Synthetic Pesticide Market Research, 2031

The global synthetic pesticide market size was valued at $16.3 billion in 2021, and is projected to reach $27.6 billion by 2031, growing at a CAGR of 5.5% from 2022 to 2031.

Report Key Highlighters:

- 20 countries are covered in the synthetic pesticide market report. The segment analysis of each country in both value and volume for the forecast period 2021-2031 is covered in the report.

- The synthetic pesticide market is fragmented in nature with various players such as ADAMA Ltd., Aimco Pesticides Ltd., BASF SE, Bayer Crop Science AG, Corteva Agriscience, FMC Corporation, Nufarm Limited, Sumitomo Chemical Co., Ltd., Syngenta AG and UPL Limited. Also tracked key strategies such as acquisitions, product launches, mergers, expansion etc. of the palyers operating in synthetic pesticide market.

- Historical data related to synthetic pesticide trade, regulations, and its use is also covered in the report

Synthetic pesticides are man-made chemicals developed particularly to kill or repel pests. Synthetic pesticide chemicals are used to control and manage plant pests such as weeds, insects, and/or fungal infections. They are widely accessible and last longer than most organics. Synthetic pesticides are substances intended for preventing, destroying, and controlling any insects, including vectors of human or animal disease, unwanted species of plants or animals, causing harm during or interfering with the manufacturing, handling, storage, transport, or marketing of food, agricultural commodities, wood and wood products, or animal feedstuffs.

Growing demand from the agricultural sector is predicted to drive the global synthetic pesticides market during the forecast period.

Synthetic pesticides are mostly utilized in agriculture, but they are also employed in other sectors and for residential purposes. They kill harmless insects, which are hazardous to a wide range of creatures, including birds, fish, helpful insects, and non-target plants.

Pest control strategies are used, on the basis of a variety of characteristics such as industry, pest species, pest volume & dispersion, and environmental conditions. Synthetic pesticides are most often used in agriculture and forestry. Synthetic pesticides are also widely utilized in many industries, trade, storage, and other sectors of economic activity and home. Adequate pesticide application effects productivity, in terms of product protection and quality improvement, labor cost savings, and a large economic advantage.

Synthetic pesticide, Dichlorodiphenyltrichloroethane (DDT), is widely used in urban aerial sprays to control urban mosquito and gypsy moth. Pesticides such as malathion and chlorpyrifos are often used on all fruits and vegetables, with higher pesticide concentrations in fruits including peaches, nectarines, cherries, strawberries, grapes, raspberries, pear, and apples. In addition, use of foliar spray is the highest for insecticides due to its ease of application and high effectiveness. Foliar spraying is a technique of treating plants with liquid insecticides directly to their leaves, which is an excellent solution for plants experiencing pest attacks.

Synthetic insecticides are frequently less expensive than organic pest control solutions. While some synthetic pesticides have a limited life in the environment, many are more persistent than organic pesticides. Synthetic pesticides can address situations such as high or low soil pH, temperature stress, too little, or too much soil moisture, root disease, presence of pests that impair nutrient intake, and nutritional imbalances in the soil. Agriculture may utilize synthetic pesticide formulations such as wettable powders, liquid concentrates, and emulsions, which further propels growth of the synthetic pesticide market. However, adverse effects of synthetic pesticides on human health and ecosystem are anticipated to hamper growth of the synthetic pesticide market. On the contrary, new product launches and technological advancements are expected to generate lucrative opportunities for the global synthetic pesticides industry.

