Supersonic Jets Market Research, 2033

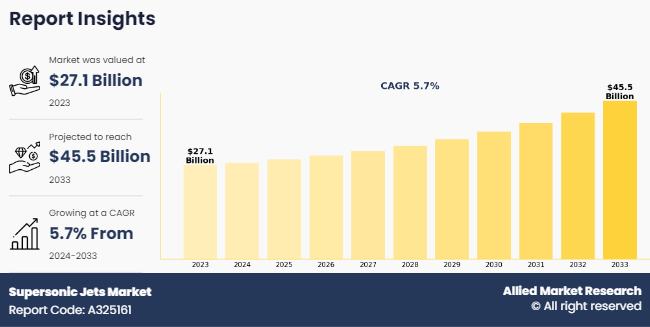

The global supersonic jets market was valued at $27.1 billion in 2023, and is projected to reach $45.5 billion by 2033, growing at a CAGR of 5.7% from 2024 to 2033.

Supersonic jets are engineered to exceed the speed of sound (1 Mach). The inception of these jets dates to the mid-20th century, primarily driven by military and defense sectors. Military aircraft include both combat and multi-role variants, typically outfitted with weapon systems designed to neutralize enemy targets. These jets are optimized for high-altitude flight, achieving speeds between 1 Mach and 3 Mach. The supersonic jets market is closely linked to both suppliers and buyers, heavily reliant on government funding.

In 2010, several companies proposed a more efficient aircraft than the Concorde, aiming to fly from Los Angeles to Sydney in just 6 hours. The first flight was planned for 2021, with production for pre-orders expected by 2023, which could boost the supersonic jets market. The commercial supersonic jet is expected to be operational by 2025 and gain popularity by 2030. Companies such as Boom Technology, Spike Aerospace, and Lockheed Martin are prominent in the market and have received pre-orders for their developing aircraft. The military sector has faced significant challenges due to the COVID-19 pandemic, leading to slower growth as defense budgets were put on hold in the U.S., the UK, India, and other developed countries.

In 2022, the conflict between Russia and Ukraine led many countries to increase their defense budgets and evaluate their military readiness. Global military spending grew by 3.7% in 2022, hitting a record of $2240 billion. Russia's attack on Ukraine significantly contributed to this rise in spending. The top five military spenders in 2022 were the U.S., China, Russia, India, and Saudi Arabia, making up 63% of total military expenditures globally.

Key Developments/Strategies in Supersonic Jets

- In June 2024, Boom Supersonic started Overture Superfactory at Piedmont Triad International Airport in Greensboro, North Carolina, U.S. It the first supersonic airliner factory in the U.S with a capacity to produce 33 Overture aircraft per year, valued at more than $6,000 Million.

- In March 2024, Hexcel Corporation opened its engineered core operations plant in Morocco to meet the growing demand for lightweight advanced composite materials for the aerospace industry. The 13,000-square-meter expansion in the Midparc Free Trade Zone in Casablanca has doubled the size of the plant to 24,000-square meters.

- In January 2024, Lockheed Martin Corporation launched X-59 Quiet Supersonic Aircraft in collaboration with NASA. The aircraft is designed to cruise at Mach 1.4 (approximately 925 mph) at an altitude of around 55,000 feet. Its unique, elongated nose and streamlined shape help to manage the shock waves produced during supersonic flight.

- In September 2023, SAAB signed a contract with Eagle Picher Technologies to design and fabricate a 24-volt lithium-ion battery for the Gripen E-series supersonic multirole fighter aircraft. This strategy is a milestone for Saab‐™s combat jet program as it will produce the first lithium-ion-based power source for the Gripen aircraft.

- In June 2022, Boom Supersonic collaborated with Northrop Grumman for development of supersonic aircraft tailored to provide quick-reaction capabilities to the U.S. military and allies. It is designed to carry up to 80 passengers at twice the speed of today's airliners & support government and military missions that require rapid response.

Market Dynamics

Rising Need for Reduced in-Time to Drive the Market

Rise in demand for reduced in-flight durations is a key driver of the supersonic jets market. Supersonic travel significantly cuts down travel time, often halving the duration as compared to conventional commercial jets. Secondgeneration supersonic jets, capable of speeds exceeding Mach 2, are designed to be 30% more efficient than the latest subsonic aircraft. This advancement not only enhances speed but also optimizes fuel consumption, making these jets more cost-effective.

