Automotive TPMS Market 2022-2031:

The global tire pressure monitoring system market was valued at $5.32 billion in 2021, and is projected to reach $12.32 billion by 2031, growing at a CAGR of 8.6% from 2022 to 2031.

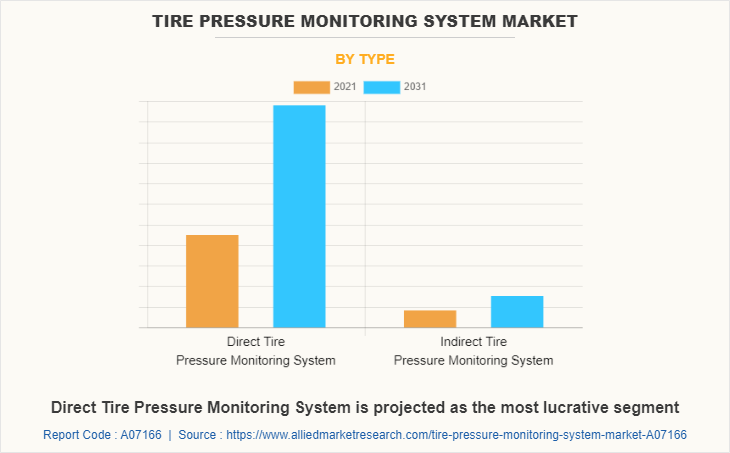

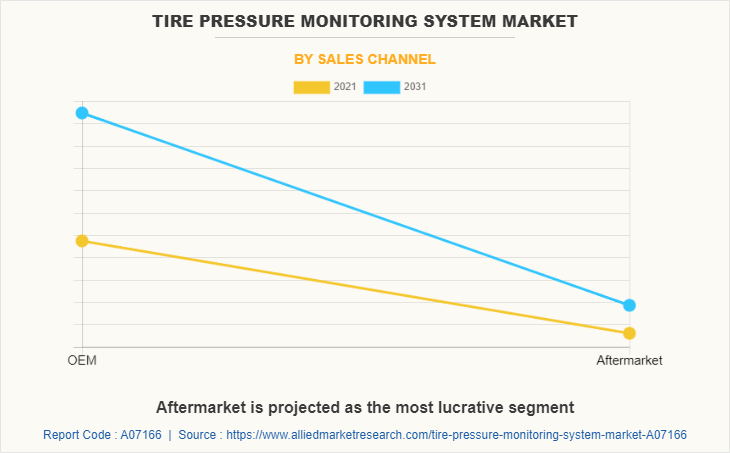

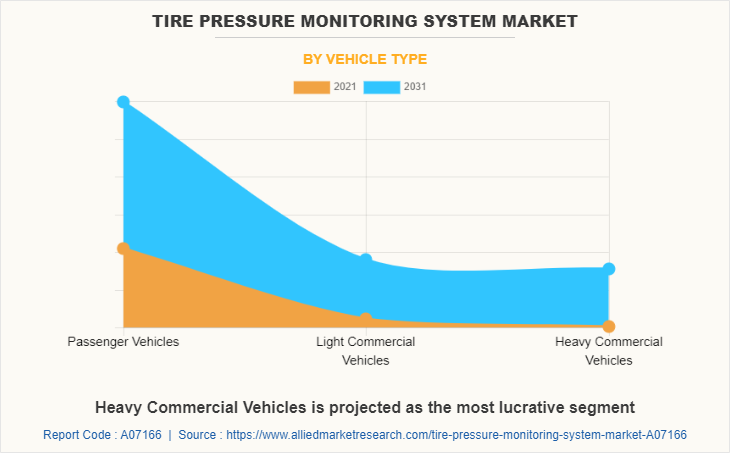

The tire pressure monitoring system market is segmented into Type, Sales Channel, Vehicle Type and Propulsion.

