Smart Building Market Analysis, 2032

The global smart building market size was valued at USD 78.28 billion in 2022, and is projected to reach USD 247.17 billion by 2032, growing at a CAGR of 12.3% from 2023 to 2032.

The surge in the adoption of smart buildings in multiple regions is driven by the growing need for better utilization of the building (and building premises) and the need for improved resource management in urban environments. In addition, the growth in the need for public safety and security is fueling the growth of the smart building market. Furthermore, the development of 5G networks provides enhanced connectivity, allowing for faster and more reliable communication between devices in smart buildings, further supports in market expansion. In addition, the governments support in investments for energy-efficient upgrades are motivating developers and property owners to incorporate smart technologies into their buildings, driving the global smart buildings market size in the upcoming years.

For instance, smart building solutions can monitor indoor air quality (IAQ), and inform habitants and alerts building operators about the same. Higher indoor air quality is directly associated with health and well-being of building’s habitants. According to a report published by World Economic Forum in February 2021, non-residential buildings are on average 40% more energy-intensive than residential buildings. Energy efficiency measures such as the use of smart building solutions can mitigate this increase by atleast around 20%.

A smart building is a structure that uses IoT and automated technologies to control building functions such as heating, ventilation, air conditioning, lighting, security, and other systems. A smart building collects and manages data using sensors, actuators, and microchips in accordance with the functions and services of an organization (or household). Such smart infrastructure solutions assists building owners, operators, and facility managers in improving asset dependability and performance, decreasing energy consumption, improving space utilization, and reducing buildings' environmental effects.

However, security concerns associated with intelligent building and lack of funding & adequate infrastructure limit the growth of this market. Where there is data, there are risks of cyber security and data privacy threats. This causes building managers and businesses to limit their plans for expanding their IoT and data analytics investments for residential and non-residential buildings, as they have to take serious consideration for users’ data and privacy. Such factors limit the smart building market research.

Conversely, the emergence of artificial intelligence in smart buildings and the rise in the IoT market & its application in smart buildings are anticipated to provide numerous opportunities for the expansion of the smart building market during the forecast period. Internet of things (IoT) is one of the most important technologies used in smart building market. It connects multiple devices through a common Internet Protocol (IP) platform to exchange and analyze information. This has led to its numerous applications in smart building market such as smart HVAC (heating, ventilation and air conditioning) and smart lighting to enhance guest and employee experience, smart restrooms which schedule cleaning crews after a set number of visitors have passed through, and smart soap and smart paper towel dispensers which digitally alert cleaning crews when their levels are running low, or even restock on their own.

The ongoing healthcare revolution has led to the increase in the demand for smart healthcare facilities that optimize patient care and operational efficiency. Hospitals and clinics are adopting smart building technologies to enhance patient experience, improve energy efficiency, and streamline operations, creating remunerative smart building market opportunity for tailored smart building solutions in the healthcare sector. Furthermore, the demand for retrofitting older buildings with smart technologies is increasing as businesses seek to enhance energy efficiency and sustainability. Many are modernizing their infrastructure to meet new energy standards and provide tech-driven experiences. This trend presents a lucrative opportunity for companies to offer affordable and efficient solutions for older buildings. Moreover, Governments across the globe are increasingly offering incentives and regulatory structures to promote the use of smart technologies in construction. This encompasses tax incentives, grants, and various other benefits for implementing energy-efficient and sustainable building practices. Businesses can leverage these opportunities to provide products and services that assist developers and organizations in meeting regulatory standards while capitalizing on available advantages.

Market Trends Insights:

One of the prominent trends in the smart building industry is the surge in implementation of energy management systems (EMS) to enhance energy efficiency within structures. These systems utilize advanced sensors, IoT devices, and data analysis to monitor and control energy usage in real-time, promoting more efficient resource utilization. By employing smart technologies, buildings can automatically adjust heating, cooling, lighting, and other energy-consuming functions based on occupancy patterns and external factors such as weather, helping to reduce energy consumption and improves sustainability. In addition, the emergence of smart building technologies is significantly influencing the market. These technologies aim to enhance building management via automation, allowing for the smooth integration of multiple systems like security, lighting, HVAC, and others. Leveraging AI-based analytics, these systems can forecast and respond to varying conditions, thereby minimizing energy usage and boosting overall operational efficiency.

