UAS Traffic Management (UTM) System Market Research, 2033

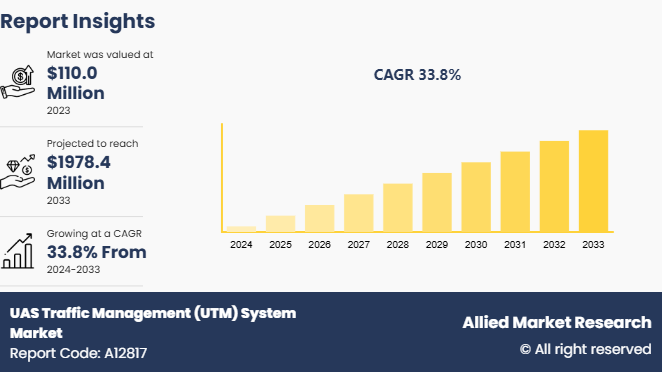

The global UAS traffic management (UTM) system market size was valued at $110.0 million in 2023, and is projected to reach $1978.4 million by 2033, growing at a CAGR of 33.8% from 2024 to 2033.

Market Introduction and Definition

UAS traffic management (UTM) system industry refers to a system designed to manage drone operations safely and efficiently within the airspace. The need for a structured framework to regulate their movements becomes crucial owing to the increasing use of drones across various industries, from deliveries and inspections to photography and emergency response. UTM systems integrate technologies such as real-time data exchange, communications, navigation, and surveillance to enable safe and reliable drone operations. Key components typically include airspace management, flight planning, conflict avoidance, and contingency management.

UTM aims to address several challenges, including airspace congestion, collision avoidance, and integration of drones into existing airspace alongside manned aircraft. It involves collaboration among stakeholders such as drone operators, regulatory bodies, airspace managers, and technology providers. Essential features may include geofencing to restrict drone movements in sensitive areas, real-time tracking for situational awareness, and automated systems for flight authorization and monitoring.

Key Takeaways

UAS traffic management (UTM) system market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major UAS traffic management (UTM) system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In November 2021, Thales’s TopSky announced that its UAS solution, which was already in service in Lille, in northern France, had been adopted by air traffic controllers at Rennes airport in Brittany to manage unmanned air traffic. The solution makes flight request process more efficient, helping drone operators to gain easier access to airspace.

In December 2021, DroneUp announced that it acquired the digital airspace and automation company, AirMap, Inc. The acquired company offers an Unmanned Aircraft System Traffic Management service, which will benefit DroneUp’s network of pilots and growing ground infrastructure.

Key Market Dynamics

The rise in commercial drone usage drives demand for UAS Traffic Management (UTM) systems by necessitating organized airspace management. The airspace becomes congested, that needs sophisticated UTM systems to ensure safety and efficiency as agriculture, delivery services, and surveillance sectors adopt drones. These systems provide real-time tracking, conflict avoidance, and regulatory compliance, enabling seamless integration of numerous drones into the airspace. This growth in commercial applications underscores the need for advanced UTM solutions to manage the expanding drone operations. Furthermore, technological advancement, and enhanced safety and efficiency have driven the demand for UAS traffic management (UTM) system market share.

However, high implementation costs are hampering the growth of the UAS traffic management (UTM) system market growth. Developing and deploying UTM infrastructure involves significant investment in advanced technologies, software, and hardware. Ongoing maintenance and operational costs further escalate expenses. These high costs can deter smaller businesses and emerging markets from investing in UTM systems, decreasing the market growth. The financial burden limits the scalability and accessibility of UTM solutions, impacting the overall expansion and adoption within the drone industry. Moreover, technical limitation, and regulatory challenges are major factors that hamper the growth of the UAS traffic management (UTM) system market size.

On the contrary, integration with smart cities presents a lucrative opportunity for the UAS Traffic Management (UTM) system market by enhancing urban infrastructure and efficiency. UTM systems can streamline logistics, emergency services, and traffic management within smart cities, improving overall operational efficiency. UTM systems support innovative applications like aerial deliveries, real-time surveillance, and disaster response by facilitating safe and organized drone operations. This integration aligns with the growing trend of urban modernization, creating substantial demand for advanced UTM solutions to support the evolving needs of smart cities.

