Smart Lamp Market Research, 2032

The Global Smart Lamp Market was valued at $4.1 billion in 2022, and is projected to reach $25.1 billion by 2032, growing at a CAGR of 20.1% from 2023 to 2032.

A smart lamp, also known as a connected or intelligent lamp, is a lighting fixture equipped with advanced technology and connectivity features that enable users to control various aspects of the lamp's operation remotely or through automation. These lamps are typically integrated with Wi-Fi or Bluetooth capabilities and can be managed using smartphone apps, voice commands, or other smart home automation systems.

Users can turn the lamp on/off, adjust brightness levels, and change the color or color temperature from a smartphone or tablet, even when they are not physically present in the room. Smart lamps often offer the ability to dim the light to create different lighting atmospheres and change the color of the light to suit various moods or activities.

Smart lamp can be controlled remotely via smartphones or voice assistants like Amazon Alexa or Google Assistant. This level of convenience allows users to adjust lighting settings without getting up from their seats making it an attractive option for modern homeowners. Smart lamp often incorporate LED technology which is energy-efficient and can significantly reduce electricity consumption compared to traditional incandescent or fluorescent bulbs. Several smart lamps also have built-in sensors that adjust brightness based on ambient light levels further optimizing energy use. Smart lamps offer a wide range of customization options allowing users to set different lighting scenes, colors, and brightness levels to suit their preferences or activities. This level of personalization enhances the overall living experience in a smart home.

Moreover, smart lamps can be seamlessly integrated into larger smart home ecosystems. They can be synchronized with other smart devices such as thermostats or security systems and entertainment systems, creating a cohesive and interconnected home automation experience. With a growing focus on environmental sustainability, consumers are increasingly drawn toward energy-efficient solutions like smart lamps that reduce their carbon footprint and contribute toward lower energy bills. Moreover, the rising consumer demand for smart lamps in the context of smart homes is driven by the combination of convenience, energy efficiency, customization, integration, and the overall enhanced living experience that these devices offer.

Smart lamps and bulbs are typically more expensive than their traditional counterparts. The initial cost of purchasing smart bulbs and the necessary hubs or controllers can be a significant deterrent for price-sensitive consumers. This initial investment is often higher because of the advanced technology embedded in smart bulbs. In addition to the cost of the bulbs themselves, consumers may need to invest in other accessories such as smart switches, bridges, or hubs to enable full functionality.

These additional costs can further increase the overall expenditure on setting up a smart lighting system. Some consumers may struggle to justify the higher cost of smart lamps compared to traditional ones. While smart lamps offer added convenience and features, some users may not see the perceived value matching the price tag. These are the major factors anticipated to hamper the smart lamp industry's growth.

The market for smart lamps has a sizable opportunity due to the increased adoption of smart home technology. As smart home technology gains traction worldwide, the smart lamp market demand is projected to expand globally. Different regions have unique preferences and requirements, leading to diverse product offerings and opportunities for market growth. With advancements in technology and increased competition, smart lamps are becoming more affordable. Lower price points make them accessible to a broader range of consumers, further driving their adoption. The ability to control and monitor smart lamps remotely through mobile apps is another selling point.

The smart lamp market is not limited to residential use, as it also has potential applications in commercial settings, such as hotels, restaurants, and offices. These sectors adopt smart lamps for their energy efficiency, ambiance control, and cost-saving benefits. Smart lamp market outlook size offers convenience and customization options that traditional lamps cannot match. Users can control brightness, and color, and even schedule lighting to suit their preferences. This level of control appeals to consumers looking to personalize their living spaces. These are the major factors projected to offer growth opportunities for key players operating in the market during the forecast period.

The key players profiled in this report include Honeywell International Inc., Syska, Cree Inc., Acuity Brands Inc., Cisco Systems Inc., Deco Lighting Inc., Eaton, Dialight, Koninklijke Philips N.V., and General Electric. Investment and agreement are common strategies followed by major market players. For instance, in January 2023, Savant company GE Lighting announced the expansion of its smart home ecosystem, Cync. Cync unveiled its entire Dynamic Effects entertainment lineup, which includes 16 million colors, pre-set and custom light shows, on-device music syncing, and other features. In addition, following a successful launch last year, Cync has expanded its Wafer light fixture line.

