Torpedo Market Research, 2032

The global torpedo market size was valued at $3.1 billion in 2022, and is projected to reach $6.3 billion by 2032, growing at a CAGR of 7.6% from 2023 to 2032. Torpedoes are undersea weapons that are launched from submarines, surface ships, or aircraft to target enemy vessels. The torpedo market is the global system for producing, purchasing, and trading torpedoes among countries, armed forces, and defense contractors.

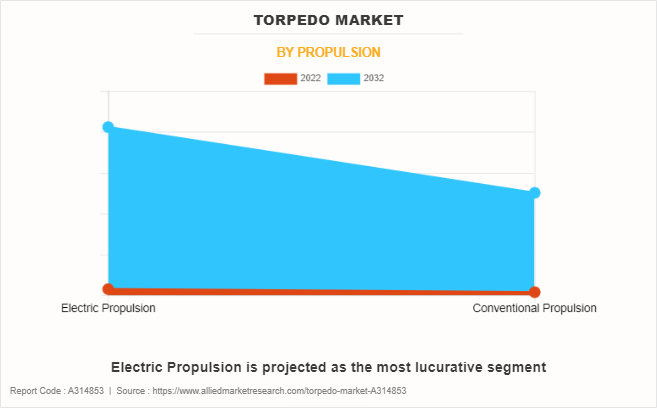

Furthermore, torpedoes are fitted with a motor or engine that gives them the required thrust to travel through water. Modern torpedoes are propelled either by electric batteries or by a combination of electric and thermal systems, although early torpedoes were frequently powered by compressed air engines.

Report Key Highlighters:

The torpedo market studies more than 16 countries. The research includes a segment analysis of each country in terms of value ($million) during the forecast period.

The research combined high-quality data, professional opinion, and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market and help stakeholders make educated decisions to achieve ambitious growth goals.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The key players in the market are ASELSAN A.S., Atlas Elektronik GmbH, BAE Systems, Bharat Dynamics Limited, Leonardo S.p.A., Naval Group, Northrop Grumman, Raytheon techmologies, Rosoboronexport, and Saab. Major strategies such as contracts, partnerships, product launches, and other strategies of players operating in the market are tracked and monitored.

Different types manufactures of torpedoes have different guidance systems. Certain torpedoes are wire-guided, which means they use a real wire to receive commands from the launching station. Others are guided autonomously or by sound, employing sensors to follow and focus on a target. Furthermore, torpedoes change their path, depth, and speed owing to control surfaces and other systems. This enables them to avoid countermeasures and navigate in the direction of the target.

Furthermore, major torpedo market players have undertaken various strategies to increase the competition and offer enhanced services to their customers. For instance, in November 2022, Northrop Grumman Systems won a $9 million deal for the manufacturing of the MK48 heavyweight torpedo.

Furthermore, in October 2021, the ministry of defense signed contracts worth $51.11 million with U.S. for procurement of MK 54 Torpedo and Expendable (Chaff and Flares) for the Indian Navy at a cost of 423 Crores. These weapons are the outfit of P-8I aircraft, which are used for long-range maritime surveillance, anti-submarine warfare, and anti-surface warfare (ASV).

For instance, in 2021, Thales Australia won a contract from the Australian Department of Defense to sustain the Royal Australian Navy’s (RAN) MU90 lightweight torpedo. Thales Australia is expected to continue to maintain the advanced anti-submarine torpedoes of RAN in Western Australia (WA) under the terms of the $14.5 million contract.

Factors such as rise in maritime border dispute among neighboring countries and rise in procurement of naval vessels owing to growing defense budget drive the torpedo market growth across the globe. However, rise in cyber-attacks & development of ballistic missiles in submarine and regulatory challenges concerns act as barriers for the growth of the market. Furthermore, rise in awareness in unmanned underwater vehicles, and collaboration & partnerships are expected to create ample opportunities for the growth of the market during the forecast period.

