Thickeners Market Research, 2031

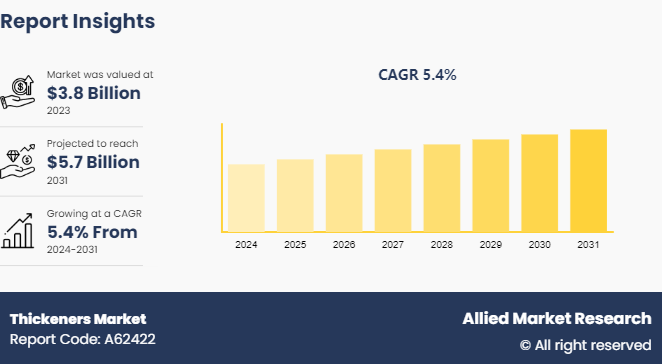

The global thickeners market was valued at $3.8 billion in 2023, and is projected to reach $5.7 Billion by 2031, growing at a CAGR of 5.4% from 2024 to 2031.

Market Introduction and Definition

Thickeners are substances added to liquids to increase their viscosity, thereby improving texture, stability, and overall quality. They are commonly used in various industries such as food, cosmetics, pharmaceuticals, and manufacturing. Thickeners function by absorbing water or forming a gel-like structure, which thickens the liquid.

Their properties include versatility in application, ability to enhance mouthfeel and consistency, and stability under different processing conditions. Thickeners may be natural, such as starches and gums, or synthetic, such as cellulose derivatives. Key properties include their solubility, viscosity, pH sensitivity, and compatibility with other ingredients, ensuring their effectiveness across diverse formulations.

Key Takeaways

- The Thickeners market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2031.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major energy storage system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The expansion in the paints and coatings industry is significantly driving the demand for thickeners. As the construction and automotive sectors grow, the need for paints and coatings with enhanced properties such as improved viscosity and application performance increases. Thickeners play a crucial role in achieving these properties by stabilizing the formulation, preventing sagging, and ensuring a smooth finish. The construction boom in emerging economies, coupled with the rising demand for high-performance automotive coatings, underpins this trend. In addition, advancements in technology have led to the development of new thickening agents that offer better performance and environmental benefits, catering to the stringent regulatory standards in the industry. Major companies are investing in innovative thickener solutions to meet the evolving requirements of the paints and coatings market, thereby driving overall market growth. The commercial building industry in North America had robust expansion as a result of large expenditures made in both the US and Canada.

The U.S. Census Bureau estimates that in December 2021, the country's construction spending would have reached a seasonally adjusted annual rate of $ 1, 639.9 billion, 0.2% higher than the revised estimate from November of $ 1, 636.5 billion. In addition, the amount spent on buildings in 2021 was $ 1, 589.0 billion, 8.2% more than $ 1, 469.2 billion in 2020, which increased the need for paints and coatings in construction applications. The growing middle-class population and their rising disposable income have made it easier for the middle-class housing market to grow, which has in turn fueled residential construction. The expansion of the building sector has made the Asia-Pacific area the largest market for architectural coatings. For example, in the upcoming years, the Indian government is pushing for significant projects. By 2022, the government hopes to have more than 20 million affordable homes built for the urban poor under its Housing for All plan. This continuous innovation and the increasing application of thickeners in paints and coatings underscore the critical role of thickeners in the industry's expansion and sustainability efforts.

Fluctuating raw material prices pose a significant challenge to the thickeners market, impacting both supply chain stability and consumer demand. Thickeners, essential in various industries such as food, cosmetics, and pharmaceuticals, rely heavily on consistent access to raw materials such as starches, gums, and hydrocolloids. However, price volatility in these inputs can disrupt production schedules, leading to uncertainty in product availability and pricing for manufacturers and consumers alike. Moreover, the increased costs associated with fluctuating raw material prices can squeeze profit margins for thickeners producers, potentially limiting their ability to invest in innovation or expand operations. This, in turn, may hinder the development of new thickener formulations or the exploration of alternative sourcing strategies. Consequently, businesses may face challenges in meeting customer demands, as price fluctuations could lead to higher product prices or supply shortages. To mitigate these effects, thickeners manufacturers may need to implement proactive supply chain management strategies, such as securing long-term contracts with suppliers or diversifying their raw material sources. In addition, investments in research and development to identify more stable or cost-effective alternatives could help buffer the impact of fluctuating raw material prices on the thickeners market in the long term.

The rise of natural and sustainable thickeners presents a lucrative opportunity for the growth of the thickeners market. As consumers increasingly prioritize environmentally friendly and health-conscious products, there has been a significant shift towards natural alternatives in various industries. Natural thickeners derived from plant-based sources such as tapioca starch, agar-agar, and pectin are gaining popularity due to their renewable and eco-friendly nature. Moreover, these ingredients often offer comparable functionality to synthetic thickeners while appealing to consumers seeking clean label products with minimal additives. The demand for natural and sustainable thickeners is particularly pronounced in the food and beverage industry, where manufacturers are reformulating products to meet evolving consumer preferences. In addition, the adoption of natural thickeners aligns with corporate sustainability initiatives and regulatory pressures to reduce reliance on synthetic chemicals. As a result, companies that invest in the development and marketing of natural and sustainable thickeners stand to capitalize on this growing market opportunity, driving innovation and differentiation in the thickeners market while meeting the demands of environmentally conscious consumers.

