Space Semiconductor Market Research, 2032

The global space semiconductor market size was valued at $2.1 billion in 2022, and is projected to reach $4.8 billion by 2032, growing at a CAGR of 8.8% from 2023 to 2032. Space semiconductor devices are electronic devices that enhance system performance and efficiency by providing various advantages over standard electronics components. The radiation-hardened semiconductor solution has high stability and efficiency at a very high temperature, making it ideal for space application. Furthermore, space semiconductors describe semiconductor devices and materials that have been specially created and developed for usage in space conditions. The severe environment of space, which includes high temperatures, radiation, vacuum, and mechanical pressures, must be tolerated by these gadgets.

![]()

For instance, in November 2022, NASA launched its next-generation Artemis exploration mission and the moon rocket blasted off from Florida for its debut flight. It is a crewless voyage initiating the U.S. space agency's Artemis exploration program 50 years after the final Apollo moon mission.

Materials referred to as space semiconductor market growth have electrical conductivities that fall between those of an insulator and a conductor. They are essential parts of integrated circuits, transistors, and diodes, among other electrical devices. Semiconductors are employed in many systems in space applications, such as power management circuits, sensors, communication systems, and spacecraft computers.

Furthermore, space semiconductors are subjected to rigorous qualifying and testing procedures that guarantee their dependability and longevity in space. To mitigate the effects of cosmic rays and other radiation types found in space, they frequently use materials and designs that have been radiation-hardened across order to account for the high thermal conditions seen on space missions. They may also be made to function well across a broad temperature range.

For in January 2024, Redwire Space has expanded its in-space manufacturing technology portfolio to tap into the global semiconductor market with the first pathfinder mission for its autonomous semiconductor manufacturing platform, Master of Science in Information Technology (MSTIC). MSTIC will launch to the International Space Station (ISS) onboard Northrup Grumman’s 20th cargo resupply services mission (NG-20).

Major market players have undertaken various strategies to increase the competition and offer enhanced services to their customers. For instance, in October 2023, UK startup Readies launched a satellite that will manufacture a new semiconductor, the ForgeStar-1 material, that could be used in electronic devices on earth. The American aerospace giant Northrop Grumman and Space Forge have recently inked a cooperation agreement for Space Forge to supply semiconductor platform manufactured in space, which Northrop can further develop in their manufacturing facilities.

For instance, in May 2021, Infineon Technologies AG launched its next generation radiation-hardened 144Mbit QDR-11+SRAM for radar, onboard data processing, and networking applications in space. This new solution is certified to QML-V, the highest quality and reliability standard certification for aerospace-grade ICs.

Factors such as rise in satellite deployment, advancement in space exploration, and motorization and power efficiency drive the growth of the space semiconductor market across the globe. However, harsh environmental condition and stringent qualification processes act as barriers for the growth of the market. Furthermore, emerging market for small satellites, and integration of AI and machine learning create ample opportunities for the growth of the market during the forecast period.

