The global shared mobility market was valued at $435.20 billion in 2021, and is projected to reach $1,266.80 billion by 2031, growing at a CAGR of 11.5% from 2022 to 2031.

Shared mobility refers to the shared use of a vehicle, motorcycle, scooter, or other mode of transportation for accessing transportation service on an as-needed basis. The fundamental idea of shared mobility is the use of same vehicle by several occupants. It includes public transit; micromobility (bike sharing, scooter sharing); automobile-based modes (car sharing, rides on demand, and microtransit) and commute-based modes or ridesharing (carpooling and vanpooling). Moreover, it has several benefits such as efficient travel, reduction in transportation costs, reduced fuel consumption, improves traffic conditions, and reduced emissions of greenhouse gases.

The growth of the global shared mobility market is propelling, due to rise in venture capital and strategic investments, government initiatives for smart cities, and increase in inclusion of e-bikes in the sharing fleet. However, low rate of internet penetration in developing regions is the factor hampering the growth of the market. Furthermore, increase in government initiatives for the development of bike sharing infrastructure is the factor expected to offer growth opportunities during the forecast period.

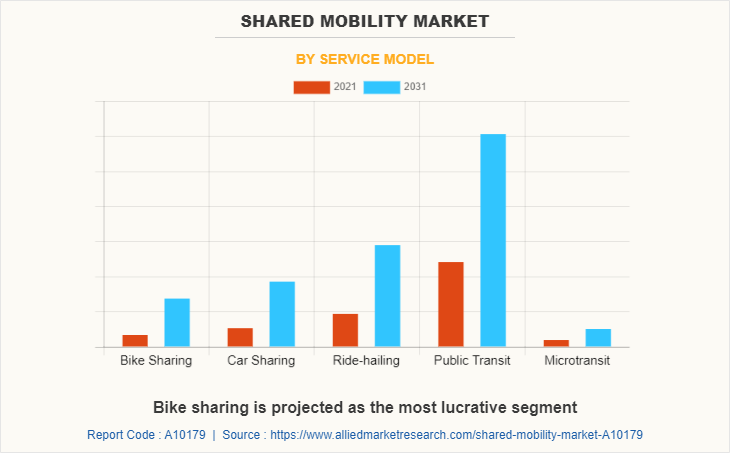

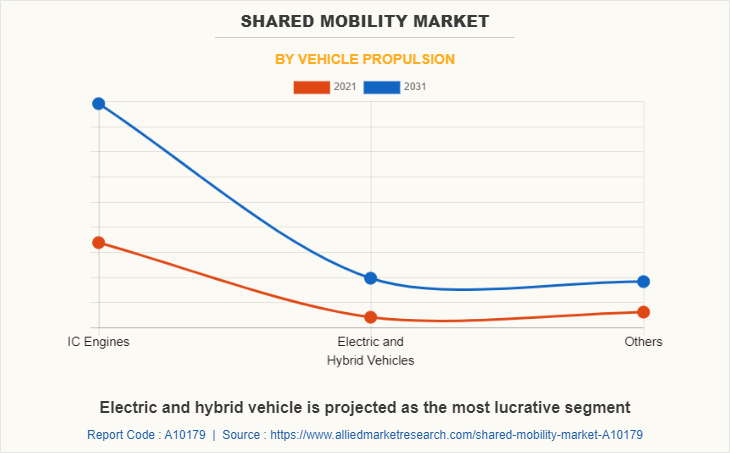

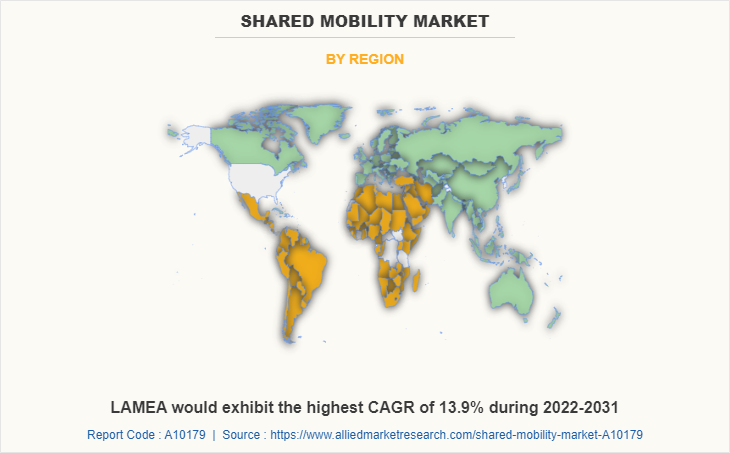

The shared mobility market is segmented on the basis of service model, vehicle type, vehicle propulsion, sales channel, and region. By service model, it is segmented into bike sharing, car sharing, public transit, and microtransit. By vehicle type, it is classified into two-wheelers, passenger cars, buses & rails, and others. By vehicle propulsion, it is fragmented into IC engine, electric & hybrid vehicles, and others. By sales channel, it is categorized into offline and online. By region, the report is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Some leading companies profiled in the shared mobility market report comprises ANI Technologies Pvt. Ltd., Autocrypt Co., Ltd., BlaBlaCar, Blu-Smart Mobility Pvt. Ltd., Bolt Technology OU, Cabify Espana S.L.U., DiDi Global Inc., EasyMile, Free2move, Getaround, Inc., Lyft, Inc., Meru Mobility Tech Pvt. Ltd, Uber Technologies, Inc., Yandex N.V., and Zoomcar India Pvt. Ltd.

