U.S. Automotive Composites Market Research, 2033

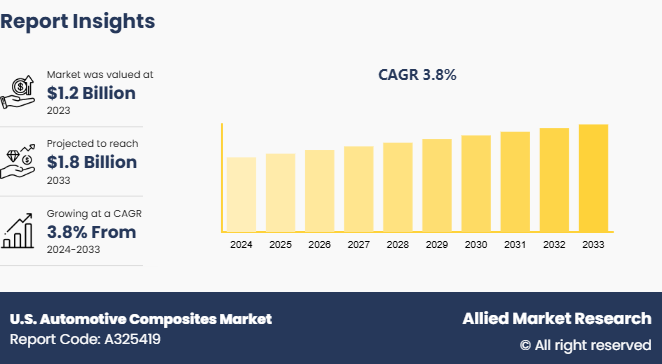

The U.S. automotive composites market was valued at $1.2 billion in 2023, and is projected to reach $1.8 billion by 2033, growing at a CAGR of 3.8% from 2024 to 2033.

Market Introduction and Definition

Automotive composites refer to advanced materials made from a combination of two or more distinct substances that work together to enhance performance, reduce weight, and improve the overall efficiency of vehicles. It is composed of a polymer matrix reinforced with fibers such as carbon, glass, or aramid. These composites offer exceptional strength-to-weight ratios, corrosion resistance, and design flexibility. As automakers increasingly seek ways to enhance fuel efficiency and reduce greenhouse gas emissions, automotive composites have gained traction in various applications, including body panels, interior components, and structural parts. Their ability to deliver high performance while minimizing weight makes them an essential material in the development of modern vehicles.

Key Takeaways

- The U.S. automotive composites market study includes a segment analysis in terms of value for the projected period.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major U.S. automotive composites industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

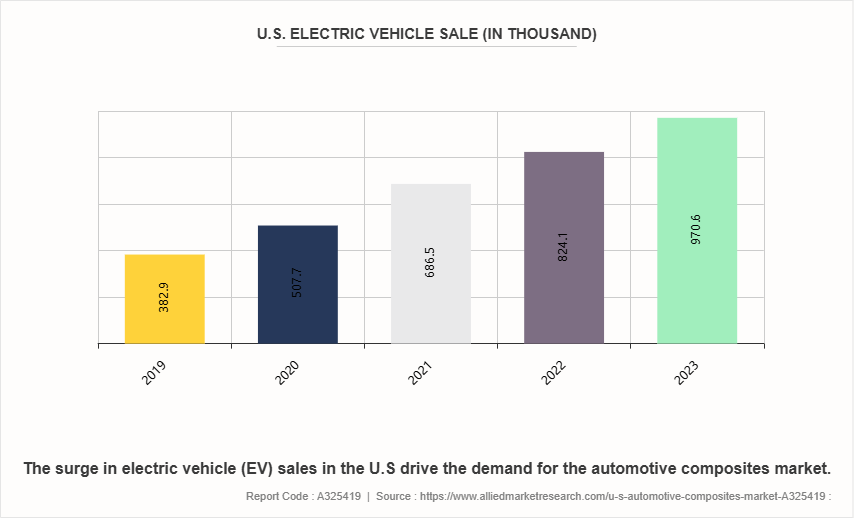

The growing adoption of electric vehicles (EVs) in the U.S. is a significant driving force behind the increasing demand for automotive composites. As automakers shift their focus toward electric mobility, the need for lightweight materials becomes more pronounced. EVs are inherently heavier than traditional internal combustion engine vehicles due to the weight of their battery systems. To counterbalance this additional weight and enhance energy efficiency, manufacturers are turning to automotive composites, which offer superior strength-to-weight ratios compared to conventional materials like steel and aluminum. By incorporating these advanced composites into vehicle structures, manufacturers can improve the overall performance, range, and handling of EVs while maintaining structural integrity. All these factors are expected to drive the growth of the U.S. automotive composites market during the forecast period.