For instance, in February 2025, Johnson Controls participated as the Building Technology Partner at ACREX India 2025, showcasing its advanced HVAC&R technologies. The company focused on data centers, mid-market industrial, and commercial markets. With over three decades in India, Johnson Controls aimed to help businesses reduce costs, improve productivity, and meet sustainability targets. It emphasized on the importance of smart, high-performance technologies for India's transformative infrastructure growth and net-zero ambitions.

Another notable trend the market is expected to witness is the increase in investment in smart technologies by building owners and managers, that enable real-time energy monitoring, predictive maintenance, and automated optimization. These trends are driving the demand for smart buildings, as they offer substantial cost savings, improved environmental performance, and enhanced occupant comfort, positioning intelligent building solutions as a key focus for the future of the industry. In addition, the upsurge of smart-sized buildings is gaining traction in the smart building market, where buildings are designed to optimize space usage while incorporating advanced technologies that enhance operational efficiency. These buildings are often more adaptable and flexible, accommodating the growing demand for efficient use of space in urban environments.

Segment Review:

Depending on component, the smart building market is divided into solutions and services. The solution segment is estimated to have gained the largest market share in 2022, while services segment is likely to grow at the fastest rate during the forecast period. Smart building solutions use IoT technology, which enable efficient and economical use of resources, such as IoT sensors, analytics software, a user interface, and a means of connectivity. This helps create a safe and comfortable environment for end users. In addition, it uses a range of technology, such as sensors and actuators, to gather activity data on various aspects within the building, which helps analyze and utilize operation more efficiently.

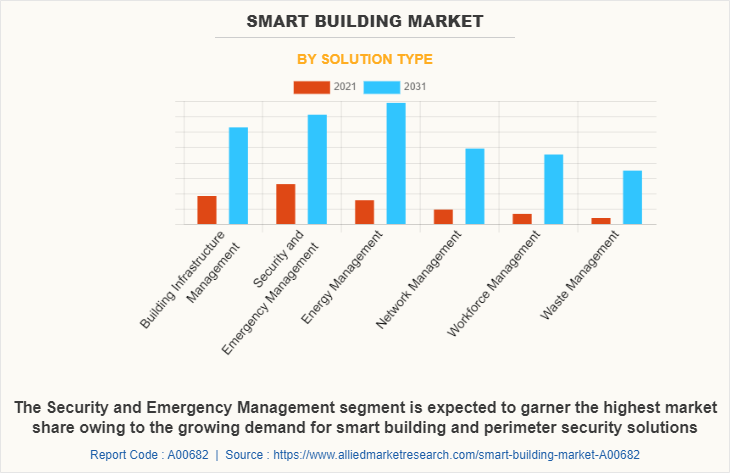

Based on solutions type the market is segmented into building infrastructure management (BIM), security & emergency management (SEM), energy management, network management, workforce management, and waste management. The security & emergency management (SEM) segment dominated the smart building market share in 2022, and is expected to have among the top market shares during the forecast period owing to the growth in digital disruption in people's everyday lifestyles contributing to the growth in demand for smart infrastructure solutions, which in-turn strengthens the demand for real time security & emergency management.

The demand for SEM in smart building is increasing owing to intelligent evacuation systems that combines Internet of things (IoT), fog layer, and cloud layer. The IoT technologies are used to capture environmental information and the location of occupants to track their movements and automatically count those who have reached the designated muster, or gathering point. On the other hand, the workforce management segment is expected to witness the highest growth in the upcoming years, as the demand for green and sustainable building management solutions is aiding in the smart building market growth.