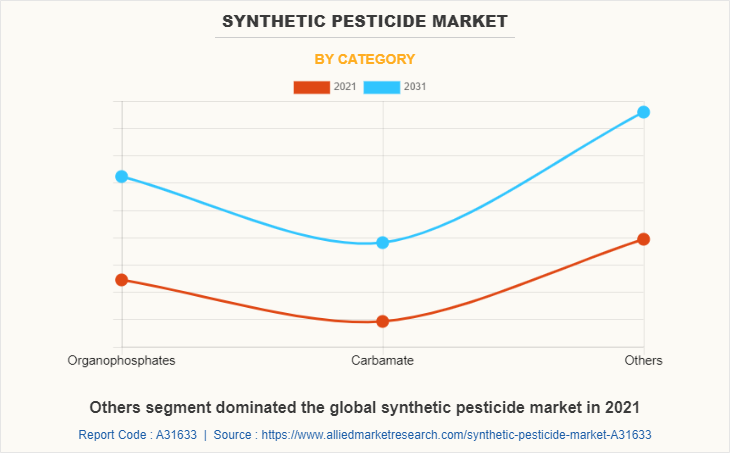

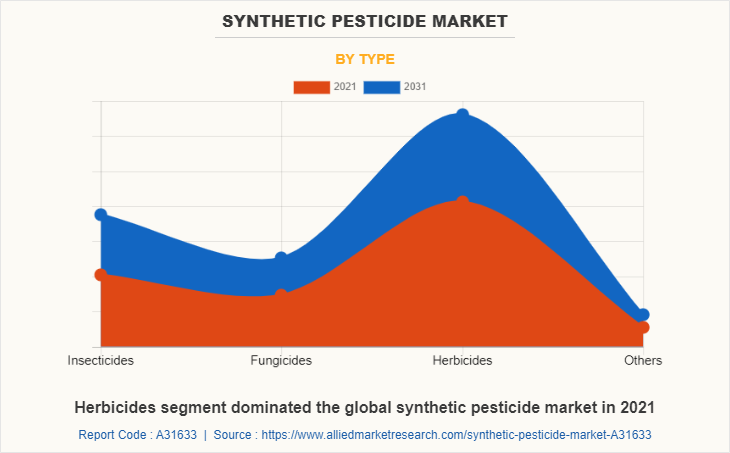

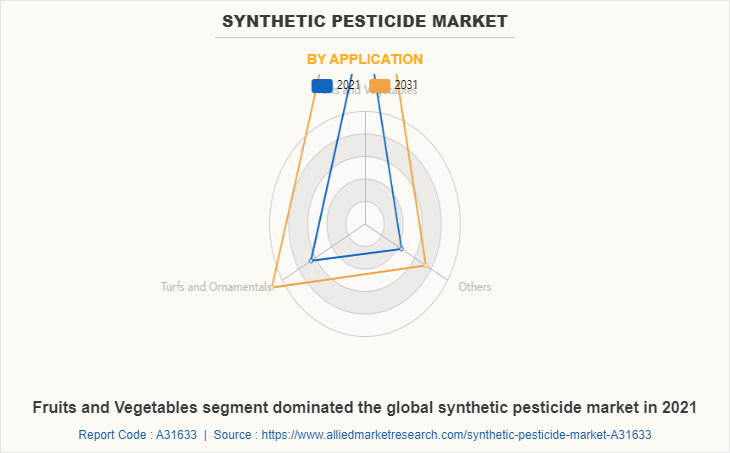

The synthetic pesticide market is segmented into category, type, application, and region. On the basis of category, the market is categorized into organophosphate, carbamate, and others. By type, it is categorized into insecticides, fungicides, herbicides, and others. On the basis of application, it is categorized into fruits & vegetables, turfs & ornamentals, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA. The synthetic pesticide market share is analyzed across all significant regions and countries.

Asia-Pacific is projected to register robust growth during the forecast period. Synthetic pesticides are used to boost agricultural productivity in countries such as India and other Southeast Asian nations as demand for food crops increases due to population growth.

Synthetic pesticides in Asia-Pacific can be used in a great variety of everyday foods and vegetables, including water, wine, fruit juices, refreshments, and animal feeds. Synthetic pesticides also help farmers in producing an abundance of healthy, all-around vegetables that are essential for human health. Fruits and vegetables, gain critical nutrients and become more plentiful and less expensive by adding pesticides. Grains, milk, and proteins, which are essential for childhood growth, are becoming more readily available owing to decreasing food and animal feed production costs.

The others segment dominated the global synthetic pesticide market in 2021. The others segment includes pyrethrin, pyrethroid and organochlorine. Pyrethrins are widely used to control mosquitoes, fleas, flies, moths, ants, and a variety of other pests. Pyrethrins are often extracted from flowers. They do, however, usually include contaminants from the bloom. Pyrethroid pesticide is a specific chemical family of active chemicals present in many current pesticides on shop shelves and employed for pest control. Pyrethrin and Pyrethroid chemicals are designed to resemble plant pesticides, notably poisonous chrysanthemum variants. Pyrethroids can be found in a variety of commercial pesticides, including home insecticides, pet lotions, and shampoos. Some pyrethroids are also used to treat lice on the head and as mosquito repellents that may be sprayed to garments.

Herbicides segment dominated the global synthetic pesticide market in 2021. Herbicides are chemical substances that are used to manage or control unwanted plants. Herbicides are most often used in row-crop farming, where they are administered prior to or during planting to improve crop yield while limiting other vegetation. They can also be used on crops in the fall to promote harvesting. Herbicides are also employed in forestry, where specific formulations have been discovered to inhibit hardwood species in favor of conifers following clearcutting, grazing systems, and wildlife habitat management.

