Smoked Meats Market Research, 2033

Market Introduction and Definition

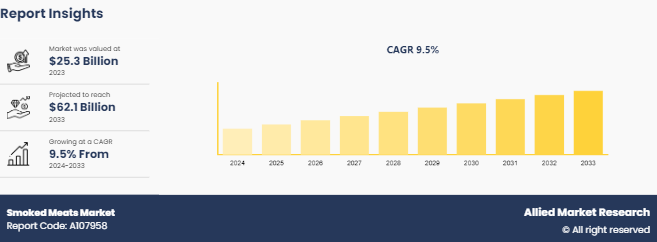

The global smoked meats market was valued at $25.3 billion in 2023, and is projected to reach $62.1 billion by 2033, growing at a CAGR of 9.5% from 2024 to 2033.

Smoked meats are cooked and preserved by exposure to smoke from burning or smoldering materials, typically wood. The smoking process imparts a distinct flavor, enhances the color, and extends the shelf life of the meat. Common types of smoked meats include smoked bacon, sausages, hams, and poultry. These products are popular across various regions due to their rich taste, traditional preparation methods, and long-lasting quality. Smoked meats are consumed as a part of various cuisines globally, either as a main dish, in sandwiches, or as a flavoring component in other recipes.

Key Takeaways

The smoked meats market study covers 25 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period.

More than 1, 200 product literatures, industry releases, annual reports, and other documents of major food industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The rise in consumer demand for protein-rich diets is significantly boosting the growth of the market. More consumers are turning to smoked meats as a tasty and convenient protein source as awareness of the benefits of protein increases, which increases the smoked meats market size.

Increasing urbanization and changing dietary patterns are driving the demand for processed and ready-to-eat meat products, including smoked meats, particularly in emerging markets. This urbanization is creating a new consumer base that values convenience and variety in their food choices, increasing the smoked meats market share.

However, the smoked meats market faces challenges from rising health concerns over processed meats, which are often associated with high levels of sodium and preservatives. This has led to some consumer hesitancy, particularly among health-conscious demographics.

Additionally, the environmental impact of meat production and processing is becoming a growing concern, with more consumers and regulatory bodies advocating for sustainable practices. This creates a challenge for the smoked meats industry to innovate and adopt more eco-friendly practices.

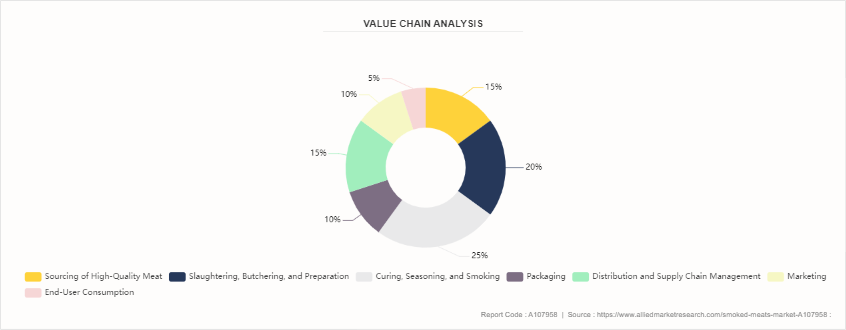

Value Chain of Smoked Meats Market

The value chain of the market begins with the sourcing of high-quality meat from livestock farms, followed by slaughtering, butchering, and preparation. The meat is then cured, seasoned, and smoked using various traditional and modern techniques to achieve the desired flavor and preservation. After smoking, the meats are packaged in a variety of formats, including vacuum-sealed, canned, or bulk packaging, and distributed through a well-established supply chain. According to smoked meats market forecast, this includes warehousing, inventory management, and transportation to various retail outlets, such as supermarkets, specialty stores, and online platforms. Companies invest in marketing, branding, and sales strategies to promote their products, utilizing both traditional and digital channels to reach consumers. The value chain concludes with end-user consumption, where consumer preferences and feedback drive continuous product development and innovation.

Market Segmentation

The smoked meats market is segmented into product type, source, distribution channel, and region. On the basis of product type, it is fragmented into smoked bacon, smoked sausages, smoked ham, and smoked poultry. On the basis of source, it is categorized into pork, beef, chicken, and others. On the basis of distribution channel, it is divided into supermarkets/hypermarkets, convenience stores, online retail, and specialty stores. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The U.S. smoked meats market is experiencing steady growth, driven by the strong tradition of meat consumption and the popularity of barbecued and smoked foods such as the growing demand for convenience foods and protein-rich diets are key drivers in this market. According to USDA reports, the U.S. meat consumption has seen a consistent rise, with processed and smoked meats making up a significant portion of this demand. The U.S. market benefits from a well-established distribution network, with a strong presence in both physical and online retail channels. Additionally, the market is witnessing innovation in product offerings, including organic and natural smoked meats, which cater to health-conscious consumers, increasing the smoked meats market growth.

In China, the smoked meats market is expanding rapidly, driven by the increasing disposable incomes, urbanization, and the growing demand for convenience food. Macro factors include the strong tradition of meat consumption in Chinese cuisine, where smoked and cured meats are popular. The market is further supported by the government’s initiatives to improve food safety and quality, which is driving the demand for higher-quality smoked meats. On a micro level, local manufacturers are innovating with flavors and packaging to cater to regional tastes, while international brands are expanding their presence in the Chinese market, leveraging the growth of e-commerce to reach a broader audience.

Competitive Landscape

The key players profiled in the report are Hormel Foods Corporation, Smithfield Foods, Inc., Tyson Foods, Inc., Kraft Heinz Company, Conagra Brands, Inc., BRF S.A., Perdue Farms, Inc., Foster Farms, Maple Leaf Foods, and Pilgrim's Pride Corporation.

Recent Key Strategies and Developments

In 2023, Tyson Foods introduced a new range of smoked sausages under its Hillshire Farm brand, focusing on natural ingredients and reduced sodium content.

In 2021, Hormel Foods launched a new line of smoked bacon products under its Black Label brand, targeting the premium segment with a focus on gourmet flavors and artisanal smoking techniques.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the smoked meats market analysis from 2024 to 2033 to identify the prevailing smoked meats market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the smoked meats market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global smoked meats market trends, key players, market segments, application areas, and market growth strategies.

Smoked Meats Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 62.1 Billion |

| Growth Rate | CAGR of 9.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 255 |

| By Product Type |

|

| By Source |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Maple Leaf Foods, Smithfield Foods, Inc., Tyson Foods, Inc, Hormel Foods Corporation, BRF S.A., Conagra Brands, Inc., Perdue Farms, Inc., Kraft Heinz Company, Pilgrim's Pride Corporation, Foster Farms |

The global smoked meats market was valued at $25.3 billion in 2023, and is projected to reach $62.1 billion by 2033, growing at a CAGR of 9.5% from 2024 to 2033.

The global smoked meats market is undergoing notable shifts driven by changing consumer preferences, innovations in production, and a focus on health and sustainability.

The key players profiled in the report are Hormel Foods Corporation, Smithfield Foods, Inc., Tyson Foods, Inc., Kraft Heinz Company, Conagra Brands, Inc., BRF S.A., Perdue Farms, Inc., Foster Farms, Maple Leaf Foods, and Pilgrim's Pride Corporation.

The largest regional market for smoked meats is North America.

The leading application of the smoked meats market is its use in the foodservice industry,

Loading Table Of Content...