Space Militarization Market Research, 2033

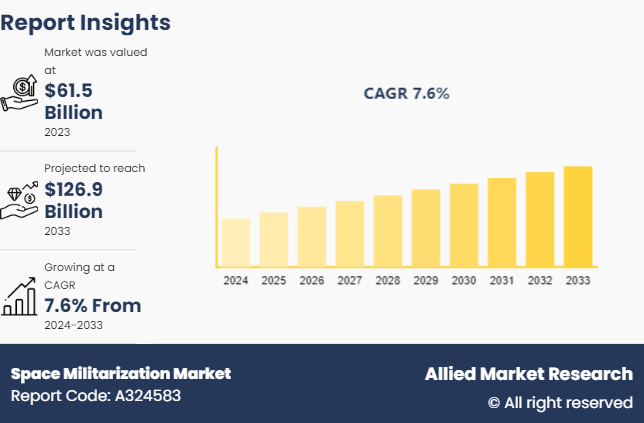

The global Space Militarization Market Size was valued at $61.5 billion in 2023, and is projected to reach $126.9 billion by 2033, growing at a CAGR of 7.6% from 2024 to 2033.

Market Introduction and Definition

Space militarization refers to the process by which military activities and capabilities are developed and deployed in outer space. This concept encompasses the use of space for military purposes, including reconnaissance, communication, navigation, surveillance, missile early warning, and potentially offensive operations.

Space militarization involves the development and deployment of satellites, space-based weapons systems, and technologies aimed at enhancing military capabilities both in space and on Earth. Moreover, there are several key factors associated with space militarization such as national security, technological advancements, deterrence, strategic dominance, and economic opportunities.

Different countries invest in space military technology to increase their communication, surveillance, and security. Satellite communication, navigation system, and reconnaissance are important factors associated with space militarization technology. Space military technology helps improve the nation's ability to monitor and respond to space threats. In addition, space militarization also helps in providing strategic dominance to the countries in case of modern warfare.

Space military capabilities, such as satellite communication (SATCOM) , support the military's ability to maintain the upper hand in real-time mission-critical data and positioning. For the U.S. and other developed nations worldwide, satellite communications (SATCOM) are an essential part of their national defense strategy. Military organizations can conduct nimble and responsive missions with the real-time bird's-eye vision made possible by space connectivity.

Key Takeaways

The space militarization marketSpace Militarization Market Size study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major space militarization industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Strategies and Developments

In December 2022, Raytheon Technologies Inc. demonstrated solutions required to connect defense networks and simplify U.S. Army command and control systems during the Army’s Project Convergence exercise. The Raytheon Technologies operating division named Collins Aerospace created FlexLink solution, an open-system radio technology that is intended to link various air and ground systems.

In November 2022, engineers at Boeing demonstrated a novel, self-governing system that effectively thwarts attempts to jam satellite communications used by the US Department of Defense (SATCOM) . The Protected Tactical SATCOM Prototype (PTS-P) of the U.S. Space Force was used for the test, which demonstrated how the technology offers secure communication in disputed areas.

The U.S. Department of Defense (DoD) successfully launched five L3Harris Technologies-designed satellites in February 2024. The deployment intends to enhance the monitoring and tracking capabilities of the country's defense apparatus and is spearheaded by the Space Development Agency's (SDA) Tranche 0 (T0) Tracking Layer program and the Missile Defense Agency's (MDA) Hypersonic and Ballistic Tracking Space Sensor (HBTSS) program. By witnessing navigating hypersonic missiles, these satellites effectively increase the detection range of existing ballistic missile systems.

On November 11, 2023, Ymir-1, a satellite using Saab technology, was launched into space aboard SpaceX Falcon 9. Ymir-1 is a test satellite and part of the development of the next generation of the Automatic Identification System (AIS) , a system used by ships to communicate position, speed, course, and other data.

In July 2023, a significant recruitment drive was launched by Teledyne e2v Space Imaging in response to the growing interest in the UK commercial space sector. Teledyne e2v Space Imaging's specialized complementary meatal-oxide semiconductor (CMOS) and charge-coupled device (CCD) imaging sensors are used in ground astronomy, scientific research, space telescopes for cosmic exploration, and Earth observation data collection. The technologies are created using numerous platforms that meet the requirements of space missions, ground-based applications, and the sciences, to fit applications ranging from x-ray to visible and shortwave infrared.

Key Market Dynamics

Geopolitical tensions & national security and advancement in technology are the two significant factors driving the growth of space militarization market. Furthermore, high investment cost and growing environmental regulations are two significant restraints that are holding back space militarization market growth. Moreover, increasing collaboration between private sector and government organizations, and growing concerns for expanding defense manufacturing are two important factors that are presenting opportunities for further growth of space militarization market.

Market Segmentation

The space militarization market is segmented into capability, solution, and region. By capability, the market is bifurcated into defense and support. By solution, the market is divided into space-based equipment, ground-based equipment, and logistics & services. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Regional/ Country Market Outlook

Mexican companies are collaborating with different space agencies and defense organizations to develop satellites and space capabilities. For instance, the Mexican space agency and Uruguayan Earth-observation satellite business Satellogic signed?a contract in December 2023 for a specialized satellite constellation that provided?multi-spectral imaging. The constellation-as-a-service program deal was signed by Agencia Espacial Mexicana (AEM) . As part of the agreement, a pilot project using archive imagery and nationwide surveillance up to three times a year, ?were the objectives that were to?be implemented.

