Global Tower Crane Market Outlook-2028

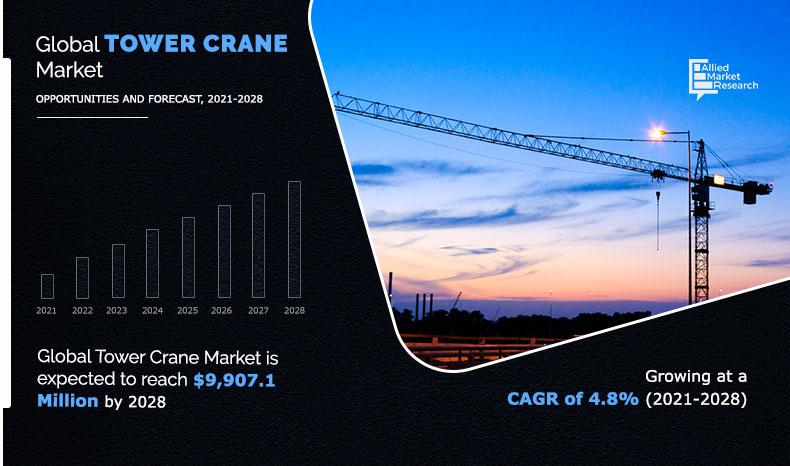

The global tower crane market size is expected to reach $9,907.1 million in 2028, from $6,683.2 million in 2020, growing at a CAGR of 4.8% from 2021 to 2028. Tower cranes are utilized for lifting and handling goods and materials. They are powerful equipment and can easily surpass lifting capabilities of any other type of crane. In addition, it offers extremely high lifting capability and offers peak efficiency, stability, and precision.

Moreover, tower cranes are widely utilized in the construction industry owing to the high demand for material handling on elevated levels. However, they also find applications in construction of structures such as dams, bridges, industries, power generation plants, and others. Further, tower cranes were first introduced by the company Liebherr-International Deutschland GmbH, headquartered in Germany in 1949, and witness a high demand in the global tower crane construction industry.

The surge in urbanization is a major factor influencing the demand for tower cranes in developing nations such as India, Vietnam, Brazil, and others. The surge in necessity for housing especially in urban areas has influenced the construction of high-rise structures which require lifting and handling of building materials and components at elevated heights. Tower cranes are mostly static in nature and thus, offer a stable and safe operating platform for lifting of heavy material. In addition, this also improves the efficiency of lifting in congested urban areas where the movement of lifting equipment is restrained due to the closely spaced building. Thus, surge in urbanization drives the growth of the tower crane market.

By Type

Self Erecting segment is projected to grow at a significant CAGR

Moreover, tower cranes are efficient for operations in rough and uneven terrains owing to the fixed foundation of these cranes. The fixed nature of tower cranes improves the stability offered by the equipment thereby, making them efficient in construction of bridges, railway lines, dams, and others. In addition, tower cranes are also helpful in lifting prefabricated components of bridges and other infrastructural structures, which is expected to drive the growth of the tower crane market.

However, the high cost of tower cranes is one the influential restraining factor for the growth of the tower crane market. The fixed nature of tower cranes makes it expensive for operating and assembling, which surges the overall costs incurred while using tower cranes. Further, the growing popularity of mobile cranes and mobile crane rentals is expected to hinder the demand for tower cranes. In addition, the COVID-19 pandemic has shut-down the production and sales of various products in the tower cranes, mainly owing to the prolonged lockdown in major global countries including the U.S., Italy, the UK, and others. This has hampered the growth of the tower crane market significantly within the last few months, and is likely to continue during 2020. Moreover, the lockdowns have also led to a halt in construction activities, thereby hampering the demand for tower cranes during 2020.

By Lifting Capacity

Less than 5 ton segment is projected to grow at a significant CAGR

On the contrary, autonomous and automated crane systems allow remote access to the machines that operate without human drivers. The rise in adoption of remotely operated equipment also reduces the risk of accidents and fatalities, which is anticipated to drive the growth of the tower crane market in near future.

The tower crane market is segmented on the basis of type, lifting capacity, application, and region. By type, it is classified into self-erecting, luffing jib, hammer head, and flat top. By lifting capacity, it is categorized into less than 5 ton, 6 to 10 ton, and more than 10 ton. By end user industry, it is divided into building construction, infrastructural construction, energy, and others. By region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Italy, and rest of Europe), Asia-Pacific (China, India, Japan, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). Asia-Pacific is expected to hold the largest market share throughout the study period, and LAMEA is expected to grow at the fastest rate.

By End-user Industry

Building Construction segment holds dominant position in 2020

Competition Analysis

The key market players profiled in the report include Action Construction Equipment Ltd., ENG CRANES Srl, JASO Tower Cranes, Liebherr-International AG, Manitowoc Company, Inc., SANY Global, Sarens n.v./s.a., Terex Corporation, WOLFFKRAN International AG, and Zoomlion Heavy Industry Science & Technology Co., Ltd.