However, the high cost of raw materials significantly hampers the growth of automotive composites in the U.S. market, presenting a considerable challenge for manufacturers aiming to integrate these advanced materials into vehicle production. Composites rely on specialized fibers such as carbon and glass, as well as advanced resin systems, which are expensive to source and process. Fluctuations in the prices of these raw materials, influenced by global supply chain disruptions, geopolitical tensions, and market demand lead to increased production costs. As a result, automakers hesitate to adopt composites widely, especially in a competitive market where price sensitivity is crucial. All these factors hamper the growth of the U.S. automotive composites market.

The rise of sustainable and recyclable automotive materials is creating new opportunities for the automotive composites market in the U.S. As environmental concerns become increasingly central to consumer preferences and regulatory frameworks, automakers are seeking materials that enhance vehicle performance and minimize their ecological footprint. Automotive composites, which are designed with sustainable practices in mind, offer a compelling solution. Many of these materials are derived from renewable sources or are engineered to be recyclable at the end of their lifecycle, aligning with the industry's shift toward circular economy principles. All these factors are anticipated to offer new growth opportunities for the U.S. automotive composites market during the forecast period.

Market Segmentation

The U.S. automotive composites market is segmented into fiber type, resin type, and application. By fiber type, the market is classified into glass fiber, carbon fiber, and others. By resin type, the market is divided into thermosets and thermoplastics. By application, the market is categorized into exterior, interior, and others.

Electric Vehicle Sale in U.S.

The surge in electric vehicle (EV) sales in the U.S. from 382.9 thousand units in 2019 to an estimated 970.6 thousand units in 2023 has profound implications for the automotive composites market. This growth in EV adoption underscores a shifting consumer preference towards electric mobility, driven by factors such as environmental awareness, government incentives, and advancements in battery technology. As EV manufacturers strive to improve vehicle performance, efficiency, and range, the demand for lightweight materials becomes critical. Automotive composites, known for their excellent strength-to-weight ratios, play an essential role in achieving these objectives. The increased sales of EVs create a burgeoning market for composites as automakers seek to reduce vehicle weight and enhance energy efficiency, leading to extended battery life and improved driving range.

Competitive Landscape

The major players operating in the U.S. automotive composites market include Toray Industries, Inc, Hexcel Corporation, Teijin Limited, Mitsubishi Chemical Corporation, Owens Corning, Huntsman Corporation, Solvay S.A., Magna International Inc, Plasan Carbon Composite, and A. Schulman, Inc.

Key Sources Referred

- International Trade Administration

- American Automotive Policy Council

- The United States Council for Automotive Research

- Alliance for Automotive Innovation

- American Composites Manufacturers Association

Key Benefits for Stakeholders

- Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

- Analyze the key strategies adopted by major market players in U.S. automotive composites market.

- Assess and rank the top factors that are expected to affect the growth of U.S. automotive composites market.

- Top Player positioning provides a clear understanding of the present position of market players.

- Detailed analysis of the U.S. automotive composites market segmentation assists to determine the prevailing market opportunities.

- Identify key investment pockets for various offerings in the market.

U.S. Automotive Composites Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1.8 Billion |

| Growth Rate | CAGR of 3.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 310 |

| By Fiber Type |

|

| By Resin Type |

|

| By Application |

|

| Key Market Players | Plasan Carbon Composite, A. Schulman, Inc, Hexcel Corporation, Solvay S.A., Owens Corning, Mitsubishi Chemical Corporation, Teijin Limited, Huntsman Corporation, Toray Industries, Inc, Magna International Inc |

The U.S. Automotive Composites Market is projected to grow at a CAGR of 3.8 % from 2024 to 2033

Toray Industries, Inc, Hexcel Corporation, Teijin Limited, Mitsubishi Chemical Corporation, Owens Corning, Huntsman Corporation, Solvay S.A., Magna International Inc, Plasan Carbon Composite, A. Schulman, Inc are the leading players in U.S. Automotive Composites Market

Interior is the major application in the U.S. Automotive Composites Market.

U.S. Automotive Composites Market is classified as by fiber type, by resin type, by application

Loading Table Of Content...