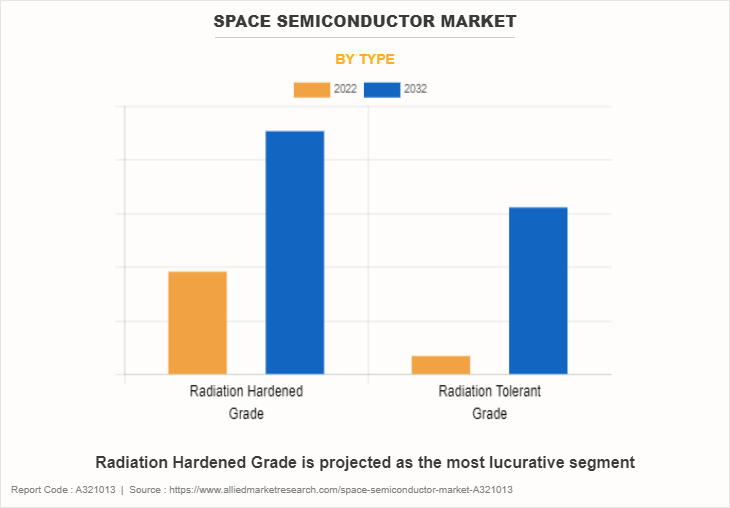

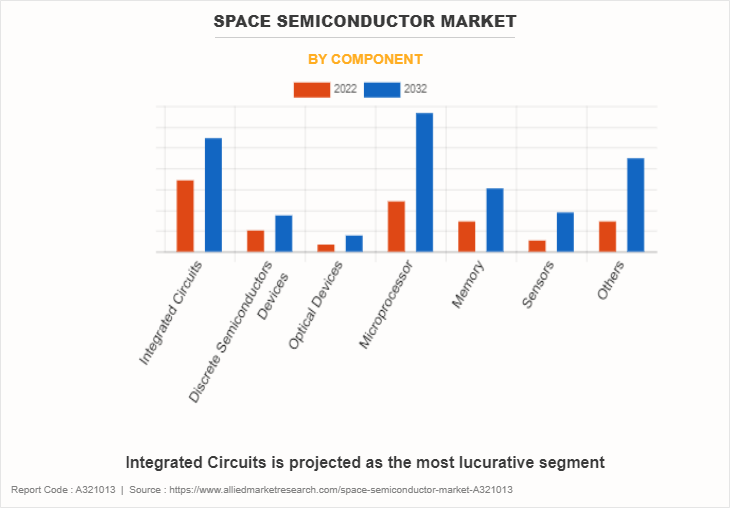

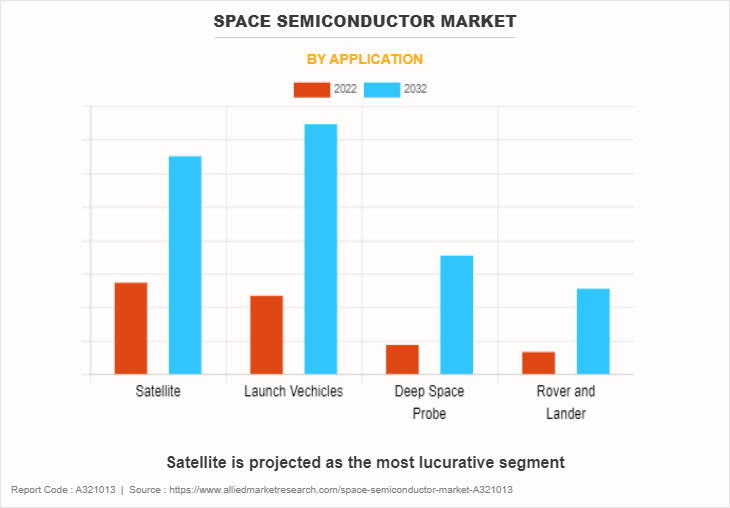

The space semiconductor market is segmented on the basis of type, component, application, and region. By type, it is divided into radiation hardened grade, radiation tolerant grade, and others. By component, the market is classified into air integrated circuits, discrete semiconductors devices, optical devices, microprocessor, memory, sensor, and others. By application, it is classified into satellite, launch vehicles, deep space probe, and rover and lander. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading companies profiled in the space semiconductor market report include BAE Systems, cobham advanced electronic solutions, Honeywell International Inc., Infineon Technologies AG, Microchip Technology Inc., solid state devices, STMicroelectronics, Teledyne Technologies Incorporated., Texas Instruments Incorporated., and AMD-Xilinx, Inc.

The U.S. has a rich legacy of space exploration and a highly advanced aerospace sector. Leading businesses in the sector include Lockheed Martin, Boeing, Northrop Grumman, and SpaceX. These businesses have a great need for high-grade space-grade semiconductors to power their satellite systems and spacecraft, and they have a great deal of experience with space systems.

Furthermore, the U.S. government makes significant investments in national security, satellite communication, space exploration, and scientific research through institutions including the Department of Defense (DoD), NASA (National Aeronautics and Space Administration), and other agencies. Manufacturers in the nation of space semiconductors now have access to a steady and profitable market due to this investment.

For instance, in March 2023, the U.S. Space Force plans to build satellites in orbit with a $1.6 million Arkisys deal. Under the space force agreement, the U.S. defense agency's innovation division, SpaceWERX, has awarded a $1.6 million Direct-to-Phase II SBIR contract to the California-based Arkisys Inc., in collaboration with aerospace partners Qediq Inc., Novawurks, Motive Space Systems, iBoss, and the Texas A&M Engineering Experiment Station (TEES).

