Spray Polyurea Elastomer (SPUA) Market Research, 2033

The global spray polyurea elastomer (SPUA) market size was valued at $669.3 million in 2023, and is projected to reach $900.3 million by 2033, growing at a CAGR of 3.1% from 2024 to 2033.

Market Introduction and Definition

Spray polyurea elastomer (SPUA) is a type of advanced protective coating and lining material known for its exceptional durability, flexibility, and rapid curing time. It is created through a chemical reaction between an isocyanate component and a resin blend component. This elastomeric material is applied through a spray process, creating a seamless and resilient protective layer. SPUA is known for its rapid curing, durability, and resistance to abrasion that makes it a preferred choice for applications requiring robust protective coatings. It has applications in various end use industries such as construction, automotive, industrial, and marine sectors. It serves as an effective solution for waterproofing, corrosion protection, and enhancing the longevity of structures and equipment.

Key Takeaways

The spray polyurea elastomer (SPUA) market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major spray polyurea elastomer (SPUA) industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The increase in demand for spray polyurea elastomer (SPUA) in the automotive and industrial sectors is a crucial factor driving market expansion. SPUA's excellent adhesion properties and its ability to form a seamless, waterproof barrier are particularly valuable for automotive uses. The waterproof nature of SPUA prevents water ingress and corrosion, protecting the vehicle's structural integrity. Moreover, industrial machinery and equipment exposed to harsh environments and corrosive substances require robust shielding to ensure prolonged functionality and structural integrity. SPUA's capacity to provide seamless, protective coating becomes a preferred choice in this context. All these factors are expected to drive the demand for the global spray polyurea elastomer (SPUA) market during the forecast period.

However, the instability in the prices of essential components used in the production of SPUA poses considerable challenge for manufacturers, influencing the overall dynamics of the market. The primary raw materials involved in SPUA formulation such as polyols and isocyanates, are susceptible to fluctuations in the global market. These variations in raw material prices directly impact the manufacturing costs of SPUA, creating an environment of uncertainty for both producers and consumers. The unpredictability in costs leads to challenges in establishing consistent pricing models for SPUA products, hindering long-term planning and investment strategies within the market. All these factors hamper the spray polyurea elastomer (SPUA) market growth.

Environmental sustainability marks a substantial shift in the dynamics of the coatings industry. SPUA has gained traction with an increased global consciousness regarding ecological issues, witnessing an increase in demand owing to its eco-friendly characteristics. The rapid application and curing result in reduced energy consumption throughout the coating process, thereby diminishing the overall carbon footprint. This efficiency improves the cost-effectiveness of the application and establishes SPUA as an environmentally conscious option compared to coatings requiring lengthier curing times and higher energy usage. In addition, the increase in focus on corrosion protection within various industries presents a substantial opportunity for the adoption and growth of spray polyurea elastomer (SPUA) market.

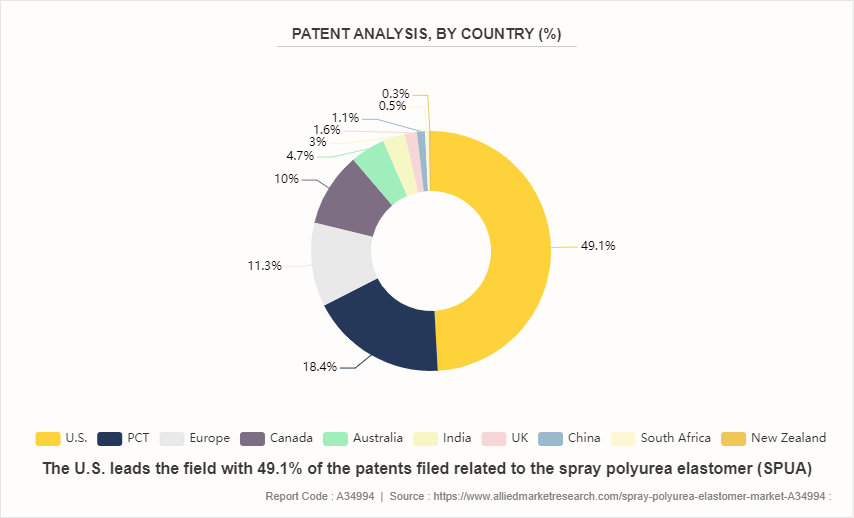

Patent analysis of global spray polyurea elastomer (SPUA) industry

The U.S. leads the field with 49.1% of the patents filed, indicating a strong focus on developing and protecting SPUA technology domestically. This dominance suggests that the U.S. is a major hub for R&D in this area, possibly driven by its large automotive, construction, and industrial sectors which benefit greatly from SPUA’s protective properties. Europe follows with 11.3% of the patents, underscoring significant activity and interest within the European Union. This region's automotive and industrial markets, coupled with stringent environmental regulations, drive innovation and the adoption of advanced protective materials such as SPUA. The recently filed patent is related to the aliphatic spray polyurea elastomers, spray polyurea elastomers with abrasion resistance, spray polyurea coating systems, and spray polyurea elastomers containing organic carbonates to improve processing characteristics.

Market Segmentation

The spray polyurea elastomer (SPUA) market is segmented into type, application, by end-use industry, and region. Based on type, the market is bifurcated into universal and waterproof. By application, the market is classified into industrial anti-corrosion, building waterproofing, wear-resistant lining, and others. By end-use industry automotive, marine, construction, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The major players operating in the spray polyurea elastomer (SPUA) market analysis include Johnson Fine Chemical Co., Taiwan PU Corporation, Pearl Polyurethane Systems LLC, Shundi new material (Shanghai) Co., Ltd, Specialty products (SPI) , Nukote Coating Systems, PPG Industries, Inc., Futura Europe, SWD POLYURETHANE (SHANGHAI) CO., LTD, and Perflex Group.

