Therapeutic Drug Monitoring Market Research, 2031

The global Therapeutic Drug Monitoring Market Size was valued at $1,932.93 million in 2021 and is projected to reach $4,415.3 million by 2031, registering a CAGR of 8.5% from 2022 to 2031. Therapeutic drug monitoring (TDM) is a medical process in which a patient’s blood levels of a drug are measured in order to optimize the effectiveness of the treatment and reduce the risk of adverse effects. This process is used to ensure the patient is receiving the optimal dose of medication and that the drug is not causing any adverse effects. It is a valuable tool in the management of drug treatment, offering numerous advantages in terms of safety, efficacy, and personalized care. Therapeutic drug concentration is monitored through immunoassays, calorimetric immunoassays, and chromatography-mass spectrometry.

Historical overview

The Therapeutic Drug Monitoring Market Size is analyzed qualitatively and quantitatively from 2021-2031. The therapeutic drug monitoring market is anticipated to witness growth at a CAGR of around 8.5% during the forecast period. Most of the growth was derived from the Asia-Pacific and North America region owing to improvements in health awareness, a rise in incidences of drug-drug interaction, increased collaboration between healthcare providers and other healthcare professionals in promoting therapeutic drug monitoring as a critical component of patient care, increase in disposable income, development in healthcare facilities, and surge in healthcare expenditure.

Market dynamics

The therapeutic drug monitoring market growth is driven by the growing prevalence of chronic diseases, an increase in awareness about therapeutic drug monitoring, and a rise in demand for therapeutic drug monitoring services in emerging markets. The rise in the prevalence of chronic diseases such as cardiovascular diseases, cancer, and neurodegenerative diseases, which require long-term treatment with drugs that have a narrow therapeutic window, is driving the demand for therapeutic drug monitoring services. For instance, according to World Health Organization (WHO), about 18,094,716 new cancer cases were diagnosed in 2020. In addition, according to the Centers for Disease Control and Prevention (CDC), coronary heart disease is the most common type of heart disease and about 20.1 million adults age 20 and older have coronary artery disease (CAD).

In addition, increased use of therapeutic drug monitoring in organ transplantation to ensure the success and safety of the transplantation boosts market growth. Moreover, growing awareness of therapeutic drug monitoring and rise in the prevalence of autoimmune diseases further drive the market growth during the forecast period Furthermore, the rising demand for precision medicine, technological advancements in drug monitoring technologies, and the increasing number of initiatives taken by the government to promote healthcare are some of the other factors driving the market growth. In addition, the surge in personal disposable income, and rise in healthcare spending in developing regions are expected to offer potential Therapeutic Drug Monitoring Market Opportunity in upcoming years.

However, a lack of skilled professionals can restrain the growth of the therapeutic drug monitoring market by limiting the availability of qualified personnel to perform the tests and interpret the results. This can lead to delays in diagnosis and treatment, increased medication errors, and decreased patient outcomes. In addition, the lack of skilled professionals can also lead to limited access to the latest technology, which is necessary for the successful implementation of the tests. Thus, the lack of trained professionals may lead to a decrease in the demand for therapeutic drug monitoring services, as fewer people may be able to afford the tests or access the results. These are the key factors that can hinder the growth of the therapeutic drug monitoring market in the upcoming years.

The overall impact of COVID-19 remains negative on the therapeutic drug monitoring market. The COVID-19 pandemic has caused delays in laboratory testing due to disruptions in the supply of reagents and testing kits, which has led to decreased therapeutic drug monitoring capacity and accuracy. Furthermore, the pandemic has shifted healthcare resources away from the monitoring of chronic diseases, such as those related to therapeutic drug monitoring, toward the care of COVID-19 patients.

In addition, the decline in the number of organ transplants across the world during COVD-19 has further reduced the availability of therapeutic drug monitoring services. For instance, according to the report published by the National Center for Biotechnology Information in 2020, an estimated 16% global decrease was observed in transplant activity.

Therapeutic drug monitoring is important in organ transplantation to monitor the levels of immunosuppressant drugs in a patient's bloodstream, individualize treatment, and improve patient outcomes. Thus, the decrease in the number of transplant procedures reduces the demand for therapeutic drugs, which affected the growth of the market during the COVID-19 pandemic. However, the post-pandemic market is expected to grow at a significant rate owing to the increased number of individuals needing organ transplants. Due to the increased risk of rejection, therapeutic drugs will be needed to help monitor the body's acceptance of the new organ.