For instance, in October 2023, the Welsh startup Space Forge launched a semiconductor satellite into orbit known as ForgeStar-1. It was launched from the U.S. It is equipped with an automated chemistry lab that allows for remote chemical compound mixing and the development of semiconducting alloys. The unique environment of space offers opportunities for research and development that are not possible on Earth. Higher levels of radiation, microgravity, and near-vacuum less conditions in space allow companies like Space Forge to explore new manufacturing methods and materials. This opens up possibilities for advancements in semiconductors, pharmaceuticals, composite materials, and more.

Rise in Satellite Deployment

In order to operate efficiently in space, satellites need complex electronic systems. Onboard computers, power management systems, sensors for remote sensing applications, communication payloads, and navigation systems are a few examples of these systems. The power and control of such electronic devices is mostly dependent on space semiconductors. Furthermore, electronic components that are compact, light, and power-efficient are needed to keep up with the trend of miniaturization in satellite design. Space-grade semiconductors are made especially to fulfill such specifications, allowing for the creation of small and effective satellite systems.

Satellites operating in space are subject to a variety of radiation threats, including as solar radiation, cosmic rays, and charged particles caught in the magnetic field of Earth. Electronic component malfunctions and mistakes can be brought on by radiation. To endure these extreme radiation environments, space semiconductors are radiation-hardened, guaranteeing the dependability and durability of satellite systems. Moreover, the need for satellite systems and components is growing as a result of the increase in commercial space exploration projects, such as satellite internet constellations, lunar exploration missions, and space tourism programs. These endeavors require space semiconductors as fundamental building blocks, which propels the space semiconductor market's continued expansion.

For instance, in July 2023, HCL Group announced that it has submitted a proposal for setting up an assembly, testing, marking, and packaging (ATMP) facility for semiconductors worth $200-300 million. Therefore, rise in satellite deployment has increased the demand in the market.

Advancement in Space Exploration

Satellites are frequently needed to collect data for space research missions, such as robotic probes to other planets or telescopes viewing far-off galaxies. Spacecraft outfitted with scientific apparatuses including particle detectors, spectrometers, and cameras are employed to investigate cosmic occurrences, planetary atmospheres, and celestial bodies. Progress in space exploration generates a heightened need for specialized scientific satellites designed to achieve certain research goals. Furthermore, for communication, navigation, earth observation, and space situational awareness, satellites are necessary for any human spaceflight mission, whether it is to the moon, low earth orbit, or beyond.

As a vital source of navigational assistance, communication channels, and weather monitoring, satellites are integral to crewed missions. Space exploration advancements, such as plans for lunar outposts, Mars missions, and space tourism, are driving demand for satellites that enable spaceflight operations by humans. For instance, June 2023, Airbus Ventures announced that it has invested $7.5 million in Zero-Error Systems, a company that provides semiconductor solutions for space and power management applications.

Space infrastructure is becoming more and more necessary to support mission operations, logistics, and resource use as space exploration efforts increase. This covers space homes, refueling stations, and manufacturing facilities along with satellite networks for communication, navigation, and earth observation. The creation of satellite-based infrastructure to support long-term human presence and activity in space is fueled by advancements in space exploration. Therefore, advancements in space exploration drives the growth of the space semiconductor market share.

Miniaturization and Power Efficiency

The construction of lighter and smaller satellites is made possible by miniaturization, and this is essential for lowering launch costs and boosting payload capacity. Smaller and lighter space-grade semiconductors aid in the overall miniaturization efforts, facilitating the development and implementation of more efficient and compact satellite systems.

Furthermore, more integration, better performance, and greater functionality are the results of miniaturization, which frequently follows developments in semiconductor technology. More sophisticated functions and more effective data processing are made possible by space-grade semiconductors with cutting-edge features like faster processing rates, larger memory capacities, and reduced power consumption.

Due to the limited availability of power sources in space, power efficiency is essential for satellite operations. Satellites can operate more than 100 years and require fewer onboard power generating and storage systems when space-grade semiconductors with lower power consumption are used. This is especially crucial for missions that call for extended operations or trips to far-off locations where power production alternatives can be scarce.

In addition, semiconductor design, power efficiency and miniaturization frequently follow developments in robustness and dependability. Space-grade semiconductors are put through a thorough qualifying and testing procedure to make sure they can survive the intense mechanical forces, radiation exposure, and temperature changes that occur in space. Improved reliability lowers the possibility of component failures and raises the success rate of missions overall when satellites are deployed. Therefore, miniaturization and power efficiency are increasing the demand for space semiconductor market trends.