Tire pressure monitoring system (TPMS) is an electronic system used for monitoring the air pressure in tires. The purpose of the TPMS is to warn the driver in case of high or low tire pressure by illuminating light. The demand for tires that improve fuel efficiency has increased in the recent years. Thus, tire manufacturers have focused on upgrading the existing technologies to improve traction, safety, and mileage. It is crucial to maintain optimum pressure in tires for safe driving, optimal fuel efficiency, and maximizing tire life. TPMS helps to provide greater fuel economy, increases vehicle safety and overall reduces the CO2 emission. TPMS assists in measuring tire pressure and temperature. Moreover, it reduces rolling resistance and the overall weight of the tires.

Factors such as increase in demand for safety features, growth in implementation of electronic systems in vehicles, technological advancements related to tire pressure management are anticipated to boost growth of the global tire pressure monitoring system market during the forecast period. However, software failures associated with sensors, and high initial cost and complex structure are expected to hinder growth of the market during the forecast period. Moreover, integration of automatic tire inflation system with telematics, and rise in demand for comfort while driving is expected to create opportunities for the market growth in the future.

The tire pressure monitoring system market is segmented on the basis of type, sales channel, vehicle type, propulsion, and region. By type, it is divided into direct tire pressure monitoring system, and indirect tire pressure monitoring system. By sales channel, it is segmented into OEM, and aftermarket. By vehicle type, it is divided into passenger vehicles, light commercial vehicles, and heavy commercial vehicles. By propulsion, it is divided into ICE, electric &hybrid, and alternate fuel vehicle. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key players that operate in this automotive TPMS market include Continental AG, Delphi Technologies (BorgWarner Inc.), Denso Corporation, Hamaton Automotive Technology Co., Ltd., Hampton Auto Repair, Hitachi Astemo, Ltd., Huf Hülsbeck & Fürst GmbH & Co. KG, InnotechRV (WiPath Communications LLC.), NIRA Dynamics AB. Orange Electronic Co., Ltd., Pacific Industrial Co. Ltd., Renesas Electronics Corporation, Robert Bosch GmbH, Sensata Technologies Inc., The Goodyear Tire & Rubber Company, Valeo, and ZF Friedrichshafen AG.

Increase in demand for safety features

Road accidents are a major cause of death globally and tremendous increase in death rates, owing to road accidents has been observed in last few years. For instance, according to the World Health Organization report published in 2021, nearly 1.3 million people died in road traffic crashes each year. Moreover, road traffic injuries leading to death are higher among teenagers. These factors are leading to surge in demand for safety features in vehicles. Companies operating in the automobile sector are developing and introducing the safety features to meet needs of customers.

Demand for safety features, such as tire pressure monitoring system, parking assistance, collision avoidance systems, lane departure warnings, traction control, electronic stability control, tire pressure monitors, and airbags is experiencing an upward trend, owing to increase in number of road accidents worldwide. In addition, these systems ensure the safety and security of the vehicle as well as passengers on-board by creating an advanced alert related to the vehicle condition. Moreover, prominent players operating in the industry have developed advanced vehicle safety features, which include numerous subcomponents such as sensors and microcontrollers such as tire pressure sensors, which are intended to provide real-time information of the vehicle, thus ensuring safety of the vehicle. Moreover, increased government norms for inclusion of numerous safety features in vehicles creates a wider scope, thus supplementing the growth of the tire pressure monitoring system industry across the globe. For instance, in 2014, European Union (EU) has mandated the use of tire pressure monitoring system (TPMS) for all class M1 vehicles registered after 1st November 2014.

Technological advancements related to tire pressure management

Most manufacturing companies are using automation to increase productivity and profitability. The automotive tire industry is expected to witness growth as a result of rapid technological advancements in the associated component industry, such as the tire pressure monitoring system. In addition, major tire component manufacturers are employing nanotechnology and other innovations or software to create a variety of advanced tire sub systems. For instance, in September 2021, Hendrickson USA, LLC developed its existing tire pressure system with TIREMAAX PRO-LB that helps to eliminate the guesswork of tire pressure management by monitoring the pressure in air springs and reacting to changing loads automatically.