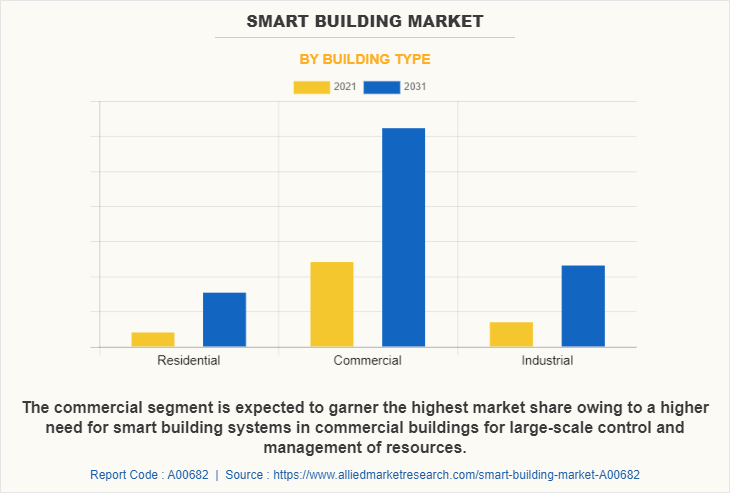

In terms of building type, the smart building market is segmented into residential, commercial and industrial segments. The intelligent building market was led by commercial buildings in 2022 and this trend is expected to continue during the forecast period. Meanwhile, the residential segment is expected to expand at the fastest rate during the forecast period. Infact, the 3 most popular characteristics of smart residential buildings are cloud-based software, smart amenities, and property management technologies (PMS). Different cloud-based devices can be integrated such as an apartment intercom system, building directory or CRM, communication tools such as Slack. PMS can automate many tasks such as collecting rent and managing resident maintenance requests. Examples of smart amenities include smart lights, smart locks, voice-controlled appliances, and smart thermostats.

For instance, in September 2024, Huawei signed an agreement with Talaat Moustafa Group (TMG) to develop AI-powered cloud technology for the "NOOR City" project, marking the first such partnership in Egypt. TMG leveraged Huawei's cloud technologies to build data centers and AI solutions, enhancing smart city development. The "NOOR Cloud" platform aimed to provide comprehensive cloud services to the Egyptian market. This collaboration was expected to drive economic growth and innovation in various industries.

Regional Insights:

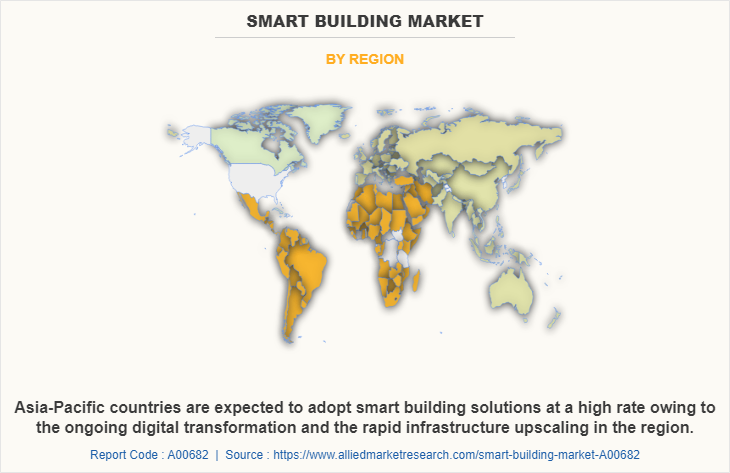

Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The smart building market was dominated by North America in 2022 and is expected to retain its position during the forecast period, owing to the presence of a highly developed ICT sector and high spending that aid the growth of the smart building market. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to various government initiatives and digital transformation trends within the region, which is expected to fuel the intelligent building market analysis in this region.

For instance, in December 2024, LG CNS partnered with SomeraRoad and Mastern America to enter the U.S. DX technology sector for buildings. They collaborated on smart real estate initiatives, incorporating AI, IoT, and automation to enhance building management and user experiences. LG CNS used its 'Cityhub Building' platform to transform various properties into smart buildings, offering services like mobile access cards with blockchain-based security and a Content Management System for digital signage. The initiative focused on projects in Kansas City, Nashville, and other locations.

Increasing demand for smart building solutions significantly across various countries of Asia-Pacific, as it is an emerging market and is expected to occupy a significant smart building market share owing to the rise in Internet penetration, increase in usage of cloud-based services among small and medium-sized businesses, and government initiatives promoting digitization and smart city development. Furthermore, the advent of high-speed networking technologies has been a key driving force in the smart building industry.

