S., holds a dominant position in the secure digital card market, owing to the rise in investment by prime vendors to boost the secure digital card for consumer electronics and IT & telecom applications.

In Europe, the UK, dominated the secure digital card market, in terms of revenue, in 2021 and is expected to follow the same trend during the forecast period. However, Germany is expected to emerge as the fastest-growing country in Europe's secure digital card with a notable CAGR, due to advancement in the automotive industry which drives the usage of microelectronics in the country and thus creates lucrative growth opportunities for the secure digital SD card market in Germany.

In Asia-Pacific, China is expected to emerge as a significant market for the secure digital card industry, owing to new product developments and a significant rise in investment by prime players and government institutions. The well-established electronics industry in the Asia-Pacific region and the adoption of innovative technologies have given organizations in the region a competitive secure digital card market opportunity.

In the LAMEA region, the Middle East countries garner significant market share in 2021 due to the adoption of new technologies, digital transformation and connectivity are reshaping the future of the automotive and consumer electronics industry in the Middle East. Moreover, the Latin America region is expected to grow at a significant CAGR from 2022 to 2031, owing to shifts in artificial intelligence, industry 4.0, and smart technological changes in recent years, which is expected to reshape the growth of the secure digital card in the Latin America region.

TOP IMPACTING FACTORS

The major factors driving the secure digital card market growth are the increasing technological advancements; for instance, the new camera modules allow users to capture images or videos in high-resolution formats, which require large storage space. In addition, the increase in the need for surveillance video cameras, because in contrast to (CCTV) and security cameras, video surveillance cameras allow users to monitor the feed from any location, these are the factors propelling the SD card market growth. On the other hand, declining prices of NAND flash memory and expanding in-built memory space in smartphones, quick acceptance of cloud technology, and rising online streaming usage are all predicted to hinder the market growth. Furthermore, the rise of IoT is increasing the use of SD memory cards in various devices providing lucrative growth opportunities for the SD card market.

COMPETITIVE ANALYSIS

The global secure digital card market outlook is highly competitive, owing to the strong presence of existing vendors. Vendors of the secure digital card market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to increase as technological innovations, product extensions, and different strategies adopted by key vendors increase. Competitive analysis and profiles of the major global secure digital card market players that have been provided in the report include SanDisk Corporation, Transcend Information, ADATA Technology Co., Ltd., Toshiba Corporation, Samsung Electronics Co Ltd., Sony Corporation, Panasonic Corporation, Micron Technology Inc., Kingston Technology, and PNY Technologies Inc.

KEY DEVELOPMENTS/ STRATEGIES

SanDisk Corporation, Micron Technology Inc., Samsung Electronics Co Ltd., Panasonic Corporation, and Transcend Information are the top 5 key players in the secure digital card market. Top market players have adopted various strategies, such as acquisition, agreement, business development, business expansion, collaboration, product launch, innovation, and product expansion to expand their foothold in the market and create secure digital card market opportunity.

In September 2021, Samsung launched the new EVO Plus and PRO Plus memory card families that are specially designed for professionals, videographers, and content creators.

In April 2020, Kingston Digital Inc, launched KC2500 its next generation M.2 NVMe PCIe SSD. That are specially designed for desktops, workstations, and high-performance computing devices.

In March 2020, Kingston Digital Inc, launched DC1000M, a new U.2 data center NVMe PCIe SSD. This card is designed to support a wide range of data intensive applications such as artificial intelligence, HPC, cloud computing.

KEY BENEFITS FOR STAKEHOLDERS

This study comprises analytical depiction of the secure digital card market size along with the current trends and future estimations to depict the imminent investment pockets.

The overall secure digital card market analysis is determined to understand the profitable trends to gain a stronger foothold.

The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

The secure digital card market forecast is quantitatively analyzed from 2022 to 2031 to benchmark the financial competency.

The Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the secure digital multimedia card market.

The report includes the share of key vendors and market trends.

Secure Digital Card Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 13 billion |

| Growth Rate | CAGR of 4.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 211 |

| By Application |

|

| By Size |

|

| By Region |

|

| Key Market Players | Toshiba Corporation, PNY Technologies Inc., ADATA Technology Co., Ltd., Panasonic Corporation, Kingston Technology, Transcend Information, Sony Corporation, Samsung Electronics Co Ltd, SanDisk Corporation, Micron Technology Inc. |

Analyst Review

The secure digital Card market is expected to grow at a significant rate owing to the rise in consumer electronics demand and the demand for more storage space in mobile phones, digital cameras, and other portable electronic devices. Rising advancements in NAND technology have increased the adoption of SD memory cards. Many companies are incorporating novel features in the SD cards, in order to attract customers and increase sales. These companies are adding innovative features such as memory-expansion options, free software, and waterproof SD cards.

In addition, the global market for secure digital (SD) memory cards is anticipated to expand at a faster rate in the near future, because to remain competitive in the global market, businesses are introducing SD memory cards with the fastest speeds and the largest capacities. In addition, in 2017 the SD Association introduced a UHS-III bus interface with a speed of 624 MB per second to meet the growing demand for Gigabyte wireless communication, 8K video, and 360-degree cameras. This opens the door to highly anticipated new video and imaging features.

The Secure Digital Card Market is expected to grow at a CAGR of 4.29% from 2022-2031.

Digital Camera is the leading application of the Secure Digital Card Market.

Asia-Pacific is the largest regional market for Secure Digital Card.

The industry size of the Secure Digital Card market is estimated to be $8,766.0 million in 2021.

The top companies to hold the market share in the Secure Digital Card market are SanDisk Corporation, Transcend Information, ADATA Technology Co., Ltd., Toshiba Corporation, Samsung Electronics Co Ltd., Sony Corporation, Panasonic Corporation, Micron Technology Inc., Kingston Technology, and PNY Technologies Inc.

Loading Table Of Content...

Loading Research Methodology...