Steel Processing Market Research: 2031

The Global Steel Processing Market Size was valued at $647.7 billion in 2021, and is projected to reach $884.1 billion by 2031, growing at a CAGR of 3.1% from 2022 to 2031. Steel processing is the set of techniques and operations used to transform raw steel into finished products that can be used in various industries. This process typically involves the use of advanced technologies and machinery to shape, cut, form, weld, and coat steel to meet the specific requirements of customers. The course of steel processing can include several stages, such as melting, casting, rolling, forging, machining, and coating. Each stage requires specialized equipment and techniques to ensure that the finished steel products meet the required standards for strength, durability, and quality.

Market Dynamics

The high demand for steel in the construction industry is a major growth factor of the steel processing market. Steel is a strong and durable material that is ideal for construction, making it an essential component for various infrastructure projects. As countries continue to invest in infrastructure development, the demand for steel in the construction industry is expected to grow, driving the growth of the steel processing market. Additionally, the growing population and urbanization are leading to an increase in demand for residential and commercial buildings, which further fuels the demand for steel. Furthermore, steel processing technology has advanced, resulting in improved efficiency and cost-effectiveness, making it an attractive option for construction companies.

The prices of raw materials such as iron ore, coal, and scrap metal can have a significant impact on the steel processing market. Fluctuations in these prices can affect the cost of producing steel and, in turn, the profitability of steel processing companies. Rising raw material prices can lead to higher costs for steel processing companies, which may result in lower profit margins or even losses if the companies cannot pass on the increased costs to their customers. Conversely, when raw material prices decrease, steel processing companies may experience higher profit margins. To mitigate the impact of fluctuating raw material prices, steel processing companies may use hedging strategies, such as futures contracts, to lock in prices for raw materials. They may also look for alternative sources of raw materials or seek to reduce their reliance on a single supplier, which are expected to hinder the market's growth.

The steel processing market presents numerous opportunities for businesses to diversify their product offerings and expand into new markets. By focusing on producing high-quality steel products for the construction, automotive, or energy industries, companies can tap into the growing demand for steel in these sectors. In the construction industry, steel is used for a wide range of applications, from building bridges and skyscrapers to reinforcing concrete structures.

As urbanization continues to drive demand for new construction, the need for high-quality steel products is expected to grow. This presents an opportunity for steel processors to develop innovative products that meet the specific needs of the construction industry. The steel processing market offers numerous opportunities for businesses to diversify their product offerings and expand into new markets. By focusing on producing high-quality steel products that meet the specific needs of the construction, automotive, and energy industries, companies can tap into the growing demand for steel and position themselves for long-term success.

The key players profiled in this report include China Baowu Group, ArcelorMittal, Ansteel Group, Nippon Steel Corporation, Shagang Group, POSCO, HBIS Group, Jianlong Group, Shougang Group, and Tata Steel Group.

The global steel processing market is segmented on the basis of method, steel type, product end-use industry, and region. By method, the market is sub-segmented into blast furnace and electric arc furnace. By steel type, the market is sub-segmented into alloy steel, and carbon steel. By product, the market is sub-segmented into flat steel, long steel and tubular steel. By end-use industry, the market is classified into building and infrastructure, automotive, metal products, mechanical equipment, transport, electrical equipment, and domestic appliances. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The steel processing market is segmented into Method, Steel Type, Product and End-use Industry.

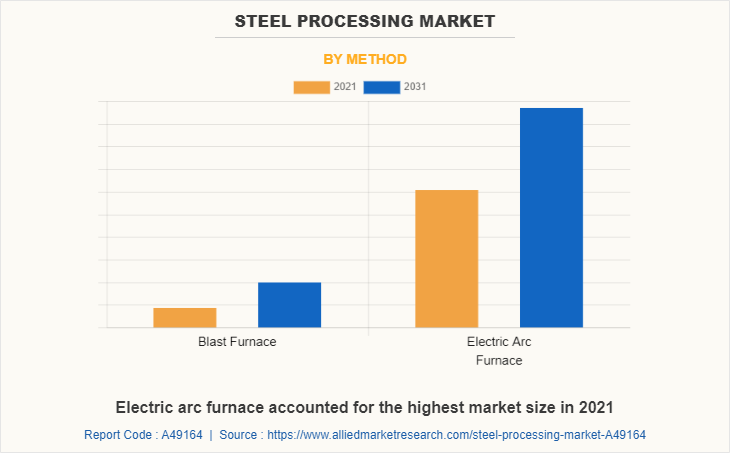

By Method,

The electric arc furnace sub-segment dominated the market in 2021. Electric Arc Furnaces use electricity to melt scrap steel and other iron-containing materials to produce new steel products. Unlike traditional steelmaking methods, EAFs do not require the use of coal or coke, resulting in significantly lower carbon emissions. As environmental regulations continue to become more stringent, EAFs are becoming increasingly popular as a more sustainable alternative to traditional steelmaking methods. These are predicted to be the major factors having a positive impact on the steel processing market outlook during the forecast period.