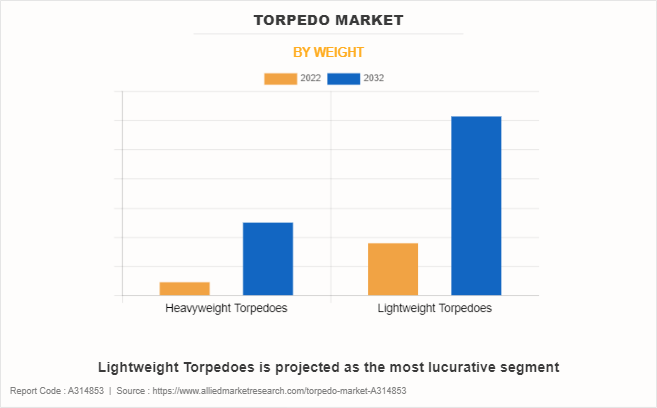

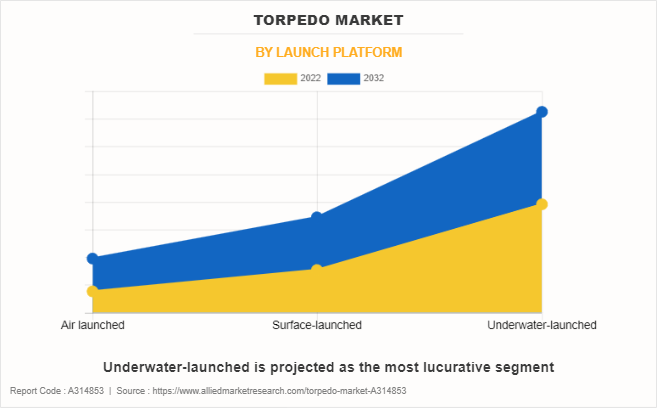

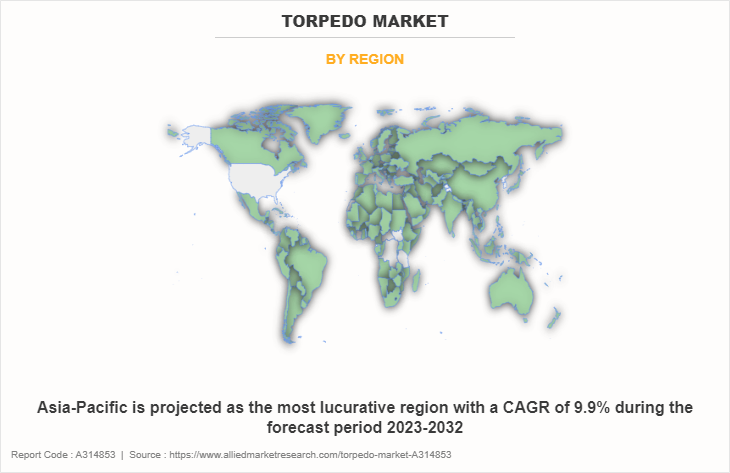

The torpedo market is segmented on the basis of weight, launch platform, propulsion, and region. By weight, it is divided into heavyweight torpedoes and lightweight torpedoes. By launch platform, the market is classified into air launched, surface-launched, and underwater-launched. By propulsion, it is bifurcated into electric propulsion and conventional propulsion. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The U.S. Department of Defense provides substantial money for the development, procurement, and retention of advanced military technologies, such as torpedoes, in North America, which has historically been a leader in defense spending. Furthermore, defense businesses in North America frequently form strategic relationships with foreign countries to facilitate the sale of military hardware, such as torpedoes. The global market for weaponry exports is heavily dominated by the U.S. in particular.

For instance, in April 2023, the U.S. Navy partnered with Australia for the cooperative development, production, and through-life support of replacement heavyweight torpedoes (HWT). This development program involves replacing the existing Mk 48 Mod 4 analog HWT with the digital Mk 48 Common Broadband Advanced Sonar System (CBASS) HWT (Mk 48 Mod 7 CBASS HWT).

For instance, in January 2023, Russia produced the first set of Poseidon nuclear-capable super torpedoes that have been developed for deployment on the Belgorod nuclear submarine.

Furthermore, the Russia is credited with developing the autonomous underwater vehicle (AUV) known as Poseidon. Its purpose is to create a nuclear-armed, long-range torpedo with the ability to carry both nuclear and conventional warheads. Poseidon torpedoes are anticipated to be carried by a number of platforms, including the special-purpose submarine Belgorod.

Rise In Maritime Border Dispute Among Neighboring Countries

A rise in maritime border disputes among neighboring countries is indeed a significant driver for the rising demand in the torpedo market. Torpedo systems are among the advanced naval capabilities that nations invest in as tensions in maritime boundary disputes rise to preserve their maritime interests and ward off potential threats.

Furthermore, monitoring and safeguarding large water areas are common tasks in maritime warfare. By offering the capacity to identify, follow, and efficiently counter threats, torpedo systems significantly contribute to the improvement of marine security.

For instance, in June 2023, the Indian Navy successfully carried out a test to hit an underwater target with an indigenously developed heavy-weight torpedo, which was a significant milestone in the Indian Navy's and the Defense Research and Development Organization's (DRDO).

Important sea lanes and vital waterways are at the center of many maritime disputes. Ensuring the safety of these crucial routes is crucial for both national security and trade. Systems of torpedoes is helpful in securing these vital sea routes.

Moreover, underwater warfare capabilities are given more attention in situations where maritime tensions are on the rise. An essential part of underwater warfare, torpedoes are used as a focal point in military plans to obtain the upper hand in contested waters.