For instance, in September 2024, Hitachi and Hitachi Building Systems launched its new model of BuilMirai building IoT solution for small and medium-sized buildings. These solutions, part of the Lumada platform, aim to improve building management efficiency, operational quality, and user comfort. Starting November 2024, Hitachi Building Systems offered three smartphone-accessible solutions for security, facility monitoring, and security camera imagery via monthly subscriptions. They plan to expand these solutions globally in collaboration with GlobalLogic Inc. to strengthen their green and smart building business.

Top Impacting Factors

The high rate of adoption of smart buildings is driven by the increase in need of better utilization of the building as well as the requirement to better utilize resources in urban environments. Separately, the need for public security and safety also leads to the growth of intelligent building market. On the other hand, data security concerns associated with smart buildings hold back the market, apart from a paucity of funding and adequate infrastructure. Meanwhile, the ability to increasingly use artificial intelligence in smart buildings and the rise in IoT applications in smart buildings market are expected to provide many opportunities for expansion of smart building market during the forecast period.

Historical Data & Information

The smart building market is fairly competitive, owing to the strong presence of existing vendors. Market vendors are expected to gain a competitive advantage over their competitors because they can cater to market demands with a wide range of products. The competitive environment in this market is expected to increase as technological innovations, product extensions, and different strategies are adopted by key vendors.

For instance, in September 2024, UnaBiz, a leading IoT service provider, announced three new smart building solutions at BEX Asia 2024. These solutions aimed to automate monitoring, optimize operations, and help building owners achieve sustainability goals by reducing waste and enhancing efficiency. The lineup included UnaBiz’s FCU monitoring solution and two new offerings from Milesight: advanced energy monitoring and occupancy monitoring solutions.

Key Market Players:

The global smart building market is dominated by key players such as ABB, Cisco Systems, Inc., Hitachi, Ltd., Honeywell International Inc., Huawei Technologies Co., Ltd., IBM Corporation, Intel Corporation, Johnson Controls, PTC, and Siemens. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Recent Product Launches in Market

In May 2022, Siemens deployed AI integrated data center management software at the largest and most energy efficient data center in the Baltic region. The building management software (BMS), the energy and power management software (EPMS), and the White Space Cooling Optimization (WSCO) help Greenergy Data Centers to lower energy usage, ensure thermal protection, and manage reliable operation of the critical infrastructure.

In May 2023, Siemens Smart Infrastructure launched Connect Box, an open and easy-to-use IoT solution designed to manage small to medium-sized buildings. The latest addition to the Siemens Xcelerator portfolio, Connect Box is a user-friendly approach for monitoring building performance, with the potential to optimize energy efficiency by up to 30% and to substantially improve indoor air quality in small to medium sized buildings such as schools, retail shops, apartments or small offices.

In May 2022, IBM released the latest “AI adoption for business study and society standards”. The adoption and acceptance of AI is to enhance productivity and solve challenges with greater social and environmental impact and help companies address labor and skills shortage by automating repetitive tasks.

Government Initiatives:

Many countries have initiated programs to improve the efficiency and sustainability of building operations. These efforts are focused on optimizing energy consumption, lowering operational expenses, and improving the overall performance of smart buildings.

Furthermore, governments across the globe are encouraging the use of smart building technologies, including IoT, artificial intelligence (AI), and energy management systems, to enhance energy efficiency, sustainability, and occupant comfort. Significant instances include the application of AI for predictive maintenance, which aids in minimizing downtime and prolonging the longevity of building systems. For instance, in August 2024, The Union Cabinet approved 12 new industrial smart cities across different states with an outlay of Rs 28,602 crore to boost domestic manufacturing. Two cities were planned in Andhra Pradesh and one in Bihar. The government announced the development of 'plug and play' industrial parks in or near 100 cities. The projects aimed to transform India's industrial landscape, create 10 lakh direct and up to 30 lakh indirect jobs, and attract Rs 1.5 lakh crore in investment. They were built on PM GatiShakti principles with 'plug-n-play' and 'walk-to-work' concepts. These cities will feature advanced infrastructure, including smart building solutions, to support sustainable and efficient industrial operations.

Recent Collaborations in Market:

- In September 2024, ABB India Launched its Innovative Wireless Home Automation Solutions. ABB-free@home expands smart home capabilities, increasing comfort and convenience with seamless interoperability. It integrated with Samsung SmartThings and major brands like Philips Hue, Miele, and Sonos, allowing comprehensive control and automation. By optimizing energy consumption, homeowners could reduce their carbon footprint.

