The global secure logistics market size was valued at $87.1 billion in 2022, and is projected to reach $191.9 billion by 2032, growing at a CAGR of 8.4% from 2023 to 2032.

Report Key Highlights:

- The report covers a detailed analysis on the secure logistics industry.

- The secure logistics market has been analyzed from the year 2022 till the year 2032.

- Latest developments have been mentioned in the research study.

- Top companies operating in the industry has been profiled in the research study.

- The research study includes different segments & regions across which the market has been analyzed.

Logistics refers to the handling and supervision of the movement of materials, resources, goods, and information from its origin to its destination or consumption. The whole activity involves processes including inventory management, transportation, and warehousing. Logistics plays an important part in every industry as it helps in the distribution of goods or packages to their final destination. Secure logistics is also similar to logistics, but it is for the products or materials that possess high value and are rare in nature which includes cash logistics, diamonds & gemstones, advanced, and sophisticated technology. Secure logistics offers the best possible secure solution to any shipment and helps to avoid any tampering, theft, and unauthorized access to the package. The use of technologies in the secure logistics includes radio frequency identification (RFID), global positioning system (GPS) and even real time monitoring is possible, ensuring transparency with its logistics partners and enabling companies to win the trust of the clients.

Secure logistics not only safeguard the package with technology, but they also provide security personnel that defend the package at the time of emergency. The package can be moved in an armored vehicle or can be moved around the world in an airplane, thus offers various modes of transfer to ship the package.

The factors such as increase in the demand for outsourcing branch and ATM service and increase in the demand for product integrity supplement the growth of the secure logistics market. However, the increase in the usage of electronic payment and high cost involved in service are the factors expected to hamper the growth of the market. In addition, focus on securing last mile delivery and integration of cyber security in secure logistics creates market opportunities for the key players operating in the secure logistics industry.

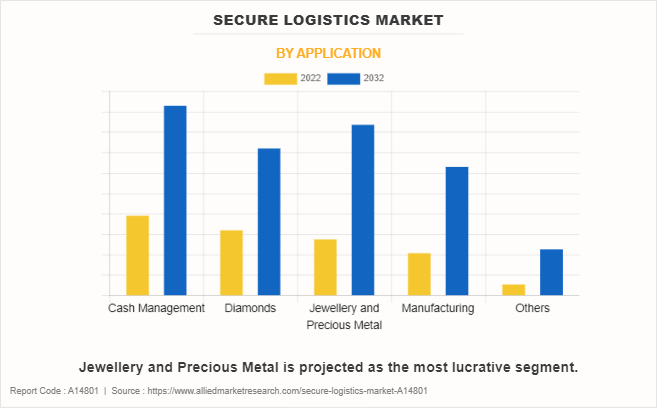

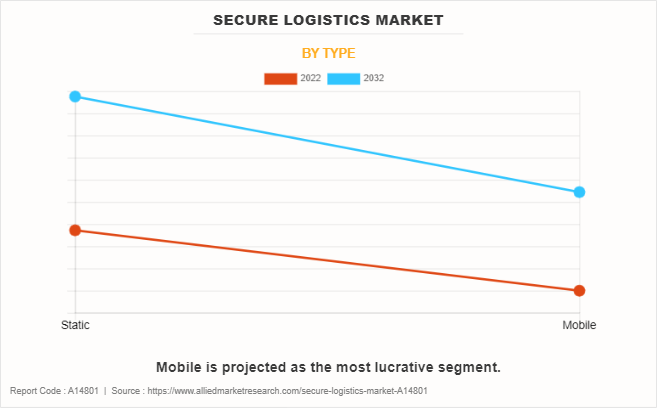

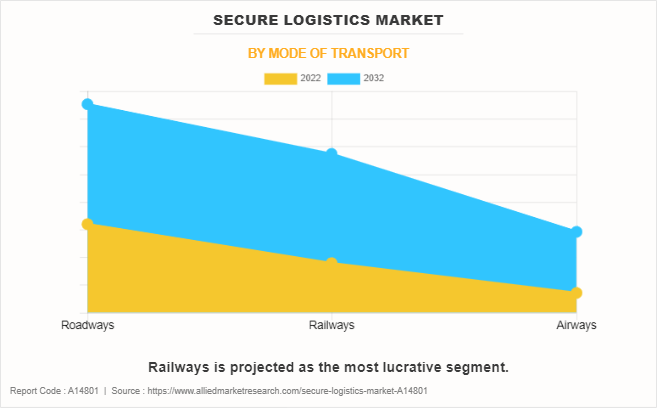

The secure logistics market is segmented into application, type, mode of transport, and region. By application, the market is divided into cash management, diamonds, jewelry & precious metal, manufacturing, documents and others. By type, the market is bifurcated into static and mobile. On the basis of mode of transport, the market is classified into roadways, railways and others. By region, the market is analyzed across North America, Europe, Asia-Pacific and LAMEA.

The companies in the global secure logistics market include Allied Universal, Brink's incorporated, CargoGuard, CMS Info Systems, PlanITROI, Inc., GardaWorld, Lemuir Group, Prosegur, Securitas AB, and Secure Logistics LLC.

