The global truck suspension system market size was valued at $21.9 billion in 2022, and is projected to reach $32.9 billion by 2032, growing at a CAGR of 4.2% from 2023 to 2032.

Report Key Highlights:

- The report covers a detailed analysis on truck suspension system used in the transportation industry.

- The truck suspension market has been analyzed from the year 2022 till the year 2032.

- Latest developments have been mentioned in the research study.

- Top companies operating in the industry have been profiled in the research study.

- The research study includes different segments & regions across which the market has been analyzed.

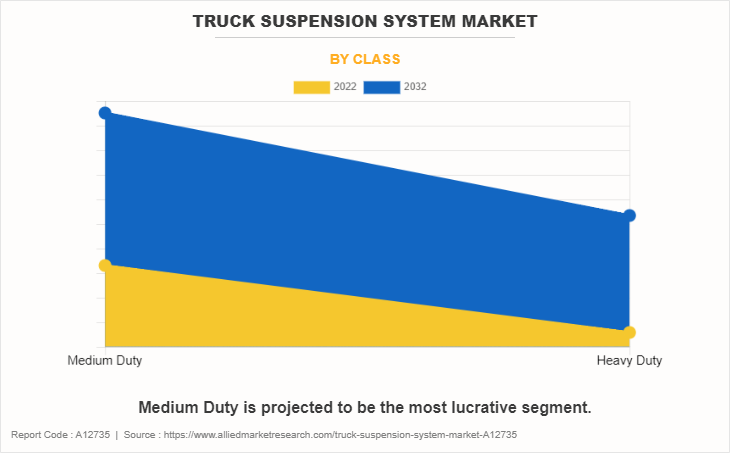

Truck suspension systems are a system that helps trucks to support their weight and offer a comfortable ride, the suspension system helps in overall weight distribution among the wheels of the vehicle, thus improving the handling of the vehicles. Similarly, the truck suspension also provides stability to trucks carrying heavy loads during long-haul journeys. The trucks considered in the research study are medium-duty and heavy-duty trucks from class 4- class 8.

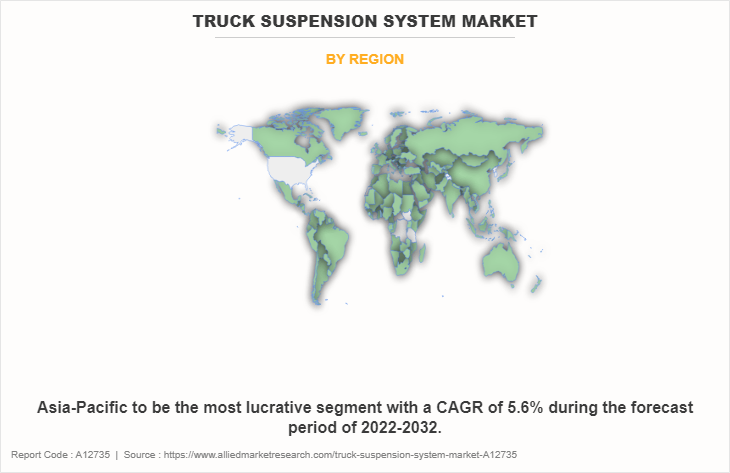

The market for truck suspension systems industry is growing due to increasing demand for comfort and safety from the logistics industry. Also, the increase in the production of trucks worldwide is driving the market demand. As of now, a major portion of trucks are located in the Asia-Pacific region. However, a significant portion of these trucks are of older generation and need specific upgrades, including newer suspension systems. In order to tackle the issue, the government in the region have started implementing strict rules and regulation for promoting efficient transportation and reducing emission from the logistics sector.

For instance, in April 2020, India Introduced BS6 norms, which outline a permissible level of pollutants from a vehicle, especially from a vehicle using diesel and petrol as fuel. In addition, the country also introduced a vehicle scrapping policy that outlines that older commercial vehicles need to be re-registered after 15 years; if the vehicles are found unfit, they are expected to be scrapped. Many other countries, such as Indonesia and Vietnam, have implemented new rules and regulations that are positively promoting fleet modernization. Similarly, companies operating in the market are collaborating to develop solutions for heavy-duty trucking applications. For instance, on November 10, 2023, Meritor, Inc announced a collaboration with ConMet, the collaboration aims towards the development of purpose-built trailer suspensions and brakes, as well as tire inflation systems. The company will also jointly evaluate the application of industry leading, complementary advanced technologies that address evolving e-mobility market trends.

The truck suspension system market is segmented into Class, Sales Channel and Type.