Moreover, in 2019, Bridgestone Corporation launched smart strain sensor technology, which is capable of estimating a wheel axle load & tire wear condition by using newly developed sensors attached inside tires to track tire inflation pressure & temperature and is able to measure the dynamic change in strain that occurs when a tire is in use. Moreover, the companies such as Bridgestone Corporation, Michelin, the Goodyear Tire & Rubber Company, and Continental AG are testing software platforms and Internet of Things (IoT)- connected sensors to monitor and evaluate tire quality as well as the pressure in the tire. Such developments carried out by leading companies are expected to offer remunerative opportunities for the growth of the market during the forecast period.

Software failures associated with sensors

The increasing installation of sensors and devices in vehicle has made the driving safer and convenient. Built-in computer systems and sensors provide a better driving experience, but if mismanaged or incorrectly updated, they can cause catastrophic accidents and injuries. Automotive software failure, depending on where and how it occurs, can place vehicle occupants in severe danger of catastrophic injury. Automotive software has evolved into complicated and sophisticated programs for operating advanced automobile technology and components such as camera systems, sensors, and others. As the automotive software gets intricate, the risk of failure increases. Many modern vehicles contain multiple electronic control units (ECUs) connected through network connections, most of which are required to perform essential safety systems such as tire pressure monitoring system, and others. The failure of the sensors and ECUs might result in accidents and injuries.

Moreover, accidents can occur when software malfunctions and essential vehicle systems cease operating. In addition, software bugs create misalignment or disruption in the automotive sensors' real-time environmental monitoring capability. The failure of automotive software and sensors has a negative effect on the performance of tire pressure monitoring system, limiting the growth of the tire pressure monitoring system market.

Integration of automatic tire inflation system with telematics

Telematics include advanced tracking devices and sensors installed in vehicles which send, receive, and store telemetry data of vehicular operations. It works on own onboard diagnostics systems (ODBI). ODBI decreases vehicle’s fuel consumption, improves safety, and reduces the possibility of cost manipulation by vehicle drivers due to the presence of on-board telematics system in vehicles. Moreover, in automotive automatic tire inflation system (ATIS) vehicle’s tires pressure is maintained according to the vehicle load & type, road surface, and variety & size of the tire.

Owing to such benefits automotive automatic tire inflation system (ATIS) is gaining high traction in the market, as it improves the performance of vehicle as well as ensures safety of the vehicle, thereby creating a positive impact on the growth of the market. Moreover, the integration of automatic tire inflation system with telematics makes air tire inflation system more reliable and advanced, as the system can perform automatically. The tire pressure monitoring system (TPMS) is an integral part of automotive automatic tire inflation system (ATIS). Using TPMS, the ATIS system continuously monitor tire pressure and maintain the tire pressure of the vehicle as per the desired conditions. Moreover, increase in concern over road safety and stringent regulations imposed by governments globally pertaining to the integration of automatic tire inflation systems in new vehicles is projected to open new avenues for the expansion of the automotive automatic tire inflation system market in the near future.

By Region

Europe would exhibit the highest CAGR of 9.5% during forecast period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the tire pressure monitoring system market analysis from 2021 to 2031 to identify the prevailing tire pressure monitoring system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the tire pressure monitoring system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global tire pressure monitoring system market trends, key players, market segments, application areas, and market growth strategies.