Supersonic jets offer unparalleled speed and reduced flight times compared to traditional jets. Their ability to travel at supersonic speeds addresses the growing need for quicker and more agile aircraft. As global demand rises for faster, more efficient air travel, supersonic jets are becoming increasingly appealing to both commercial and private sectors. Advanced technological solutions that meet the needs of high-speed, time-sensitive travel drive the supersonic jets market growth. This trend emphasizes the shift towards more innovative and efficient aerospace technologies, catering to a variety of users seeking faster and more effective means of transportation.

Stringent Rules and Regulations Related to Supersonic Flight Testing

Supersonic commercial flights remain prohibited in the U.S. However, the Federal Aviation Administration (FAA) along with the U.S. Department of Transportation has established stringent regulations that outline the criteria for obtaining special authorizations for supersonic test flights. In September 2023, the FAA announced the final regulations governing civil supersonic test flights within the country. All applications for supersonic aircraft test flights must assess their environmental impacts in compliance with the National Environmental Policy Act (NEPA). The FAA will base its decisions on these applications in accordance with the regulations set forth by the Council on Environmental Quality (CEQ), particularly addressing the concern of noise pollution associated with supersonic test flights.

Increasing Demand for Arm Races among Economies

Rise in global conflicts and escalating cross-border tensions have prompted nations such as China, India, and South Korea to modernize and fortify their defense systems. Thus, governments are significantly increasing defense budgets to expand their air force capabilities. The demand for upgraded aerial firepower from the world‐™s leading defense spenders is a key driver for the growth of the supersonic jets market.

For instance, India delivered more than 100 Rafale jets by 2022, underscoring the intensifying arms race. This competition does not enhance military capabilities but also fuels advancements in military technology, leading to surge in procurement of next-generation aircraft and related systems. Such developments are expected to create lucrative growth opportunities during the forecast period.

Impact of Russia-Ukraine War on Supersonic Jets Market

The Russia-Ukraine war has significantly impacted the global supersonic jets market, reshaping both military and commercial sectors. In the defense sector, the conflict has underscored the importance of air superiority, leading many countries, particularly in Europe and NATO, to accelerate investments in advanced military aircraft. Supersonic jets, with their high-speed interception and strike capabilities, have become a focus for governments looking to enhance their defense readiness. This has prompted increased funding for the development of next-generation jets, incorporating cutting-edge technologies such as hypersonic weapons integration, stealth capabilities, and enhanced radar evasion systems.

The increased focus on advanced supersonic jets is not limited to military applications, the aerospace sector is gaining popularity in supersonic technology. However, the conflict has also challenges such as supply chain disruptions, especially regarding critical raw materials such as titanium and aluminum, which are crucial for aerospace manufacturing and are heavily sourced from the region. Sanctions and geopolitical instability have further increased the cost and complexity of obtaining these materials, affecting both military and commercial aircraft production.

Moreover, the concerns about the regulatory environment for supersonic jet development, as military needs may push boundaries on environmental regulations and airspace restrictions, particularly for commercial supersonic travel. The long-term impact could shape the direction of future innovations, focusing more on speed, agility, and security, as global defense dynamics evolve due to the ongoing conflict.

Top Impacting Factors

The global supersonic jets market is expected to witness notable growth registering a CAGR of 5.65%, The supersonic jets market is expected to witness notable growth owing to rising need for reduced in-time to drive the market and surge in need for replacement aging military fleets. Moreover, increasing arm races among economies is expected to provide lucrative supersonic jets market opportunities during the forecast period. On the contrary, stringent rules and regulations related to supersonic flight testing limits the growth of the supersonic jets industry.

Historical Data & Information

The global supersonic jets industry market is competitive, owing to the strong presence of existing vendors. Vendors of the global supersonic jets market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands, which are higher than the supply. The competitive environment in this market is expected to increase owing to technological innovations, product extensions, and different strategies adopted by key vendors.