Segmental Overview

The therapeutic drug monitoring market is segmented on the basis of product, technology, drug class, end user and region. As per product, the market is classified into consumables and equipment. On the basis of technology, the market is segmented into immunoassay, chromatography-spectrometry, and others. According to drug class, the market is divided into anti-epileptic drugs, antibiotics drugs, anti-arrhythmic drugs, immunosuppressants, and others. On the basis of region, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and Rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and Rest of LAMEA).

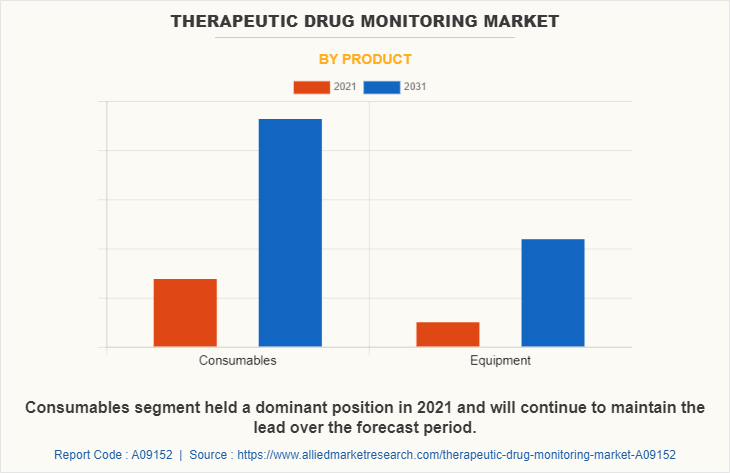

By Product

On the basis of product, the market is bifurcated into equipment and consumables. The consumables segment has the largest Therapeutic Drug Monitoring Market Share in 2021, owing to the rising prevalence of chronic diseases such as autoimmune disease, epilepsy, diabetes, and cardiovascular diseases are driving the growth of the therapeutic drug monitoring market. On the other hand, the equipment segment is the fastest growing segment during the forecast period owing to a rise in the adoption of technologically advanced therapeutic drug monitoring equipment such as automated analyzers and chromatography-spectroscopy equipment to monitor the therapeutic drug concentration in patients is the key factor that drives the growth of the market.

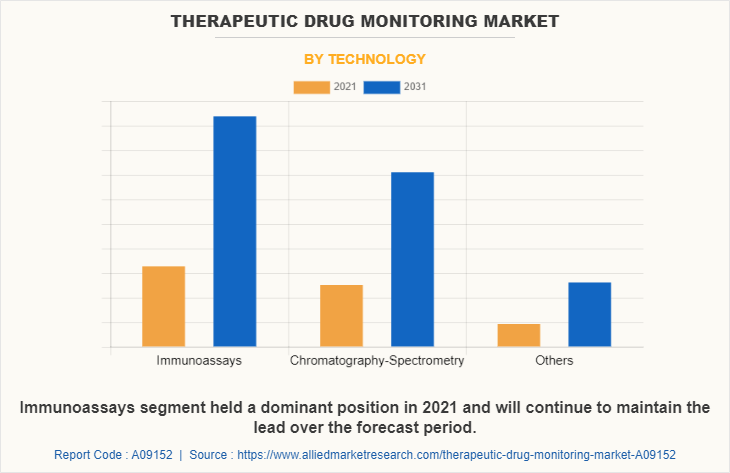

By Technology

By technology, the therapeutic drug monitoring market has been segmented into immunoassay, chromatography, spectrophotometer, and others. In 2021, the immunoassays segment has the largest Therapeutic Drug Monitoring Market Share in 2021 and is expected to maintain its lead during the Therapeutic Drug Monitoring Market Forecast period. On the other hand, the chromatography segment is expected to witness considerable market growth during the forecast period, owing to a rise in the adoption of chromatography techniques to monitor drug levels concentration in patients’ blood suffering from various diseases.

