Smart Container Market Research, 2032

The Global Smart Container Market was valued at $4.0 billion in 2022 and is projected to reach $24.1 billion by 2032, growing at a CAGR of 19.8% from 2023 to 2032.

A smart container is a type of shipping container equipped with various technologies such as Internet of Things (IoT) capabilities, sensors, GPS tracking, solar panels, and others. These technologies allow the collection of data in real time in terms of container location, status, and features. Smart containers provide 24/7 visibility and real-time information about cargo, giving shipping companies and stakeholders access to container data regardless of its location in the journey.

Segment Overview

The smart container market is segmented into technology, offering, industry vertical, and region.

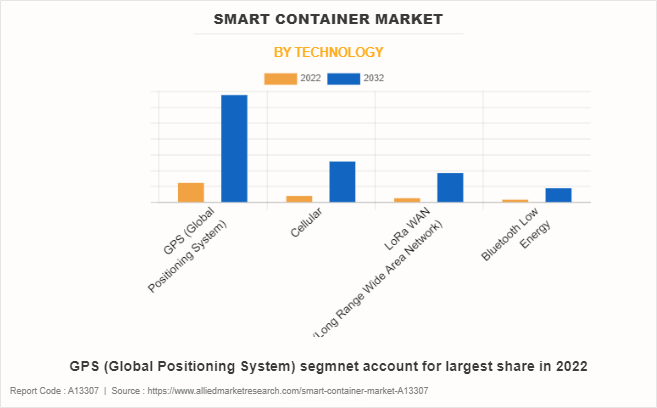

Based on technology, the market is bifurcated into GPS (Global Positioning System), Cellular, LoRa WAN (Long Range Wide Area Network), and Bluetooth Low Energy.

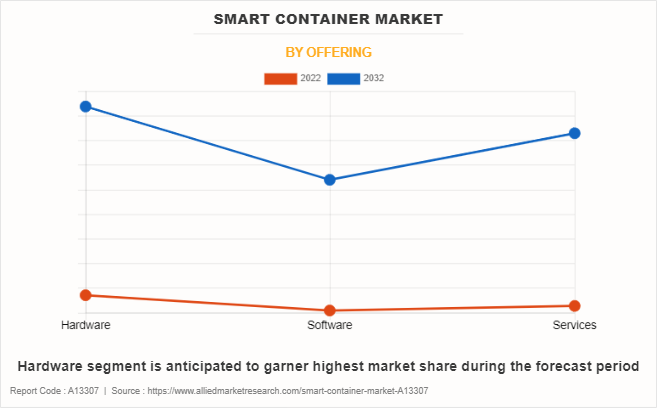

Based on the offering, the market is divided into hardware, software, and services.

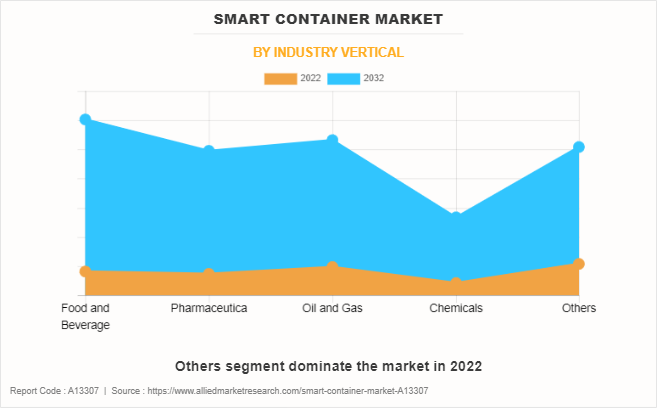

Based on industry vertical, the market is classified into food and beverage, pharmaceutical, oil and gas, chemicals, and others.