Rise in venture capital and strategic investments

The significant rise in the preference of car pool and bike pool services among regular office commuters is the primary factor contributing toward the growth of the ride hailing and ride sharing services. In addition, increase in services offered by the leading shared mobility industry players, including Uber and Ola, and the option to choose convenient pick-up and drop locations are encouraging consumers to opt for ride hailing and ride sharing services. Moreover, significant rise in the number of multiple ride-hailing and ride-sharing services such as bike sharing and auto sharing service, even for short distance travel fuels the growth of the shared mobility market. Furthermore, ride sharing service providers are offering advantages such as affordable doorstep pick-up and drop, co-passenger information, and higher convenience as compared to the traditional transport service providers. This is expected to propel the demand for ride share services. In addition, several service providers offer various facilities, offers and discounts such as monthly pass on shared ride, to reduce the expenses of daily commuters.

Government initiatives for smart cities

Several government initiatives have been made for implementing the concept of shared mobility across the globe. This has led to the growth of the global shared mobility market. For instance, in 2019, in Japan, the Ministry of Economy, Trade, and Industry (MEIT) and the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) jointly created the smart mobility challenge subsidy program, thereby generating revenue of $27.6 million for the smart mobility challenge subsidy program. Similar investments and subsidy programs have been implemented by different governments across the globe, which also led to the growth of the global shared mobility market.

The shared mobility market is segmented into Service Model, Vehicle Type, Vehicle Propulsion and Sales Channel.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the global shared mobility market analysis from 2021 to 2031 to identify the prevailing shared mobility market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the shared mobility market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global shared mobility market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global shared mobility market trends, key players, market segments, application areas, and market growth strategies.

Shared Mobility Market Report Highlights

| Aspects | Details |

| By Service Model |

|

| By Vehicle Type |

|

| By Vehicle Propulsion |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Free2move, Didi Chuxing Technology Co., Zoomcar India Private Limited, Blu-Smart Mobility Pvt. Ltd., Yandex LLC, Autocrypt Co., Ltd., Cabify Espaa S.L.U., Meru Mobility Tech Pvt. Ltd., Lyft, Inc., ANI Technologies Private Limited (Ola), Uber Technologies Inc., Bolt Technology OÜ, EasyMile SAS, Getaround, Inc., BlaBlaCar |

Analyst Review

The global shared mobility market is expected to witness significant growth owing to enhancement in efficiency and operations offered by shared mobility providers, across a wide range of applications.

Governments across the globe are offering subsidies to service providers for developing stations and expanding their reach to a large number of commuters. In addition, owing to growing concerns related to the rise in environmental pollution, government authorities are providing incentives for the adoption of environment-friendly transport solutions, including bicycles and electric bikes. For instance, in 2022, in India, Delhi government has introduced a scheme that will provide financial incentives for people who buy electric bikes. E-cycle buyers will receive a 25% discount on the purchase price, with a maximum of $69.25 per piece.

Moreover, governments are also setting up the bike charging infrastructure, dedicated bike lanes, and parking zone. For instance, in January 2021, City Government of the French capital Helsinki has approved a decision to extend the city’s bike sharing service. The bike service will be expanded with 105 new stations and 1,050 new bicycles, significantly increasing the availability of bicycles and the coverage of the network. The improvement of the city bike service is part of the city’s Bicycle Action Plan, which was adopted in December 2020. In addition, in June 2020, Pittsburgh unveiled a 10-year plan to significantly expand bike infrastructure in the city by more than 120 miles of new trails, bicycle lanes and other street improvements. Therefore, increasing government initiatives for the development of reliable bike-sharing infrastructure and the proliferation of smart cities across the globe are anticipated to offer lucrative growth opportunities for the shared mobility market.

The global shared mobility market was valued at $435.2 billion in 2021 and is projected to reach $1,266.8 billion in 2031.

Asia-Pacific is the largest regional market for shared mobility.

Public transit is the leading application of shared mobility market.

Some leading companies in the shared mobility market include ANI Technologies Pvt. Ltd., Autocrypt Co., Ltd., BlaBlaCar, DiDi Global Inc., Free2move, Lyft, Inc., Uber Technologies, Inc., and Yandex N.V. among others.

The upcoming trends in the shared mobility market include development of autonomous solutions and greater adoption of electric and hybrid vehicles.

Loading Table Of Content...