Fleet Composition and Utilization Trends for the UAS Traffic Management (UTM) System Market

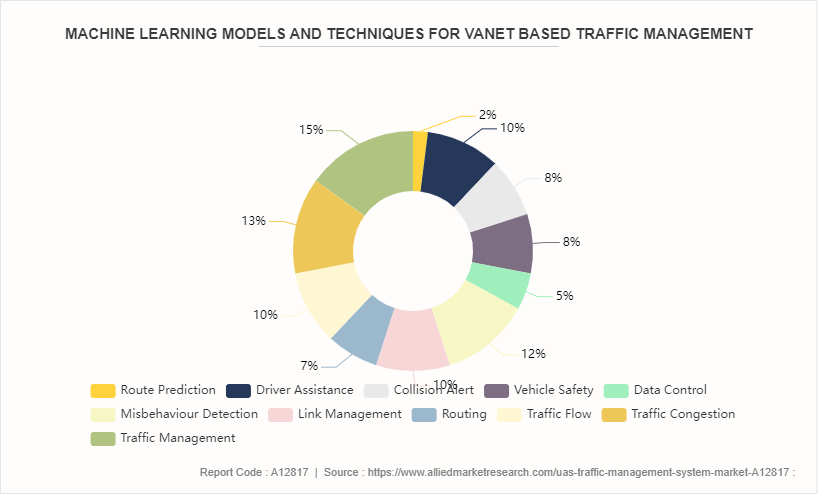

Fleet composition and utilization trends in the UAS traffic management (UTM) system market opportunity reflect a dynamic and evolving landscape driven by technological advancements and diverse applications. Fleets now include a mix of small, medium, and large drones, each serving specific purposes such as delivery services, agriculture, infrastructure inspection, and urban air mobility (UAM) . There is a notable shift towards increased autonomy, with drones transitioning from manually piloted to semi-autonomous and fully autonomous operations, enhancing efficiency and reducing human intervention. Advanced technology integration, such as AI, ML, and sophisticated sensors, is becoming standard, enabling improved navigation, obstacle avoidance, and data collection.

In addition, there is a growing preference for environment-friendly drones utilizing hybrid and electric propulsion systems, aligning with global sustainability goals. These trends collectively drive the need for robust UTM systems to manage diverse and complex drone operations, ensuring safety, efficiency, and regulatory compliance in increasingly crowded airspaces.

Market Segmentation

The UAS traffic management (UTM) system market is segmented into component, type, application, end-user, and region. On the basis of component, the market is divided into solution, software, and service. On the basis of type, the market is segregated into non-persistent, and persistent. On the basis of application, the market is classified into aviation, homeland security, agriculture, logistics and transportation, and others. On the basis of end-user, the market is categorized into commercial, and government law. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, Middle East and Africa.

Regional/Country Market Outlook

North America has attained the highest market share in the UAS Traffic Management (UTM) system market due to he region's robust regulatory framework, led by agencies such as the Federal Aviation Administration (FAA) , has established clear guidelines for drone operations, fostering a conducive environment for UTM system development and adoption. The FAA's UTM Pilot Program and partnerships with industry stakeholders have accelerated the implementation of UTM solutions, setting a global standard. Furthermore, North America boasts significant technological advancements and a strong presence of leading UAS and UTM system manufacturers. Companies in the U.S. and Canada are at the forefront of innovation, driving the development of advanced UTM technologies, such as AI, ML, and real-time data analytics. This technological leadership provides a competitive edge in the global UAS traffic management (UTM) system market forecast.

The Asia-Pacific region has attained the fastest market share growth in the UAS Traffic Management (UTM) system market due to several compelling factors. The region is experiencing a rapid increase in drone adoption across various sectors such as agriculture, e-commerce, logistics, and public safety. Countries like China, Japan, and South Korea are leading this surge, driven by their strong emphasis on technological innovation and economic development. The widespread application of drones in these industries necessitates advanced UTM systems to ensure safe and efficient airspace management.

Moreover, governments in the Asia-Pacific region are actively developing and implementing regulatory frameworks to support drone operations. Initiatives such as China's Civil Aviation Administration's (CAAC) policies and India's Directorate General of Civil Aviation (DGCA) drone regulations are creating an enabling environment for UTM system deployment. These regulatory advancements are crucial for fostering market growth and ensuring compliance with safety standards.

In November 2021, a drone logistics company PABLO AIR, a member of Born2Global Center, successfully demonstrated 75km maritime flight by integrating Ground Control System (GCS) as well as the unmanned traffic management (UTM) and the Air Traffic Management (ATM) .