Japan is also investing in satellite communication, surveillance, and missile defense systems. For instance, Japan announced the establishment of a 1 trillion-yen ($6.43 billion) fund for the development of private space in April 2024. The fund aims to support up to 100% of research and development expenses incurred by universities and startups, with the goal of promoting technological innovation in the country. In addition, the cabinet office and several ministries are working with the Japan Aerospace Exploration Agency (JAXA) to establish the fund.

United Arab Emirates (UAE) launched first Arab-built lunar rover called SpaceX Falcon 9 in December 2022. The nation invested $816 million to support private sector involvement in the space industry. The United Arab Emirates also developed a satellite called 813 that was built to enhance regional data collection and analysis capabilities.

As per Saudi Arabia Vision 2030 Plan, Saudi Arabia kingdom heavily invested in its space program to accelerate its technological infrastructure and capabilities.

Competitive Analysis

The major players operating in the space militarization market include Airbus, Aselsan A.S., BAE Systems plc, China Aerospace Science and Technology Corporation, General Dynamics Corporation, Israel Aerospace Industries Ltd., L3Harris Technologies, Inc., Leonardo S.P.A., Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, Saab Ab, Space Exploration Technologies Corporation (SpaceX) , Teledyne Technologies Inc., Thales Group and The Boeing Company.

The following players adopted product launch, joint venture, agreement, and collaboration strategies to increase their Space Militarization Market Sharein the global space militarization industry.

The other players in the industry include MBDA Inc., Orbital ATK, Aerojet Rocketdyne Holdings Inc., Maxar Technologies Inc., Kratos Defense & Security Solutions Inc., Ball Aerospace & Technologies Corporation, Cobham plc., Mitsubishi Heavy Industries Ltd, Rheinmetall AG, and Serco Group Plc.

Industry Trends

North American governments, especially in case of U.S. are implementing significant investments in space exploration and space defense. The investment is supporting the deployment and development of space-based military technologies. As per the Space Defense article published on April 10, 2024, U.S. invested $38.9 billion in space defense in 2023.

American companies such as SpaceX, Boeing, and Lockheed Martin Corporation are implementing partnership strategies with government agencies to form and develop space defense systems and offer military satellite services. For instance, the U.S. Army granted Lockheed Martin a $756 million contract in May 2024 to supply extra capability for the country's Long Range Hypersonic missile, a ground-based hypersonic missile system.

China is increasing its on-orbit intelligence, surveillance, and reconnaissance satellites in space. For instance, on May 11, 2024, China launched the latest Shiyan-23 satellite from its Jiuquan Satellite Launch Center, in the Gobi Desert, Northwest China at 7:43pm. The satellite is expected to be used for space environment monitoring. The country is also developing and deploying various counterspace weapons such as reversible jamming systems, and kinetic hit-to kill anti satellites.

India is heavily investing in advance military technologies such as anti-satellite systems, kinetic energy weapons, and directed energy weapons. In 2019, the country conducted an anti-satellite test named Mission Shakti. Furthermore, Indian organizations such as defense space agency and defense space research organization are presently working towards integrating and advancing military space assets.

Canada is a member of different international treaties and organizations such as United Nations Committee on the peaceful uses of outer space. The country is participating in discussions on space governance and security. For Instance, from?January 31, 2023, ?to April 4, 2023, Canadians were invited to share their views on Canada's space regulatory framework. The consultation period was closed on?April 4, 2023.

Key Sources Referred

Space and Defense

Lockheed Martin Corporation

Space.com

The Diplomat

Via Satellite

Nikkei Asia

CNN

Nationnews.com

vision2030.gov.sa

Collinsaerospace.com

Boeing Mediaroom

Airforcetechnology.com

Saab.com

Teledynee2v

Government of Canada

Viasat

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the space militarization market analysis from 2024 to 2033 to identify the prevailing space militarization market opportunities.

The market research is offered along with information related to key drivers, restraints, and Space Militarization Market Opportunity.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the space militarization market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global space militarization market trends, key players, market segments, application areas, and market growth strategies and Space Militarization Market Forecast.

Space Militarization Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 126.9 Billion |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 269 |

| By Capability |

|

| By Solution |

|

| By Region |

|

| Key Market Players | Maxar Technologies Inc., Aerojet Rocketdyne Holdings Inc., Thales Group, Saab Ab, Cobham plc., Space Exploration Technologies Corporation (SpaceX), L3Harris Technologies, Inc., Orbital ATK, Leonardo S.P.A., Serco Group Plc, The Boeing Company, Rheinmetall AG, General Dynamics Corporation, Kratos Defense & Security Solutions Inc., MBDA Inc., Ball Aerospace & Technologies Corporation, Aselsan A.S., Teledyne Technologies Inc., Mitsubishi Heavy Industries Ltd, Raytheon Technologies Corporation, Northrop Grumman Corporation, BAE Systems plc, Airbus, Israel Aerospace Industries Ltd., China Aerospace Science and Technology Corporation, Lockheed Martin Corporation |

Nations such as U.S., Russia, China, and India have developed and demonstrated anti-satellite (ASAT) capabilities. These technologies are designed to disable or destroy satellites, which are crucial for communication, navigation, and surveillance in modern warfare.

The defense segment is the leading application of Space Militarization Market. This growth is driven by advancements in satellite technology, growing commercial space exploration activities, and the need for enhanced situational awareness and communication capabilities in defense operations.

North America is the largest regional market for Space Militarization. This is due to the significant investments made by the United States Department of Defense (DoD) in space-based defense technologies and capabilities.

$126.9 billion is the estimated industry size of Space Militarization.

Airbus, Aselsan A.S., BAE Systems plc, China Aerospace Science and Technology Co rporation, General Dynamics Corporation are the top companies to hold the market share in Space Militarization.

Loading Table Of Content...