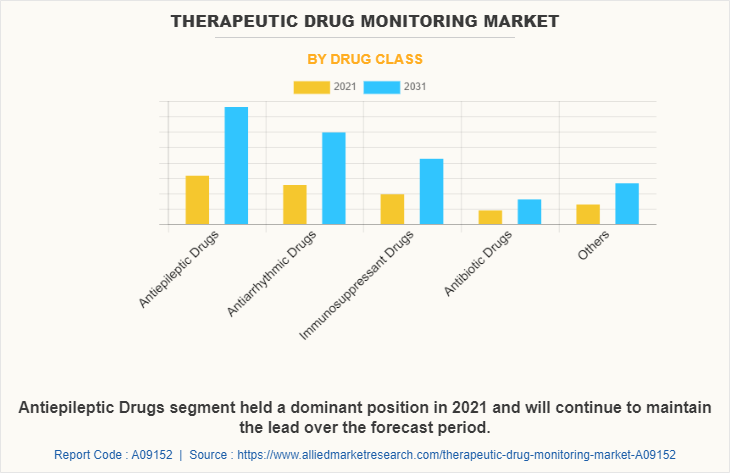

By Drug Class

By drug class, the therapeutic drug monitoring market is categorized into immunosuppressant drugs, anti-epileptic drugs, antibiotic drugs, anti-arrhythmic drugs, and others. In 2021, the anti-epileptic drugs segment generated major revenue and is expected to maintain its lead during the forecast period. On the other hand, the anti-arrhythmic drugs segment is expected to witness considerable market growth during the forecast period, owing to a rise in the prevalence of chronic diseases such as arrhythmia and tachycardia among the geriatric population across the world is the key factor that drives the growth of the market.

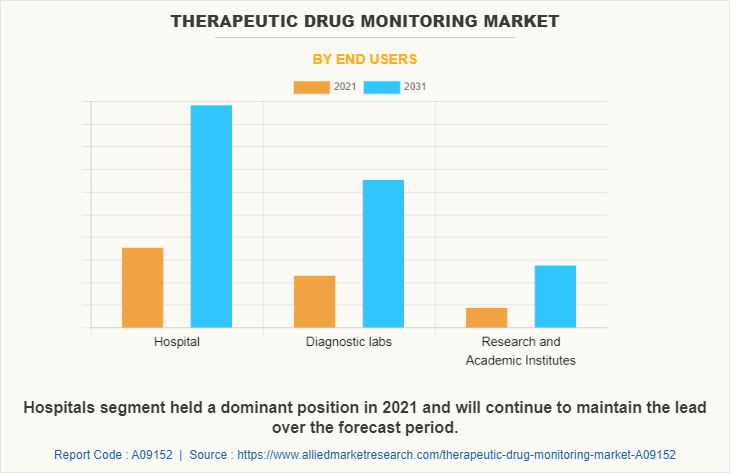

By End User

By end user, the Therapeutic Drug Monitoring Industry has been segmented into hospitals, diagnostic labs, and research and academic institutes. In 2021, the hospital segment generated major revenue and is expected to maintain its lead during the forecast period. On the other hand, the diagnostic lab segment is expected to witness considerable market growth during the forecast period. Owing to the rise in the number of patient visits suffering from various chronic diseases and the rise in the adoption of therapeutic drug monitoring products in diagnostic labs to analyze therapeutic drug levels in patient’s blood samples is the key factor driving the growth of the market.

By Region

On the basis of region, the therapeutic drug monitoring market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the therapeutic drug monitoring market in 2021 and is expected to maintain its dominance during the forecast period, owing to the presence of a large number of players which are providing therapeutic drug monitoring products. For instance, Thermo Scientific™ CEDIA™ therapeutic drug monitoring assays help physicians in determining the optimal drug dosage for an individual patient, by monitoring serum or plasma drug concentrations to ensure effectiveness and patient compliance.

In addition, the rise in the use of anti-arrhythmic drugs & anti-diabetic drugs for the treatment of diabetes and cardiovascular disease has led to an increase in the demand for therapeutic drug monitoring kits and instruments among hospitals across the region which further drives the growth of the market. For instance, according to International Diabetes Federation, in 2021, it was estimated that around 32.2 million people are living with diabetes in the U.S., and is expected to reach 36.3 million in 2045. Furthermore, the rising number of drug-related adverse events, increasing government initiatives to promote therapeutic drug monitoring, and growing awareness about the benefits of therapeutic drug monitoring across the region are the key factors anticipated to boost the growth of the market.

Asia-Pacific is expected to grow at the fastest rate during the forecast period. This is attributed to e increasing patient population in developing countries like China, India, and Japan and the rise in the number of geriatric populations who suffer from various chronic diseases such as autoimmune disease epilepsy, and others.