Harsh Environmental Conditions

Comprehensive research, development, and testing are needed to design semiconductors that can survive the harsh space environment, which includes large temperature swings, radiation exposure, and vacuum. Manufacturers of semiconductors may face difficulties as a result of increased lead times and development expenses. For instance, in September 2023, SpaceX launched 22 more of its Starlink internet satellites to orbit and landed the returning rocket on a ship at sea. Furthermore, space-grade semiconductors are put through a thorough qualifying and testing procedure to make sure they meet the performance and durability requirements needed for space missions. New semiconductor technologies may not go onto the market as soon as possible due to the time and resource requirements of qualifying to strict standards and testing in simulated space settings.

Space's harsh environment can have an impact on semiconductor devices' lifespan and performance. Radiation-induced deterioration, for instance, might eventually impact semiconductor component operation, resulting in decreased dependability and a higher failure rate. Continued research and development in semiconductor materials and design is necessary to overcome these technological limitations. Therefore, harsh environmental condition is hampering the growth of the space semiconductor market analysis.

Stringent Qualification Processes

Space-grade semiconductors must pass a rigorous qualification procedure that includes testing, analysis, and documentation to ensure that performance and reliability requirements are met. This procedure can be expensive and time-consuming, requiring a sizable investment in testing facilities, tools, and knowledge. As a result, time-to-market and total development expenses may present difficulties for semiconductor makers.

Furthermore, space-grade semiconductors have to adhere to a very strict set of standards pertaining to long-term reliability, vacuum compatibility, radiation hardness, and temperature tolerance. Complying with these specifications calls for specific knowledge and proficiency in materials science, testing procedures, and semiconductor design. For semiconductor companies, especially smaller ones with fewer resources and expertise, the qualifying process' complexity might provide difficulties.

The severe qualifying procedures and significant entry hurdles could discourage new players from entering the space semiconductor business. Because they can move through the qualification process more quickly, well-established businesses with knowledge and experience in the production of space-grade semiconductors may have an advantage over their competitors. This might discourage innovation and reduce market competition. Therefore, stringent qualification processes hamper market demand of space semiconductor industry.

Emerging Markets for Small Satellites

The size, weight, and power (SWaP) limitations of small satellites, such as CubeSats and nanosatellites, are restricted. Space-grade semiconductors must be extremely small, power-efficient, and able to integrate several functionalities into a small form factor in order to achieve these requirements. The expanding market for small satellites presents an opportunity for semiconductor producers that can provide customized parts that meet their specifications.

Furthermore, small satellites are affordable that is between $10 million to $400 million substitute for conventional large satellites in a variety of fields, such as communications, remote sensing, Earth observation, and science. Companies and organizations with tight budgets can take part in space exploration and satellite deployment programs due to semiconductor manufacturers that can supply economical and dependable parts for small satellite missions.

The need for space-grade semiconductors is being driven by the emergence of satellite constellations, which are made up of hundreds or even thousands of tiny satellites cooperating with one another in a coordinated fashion. Advanced electronics are needed for power control, communication, data processing, and navigation in these constellations. The growing need for tiny satellite constellations presents an opportunity for semiconductor companies that can provide components suited for constellation deployments.

Moreover, small satellites facilitate quick iteration cycles and innovation, saving businesses and research organizations a significant amount of money and time when testing new ideas and technologies in orbit. The tiny satellite industry is dynamic, and semiconductor makers may take advantage of this by providing components that are flexible and configurable and enable quick prototype and deployment of small satellite payloads. The emerging market for small satellite offers ample opportunities market size of space semiconductor industry.

Impact of Russia-Ukraine War on Space Electronics Industry

Increased geopolitical tensions could result from the Russia-Ukraine war, which could have unintended consequences for the space semiconductor business. Increased political unpredictability and instability might strain international trade relations, causing supply chain delays and market volatility.

Some semiconductor materials, such as neon gas, which is utilized in the production of semiconductors, are produced in large quantities in Ukraine. The availability and cost of semiconductor components, including those used in space-grade applications, may be impacted by any disruption to supply chains for semiconductors coming from Ukraine.

Furthermore, some nations may decide to reevaluate their defense strategies and boost their spending on space-based technology and systems as a result of the battle. In order to support military satellite programs, communications systems, and other defense-related applications, this could increase demand for space-grade semiconductors.

Report Key Highlighters

- The space semiconductor market studies more than 16 countries. The research includes a segment analysis of each country in terms of value ($million) during the forecast period.