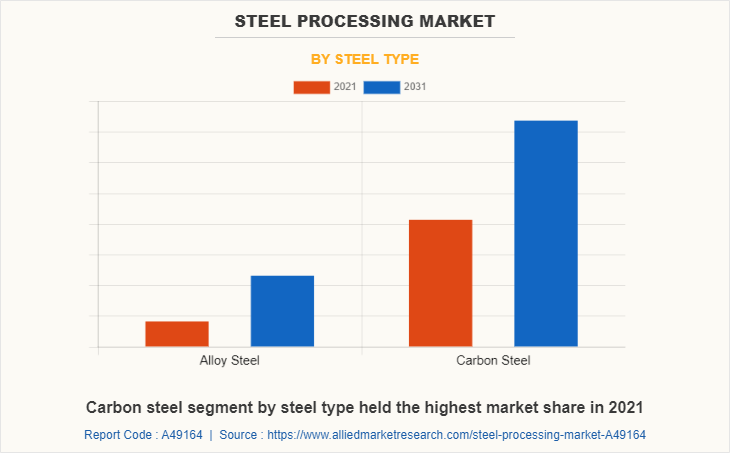

By Steel Type,

The carbon steel sub-segment dominated the market in 2021. The demand for carbon steel is largely driven by construction activities, especially in emerging economies where infrastructure development is a top priority. The growth in the automotive industry also plays a significant role in the demand for carbon steel. Carbon steel is used in the manufacturing of automotive parts such as frames, body panels, and chassis components due to its strength and formability. The manufacturing industry also relies heavily on carbon steel due to its versatility, as it can be easily fabricated into different shapes and sizes for a variety of applications. Additionally, carbon steel is used in the production of machinery, equipment, and tools.

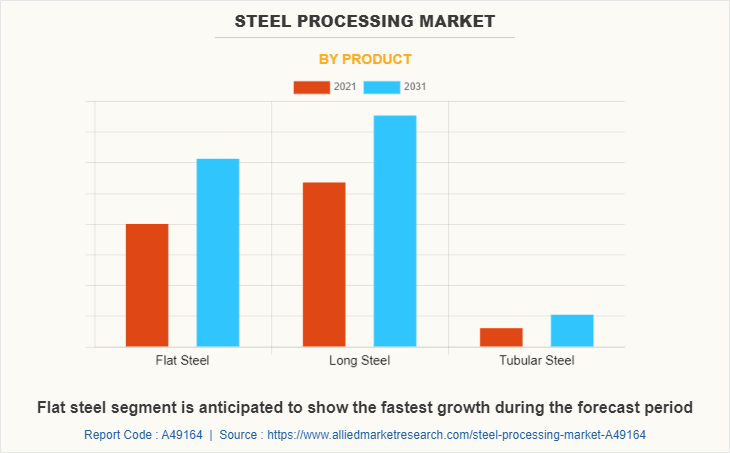

By Product,

The long steel sub-segment dominated the market in 2021. The demand for long steel products is closely linked to infrastructure development, including the construction of buildings, bridges, highways, and railways. The growth of various industries such as automotive, aerospace, and construction also drives the demand for long steel products. Rapid urbanization in developing countries also drives the demand for long steel products, as it leads to increased construction activity. Government regulations such as trade policies, import-export duties, and environmental regulations also affect the demand for long steel products. The development of new technologies for processing and manufacturing long steel products can also drive market growth.

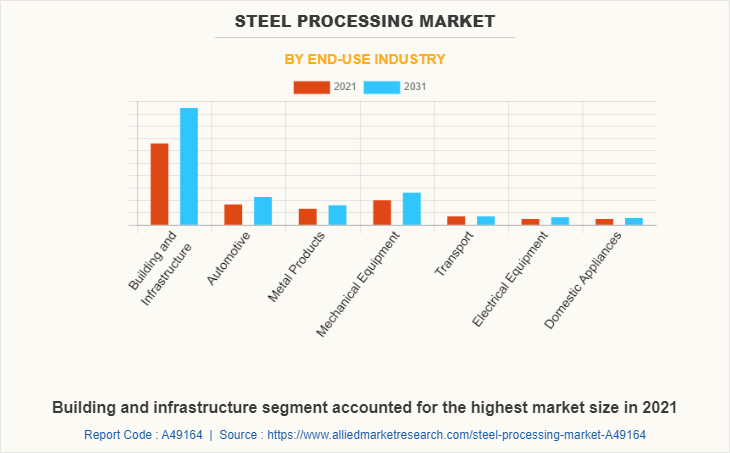

By End-Use Industry,

The building & infrastructure sub-segment dominated the global steel processing market share in 2021. The demand for steel in the building and infrastructure segment is driven by several factors, including population growth, urbanization, and the need for new and improved infrastructure. As population grows and urbanization continues, the demand for new buildings and infrastructure increases, which in turn drives demand for steel. In addition to new construction, the maintenance and renovation of existing buildings and infrastructure also requires significant amounts of steel. This includes the repair and replacement of bridges, highways, and other infrastructure, as well as the renovation of older buildings.