Factors such as fleet modernization and increasing demand for comfort and safety, growth of the logistics industry, and rise in production and sales of trucks and commercial vehicles. However, a lack of standardization is hampering the growth of the market. Furthermore, increase in demand for lightweight suspension systems and reduced maintenance costs are expected to create a market opportunity for players operating in the market.

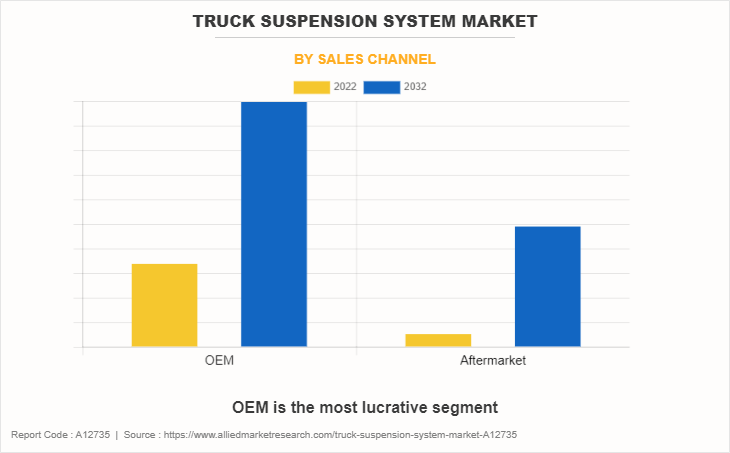

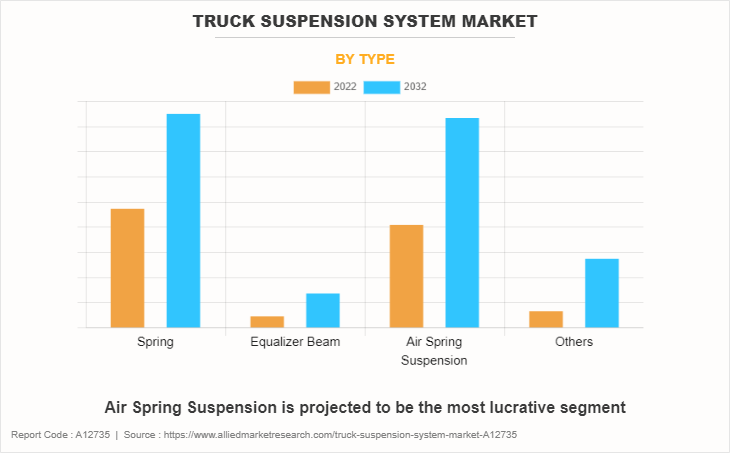

The global Truck Suspension System market is segmented on the basis of class, sales channel, type, and region. By class, the market is divided into medium class and heavy class. By sales channel, the market is fragmented into OEM and aftermarket. By type, it is categorized into spring, equalizer beam, air-spring suspension, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key manufacturers in the truck suspension system market are Link Manufacturing, Ltd, VDL Groep BV., Continental AG, ZF Friedrichshafen AG, simard suspensions, Sogefi SpA, Meritor, Inc, SAF-HOLLAND SE, Hendrickson and NHK SPRING Co.,Ltd.

Growth of the logistics industry

In recent years, the increase in the import and export of commodities between countries has created increased demand for logistics operations. For instance, in recent decades, Malaysia has witnessed increased growth in its electronics, photovoltaics, automobile defense, and chemical oil and gas and agriculture-related industries.

Since the country became independent in 1967, the country has developed itself from an agricultural economy to one of the major superpowers in Southeast Asia and at a global level. The country has also experienced increased need for logistics to support its economy, over the years the country developed over 2,000 km of rail, over 200,000 km of roads, 18 ports, and 22 airports. The country also passed important laws, like the National Transport Policy (NTP) 2019–2030, the Third Industrial Masterplan (IMP3), and the Logistics and Trade Facilitation Masterplan. These laws are meant to improve the ecosystem and help the logistics industry become more competitive and productive.

Globalization and increased tend toward e-commerce have led to increased demand for courier and parcel services other countries around the world are also experiencing increased economic activities creating an increased need for logistics further helping create demand for truck suspension system market.

Rise in production and sales of trucks and commercial vehicles.

In recent years, in developing countries, specifically from the Asia-Pacific region, such as China, India, Bangladesh, the Philippines, and Vietnam, are experiencing increasing demand for trucks and other commercial vehicles, mainly due to increased industrialization and increased economic activity in the region. Increasing industrialization activity has resulted in increased import/export activities from the country, thus the increased trade activity increased the demand for trucks.

According to NITI (National Institute for Transforming India), Aayog, an advisory board by the Government of India, which looks after promoting the social and economic development of the country, estimated that India transports ~4.6 billion tonnes of freight annually through roadways which is forecast to double in coming years. This increase in the demand for cargo is predicted to create more demand for trucks in the forecast period, positively driving the demand for truck suspension systems.