Patent Analysis of Global Thickeners Market

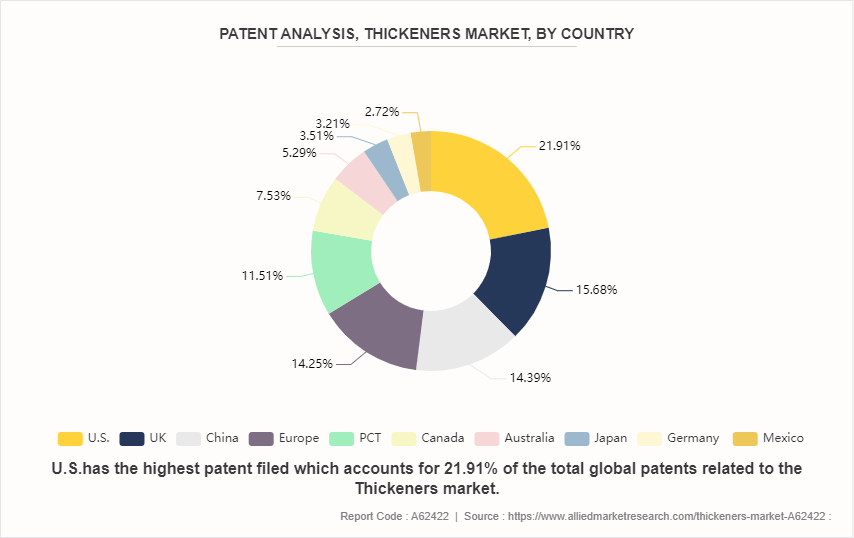

Patent analysis reveals a diverse geographical distribution of innovation in the thickeners market. The U.S. leads with 21.91% of patents, followed by the UK (15.68%) and China (14.39%) . The Europe and PCT collectively contribute 25.76% of patents, showcasing European innovation's significant impact. Canada, Australia, Japan, Germany, and Mexico hold notable shares ranging from 2.72% to 7.53%. This distribution suggests a global interest in thickener technology, with strong innovation hubs across North America, Europe, and Asia-Pacific. Understanding patent trends can aid market players in strategic decision-making and identifying emerging technologies and competitors.

Market Segmentation

The Thickeners market is segmented into type, application, and region. Based on type, the market is classified into inorganic thickener, cellulose ether, polysaccharides, polypeptides, synthetic polymer, natural polymer, and others. By application, the market is divided into paints and coatings, textile, paper and pulp, detergent, food and beverages, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The major players operating in the Thickeners market include BASF SE, Ashland Inc., CP Kelco U.S., Inc., DuPont, Dow Inc., Akzo Nobel N.V, The Lubrizol Corporation, Henkel Corporation, PPG Industries, Inc., Elementis plc.

Other players in the thickeners market include Fufeng, MEIHUA HOLDINGS GROUP CO., LTD., ALTANA, DSM.

Recent Key Strategies and Developments

- In December 2021, Cargill declared that it would expand its offering of nature-derived solutions for clients by acquiring Croda's bio-based industrial division.

- In February 2021, Jungbunzlauer introduced TayaGel®, a novel high acyl gellan gum, to meet the expanding demand for food additives in a wide range of food and non-food applications.

- In January 2021, Leading supplier of F&B ingredients, Tate & Lyle, has increased the range of thickening and gelling starches based on tapioca to help food producers produce better products with enhanced mouthfeel, fluidity, texture, and process tolerance.

- In ?November 2020, Verdient Foods Inc. was acquired by INGREDION INCORPORATED. The company is expected to benefit from this acquisition in terms of raising overall sales, boosting production capacity, and working with partners to address the growing need for plant-based food thickeners.

- In January 2020, The Portuguese company Yerbalatina Phytoactives, which produces natural plant-based extracts and components, was acquired by ADM.

Regional Market Outlook

Asia-Pacific is experiencing robust economic growth. The growth of the thickeners market in Asia-Pacific is driven by rapid urbanization, population growth, and rising disposable incomes, which boost demand for processed foods, cosmetics, and pharmaceuticals. The expansion of the food and beverage industry, coupled with health and wellness trends favoring low-fat products, further fuels this demand. In addition, the burgeoning cosmetics and personal care sector, alongside advancements in food technology, enhances thickener utilization. Improved healthcare infrastructure also increases pharmaceutical product demand, where thickeners are vital. Regulatory emphasis on food safety and product quality. In addition, it supports market growth by ensuring the adoption of compliant and safe thickening agents.