Furhthermore, the perception of violence in maritime areas under dispute lead nations to increase their total defense readiness. In terms of both deterrent and real defense in the case of hostilities, torpedo systems strengthen a country's defense capabilities. Therefore, rise in maritime border dispute among neighboring countries has increased the demand in the torpedo market share.

Rise In Procurement Of Naval Vessels Owing To Growing Defense Budget

Rise in defense spending permits countries to modernize their fleets. A greater focus is placed on acquiring capable and cutting-edge military vessels, such as surface and submarines, as part of navy modernization plans. Torpedoes are a vital component of submarines' naval defense systems. Modern torpedo systems are frequently integrated into modern navy warships to enhance their offensive and defensive capabilities.

When it comes to a country's marine security and defense posture, torpedoes play a major role as deterrents. The objective of enhancing a nation's strategic capabilities and preserving a credible deterrence against possible enemies is congruent with the procurement of improved torpedoes. Moreover, underwater warfare requires torpedoes, and countries purchasing modern naval ships understand how critical it is to be ready for dangers beneath the surface. Protecting maritime interests and fighting submarines are two things that a navy does with the help of torpedo systems. Therefore, rise in procurement of naval vessels owing to growing defense budget drives the growth of the torpedo market trends.

Technological Advancement

The accuracy and precision of torpedoes have improved by developments in guiding and targeting systems. This is essential for decreasing the chance of collateral damage and attacking underwater targets successfully. Furthermore, advancements in technology have made it possible to create torpedoes that travel farther and faster.

Torpedoes become more efficient and adaptable as a result, enabling navies to engage targets at longer ranges and react swiftly to changing threats. Continuous advancements in stealth technology increase the efficacy of torpedoes in surprise assaults by making them harder to detect.

Torpedoes are better able to survive and complete missions when enemy defenses are circumvented due to developments in countermeasure technologies. Moreover, increased deployment and mission execution flexibility are made possible by the use of autonomous and unmanned technology into torpedo systems. Undersea warfare, reconnaissance, and surveillance are expanded when unmanned undersea vehicles (UUVs) are outfitted with torpedoes.

As sensor networks become more complex, torpedoes are incorporated more frequently to facilitate cooperative aiming and real-time data exchange. By this unification, naval forces are better able to respond to changes in the overall situation. Therefore, technological advancement is increasing the demand for torpedo market.

Rise in Cyber-Attacks and Development of Ballistic Missiles in Submarine

The rise in number of cyber-attacks and the development of ballistic missile capabilities in submarines indeed present challenges to the growth of the torpedo market. Furthermore, advanced computer systems and electronics are frequently seen in modern demand of torpedoes. The increase in sophistication and frequency of cyberattacks pose a threat to the security and functionality of these systems. Purchasers hesitate due to worries about how susceptible torpedo systems are to cyberattacks.

Target acquisition and mission execution for torpedoes depend on data communication and networking, particularly in highly developed naval forces. Cyberattacks directed at such communication systems have the potential to jeopardize data integrity, which could impact torpedo mission accuracy and success.

Furthermore, the acquisition of ballistic missile capabilities by submarines cause defense spending and priorities to change. It is possible to argue that having ballistic missiles on a submarine makes it more significant strategically and adaptable, which might reduce funds allocated for developing and acquiring torpedo systems.

Naval tactics change to favor other weapons over conventional torpedoes if submarines acquire a wider range of capabilities, such as ballistic missiles, anti-ship missiles, and other cutting-edge armaments. This might influence torpedo system demand. Therefore, rise in cyber-attacks and development of ballistic missiles in submarines hamper the growth of the market.

Regulatory Challenges

The development, transfer, and sale of torpedo technology are prohibited by severe international arms control agreements and treaties. Manufacturers of torpedoes find their market access restricted by compliance with these agreements, especially when it comes to exporting to specific nations or areas.

Furthermore, defense technologies, such as torpedoes, are subject to stringent export control laws in many nations. Manufacturers of torpedoes find it difficult and time-consuming to comply with export control legislation and obtain export licenses, which might hinder their ability to grow their business internationally.

Restrictions on the export of critical military technologies, such as torpedo systems, are enforced by certain governments. This impedes the ability of manufacturers to share technology and take part in cooperative defense projects, obstructing international collaboration and joint ventures.

Furthermore, transfer of critical military technologies, such as torpedo systems, is restricted by certain nations. Manufacturers find it more difficult to exchange technology and take part in cooperative defense initiatives as a result, which impedes international collaboration and joint ventures. Therefore, regulatory challenges hamper the growth of the torpedo market analysis.