Fruits and Vegetables segment dominated the global synthetic pesticide market in 2021. Synthetic insecticides are widely used on all fruits and vegetables, as well as wheat. Pesticides are used on crops that are fed to animals, although pesticide residue is rarely seen in meat or dairy products. They are used in the production of fruits and vegetables to prevent, eliminate, or repel pests that may harm crops.

Key Players and Strategies:

Major players operating in the global synthetic pesticide market include Syngenta, BASF, Bayer Crop Science, Corteva Agriscience, FMC corp, ADAMA, UPL Limited, Sumitomo Chemicals, and Nufarm and Aimco Pesticides Ltd. These players have been adopting various strategies to gain higher share or to retain leading positions in the market. For instance, Syngenta AG introduced VAYANTIS, a novel fungicide seed treatment that protects seedlings from important blight and damping-off diseases such as Pythium and Phytophthora in the year 2021, which help farmers grow crops more productively and sustainably.

Further, in 2022, BASF SE launched Exponus, which will help boost agricultural yield while protecting crops. Corteva Agriculture and BASF SE cooperated to create future herbicide-tolerant soybeans and herbicide complement for farmers in North America and throughout the world. This led to rise in demand for synthetic insecticides.

Historical Trends:

In 1997, the U.S. purchased approximately one-third of the world's pesticides. Pesticide expenditures totaled around $11.9 billion per year, which are utilized in agriculture for two-thirds of the time. Over 160 synthetic pesticides have been identified as potential carcinogens. Many of these insecticides remain in use. Carcinogen categorization methods are used by the U.S. environmental protection agency (EPA). There is no list of carcinogenic pesticides accessible in the European Union.

As per EPA, in September 2006, the World Health Organization expressed its approval for the indoor use of DDT in African nations where malaria remained a serious health concern, saying that advantages of pesticides outweighed health and environmental hazards. The WHO view is compatible with the Stockholm Convention on persistent organic pollutants (POPs), which prohibits the use of DDT for all purposes except malaria control.

COVID-19 Analysis:

The COVID-19 pandemic had negatively impacted the synthetic pesticide market. As countries are taking stronger measures to contain the spread of COVID-19, self-quarantine and the temporary closing of businesses may affect normal food-related practices. Overall, the trade of fruits and vegetables during COVID-19 did dampen total trade flows of fruits and vegetables for approximately a 3-month period following the initial outbreak.

However, demand for synthetic pesticides, which are extensively employed to extend the life of fruits and vegetables, is increasing significantly due to their use as antimicrobials agents for preventing infections and diseases caused by pathogens.

Furthermore, pandemic-related lockdown measures had a substantial influence on numerous areas, including synthetic pesticides in turfs and ornamentals, which maintained a market worth more than $1 billion to preserve the field in golf courses, parks, and sports fields.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the synthetic pesticide market analysis from 2021 to 2031 to identify the prevailing synthetic pesticide market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the synthetic pesticide market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global synthetic pesticide market trends, key players, market segments, application areas, and synthetic pesticide market growth strategies.

Synthetic Pesticide Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 27.6 billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 340 |

| By Category |

|

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Sumitomo Chemical Co., Ltd., Corteva Agriscience, FMC Corporation, BASF SE, ADAMA Ltd., Bayer Crop Science AG, Aimco Pesticides Ltd., UPL Limited, Syngenta AG, Nufarm Limited |

Analyst Review

According to the perspective of CXOs of leading companies, the synthetic pesticide market is anticipated to grow in the future, owing to its extensive use in applications such as fruits & vegetables, turfs & ornamentals, and other end-use industries. An increase in demand for fruits and vegetables also propels the market expansion throughout the forecast period. However, the detrimental effects of synthetic pesticides on health and the environment are expected to hinder market expansion. Asia-Pacific is projected to register robust growth during the forecast period.

The global synthetic pesticides market was valued at $16.3 billion in 2021, and is projected to reach $27.6 billion by 2031, registering a CAGR of 5.5% from 2022 to 2031.

Asia-Pacific is the largest regional market for Synthetic Pesticide.

Growth of the global synthetic pesticides market is majorly attributable to its wide applications in various industries such as fruits & vegetables and turfs & ornamentals. In addition, rise in demand for fruits & vegetables propels the market growth.

Fruits and Vegetables is the leading application of Synthetic Pesticide Market.

The top companies to hold the market share in Synthetic Pesticide include Syngenta, BASF, Bayer Crop Science, Corteva Agriscience, FMC corp, ADAMA, UPL Limited, Sumitomo Chemicals, and Nufarm and Aimco Pesticides Ltd

Loading Table Of Content...