In October 2021, the Civil Aviation Ministry of India introduced a traffic control framework for public and private third-party drone service providers to manage their movement in airspace under 1, 000 feet. The integration of UTM and ATM will be necessary to continuously separate manned and unmanned aircraft from each other in the airspace.

Competitive Landscape

The report analyzes the profiles of key players operating in UAS traffic management (UTM) system market such as Airbus SE, Altitude Angel Limited, Frequentis, L3Harris Technologies Inc, Leonardo S.p.A., Lockheed Martin Corporation, Nova Systems, PrecisionHawk, Raytheon Technologies Corporation, Thales Group, and Unifly These players have adopted various strategies to increase their market penetration and strengthen their position in UAS traffic management (UTM) system market.

Industry Trends

In December 2022, Altitude Angel partnered with SAAB Group on digital tower technology to integrate its guardian UTM service into the r-TWR digital tower solution offered by Saab, allowing ANSPs and appropriate stakeholders to digitally authorize and manage uncrewed flights in conjunction with crewed flights, directly communicating authorization, clearance, and in-flight instruction to provide the enhanced situation awareness of drone operation

In December 2022, OneSky partnered with Supermal to be a member of the OneSky Future of Flight program. OneSky and Supernal are projected to work together to combine the power of OneSky’s airspace situation awareness, operations planning and simulation, and UTM/PSU solution with Supernal’s expertise in eVTOL platform manufacturing and operations.

In November 2022, ANRA Technologies won a contract to demonstrate the ability to collect, aggregate, and retransmit Broadcast Remote ID (B-RID) message. ANRA will convert these B-RID message to Network Remote ID (N-RID) message that can be shared in the Unmanned Aircraft System (UAS) service supplier (USS) Network. This FAA-funded project will test and validate advanced air traffic management functions for UAS (USS) Network.

In November 2022, Raytheon intelligence and space, a Raytheon technologies business in collaboration with the Virgina Tech Mid-Atlantic Aviation partnership, or MAAP, and the Lone star UAS Centre of Excellence and innovation has been selected by the federal aviation administration (FAA) to participate in the Uncrewed Aircraft System Traffic Management (UTM) field test.

Key Sources Referred

INTERNATIONAL ENERGY OUTLOOK

Environmental and Energy Study Institute (EESI)

U.S. Department of Energy

ITRI Ltd.

International Hydropower Association

International Energy Agency

World Economic Forum

European Association for Storage of Energy

Key Benefits for Stakeholders

This report provides a quantitative analysis of UAS traffic management (UTM) system market segments, current trends, estimations, and dynamics of market analysis to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of UAS traffic management (UTM) system market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global UAS traffic management (UTM) system market Statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global UAS traffic management (UTM) system market trends, key players, market segments, application areas, and market growth strategies.

UAS Traffic Management (UTM) System Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1978.4 Million |

| Growth Rate | CAGR of 33.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 434 |

| By Component |

|

| By Type |

|

| By Application |

|

| By End-user |

|

| By Region |

|

| Key Market Players | nova systems, Raytheon Technologies Corporation, Thales Group, Lockheed Martin Corporation, Altitude Angel Limited , Airbus SE, L3Harris Technologies Inc., PrecisionHawk, Frequentis, Leonardo S.p.A., Unifly NV |

Upcoming trends in the global UAS Traffic Management (UTM) system market include the integration of advanced AI and machine learning for real-time decision-making, the development of standardized protocols for seamless drone communication, increasing adoption of Beyond Visual Line of Sight (BVLOS) operations, and the growing focus on cybersecurity measures to protect UTM systems from potential threats.

The leading application of the UAS Traffic Management (UTM) system market is drone operations in commercial airspace, particularly for tasks like package delivery, infrastructure inspection, agriculture, and emergency response. UTM systems are critical for ensuring the safe and efficient integration of drones into low-altitude airspace, enabling widespread commercial drone use.

North America is the largest regional market for UAS Traffic Management (UTM) System

$1,978.36 million is the estimated industry size of UAS Traffic Management (UTM) System

Airbus SE, Altitude Angel Limited , Frequentis , L3Harris Technologies Inc, Leonardo S.p.A., Lockheed Martin Corporation, Nova Systems, PrecisionHawk, Raytheon Technologies Corporation, Thales Group, and Unifly

Loading Table Of Content...