Lack of standardization

Lack of standardization is the major restrain hampering the growth of truck suspension system market share. Major players operating in the market produce suspension systems specifically developed for certain truck models and brands. This results in a limited number of manufacturers developing components for aftermarket or service use. Likewise, lack of standardization also leads to repair and maintenance issues as a truck owner needs to be dependent on authorized service providers to get replacement parts.

Similarly, due to the high cost associated with OEM components, truck owners tend to use aftermarket components, which are cheaper and more readily available in the market, this leads to increased security concerns as component failure can result in accidental situations.

Increasing demand for lightweight suspension system

An old-generation suspension system can contribute approximately to one-fifth of the overall vehicle weight, as they utilize traditional materials such as iron and steel. Moreover, they are not efficiently designed for weight reduction. However, as technology is developing, there is an increased emphasis on lightweight suspension systems, which can help in weight reduction, improved performance, and increased fuel efficiency in trucks.

Major companies operating in the market are continuously modifying their product range to develop lighter designs and more efficient suspension systems; the companies are also utilizing lighter composite materials such as aluminum, carbon fibers, and hybrid composites; these materials are also modified to enhance their strength and make their corrosion resistance to enhance the overall life of the suspension system.

Recent Developments in Automotive Suspension System Industry

On July 5 2023, ZF Friedrichshafen AG collaborated with Volta Trucks in developing the mobility of the next generation and to assist the industry in its transition toward zero emissions and zero accidents. The alliance will enable ZF Friedrichshafen AG to provide key components including braking, suspension, and steering systems to Volta Trucks, this will allow Volta Trucks reduce R&D costs and shorten the time-to-market.

On June 14, 2023 SAF-HOLLAND SE announced the expansion of its Midland Aftermarket brand to meet the growing industry demand, the expansion will enable SAF-HOLLAND to further increase its reach in the market and position its brand image. As part of the expansion, new product lines will be introduced, which will utilize recent technology developments and current industry trends.

On 1 April, 2023 Hendrickson announced its partnership with Freightliner Trucks a Portland, Oregon-based truck manufacturing company. As a part of the partnership, Hendrickson will offer its next generation of heavy-duty rubber suspension systems as a part of the Freightliner Trucks chassis enhancement program for its vocational M2, SD, and Plus models. The HAULMAAX EX suspension is equipped with equalizing beams that distribute the load evenly between both axles. This helps the vehicle to maintain traction, thus offering the flexibility required for trucks that are used both on and off the road.

On May 9, 2022 Hendrickson announced the launch of a new product range specifically targeting the growing electric vehicle segment. As a part of the launch, the company announced SOFTEK, a front steer axle and suspension system integrated with the front mechanical spring suspension and lightweight clamp group, providing enhanced ride quality and weight-saving. The new suspension system can be integrated with the medium-duty electric vehicle segment.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the truck suspension system market analysis from 2022 to 2032 to identify the prevailing truck suspension system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the truck suspension system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global truck suspension system market trends, key players, market segments, application areas, and market growth strategies.

Truck Suspension System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 32.9 billion |

| Growth Rate | CAGR of 4.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 234 |

| By Class |

|

| By Sales Channel |

|

| By Type |

|

| By Region |

|

| Key Market Players | VDL Groep BV., Continental AG, Hendrickson, SAF-HOLLAND SE, ZF Friedrichshafen AG, NHK SPRING Co.,Ltd, Link Manufacturing, Ltd, Meritor, Inc, Simard Suspensions, Sogefi SpA |

Analyst Review

According to leading CXOs, the global truck suspension system market is expected to witness significant demand in the coming years due to the growth of the logistics industry and the rise in production and sales of trucks and commercial vehicles. Similarly, fleet modernization and increasing demand for comfort and safety will play an important role in driving the market demand.

The truck suspension system market is projected to grow due to increasing demand for lightweight and efficient suspension systems in the logistics industry. The market in the developing region, specifically in Asia-Pacific, is expected to grow at a faster rate as compared to other developed markets such as North America and Europe. This is due to increased demand for modern truck suspension systems and the growth of the logistics industry in the region.

Development of lightweight air suspension system are the upcoming trend in the truck suspension market

Increasing comfort and safety of the trucks are the major application of the truck suspension system

Asia-Pacific is the largest regional market for truck suspension system

The truck suspension system market accounted for $ 21,856.4 million in 2022.

ZF Friedrichshafen AG, SAF-HOLLAND SE and Hendrickson are the major companies operating in the market

Loading Table Of Content...

Loading Research Methodology...