Seed Potatoes Market Research, 2033

Market Introduction and Definition

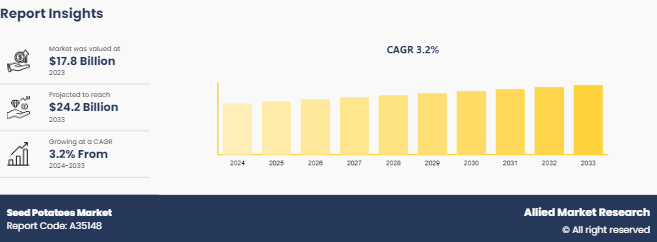

The global seed potatoes market was valued at $17.8 billion in 2023, and is projected to reach $24.2 billion by 2033, growing at a CAGR of 3.2% from 2024 to 2033. Seed potatoes are tubers specifically cultivated for planting and are essential for potato crop production. Unlike regular potatoes, seed potatoes are grown under controlled conditions to ensure they are free from disease and have optimal sprouting characteristics. The quality of seed potatoes directly impacts yield and crop quality, making them a critical input for both small-scale and commercial farmers. With the rising global demand for potatoes as a staple food and a key ingredient in processed food, the seed potatoes market is gaining momentum. The market benefits from advancements in breeding techniques, increased mechanization in agriculture, and growth in emphasis on crop yield efficiency

Key Takeaways

The seed potatoes industry study covers 18 countries, providing detailed segment analysis for each country in terms of value ($Million) for the projected period from 2023 to 2035.

Over 1, 500 product literatures, industry releases, annual reports, and other documents from major industry participants were reviewed, along with credible industry journals, trade associations' releases, and government sources, to generate high-value industry insights.

The study combines high-quality data, expert opinions and analysis, and independent perspectives to provide a comprehensive view of global markets, helping stakeholders make informed decisions for growth and strategy.

Key Market Dynamics

The increasing global demand for potatoes as a staple crop and a key raw material for processed food is a primary driver of the seed potatoes market. The rise in population and urbanization is boosting food demand, leading to a higher focus on improving agricultural productivity. The use of certified seed potatoes significantly enhances crop yield, further driving market growth as well as seed potatoes market size.

On the other hand, the high cost of certified seed potatoes and the risk of disease outbreaks affecting seed quality are notable restraints. In addition, the market is challenged by the seasonal nature of potato cultivation and the logistical complexities of distributing seed potatoes across regions. However, opportunities lie in the development of new seed varieties that are disease-resistant and climate-adaptive, as well as the increasing popularity of contract farming and cooperative seed distribution programs, increasing the seed potatoes market share.

Value Chain of the Seed Potatoes Market

The value chain of the seed potatoes market begins with research and development (R&D) by agricultural institutions and seed companies, focused on breeding disease-resistant and high-yield potato varieties. The next stage involves controlled cultivation of seed potatoes in dedicated farms, where they are rigorously tested and certified for quality. These certified seed potatoes are then packaged and distributed through various channels, including agricultural cooperatives, wholesalers, and direct sales to farmers. Stakeholders also include agronomists and advisory services, who assist farmers in using seed potatoes efficiently. Feedback from the farming community and advancements in agricultural technology contribute to continuous improvement in seed potato quality and affecting the seed potatoes market demand.

Market Segmentation

The seed potatoes market is segmented on the basis of type, form, distribution channel, and region. On the basis of type, it includes mini tubers, micro tubers, and others. Based on form, it is categorized into table consumption, processing, and seed production. By distribution channel, it is divided into cooperatives, direct sales, and online platforms. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

Europe leads the market, driven by a well-established potato cultivation sector and stringent regulations on seed quality. The Netherlands and Germany are key contributors, known for their high standards in seed potato production. The European Union's Common Agricultural Policy (CAP) supports seed potato R&D and certification processes, bolstering market growth. Asia-Pacific is a rapidly growing market, with China and India leading potato production. The region's demand for seed potatoes is fueled by the increasing population and the critical role of potatoes in the food supply chain, increasing the seed potatoes market growth. Government initiatives aimed at boosting agricultural productivity, coupled with the introduction of high-yield seed varieties, are expected to drive market growth. In India, the Ministry of Agriculture has implemented various programs to promote the use of certified seed potatoes, aiming to double farmer income by 2030.

Industry Trends

According to the seed potatoes market forecast, the growing adoption of modern agricultural practices and improved seed technologies are key trends in the market. As farmers seek to increase productivity and disease resistance in crops, there is a strong demand for high-quality seed potatoes. In addition, climate change and the need for resilient crop varieties are prompting research and innovation in the sector. In 2023, the global agricultural technology market was valued at $19.8 billion, with seed innovation being a crucial component.

The demand for disease-free and certified seed potatoes is driving the market. Regulatory frameworks and quality assurance programs, especially in regions such as Europe, are pushing for stringent seed certification processes. These programs ensure that only high-quality seed potatoes are distributed, boosting market confidence and driving adoption.

Competitive Landscape

The key players profiled in the report include HZPC Holland B.V., Agrico B.V., Germicopa SAS, Solana GmbH & Co KG, and Stet Holland B.V. These companies are focusing on product innovation, strategic partnerships, and regional expansion to strengthen their market presence.

Recent Key Strategies and Developments

In June 2023, HZPC Holland B.V. launched a new disease-resistant seed potato variety aimed at the European market, promising higher yield potential and reduced chemical usage.

In March 2023, Solana GmbH & Co KG expanded its operations in Asia, establishing a new distribution network to cater to the growing demand for seed potatoes in the region.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the seed potatoes market analysis from 2024 to 2033 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the seed potatoes market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes analysis of the regional as well as global seed potatoes market trends, key players, market segments, application areas, and market growth strategies.

Seed Potatoes Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 24.2 Billion |

| Growth Rate | CAGR of 3.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 155 |

| By Type |

|

| By Form |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Germicopa SAS, stet holland b.v., IPM Potato Group, mccain foods, McCain Foods, Solana GmbH & Co KG, HZPC Holland B.V., Norika GmbH, Xisen Potato Industry Group, ipm potato group limited, Agrico B.V, Stet Holland , Meijer Potato |

The global seed potatoes market was valued at $17.8 billion in 2023, and is projected to reach $24.2 billion by 2033, growing at a CAGR of 3.2% from 2024 to 2033.

The leading application of the seed potatoes market is in the production of table potatoes, which are cultivated for direct human consumption.

A significant trend is the development of climate-resilient seed potato varieties to combat extreme weather conditions, addressing the challenges posed by climate change.

The key players profiled in the report include HZPC Holland B.V., Agrico B.V., Germicopa SAS, Solana GmbH & Co KG, and Stet Holland B.V., Meijer Potato , Norika GmbH , Stet Holland , IPM Potato Group , Xisen Potato Industry Group and McCain Foods

North America is the largest regional market for Seed Potatoes

Loading Table Of Content...