- In May 2023, Siemens Smart Infrastructure launched Connect Box, an open and easy-to-use IoT solution designed to manage small to medium-sized buildings. The latest addition to the Siemens Xcelerator portfolio, Connect Box is a user-friendly approach for monitoring building performance, with the potential to optimize energy efficiency by up to 30% and to substantially improve indoor air quality in small to medium sized buildings such as schools, retail shops, apartments or small offices.

- In July 2023, Spacewell partnered with TCM IP Services to create more sustainable, efficient, and intelligent built environments. The collaboration focused on enhancing user experiences through data-driven insights, optimizing energy consumption, and promoting sustainability. Together, they aim to provide seamless, intuitive, and secure solutions for building owners, facility managers, and occupants.

- In March 2025, Intelligent Living Application Group Inc. (NASDAQ: ILAG) launched its Competitive Smart Lock, aiming to make life safer and smarter with affordable, high-quality locksets and smart security systems. The first batch has been shipped to the U.S. and will be available on Amazon.com soon. Key features include advanced security with encryption, remote access, smartphone integration, and a sleek design.

Key Benefits for Stakeholders:

- The study provides an in-depth analysis of the global smart building market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on global smart building market trends is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The quantitative analysis of the smart building market from 2022 to 2032 is provided to determine the market potential.

Smart Building Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Solution Type |

|

| By Building Type |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

The demand for smart buildings has grown over the past few decades as smart buildings can help provide actionable information about a building (or a specific area inside the building), allowing owners or occupants to better manage the facilities of the building. The main purpose of developing a smart building is to save operating costs, increase occupant comfort, automate energy consumption management, track the state of critical building assets, and satisfy industry worldwide standards and sustainability requirements. Such features set of the smart building is promoting the growth of the global smart building market.

Key providers in the smart building market are PTC, Huawei Technologies Co., Ltd., and Hitachi, Ltd. With the growth in demand for smart building, various companies have established partnerships to increase their smart city solutions offerings.

For instance, in April 2022, ABB announced a joint partnership with South Korean electronics manufacturer, Samsung Electronics Co., Ltd. to develop energy savings, energy management solutions, and smart Internet of Things (IoT) solutions for both, residential and commercial buildings. In November 2023, NavVis announced a collaboration with Siemens Smart Infrastructure, in which the collaboration will be used for integrating accurate as-is 3D data and an immersive 3D experience to Siemens’ latest scalable building platform Building X. Siemens has defined this platform as a scalable digital building platform to digitalize, manage, and optimize building operations, allowing for enhanced user experience, increased performance, and improved sustainability. In addition, with the surge in demand for smart buildings, various companies have expanded their current services to continue with the rise in demand for smart city solutions.

For instance, in May 2022, American multinational technology conglomerate, Cisco Systems, Inc., announced the launch of its Cisco Cloud Controls Framework (CCF) to make sure Cisco’s cloud and IoT products & services meet security and privacy requirements with a simplified, rationalized, compliance, and risk management strategy, enabling efficient utilization of resources.

Moreover, many market players have expanded their business operations and customer base by increasing their acquisitions. For instance, in January 2021, American computer software and services company, PTC Inc., announced the acquisition of software as a service (SaaS) and product life cycle management (PLM) solutions vendor, Arena solutions. With this acquisition, PTC aims to strengthen its IoT and smart solution offerings.

The global smart building market size was valued at USD 78.28 billion in 2022, and is projected to reach USD 247.17 billion by 2032

The global smart building market is projected to grow at a compound annual growth rate of 12.3% from 2023-2032 to reach USD 247.17 billion by 2032

The global smart building market is dominated by key players such as ABB, Cisco Systems, Inc., Hitachi, Ltd., Honeywell International Inc., Huawei Technologies Co., Ltd., IBM Corporation, Intel Corporation, Johnson Controls, PTC, and Siemens.

North America dominated the smart building market in 2021 and is expected to retain its position during the forecast period,

The surge in the adoption of smart buildings in multiple regions is driven by the growing need for better utilization of the building and the need for better resource management in urban environments. In addition, the growth in the need for public safety and security is fueling the growth of the smart building market.

Loading Table Of Content...