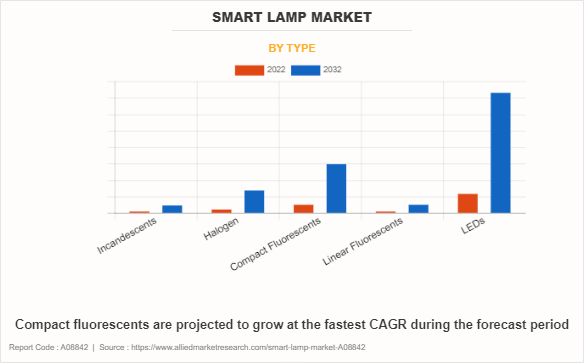

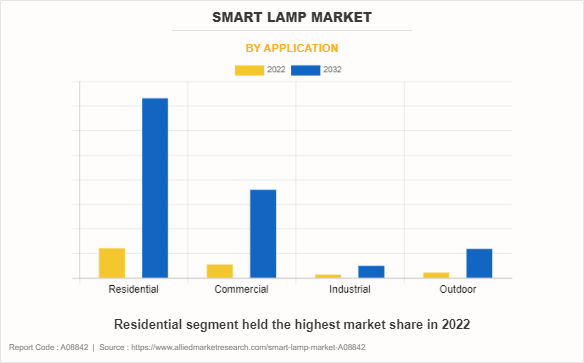

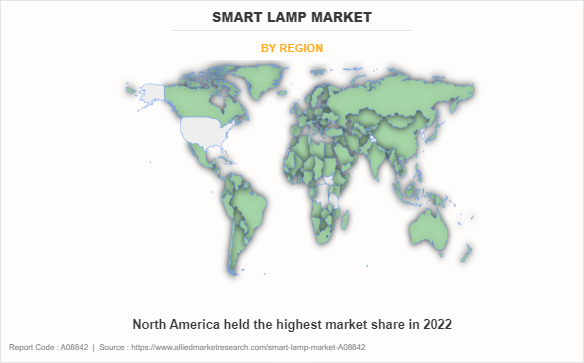

The smart lamp market is segmented based on type, application, and region. By type, the market is divided into incandescent, halogen, compact fluorescents, linear fluorescents, and LEDs. By application, the market is classified into residential, commercial, industrial, and outdoor. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Segment Overview

The smart lamp market is segmented into Type and Application.

By type, the LEDs sub-segment dominated the smart lamp market size in 2022. LEDs can be integrated into smart lamp systems easily. They can be controlled remotely through smartphones, voice assistants (e.g., Amazon Alexa, Google Assistant), or smart home automation platforms, enhancing user convenience and creating more dynamic lighting experiences. LEDs can be easily integrated into smart home ecosystems. They can be controlled remotely via smartphones or voice assistants like Amazon Alexa and Google Assistant.

This connectivity enhances the overall smart home experience and is a major driver for smart lamps with LED technology. LEDs are inherently dimmable, making them suitable for creating ambient lighting and setting the desired brightness levels for various scenarios. The reduced energy consumption and longer lifespan of LEDs contribute to a lower environmental impact, aligning with the growing awareness of eco-friendly products and sustainability. LED technology offers better color rendering and a more natural light spectrum compared to some older lighting technologies, improving visual comfort and overall quality of light. These are predicted to be the major factors driving the smart lamp market outlook size during the forecast period.

By application, the commercial sub-segment dominated the global smart lamp market share in 2022. Commercial establishments are constantly looking for ways to reduce energy consumption and lower operational costs. Smart lamps often come with energy-efficient LED technology and the ability to adjust brightness and color temperature which can lead to significant energy savings over time. Businesses appreciate the flexibility and control offered by smart lighting systems. These systems allow for precise customization of lighting settings, including scheduling, dimming, and color changing. This can enhance productivity, create desired ambiance, and improve employee comfort.

Smart lamp market trends can be integrated into broader building automation systems, making it easier to manage lighting alongside other systems like HVAC, security, and access control. This streamlines operations and offers centralized control. Commercial smart lamps often incorporate Internet of Things (IoT) technology enabling them to connect to a network and be controlled remotely. This connectivity can be used for data collection and analysis, allowing businesses to optimize lighting based on occupancy and usage patterns. The ability to adjust lighting to mimic natural daylight can have a positive impact on employee health and well-being. Commercial smart lamps often offer features that promote circadian rhythm regulation, which can lead to increased productivity and reduced absenteeism.