Increase in the demand for outsourcing branch and ATM service

Secure logistics is the handling, storage and transportation of any product, information, asset and any goods from its source of origin to its final destination. Advanced security measures are used to protect the package and information from tampering, theft, and any unauthorized access. There are various industries which rely on the services of secure logistics including banking and financial institutions. The banking and financial institutions such as The Reserve Bank of India (RBI) recently published specific guidelines for banks, non-banking financial companies (NBFCs), and other regulatory financial institutions to strictly adhere to the guidelines and norms when outsourcing IT services to ensure the confidentiality of the clients' data and to safeguard any commitments and responsibilities made to the clients.

These standards are developed in the context of regulated entities' (REs') existing practice of heavily leveraging IT and IT-enabled services (ITES) to facilitate the company's structure as well as the products and services provided to clients. Outsourcing of branch services such as cash management and ATM services in which many firms offer ATM monitoring solutions with SLA management, increases the demand for the secure logistics market share.

Increase in the demand for product integrity

Product integrity is maintaining the quality, safety, and authenticity of goods or products during transportation. The product integrity is maintained by using ways such as seals and tamper-evident packing, which can also give away any signs of unauthorized access. With the help of advanced security measures and strict protocols, the logistics provider remains vigilant and ensures that the product remains unharmed and free from any compromise throughout the shipping process. There are various industries where product integrity plays a vital role, such as in pharmaceuticals. When shipping temperature-sensitive pharmaceutical products, access to real-time monitoring data related to temperature, humidity, duration of travel, open-door events, and other factors that could jeopardize product integrity can assist stakeholders in proving that product stability and quality is not compromised, allowing the products to be released for further use. The shipping of various artifacts, and pharmaceutical products which require the special environment increases the demand for the secure logistics market and services related to it.

High cost involved in service

Secure logistics transports assets such as jewelry, diamonds, fine arts, and precious metals. The high cost involved in transportation and security of such assets ensures the utmost safety and protection of the assets. While transferring such assets the logistics firm needs highly trained and skilled security personnel. These professionals handle and safeguard packages, and they have special training and expertise in weapon handling. The transportation of the assets requires armored vehicles, and advanced security technology and other equipment such tamper evident seals, GPS tracking systems.

These equipment are expensive to purchase, maintain, and upgrade. The secure logistics market companies should also have proper authorization and certification for the use of these equipment and weapons. Many firms also research and develop their own solution based on the client’s package and demands. All these security measures and developments increase the cost of the overall service provided by the secure logistics firms. Paying such high costs makes the service inaccessible to many businesses and individuals.

Securing last mile delivery

Last mile delivery is the final stage of the shipping process in which the cargo is transported from a transportation center to the recipient. This is an important aspect of the logistics process that firms want to do swiftly, efficiently, and safely. The last mile is susceptible to theft and tampering as there are various factors involved such as inefficient routes, and unpredicted issues which may cause theft and tampering of the package. In secure logistics, last mile is equally significant and riskier as secure logistics deals with the industries where the package may contain defense instruments, and arsenal, rare materials & minerals, cash and even fine arts.

The cost involved with the package is going to be high when offering more secure services during the last mile delivery, but businesses and individuals may be willing to pay the price as it involves the objects which are rare and have possesses high value. For instance, in May 2023, there was a robbery worth $100 million as the Brink Incorporated’s (a secure logistics company) tractor trailer is transporting jewelry and gems to the recipient. Incidents like these show the requirement for improvement in the last mile delivery service in secure logistics.

Key Developments

- In July 2023, Securitas signs expanded 5-year agreement with Microsoft to provide data center security in 31 countries, cementing a strong relationship.

- In July 2023, Artificial Intelligence Technology Solutions, Inc. and its wholly owned subsidiary, Robotic Assistance Devices, Inc. (RAD), have established a partnership to deliver RAD products to GardaWorld Security Systems customers in Canada. This new partnership illustrates GardaWorld Security Systems' dedication to providing cutting-edge technologies.

- In June 2023, Prosegur Cash and Linfox Armaguard, a securities logistics company in Australia. The proposed merger of Prosegur Australia and Armaguard will allow both companies to pool their cash management and cash-in-transit (CIT) capabilities, allowing the united entity to become a financially sustainable supplier of CIT services to Australian customers.

- In June 2022, Securitas acquired the Stanley Security. The acquisition is expected to help the firm to enhance its product offering and expand its customer base.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the secure logistics market analysis from 2022 to 2032 to identify the prevailing secure logistics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the secure logistics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global secure logistics market trends, key players, market segments, application areas, and market growth strategies.

Secure Logistics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 191.9 billion |

| Growth Rate | CAGR of 8.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 252 |

| By Application |

|

| By Type |

|

| By Mode of Transport |

|

| By Region |

|

| Key Market Players | CargoGuard GmbH, SECURE LOGISTICS LLC, GardaWorld, Prosegur, CMS, PlanITROI, Inc., Lemuir Group, Brink's Incorporated, Allied Universal, Securitas AB |

Usage in manufacturing are the upcoming trends of Secure Logistics Market in the world

Transportation of jewelery and precious metal is the leading application of Secure Logistics Market

Asia-Pacific is the largest regional market for Secure Logistics

The global secure logistics market was valued at $87,059.7 million in 2022, and is projected to reach $191,890.1 million by 2032, registering a CAGR of 8.4% from 2023 to 2032.

Key players analyzed in the report include Allied Universal, Brink's incorporated, CargoGuard, CMS Info Systems, PlanITROI, Inc., GardaWorld, Lemuir Group, Prosegur, Securitas AB, and Secure Logistics LLC.

Loading Table Of Content...

Loading Research Methodology...