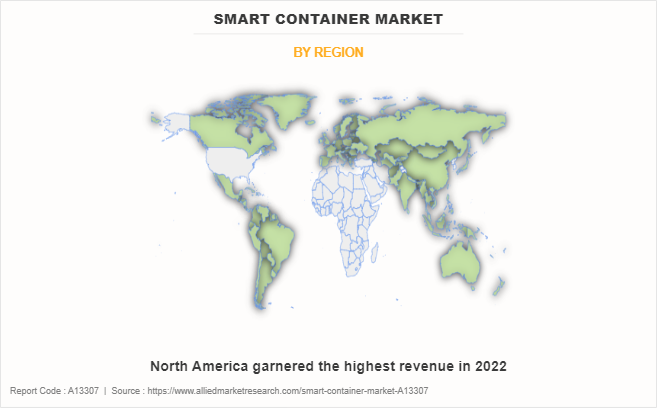

Based on region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Italy, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), and Middle East and Africa (UAE, Saudi Arabia, Qatar, South Africa, and Rest of Middle East and Africa).

Smart containers have advantages. First, their real-time monitoring capabilities greatly improve supply chain discovery by providing immediate access to critical information such as location, temperature, and humidity. In addition, IoT technology embedded in smart containers enables predictive maintenance, reduces the chances of equipment failure, and improves productivity Another notable advantage is moving security ahead, as these containers detect and report unauthorized access in advance, thereby reducing the risk of theft or tampering.

In addition, the data generated by smart containers can be used for analytics, helping to make more informed decisions and optimize policies. This improves resource efficiency, reduces costs, and increases overall efficiency. Furthermore, smart containers contribute to sustainability by precisely monitoring the environment, thereby reducing waste and energy consumption.

Lastly, compliance with regulatory standards is streamlined through accurate and easily accessible data records, ensuring adherence to quality requirements, and simplifying audit processes.

The most important driver of the smart container market is security enhancement. The demand for increased security in cargo has driven the adoption of smart containers. These tanks are equipped with advanced security features, such as sensors and monitoring systems, which allow them to detect and report unauthorized intrusions so that it can send them warnings qualifying immediately if smart storage container box security systems detect tampering or breaches This quick intervention reduces the chances of theft, damage, or any material use maximizing unauthorized access, ensuring the security and integrity of value chains throughout the supply chain. This ensures that drugs remain in specific conditions, prevents contamination, and assures the integrity of the drug supply.

Furthermore, the integration of Internet of Things (IoT) technologies is a key driver in the smart container market. By incorporating IoT capabilities, These containers enable predictive maintenance, key to reducing the risk of device failure. Sensors and connection devices in smart containers collect real-time data about the state and performance of the container and its contents. This information streamlines rapid maintenance, minimizes downtime, prevents potential disruptions in the supply chain, and ensures smooth operations. Contrary to IoT integration, this not only enhances the dependability of smart containers but, in the context of Industry 4.0, also contributes to the improvement of connected and automated logistics. For instance, a logistics firm may employ smart containers equipped with IoT-connected sensors to monitor water quality, tracking variables such as water temperature, moisture levels, rust, and mechanical issues. A company can proactively plan maintenance activities, preventing potential problems before they occur by using predictive analytics. This proactive approach helps avoid expensive delays and keeps things running smoothly in the supply chain.

On the other hand, high initial costs hinder the growth of the market. The deployment of smart containers requires advanced sensors, Internet of Things (IoT) infrastructure, and network integration. These early investments can hinder businesses, especially SMEs whose funds are limited, preventing them from rapidly adopting this technology. However, some financial constraints pose a challenge for organizations to justify the immediate implementation of smart containers.

Furthermore, advances in IoT and connectivity open opportunities for smart container manufacturers. Continued advances in Internet of Things (IoT) technologies and network development are expected to significantly increase Smart reefer Container capabilities. Advanced connectivity is expected to enable seamless and faster communication between smart containers and centralized systems, and it is anticipated to enhance advanced real-time analytics, data analytics, and overall performance on top of that. These improvements can lead to smarter and more reliable solutions, capable of delivering high-quality data and faster response times. The synergy between advanced IoT capabilities and connectivity improvements is poised to enhance the role of intelligent containers in logistics, opening up opportunities for supply chain management faster and smarter in the future.