The Rise in Interest in Unmanned Underwater Vehicles

To improve their capabilities, unmanned underwater vehicles (UUVs) are fitted with torpedoes. UUVs equipped with torpedoes are employed for a variety of tasks, such as anti-submarine warfare, mine countermeasures, observation, and reconnaissance. This integration increases the number of applications for torpedoes and gives underwater combat a new facet.

Furthermore, the need for torpedoes designed specifically for unmanned systems arise from the deployment of UUVs in various military and defense applications. It might be necessary to modify these torpedoes to meet the UUVs' dimensions, weight, and operating requirements.

Torpedo equipped UUVs provide a flexible and stealthy way to do underwater missions. Defense forces involved in a range of marine operations, such as intelligence gathering, asset protection, and surveillance, find this adaptability useful. In observation and reconnaissance missions, torpedoes that are fitted inside UUVs are quite useful. Without endangering human operators, they are utilized for surveillance of maritime borders, intelligence gathering, and underwater patrols.

Torpedo-equipped UUVs are utilized for stealthy operations, giving them a tactical edge in underwater situations. The reach of naval forces has increased, and the element of surprise is enhanced by the capability to launch torpedoes from unmanned vehicles. The rise in awareness of unmanned underwater vehicles offers ample opportunities for torpedo market growth.

Impact of Russia-Ukraine War on Torpedo Industry

Russia and Ukraine frequently spend more on defense to strengthen their armed forces during times of war. This might result in more defense systems, such as torpedoes, being purchased. Furthermore, changes in the geopolitical landscape has resulted in changes to international alliances and partnerships. Other countries may now look for new suppliers or work with other defense contractors, which could have an impact on the dynamics of the torpedo market.

The development of military technology is influenced by intense conflict between Russia and Ukraine. Governments might spend money on R&D to create new, advanced technologies or to enhance torpedo systems that are already in place. In addition, participating countries are subject to export and import restrictions or sanctions over military hardware, including torpedoes. This could have an effect on the global supply chain as well as market dynamics.

Furthermore, uncertainty surrounding the conflict between Russia and Ukraine leads to market volatility. A cautious response from investors and defense contractors affect market dynamics and investment decisions.

Recent Developments in the Torpedo Industry

In September 2023, BAE systems collaborated with Malloy Aeronautics, and successfully demonstrated the launch of an inert sting ray torpedo from a heavy-lift unmanned aerial system (UAS) during the NATO repmus exercise.

In October 2023, the Royal Australian Navy officially opened its new torpedo training facility at Her Majesty's Australian ship (HMAS) Stirling in western Australia. This state-of-the-art facility is expected to provide advanced training for naval personnel on the operation and maintenance of torpedoes.

In May 2020, the Northrop Grumman’s recently unveiled, very lightweight Torpedo could be air-launchable on several U.S. Navy aircraft. Northrop Grumman recently manufactured and tested its first prototype of the very lightweight torpedo for the United State Navy (USN).

In October 2022, the Saab AB has made the first deliveries of the new lightweight torpedo (Saab Lightweight Torpedo) to Sweden’s defense procurement agency, fair market value (FMV). The torpedo is intended primarily for Swedish submarines and Visby corvettes; however, it is prepared for integration with helicopters. FMV is now undertaking final verification of the torpedo system to ensure it meets their requirements before commissioning with the Royal Swedish Navy.

Key Benefits For Stakeholders

This study presents the analytical depiction of the global torpedo market analysis along with the current trends and future estimations to depict imminent investment pockets.

The overall torpedo opportunity is determined by understanding profitable trends to gain a stronger foothold.

The report presents information related to the key drivers, restraints, and opportunities of the global torpedo with a detailed impact analysis.

The current torpedo is quantitatively analyzed from 2022 to 2032 to benchmark financial competency.

Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Torpedo Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 6.3 billion |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Weight |

|

| By Launch platform |

|

| By Propulsion |

|

| By Region |

|

| Key Market Players | Saab, Bharat Dynamics Limited, Leonardo S.p.A., Naval Group, Atlas Elektronik GmbH, Raytheon techmologies, Rosoboronexport, Northrop Grumman, ASELSAN A.?., BAE Systems |

The global torpedo market size was valued at $3.1 billion in 2022, and is projected to reach $6.3 billion by 2032, growing at a CAGR of 7.6% from 2023 to 2032.

The global torpedo market is to grow at a CAGR of 7.6% from 2023 to 2032.

Key players operating in the global torpedo market include ASELSAN A.?., Atlas Elektronik GmbH, BAE Systems, Bharat Dynamics Limited, Leonardo S.p.A., Naval Group, Northrop Grumman, Raytheon techmologies, Rosoboronexport, and Saab.

North America is the largest regional market for Torpedo.

Factors such as rise in maritime border dispute among neighboring countries and rise in procurement of naval vessels owing to growing defense budget drive the torpedo market growth across the globe.

Loading Table Of Content...

Loading Research Methodology...