Regional Industry Outlook

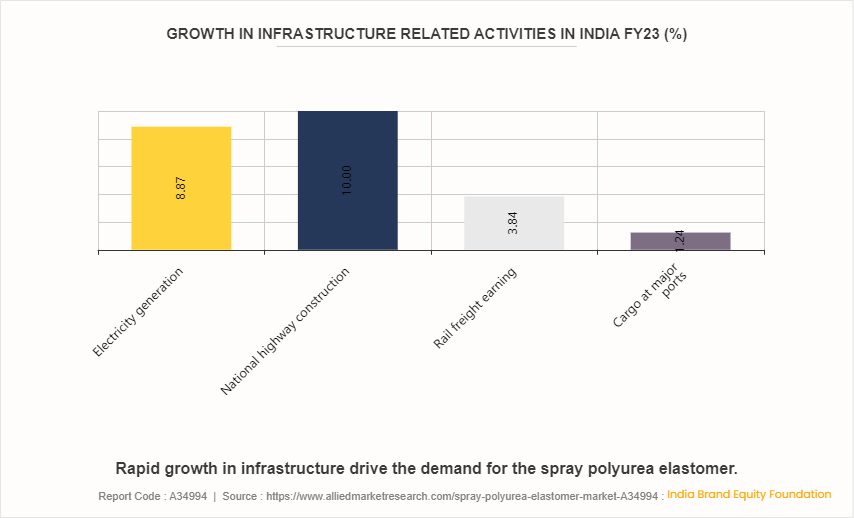

Rapid industrialization and urbanization across many Asia-Pacific countries significantly drive the demand for advanced protective materials such as SPUA. As countries such as China and India continue to expand their infrastructure, the need for durable, long-lasting materials becomes critical. SPUA’s superior abrasion resistance, flexibility, and rapid curing time make it an ideal choice for protecting infrastructure such as bridges, tunnels, and public buildings. This is particularly relevant in environments where construction speed and longevity are crucial due to high urban density and the continuous expansion of cities.

The construction industry in India is expected to reach $1.4 trillion by 2025. An estimated 600 million people are likely to be living in urban centers by 2030.

The automotive sector in Asia-Pacific, particularly in countries such as China, Japan, South Korea, and India, continues to grow robustly. SPUA is gaining traction in automotive manufacturing for applications such as underbody coatings, truck bed liners, and exterior protection.

China’s 14th five-year plan emphasizes new infrastructure projects in transportation, energy, water systems, and new urbanization. According to the International Trade Administration, overall investment in new infrastructure during the 14th five-year plan period (2021-2025) is expected to reach $4.2 trillion.

Key Industry Trends

According to the Asian Development Bank, by 2030, more than 55% of the population of Asia expected to be urban. As urban populations grow and infrastructure development accelerates, there is a corresponding increase in the demand for SPUA.

The construction and infrastructure sectors are seeing a significant increase in the use of SPUA. This trend is driven by SPUA's excellent durability, waterproofing capabilities, and rapid curing time, which are crucial for large-scale projects. The growing focus on sustainable and resilient infrastructure further boosts the demand for SPUA, as it extends the lifespan of structures and reduces maintenance costs.

Rising investment in the automotive industry is indeed driving the demand for Spray Polyurea Elastomer (SPUA) . According to the India Brand Equity Foundation, India is on track to become the largest EV market by 2030, with a total investment opportunity of more than $200 billion over the next 8-10 years.

Sustainability trends influence the development and use of SPUA. The growing emphasis on creating eco-friendly formulations that reduce environmental impact without compromising performance.

Regulatory Guidelines

OSHA (Occupational Safety and Health Administration) : OSHA sets standards for workplace safety, including exposure limits to chemicals used in the production and application of SPUA. Employers must comply with OSHA regulations to protect workers from potential hazards.

EPA (Environmental Protection Agency) : The EPA regulates the use and disposal of chemicals to minimize environmental impact. SPUA manufacturers and applicators must adhere to EPA guidelines regarding chemical handling, storage, and waste disposal to prevent pollution and ensure environmental sustainability.

ASTM International: ASTM standards provide guidelines for the testing and performance of materials such as polyurea elastomers. Compliance with ASTM standards ensures that SPUA products meet specific quality and safety criteria.

European Standards: In Europe, SPUA products must comply with relevant EN standards, such as EN 15651 for sealants or EN 14891 for liquid-applied waterproofing membranes, depending on their intended application.

Key Sources Referred

World Intellectual Property Organization

Asian Development Bank

Plastics Europe

Invest India

United Nations Development Programme

India Brand Equity Foundation

International Union of Pure and Applied Chemistry

European Polymer Federation

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the spray polyurea elastomer (SPUA) market share analysis from 2023 to 2033 to identify the prevailing spray polyurea elastomer opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the spray polyurea elastomer segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the Global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global sSpray polyurea elastomer (SPUA) market trend, key players, market segments, application areas, and market growth strategies.

Spray Polyurea Elastomer (SPUA) Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 900.3 Million |

| Growth Rate | CAGR of 3.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 320 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Nukote Coating Systems, Pearl Polyurethane Systems LLC, Taiwan PU Corporation, Perflex Group, Shundi new material (Shanghai) Co., Ltd, SWD POLYURETHANE (SHANGHAI) CO., LTD, PPG Industries, Inc., Futura Europe, Johnson Fine Chemical Co., Specialty products (SPI) |

Loading Table Of Content...