For instance, companies such as Maersk, one of the largest shipping conglomerates across the globe, have been actively investing in IoT technologies to enhance their container fleet management. Maersk can remotely monitor crucial parameters such as temperature, humidity, and location in real-time by integrating IoT sensors and connectivity. This enables proactive decision-making, minimizes risks, and ensures the seamless transport of goods. The potential for even more robust smart container solutions with improved data accuracy, communication capabilities, and overall performance becomes possible as advancements in IoT and connectivity continue, further propelling the evolution of the market.

The smart container market segmentation is based on offering, technology, industry vertical, and region. On the basis of offering, the market is divided into hardware, software, and services. On the basis of technology, the market is bifurcated into GPS (Global Positioning System), Cellular, LoRa WAN (Long Range Wide Area Network), and Bluetooth Low Energy. On the basis of industry vertical, the market is classified into food and beverage, pharmaceutical, oil and gas, chemicals, and others.

Based on region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Italy, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), and Middle East and Africa (UAE, Saudi Arabia, Qatar, South Africa, and Rest of Middle East and Africa).

Asia-Pacific, specifically China., remains a significant participant in the smart container growth projections. Major organizations and government institutions in the Asia-Pacific region have significantly put resources into action to develop enhanced Smart containers which is driving the growth of the smart container industry in the Asia-Pacific region.

Competitive Analysis

Competitive analysis and profiles of the major smart container market share by company, such as ORBCOMM Inc., SkyCell AG, Traxens, Phillips Connect Technologies, Globe Tracker, Robert Bosch GmbH, Nexiot AG, MSC (Mediterranean Shipping Company), Shenzhen joint Technology Co., Ltd., A.P. Moller - Maersk are provided in this report. Product launch and acquisition business strategies were adopted by the major market players in 2022.

Country Analysis

Based on North America, the U.S. holds the largest share in the North America region, and the U.S. smart container market is expected to grow at a CAGR of 18.12% there during the forecast period 2023-2032. There are noteworthy constants, due to the technological advances in the logistics and supply chain industry that immediately adopt new solutions.

In Europe, the UK dominated the Europe smart container market share in terms of revenue in 2022 and is expected to follow the same trend during the forecast period. Moreover, the UK is expected to emerge as one of the fastest-growing countries in Europe's smart container industry with a CAGR of 20.82%, owing to its proactive adoption of cutting-edge technologies and a robust logistics infrastructure.

In Asia-Pacific, China holds the dominant market share, and similar trends are expected to follow during the forecast period, because of robust infrastructure, extensive port infrastructure, government support, and technology the improved execution speed which contributes to the consistent leadership of the smart container market during the forecast period. Furthermore, China is expected to emerge with the highest CAGR in the Asia-Pacific region in the smart container market in this region.

In Latin America, the Latin America region accounted for the largest market share of the rest of Latin America and is expected to follow the same trend over the forecast period, as its economy grows, liquidity use up, and smart cities continue to expand. However, Argentina is expected to emerge as one of the fastest-growing countries in Latin America Smart container industry with a CAGR of 22.17% owing to its strategic geographic location, advanced logistics infrastructure, and a growing emphasis on technology adoption.

In the Middle East and Africa, the UAE dominated the smart container market size by country in the Middle East and Africa region and is expected to follow the same trend during the forecast period, because of advanced logistics infrastructure, strategic positioning, and technological leadership.

Top Impacting Factors

The smart container market is expected to witness notable growth owing to the integration of Internet of Things (IoT) technology, and the rise of smart logistics. Moreover, rapid technological advancement is expected to provide lucrative opportunities for the growth of the market during the forecast period. On the contrary, high installation cost limits the growth of the smart container market.

Historical Data and Information

The smart container market growth is highly competitive, owing to the strong presence of existing vendors. Smart container companies with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to increase as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Recent Product Launch in the Smart Container Market

- In April 2023, AELER, a LogTech company, unveiled its newest generation sustainable smart container, 'Unit One,' at the Singapore Maritime Week. Unit One is the first transportation container made of composite, making it "stronger, better insulated, and smarter," according to AELER. In addition, Unit One container emits 20% less carbon dioxide (CO2) when in use.