Segmental Analysis

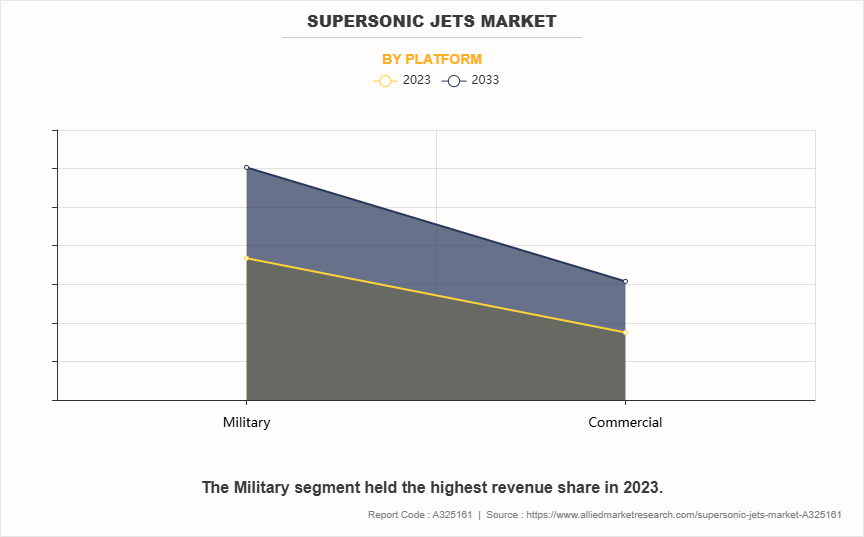

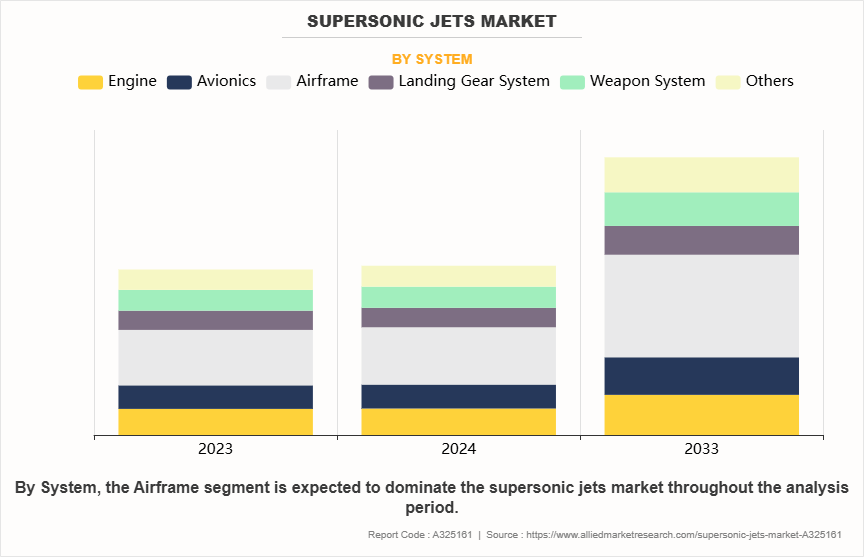

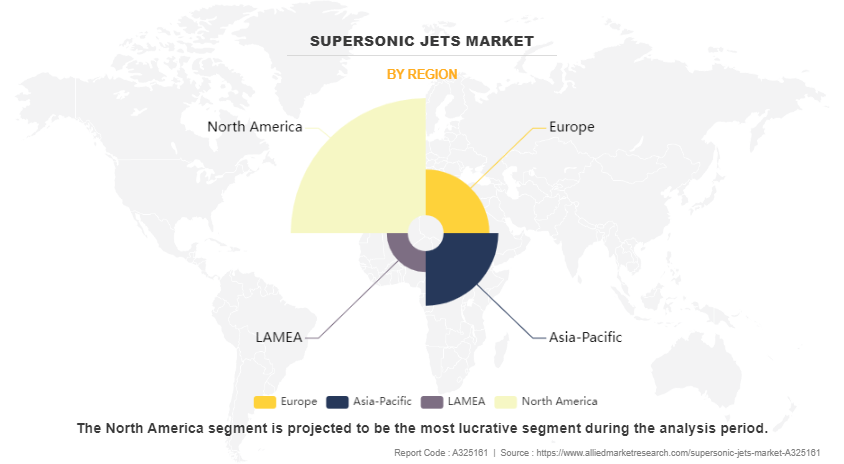

The supersonic jets market is segmented into Speed, Platform and System.On the basis of speed, the market is bifurcated into above Mach 1 and above Mach 2. On the basis of platform, the market is divided into commercial and military. On the basis of the system, the market is classified into engine, airframes, avionics, landing gear system, and weapon system.