Tire Pressure Monitoring System Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Sales Channel |

|

| By Vehicle Type |

|

| By Propulsion |

|

| By Region |

|

| Key Market Players | Huf Hülsbeck & Fürst GmbH & Co. KG, Hitachi Automotive Ltd, Sensata Technologies Inc., ZF Friedrichshafen AG, Pacific Industrial Co. Ltd., Delphi Automotive LLP, DENSO CORPORATION, The Goodyear Tire & Rubber Company, CONTINENTAL AG, InnoTechRV, Orange Electronic Co., Ltd., Hampton Automotive Technology Co. Ltd, VALEO, ROBERT BOSCH GMBH, NIRA Dynamics AB, HAMATON, Renesas Electronics Corporation |

Analyst Review

The tire pressure monitoring system market is expected to witness significant growth, owing to stringent government regulations regarding safety and security such as compulsion for manufacturers to equip the vehicles with a TPMS are driving the growth of the market. Moreover, increase in demand for improved fuel economy and reduced CO2 emission among customers is expected fuel the demand for tire pressure monitoring system during the forecast period.

Factors such as increase in demand for safety features, growth in implementation of electronic systems in vehicles, and technological advancements related to tire pressure management are anticipated to boost growth of the global tire pressure monitoring system market during the forecast period. However, software failures associated with sensors, and high initial cost and complex structure are expected to hinder growth of the market during the forecast period. Moreover, integration of automatic tire inflation system with telematics, and rise in demand for comfort while driving is expected to create opportunities for the market growth in the future.

Moreover, to fulfil the changing demand scenarios, market participants are concentrating on product launch and product developments to offer a diverse range of products and meet new business opportunities. For instance, in May 2022, Continental AG launched new tire service tools for quick TPMS service and simple tire management. This new Touchscreen control developed for super-fast activation and relearning. Moreover, in November 2021, The Goodyear Tire & Rubber Company launched a user-friendly tire pressure monitoring system, ‘DrivePoint’. DrivePoint joins the existing TPMS and Drive-Over-Reader smart tire monitoring solutions within Goodyear’s Total Mobility.

In addition, market participants are continuously focusing on entering into agreements with other companies to match changing end-user requirements. For instance, in January 2022, The Goodyear Tire & Rubber Company signed an agreement with HERE Technologies, the leading location data and technology platform. Under this HERE Technologies are being integrated into the Goodyear Total Mobility one-stop fleet management solution. The one-stop fleet management solution combines data from Goodyear’s Tire Pressure Monitoring System (TPMS) with HERE location services.

Key players that operate in this market include Continental AG, Delphi Technologies (BorgWarner Inc.), Denso Corporation, Hamaton Automotive Technology Co., Ltd., Hampton Auto Repair, Hitachi Astemo, Ltd., Huf Hülsbeck & Fürst GmbH & Co. KG, InnotechRV (WiPath Communications LLC.), NIRA Dynamics AB. Orange Electronic Co., Ltd., Pacific Industrial Co. Ltd., Renesas Electronics Corporation, Robert Bosch GmbH, Sensata Technologies Inc., The Goodyear Tire & Rubber Company, Valeo, and ZF Friedrichshafen AG.

The global tire pressure monitoring system market was valued at $5.32 billion in 2021, and is projected to reach $12.32 billion by 2031, growing at a CAGR of 8.6% from 2022 to 2031.

Passenger vehicles is the leading segment of tire pressure monitoring system market

Integration of automatic tire inflation system with telematics and technological advancements related to tire pressure management is expected to drive the tire pressure monitoring system market during forecast period

Europe is the largest regional market for tire pressure monitoring system

Key players that operate in this automotive TPMS market include Continental AG, Delphi Technologies (BorgWarner Inc.), Denso Corporation, Hamaton Automotive Technology Co., Ltd., Hampton Auto Repair, Hitachi Astemo, Ltd., Huf Hülsbeck & Fürst GmbH & Co. KG, InnotechRV (WiPath Communications LLC.), NIRA Dynamics AB. Orange Electronic Co., Ltd., Pacific Industrial Co. Ltd., Renesas Electronics Corporation, Robert Bosch GmbH, Sensata Technologies Inc., The Goodyear Tire & Rubber Company, Valeo, and ZF Friedrichshafen AG

Loading Table Of Content...