By Region,

Asia-Pacific dominated the global market in 2021 and is projected to be the fastest-growing sub-segment during the forecast period. The Asia-Pacific region is home to some of the fastest-growing economies in the world, including China, India, and Southeast Asian countries. This rapid industrialization has created a huge demand for steel for use in construction, manufacturing, and infrastructure projects. The region's growing population and urbanization have also led to an increase in demand for steel, particularly for the construction of high-rise buildings, bridges, and other infrastructure projects. The Asia-Pacific region is home to some of the world's largest automotive markets, including China, Japan, and South Korea. The growing demand for automobiles in these markets has led to an increase in demand for steel for use in car bodies and other automotive components.

Impact of COVID-19 on the Global Steel Processing Industry

- The COVID-19 pandemic has had a significant impact on the steel processing market. The global steel industry faced a downturn in demand due to the pandemic's impact on economic activity and industrial production. Many countries implemented lockdowns and travel restrictions to contain the spread of the virus, which caused disruptions in global supply chains and reduced demand for steel.

- The steel processing market includes various processes such as rolling, forging, casting, and extrusion, which are used to produce steel products such as sheets, bars, and pipes. The pandemic has affected the demand for steel products in various industries, including construction, automotive, and transportation.

- Despite the challenges posed by the pandemic, the steel processing market has shown signs of recovery in recent months. The easing of lockdowns and travel restrictions has led to increased economic activity, which has resulted in increased demand for steel products.

- Moreover, the implementation of stimulus packages by governments to support economic recovery has also helped to boost demand for steel products. The market is expected to continue its recovery in the coming years as the global economy continues to recover from the pandemic's impact.

Key Benefits For Stakeholders

- The report provides an exclusive and comprehensive analysis of the global steel processing market trends along with the steel processing market forecast.

- The report elucidates the steel processing market opportunity along with key drivers, and restraints of the market. It is a compilation of detailed information, inputs from industry participants and industry experts across the value chain, and quantitative and qualitative assessment by industry analysts.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the market for strategy building.

- The report entailing the steel processing market analysis maps the qualitative sway of various industry factors on market segments as well as geographies.

- The data in this report aims on market dynamics, trends, and developments affecting the steel processing market growth.

Steel Processing Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 884.1 billion |

| Growth Rate | CAGR of 3.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 290 |

| By Method |

|

| By Steel Type |

|

| By Product |

|

| By End-use Industry |

|

| By Region |

|

| Key Market Players | HBIS Group, Nippon Steel Corporation, POSCO, Tata Steel Limited, China Baowu Group, Jiangsu Shagang Group, ArcelorMittal , Shougang Group Co., Ltd., China Jianlong Steel Industriai Co Ltd., Ansteel Group |

Analyst Review

The aerospace industry is a significant driver of the steel processing market. Steel is widely used in the aerospace industry because of its strength, durability, and lightweight characteristics, which make it an ideal material for aircraft construction. As the demand for more fuel-efficient and environmentally friendly aircraft increases, the aerospace industry is increasingly turning to advanced lightweight materials, including high-strength steel alloys. The use of lightweight materials in aircraft manufacturing not only reduces the weight of the aircraft but also improves its fuel efficiency and reduces its carbon emissions. Steel is used in various parts of an aircraft, including the landing gear, wing components, engine components, and other critical parts.

However, the steel processing market is highly dependent on the global economy. During economic downturns, businesses and individuals tend to reduce their spending, which can lead to reduced demand for steel products such as construction materials, automobiles, and appliances.

The rising demand for customized steel products presents a significant opportunity for steel processing companies. By offering personalized services that meet the specific needs of their customers, these companies can differentiate themselves from their competitors and attract new business. The advantages of offering customized steel products are the ability to create unique solutions that are tailored to a customer's specific requirements. This can help businesses improve their operations and increase efficiency, which can ultimately lead to cost savings and increased profitability.

Among the analyzed regions, Asia-Pacific is expected to account for the highest revenue in the market by the end of 2031, followed by Europe, North America, and LAMEA. Increasing demand for steel products with the growing construction industry are the key factors responsible for the leading position of Asia-Pacific and Europe in the global steel processing market.

Steel is used in the construction of wind turbines and solar panels. Growing demand for renewable energy sources such as wind and solar power are the upcoming trends in the steel processing market.

The leading applications of steel processing market is that steel is used across various applications such as automotive, building & construction.

Asia-Pacific is the largest regional market for steel processing.

Steel processing market is anticipated to reach $884.1 billion by 2031.

China Baowu Group, ArcelorMittal, Tata Steel Group, ad Nippon Steel Corporation are the leading companies to hold the highest market share in steel processing.

Loading Table Of Content...

Loading Research Methodology...