- China and India, with their rapid economic growth and immense potential, are expected to drive demand in the region. In these nations, frozen and chilled ready meals rank among the most popular types of ready-to-eat food. The market for thickeners is enhanced by changing consumer food preferences, such as those for vegan, gluten-free, and sustainable packaging.

- For example, VegaBytz launched their plant-based, 100% vegan meat products in India in February 2022. The VegaBytz product range includes ready-to-eat meals with meat, chicken, or tuna as well as curry goods that are all vegan and made completely of plants. Further, companies in the sector are concentrating on taking calculated risks to establish a solid presence in these nations, which is fueling the market's expansion.

- Owing to growing investments and increased construction activity in the nation, the demand for paints and coating thickeners is expected to increase over the projected period. China is a major contributor, having been among the world's top infrastructure investors in recent years. As per the National Bureau of Statistics (NBS) of China, the construction industry in China generated an output value of $ 475.84 billion (CNY 31.2 trillion) in 2022, indicating a 6.5% rise from 2021.

- Furthermore, as per IBEF, the government has allotted $ 130.57 billion (INR 10 trillion) to improve the infrastructure sector in the Union Budget 2022-2023. Furthermore, during the next five years, India intends to invest $ 1.4 trillion in infrastructure through the "National Infrastructure Pipeline."

- Thus, the expanding construction and food industry in Asia-Pacific will drive the growth of the thickeners market in this region.

Industry Trends

- Expansion, product launches, and partnerships are key drivers of growth in the thickeners industry. Companies expanding production capacities, introducing innovative products, and forming strategic alliances can capture new markets, enhance competitiveness, and fuel the overall market expansion.

- Ingredion Incorporated introduced texturizers made from citrus fruit peels to its lineup of functional, clean-label ingredient solutions with the launch of FIBERTEXTM CF 502 and FIBERTEX CF 102 citrus fibers in March 2023. The company announced the release of VITESSENCE® TEX Crumbles 102 textured protein in July 2021, adding another new product to its extensive line of plant-based goods. In March 2020, a brand-new clean label component called EVANESSETM CB6194 clean label emulsifier was also unveiled.

- To meet Asia's growing need for feeds, starches, and sweeteners, Cargill established a maize wet mill in Surabaya in September 2022. This $100 million facility is to support the expansion of the food and beverage industry throughout Asia in addition to boosting the local economy and creating up to 4, 000 new jobs and employment opportunities. In February 2022, a wide variety of modified food starches were released, including roll-dried, cold-water swelling, stable, and thinned adapted starch.

- ADM launched its state-of-the-art plant-based innovation center in Singapore's Biopolis research park. The lab aims to produce cutting-edge, fashionable, and nutritious products to meet the growing demand for food and beverages in the Asia Pacific region. In January 2020, ADM also acquired Yerbalatina Phytoactives, a Portuguese company that produces organic plant-based extracts and components. In March 2019, it also acquired Erich Ziegler, a German-based supplier of citrus components that provides compounds to the food, beverage, and flavor industries.

- The expanding cosmetic industry is set to propel growth in the thickeners market. With increased demand for thickening agents in cosmetics, the market is poised for significant expansion and development opportunities. For instance, China was the world's third-largest importer of cosmetics in 2021, with a total value of almost $ 18.5 billion, according to the World's Top Exporters. The next-largest importer of cosmetics in Asia-Pacific was Hong Kong, which imported skincare and cosmetics worth over $ 7.3 billion in 2021.

Key Sources Referred

- National Bureau of Statistics (NBS) of China

- IBEF

- International Labour Organization (ILO)

- World Paint & Coating Industry Association

- U.S. Census Bureau

- Ministry of Housing and Urban-Rural Development

- World's Top Exporters

- Ministry of Health and Family Welfare of India

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the thickeners market analysis from 2024 to 2031 to identify the prevailing thickeners market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the thickeners market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global thickeners market trends, key players, market segments, application areas, and market growth strategies.

Thickeners Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 5.7 Billion |

| Growth Rate | CAGR of 5.4% |

| Forecast period | 2024 - 2031 |

| Report Pages | 300 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Akzo Nobel N.V, CP Kelco U.S., Inc., DuPont , Dow Inc., Ashland Inc, BASF SE, Elementis plc, PPG Industries, Inc., The Lubrizol Corporation, Henkel Corporation |

The global thickeners market was valued at $3.8 billion in 2023, and is projected to reach $5.7 Billion by 2031, growing at a CAGR of 5.4% from 2024 to 2031

BASF SE, Ashland, CP Kelco U.S., Inc., DuPont, Dow, Akzo Nobel, The Lubrizol Corporation, Henkel Corporation, PPG Industries, Inc., Elementis are the top companies to hold the market share in Thickeners.

Growing consumer demand for natural and sustainable products and technological advancements and product innovations are the upcoming trends of Thickeners Market in the globe.

Asia-Pacific is the largest regional market for Thickeners.

Food and beverages is the leading application of Thickeners Market.

Loading Table Of Content...