By region, North America dominated the global smart lamp market growth in 2022. The growing awareness and adoption of smart home technology among consumers are factors driving the demand for smart lamps. People are increasingly interested in controlling their lighting systems remotely through smartphone apps or voice assistants like Amazon Alexa and Google Assistant. Many consumers in North America are already using other smart devices like smart speakers, thermostats, and security cameras. Smart lamp market demand that can seamlessly integrate with these existing ecosystems is in high demand, as they allow for centralized control and automation.

Smart lamp market opportunities often come with features like dimming, scheduling, and occupancy sensors, which can help users reduce energy consumption and lower electricity bills. As environmental consciousness grow and energy costs continue to rise in the region, energy-efficient lighting solutions are projected to become more appealing. Smart lamps offer various color and brightness settings, allowing users to customize their lighting to match their preferences, mood, or specific activities. This level of customization is attractive to consumers looking to create unique lighting experiences. In certain regions of North America, government incentives and rebates for energy-efficient lighting solutions encourage consumers and businesses to invest in smart lamps.

Impact of COVID-19 on the Global Smart Lamps Industry

The COVID-19 pandemic has had a significant impact on the smart lamps market. The smart lamp market relies on the global supply chain for components and manufacturing. The pandemic disrupted supply chains worldwide, leading to shortages of key components and delays in production. This resulted in longer lead times and increased costs for smart lamp and floor lamp manufacturers.

During the pandemic, consumer spending patterns shifted significantly. With more people working and studying from home, there was an increase in demand for home office and home improvement products, including smart lamps. This led to a surge in demand for certain types of smart lamps, especially those with features like adjustable lighting and remote control capabilities.

As physical retail stores faced closures and restrictions, e-commerce became the preferred shopping method for many consumers. Smart lamps, floor lamp manufacturers, and retailers had to adapt to this shift in consumer behavior by enhancing their online presence and distribution networks.

The pandemic accelerated the trend towards smart home technology adoption. Consumers sought products that could enhance their homes and make remote work and leisure more comfortable. Smart lamp manufacturers responded by introducing new features and designs, such as lamps with integrated voice assistants, color-changing capabilities, and better energy efficiency.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the smart lamp market analysis from 2022 to 2032 to identify the prevailing smart lamp market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the smart lamp market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global smart lamp market forecast trends, key players, market segments, application areas, and market growth strategies.

Smart Lamp Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 25.1 billion |

| Growth Rate | CAGR of 20.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 289 |

| By Application |

|

| By Type |

|

| By Region |

|

| Key Market Players | Dialight, Syska, Eaton, Deco Lighting Inc., Honeywell International Inc., Koninklijke Philips N.V., General Electric, Cisco Systems Inc., Acuity Brands Inc., Cree Lighting USA LLC |

The growing demand for remote smart lamps is one of the major factors driving the growth of the market. The increasing adoption of smart home technology is a significant driver for the smart lamp market expansion. As more people invest in smart speakers, smart thermostats, and other connected devices, they are also looking for smart lighting solutions like smart lamps to enhance their homes' automation and convenience, which is estimated to generate excellent opportunities in the smart lamps market.

The major growth strategies adopted by smart lamps market players are investment and agreement.

Asia-Pacific is projected to provide more business opportunities for the global smart lamps market in the future.

Honeywell International Inc., Syska, Cree Inc., Acuity Brands Inc., Cisco Systems Inc., Deco Lighting Inc., Eaton, Dialight, Koninklijke Philips N.V., and General Electric. are the major players in the smart lamps market.

The LEDs sub-segment of the type acquired the maximum share of the global smart lamps market in 2022.

Commercial and business sectors are the major customers in the global smart lamps market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global smart lamps market from 2022 to 2032 to determine the prevailing opportunities.

Smart lamps often come with energy-efficient LED bulbs and advanced features like dimming and scheduling, which can help users reduce energy consumption and lower their electricity bills. This energy-saving aspect is a compelling reason for many consumers to switch to smart lighting solutions, which is estimated to drive the adoption of smart lamps.

Smart lamps allow users to control their lighting remotely using smartphones or voice commands through virtual assistants like Amazon Alexa and Google Assistant. The convenience of being able to turn lights on and off, adjust brightness, and set schedules from anywhere is a significant driver for the smart lamps adoption.

Loading Table Of Content...

Loading Research Methodology...