- The research combined high-quality data, professional opinion, and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market and help stakeholders make educated decisions to achieve ambitious growth goals.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The market share of top manufactures in the space semiconductor industry are BAE Systems, CASE, Honeywell International Inc., Infineon Technologies AG, Microchip Technology Inc., Solid State Devices, STMicroelectronics, Teledyne Technologies Incorporated, Texas Instruments Incorporated, and AMD-Xilinx, Inc. Major strategies such as contracts, partnerships, product launches, and other strategies of players operating in the market are tracked and monitored.

Recent Developments in the Space Semiconductor Industry

- In August 2021, BAE systems collaborated with Global Foundries to produce radiation-hardened single board computer for space. The new single board computer will provide Power Architecture software-compatible processing that is more advanced than the RAD750 radiation harden general-purpose processor while demanding less power from its spacecraft.

- In October 2023, a semiconductor innovator, Infineon Technologies, has expanded its co-innovation space in Singapore by providing crucial support for startups in their product development journey. Collaborating with Korean SMEs and startup agencies, the initiative aims to boost innovation in decarbonization and digitalization. The expanded space underscores Infineon's commitment to fostering a sustainable future through innovation.

- In September 2023, Northrop Grumman’s U.K. arm partnered with British firm Space Forge, a startup that plans to manufacture semiconductors in orbit.

- In June 2020, the Teledyne U.K. Limited, a subsidiary of Teledyne Technologies, announced that it had developed new space-grade semiconductor FPGAs incorporation with Xilinx, inc.

- In April 2023, Presto Engineering partnered with SatixFy to qualify and test its radiation-hardened ASICs for deployment in space. It is designed with radiation-hardening features, such as error-correcting codes and specific semiconductor processes, to decrease the threat of radiation-induced errors and other malfunctions.

Key Benefits for Stakeholder

- This study presents the analytical depiction of the global space semiconductor industry analysis along with the current trends and future estimations to depict imminent investment pockets.

- The overall space semiconductor opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global space semiconductor with a detailed impact analysis.

- The current space semiconductor is quantitatively analyzed from 2022 to 2032 to benchmark financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Space Semiconductor Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.8 billion |

| Growth Rate | CAGR of 8.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 445 |

| By Type |

|

| By Component |

|

| By Application |

|

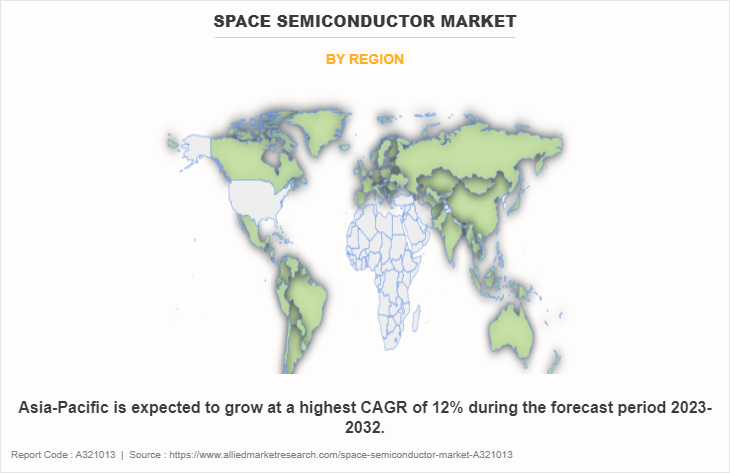

| By Region |

|

| Key Market Players | BAE Systems, Infineon Technologies AG, solid state devices, Teledyne Technologies Incorporated., Texas Instruments Incorporated., cobham advanced electronic solutions, Honeywell International Inc., Microchip Technology Inc., AMD-Xilinx, Inc., STMicroelectronics |

The space environment exposes electronic components to high levels of radiation, which can degrade or damage semiconductor devices. Therefore, there was a growing demand for radiation-hardened semiconductors that can withstand these conditions.

Satellite is the leading application of Space Semiconductor Market

North America is the largest regional market for Space Semiconductor

$4,813.8 million is the estimated industry size of Space Semiconductor market by 2032.

BAE Systems, cobham advanced electronic solutions, Honeywell International Inc., Infineon Technologies AG, Microchip Technology Inc., solid state devices, STMicroelectronics, Teledyne Technologies Incorporated., Texas Instruments Incorporated., and AMD-Xilinx, Inc.

Loading Table Of Content...

Loading Research Methodology...