Many competitors in the tower crane market adopted business expansion as their key developmental strategy to expand their production capacities and upgrade their product technologies. For instance, in January 2019, Zoomlion Heavy Industry Science & Technology Co., Ltd. based in China, opened an intelligent production plant for tower cranes in Changde, China. The production plant is claimed to be the world’s largest intelligent factory which required three years for construction and represented an investment of $115.4 million. It features Industry 4.0 standards and includes 12 automatic production lines, 100 industrial robots, more than 1,000 sensors, and other advanced equipment. The establishment of the manufacturing unit has enabled Zoomlion to garner an impressive global tower crane market share. Similarly, players in the global tower crane market are also adopting product launch as their key development strategies to offer a wide range of tower crane products. For instance, in February 2020, the U.S. based company Manitowoc, through its brand Potain, launched the MHR 175 tower crane at the CONEXPO 2020 trade show held in the U.S. The MRH 175 has hydraulic luffing technology, which eliminates the need of wire rope installation.

By Region

Asia-Pacific holds a dominant position in 2020 and LAMEA is expected to grow at a highest rate during the forecast period.

Key Benefits For Stakeholders

- The report provides an extensive analysis of the current and emerging global tower crane market trends and dynamics.

- In-depth tower crane market analysis is conducted by constructing market estimations for the key market segments between 2019 and 2027.

- Extensive analysis of the market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive tower crane market opportunity analysis of all the countries is also provided in the report.

- The global tower crane market forecast analysis from 2020 to 2027 is included in the report.

- The key players within the market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the industry.

Global Tower Crane Market Segments

By Type

- Self-erecting

- Luffing Jib

- Hammer Head

- Flat Top

By Lifting Capacity

- Less than 5 ton

- 6 to 10 ton

- More than 10 ton

By End User Industry

- Building Construction

- Infrastructural Construction

- Energy

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

Key Players

- Action Construction Equipment Ltd.

- ENG CRANES Srl

- JASO Tower Cranes

- Liebherr-International AG

- Manitowoc Company, Inc.

- SANY Global

- Sarens n.v./s.a.

- Terex Corporation

- XCMG

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

Tower Crane Market Report Highlights

| Aspects | Details |

| By TYPE |

|

| By LIFTING CAPACITY |

|

| By END-USER INDUSTRY |

|

| By Region |

|

| Key Market Players | Zoomlion Heavy Industry Science & Technology Co. Ltd., TEREX CORPORATION, WOLFFKRAN International AG, Action Construction Equipment Ltd., Manitowoc Company Inc., Liebherr International S.A., Jaso Equipos De Obras Y Construcciones, S.L., SANY Group, ENG Cranes Srl, Sarens Bestuur NV |

Analyst Review

China has emerged as the largest manufacturing hub for tower cranes with a highly fragmented market. The country plans various technological development programs to boost the sales of domestically produced tower cranes globally through the one belt, one road initiative, and ‘Made in China 2025’ initiatives.

Moreover, the overall decline in infrastructure activities in developed nations such as the U.S., Germany, the UK, and others has influenced the growth of the tower crane market in these countries. However, the emergence of manufacturing and surge in demand from China has driven the growth of the tower crane market in 2019 and 2020. Chinese manufacturing companies such as Zoomlion, Sany Global, and others have gained a significant share in the tower crane market during this period.

Further, the companies Liebherr International headquartered in Germany, and Manitowoc (Potain) based in the U.S., are the largest tower crane manufacturers outside China. Liebherr’s tower crane sales reached $612.3 million in 2019 whereas, the sales declined significantly in 2020 owing to the COVID-19 pandemic. On the contrary, the Chinese firm Zoomlion witnessed a significant surge in tower crane sales from 2019 to 2020. This is mainly due to high investment toward adoption of new technologies in manufacturing and tower crane products. For instance, Zoomlion Heavy Industry Science & Technology Co., Ltd. opened the world’s largest intelligent factory for tower crane production, in January 2019. It invested around $115.4 million for the construction of the production plant, which required three years for completion. The intelligent production plant complies to German ‘Industry 4.0’ standards, and includes 100 industrial robots, 12 automatic production lines, more than 1,000 sensors, and other advanced technologies. Establishment of the production plant helped the company to garner a significant share in the global tower crane market, globally.

The global tower crane market size was $6,683.2 million in 2020 and is projected to reach $9,907.1 million in 2028, growing at a CAGR of 4.8% from 2021 to 2028.

The forecast period considered for the global tower crane market is 2021 to 2028, wherein, 2020 is the base year, 2021 is the estimated year, and 2028 is the forecast year.

The base year considered in the global tower crane market is 2020.

No, the report does not provide Value Chain Analysis for the global tower crane market. However, it provides market share analysis for the top players in the tower crane market.

On the basis of type, the hammer head segment is expected to be the most influencing segment growing in the global tower crane market report.

Based on the end-user industry, in 2020, the building construction segment generated the highest revenue, accounting for 45.7% of the market and is projected to grow at a CAGR of 4.4% from 2020 to 2027.

The report contains an exclusive company profile section, where leading 10 companies in the market are profiled. These profiles typically covers company overview, geographical presence, and market dominance (in terms of revenue and volume sales).

The market value of global tower crane market is $7,137 million in 2021. COVID Banner Statement: The COVID-19 pandemic has hindered the demand for tower cranes in North America and Europe, however, China exhibited significant growth in demand during the outbreak of COVID-19 pandemic.

Loading Table Of Content...