- In January 2023, Sateliot and Sensefinity introduced a global 5G-IoT satellite connectivity solution for the inaugural data transmission from 1,000 smart containers. This technological advancement is expected to yield significant cost savings, potentially up to $1.4 million annually, for medium-sized shipping companies in terms of container maintenance and repairs. Using the comprehensive 5G NB-IoT satellite constellation of Sateliot, Sensefinity can provide real-time updates on location, temperature, humidity, vibration, and instances of container breaches. This development unlocks a range of impactful applications, including alerts for container falls into the ocean, notifications for fires within containers, warnings for cold-chain breaches concerning sensitive cargo like food and medicines, and reports on impacts and damages sustained by containers.

Recent Collaboration in the Smart Container Market

In February 2023, Ocean Network Express (ONE) and Sony Network Communications Europe collaborated to build a smart container solution for its global fleet. Cargo transportation of ONE experience is expected to be combined with the expertise of Sony in the creation and innovation of world-class sensor and networking technologies. ONE hopes to create a smarter, more efficient shipping experience for themselves and their clients by leveraging the expertise of Sony in developing novel sensor and networking technologies.

Key Benefits For Stakeholders

- This smart container market report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the smart container market analysis from 2022 to 2032 to identify the prevailing market opportunity.

- The Smartcontainers market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the smart container market overview segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global Smart containers.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global smart container market trends, key players, market segments, application areas, and market growth strategies.

Smart Container Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 24.1 billion |

| Growth Rate | CAGR of 19.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Technology |

|

| By Offering |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Shenzhen joint Technology Co. Ltd., MSC (Mediterranean Shipping Company), Traxens, Phillips Connect Technologies, skycell ag, Nexiot AG, ORBCOMM Inc., Robert Bosch, Globe Tracker, A.P. Moller - Maersk |

Analyst Review

The global smart container market holds high potential for the semiconductor industry. The business scenario witnesses an increase in the demand for smart container, in developed economy such as Europe, Asia-Pacific, and North American regions, and developing regions, such as China, India, Southeast Asia, and others. Companies in this industry have been adopting various innovative techniques to provide customers with customizable, advanced, and innovative product offerings.

The smart container market is expected to witness notable growth owing to integration of Internet of Things (IoT) technology, and the rise of smart logistics. Moreover, rapid technological advancement is expected to provide lucrative opportunities for the growth of the market during the forecast period. However, high installation cost limits the growth of the smart container market.

The market participants are expected to introduce technologically advanced products to remain competitive in the market. Product launch and collaboration are the prominent strategies adopted by the market players. For instance, in January 2023, Sateliot and Sensefinity introduced a global 5G-IoT satellite connectivity solution for the inaugural data transmission from 1,000 smart containers. This technological advancement is expected to yield significant cost savings, potentially up to $1.4 million annually, for medium-sized shipping companies in terms of container maintenance and repairs. Utilizing comprehensive 5G NB-IoT satellite constellation of Sateliot, Sensefinity can provide real-time updates on location, temperature, humidity, vibration, and instances of container breaches. This development unlocks a range of impactful applications, including alerts for container falls into the ocean, notifications for fires within containers, warnings for cold-chain breaches concerning sensitive cargo such as food and medicines, and reports on impacts and damages sustained by containers.

The increased integration of Internet of Things (IoT) technologies and advancements in sensors, and the adoption of blockchain technology are the upcoming trends of smart container market in the world.

Oil and gas is the leading application of smart container market.

North America is the largest regional market for smart container in 2022.

$ 4,019.38 Million is the estimated industry size of smart container in 2022.

ORBCOMM Inc., SkyCell AG, Traxens, Phillips Connect Technologies, Globe Tracker, Robert Bosch GmbH, Nexiot AG, MSC (Mediterranean Shipping Company), Shenzhen joint Technology Co., Ltd., A.P. Moller - Maersk are the top companies to hold the market share in smart container.

Loading Table Of Content...

Loading Research Methodology...