Moreover, government initiatives are playing a major role in the adoption of therapeutic drug monitoring by strengthening targeted expenditure, setting up government facilities, and releasing guidelines to ensure the appropriate usage of technologically advanced therapeutic drug monitoring equipment. For instance, the National Health Commission of the People’s Republic of China has developed a national drug monitoring program, which is designed to increase the use of therapeutic drug monitoring in clinical practice. In addition, the rise in the demand for personalized medicine, the availability of healthcare services, and the adoption of advanced technologies in emerging countries across Asia-Pacific are the key factors contributing to the growth of the therapeutic drug monitoring market.

COMPETITION ANALYSIS

Competitive analysis and profiles of the major players in the Therapeutic Drug Monitoring Industry, such as Abbott Laboratories, Biomerieux SA, Bio-Rad Laboratories, Inc., Chromsystems Instruments & Chemicals GmbH, Danaher Corporation, Exagen Inc, F. Hoffmann-La Roche Ltd., Sekisui Chemical Co Ltd., Siemens AG, and Thermo Fisher Scientific Inc. Major player have adopted product launch, product approval and agreement as key developmental strategies to improve the product portfolio of the therapeutic drug monitoring market.

Some examples of product expansion in the market

- Bio-Rad Laboratories, Inc. expanded its portfolio of independent quality controls (QC) products for the Abbott Alinity ci-series integrated clinical chemistry to enhance user experience and streamline their QC workflow.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the therapeutic drug monitoring market analysis from 2021 to 2031 to identify the prevailing therapeutic drug monitoring market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the therapeutic drug monitoring market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global therapeutic drug monitoring market trends, key players, market segments, application areas, and market growth strategies.

Therapeutic Drug Monitoring Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 4.4 billion |

| Growth Rate | CAGR of 8.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 292 |

| By Technology |

|

| By Product |

|

| By Drug Class |

|

| By End Users |

|

| By Region |

|

| Key Market Players | Chromsystems Instruments & Chemicals GmbH, F. Hoffmann-La Roche Ltd., Bio-Rad Laboratories, Inc., Siemens AG, Danaher Corporation, Abbott Laboratories, Exagen Inc., Biomerieux SA, Thermo Fisher Scientific Inc., SEKISUI CHEMICAL CO., LTD. |

Analyst Review

This section provides various opinions of the top-level CXOs in the global therapeutic drug monitoring industry. In accordance to several interviews conducted, the therapeutic drug monitoring market is expected to witness healthy growth with the rise in the adoption of therapeutic drug monitoring tools in developed countries such as U.S. and Canada. In addition, increase in prevalence of various chronic diseases and autoimmune diseases leads to high adoption of therapeutic drug monitoring systems which are expected to significantly boost the growth of the therapeutic drug monitoring market. However, limited specificity of these tools restrains the growth of the market.

According to perspective of CXO’s of leading companies in the market, the global therapeutic drug monitoring market is expected to exhibit high growth potential attributable to factors such as increase in awareness about use and benefits of therapeutic drug monitoring in the treatment of various chronic diseases such as epilepsy, arrhythmia, and others.

The CXOs further added that North America is expected to witness the highest growth, in terms of revenue, owing to increase in the demand for innovative therapeutic drug monitoring tools and increase in prevalence of chronic diseases which are expected to boost the demand for therapeutic drug monitoring systems in this region. However, Asia-Pacific is expected to register the fastest CAGR during the forecast period due to development of healthcare facilities and rise in public–private investments in the healthcare sector

The upcoming trends are increase in awareness about therapeutic drug monitoring, and rise in demand for therapeutic drug monitoring services in emerging market. The rise in prevalence of chronic diseases such as cardiovascular diseases, cancer, and neurodegenerative diseases, which require long-term treatment with drugs that have a narrow therapeutic window, is driving the demand for therapeutic drug monitoring services.

The forecast period in the report is from 2022 to 2031

North America is the largest regional market for Therapeutic Drug Monitoring

The total market value of the therapeutic drug monitoring market is $ 4,415.3 Million in 2031

The top companies that hold the major market share in the therapeutic drug monitoring market are Abbott Laboratories, Biomerieux SA, Bio-Rad Laboratories, Inc., Chromsystems Instruments & Chemicals GmbH, Danaher Corporation, Exagen Inc, F. Hoffmann-La Roche Ltd., Sekisui Chemical Co Ltd., Siemens AG, and Thermo Fisher Scientific Inc.

The market value of therapeutic drug monitoring was $1,932.93 million in 2021

The base year for the therapeutic drug monitoring market report is 2021

There are 10 therapeutic drug monitoring companies are profiled in the report

Loading Table Of Content...