By Speed

On the basis of speed, the market is bifurcated into above Mach 1 and above Mach 2. The segment Mach 1 dominated the market in 2023. In the supersonic jets market, speeds above Mach 1 are significant as they allow aircraft to drastically reduce travel times as compared to subsonic jets. Supersonic jets, such as the Concorde in the past, and newer models under development, aim to offer rapid, efficient long-distance travel. This market is driven by the demand for faster travel in business and commercial aviation, as well as potential military applications.

By Platform

On the basis of platform, the market is divided into commercial and military. The military segment generated the largest share in 2023. The segment is driven by technological advancements in propulsion systems, materials, and aerodynamics, which enable sustained speeds above Mach 2. This evolution supports enhanced manoeuvrability and faster response times in critical defence scenarios. The demand for such high-performance jets is fuelled by the need for increased national security and advanced air superiority capabilities.

By System

On the basis of the system, the market is classified into engine, airframes, avionics, landing gear system, and weapon system. The airframes segment anticipated for the largest supersonic jets market share in 2023 and is expected to follow the same trend during the supersonic jets market forecast.The design and materials used in airframes for supersonic jets must accommodate the aerodynamic forces, high temperatures, and rapid pressure changes associated with flying at speeds greater than Mach 1. Innovations in airframe design, including the use of advanced materials like titanium alloys and carbon composites, are essential for reducing weight while maintaining strength and durability.

By Region

Region-wise, the supersonic jets market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, and rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). North America generated the largest revenue in supersonic jets market size.North America is emerging as a key player in the global aerospace industry, driven by advancements in technology and a growing demand for faster air travel. The region is home to several leading aerospace companies and startups focused on developing next-generation supersonic aircraft.

Competitive Analysis

Competitive analysis and profiles of the major global supersonic jets market players that have been provided in the report include Boom Supersonic, Exosonic, BAE Systems, Dassault SA, Lockhead Martin Corporation, Saab AB, Spike Aerospace, Hermeus, and Virgin Galactic. The key strategies adopted by the major players of the global supersonic jets market are product launch and mergers & acquisitions.

Key Highlights of the Report

- The supersonic jets market studies more than 16 countries. The analysis includes a country-by-country breakdown analysis in terms of value ($million) available from 2022 to 2032.

- The research combined high-quality data, professional opinion and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

- The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

- The supersonic jets market share is marginally fragmented, with players such as Boom Supersonic, Exosonic, BAE Systems, Dassault SA, Lockhead Martin Corporation, Saab AB, Spike Aerospace, Hermeus, and Virgin Galactic. Major strategies such as contracts, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.

Key Benefits of Stakeholders

- This study comprises analytical depiction of the global supersonic jets market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall global supersonic jets market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current global market forecast is quantitatively analyzed from 2022 to 2033 to benchmark the financial competency.

- Porter‐™s five forces analysis illustrates the potency of the buyers and suppliers in supersonic jets.

- The report includes the market share of key vendors and the global market.

Supersonic Jets Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 45.5 billion |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2023 - 2033 |

| Report Pages | 292 |

| By Speed |

|

| By Platform |

|

| By System |

|

| By Region |

|

| Key Market Players | Virgin Galactic Holdings, Inc., Dassault Aviation, Exosonic, Inc., SAAB, Lockheed Martin Corporation, Boom Supersonic, BAE Systems, HERMEUS CORP., Spike Aerospace, Inc. |

Boom Supersonic, Exosonic, BAE Systems, Dassault SA, Lockhead Martin Corporation are the top companies to hold the market share in Supersonic Jets.

The upcoming trends of supersonic jets market include rising need for reduced in-time to drive the market and surge in need for replacement aging military fleets.

The military is the leading platform of supersonic jets market.

North America is the largest regional market for supersonic jets.

The global supersonic jets market was valued at $27.1 billion in 2023.

Loading Table Of Content...

Loading Research Methodology...