UAV Flight Training And Simulation Market Research, 2033

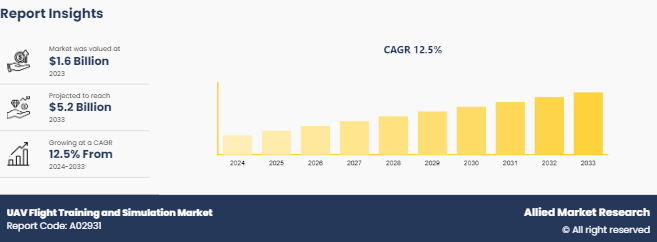

The global uav flight training and simulation market was valued at $1.6 billion in 2023, and is projected to reach $5.2 billion by 2033, growing at a CAGR of 12.5% from 2024 to 2033.

Market Introduction and Definition

UAV Flight Training and Simulation encompasses the educational and practical processes involved in training individuals to operate Unmanned Aerial Vehicles (UAVs) through simulated environments. This field integrates theoretical knowledge with hands-on experience, using advanced simulation technologies to replicate real-world scenarios. It involves familiarizing trainees with UAV controls, navigation systems, flight dynamics, and operational procedures in a safe and controlled setting. By providing a realistic training environment, UAV Flight Training and Simulation prepare operators for diverse missions, including surveillance, reconnaissance, mapping, and aerial inspections. It aims to enhance proficiency, safety, and efficiency in UAV operations while minimizing risks associated with actual flight training.

The rising adoption of unmanned aerial vehicles (UAVs) across diverse industries such as defense, agriculture, and logistics is poised to significantly propel the demand for UAV Flight Training and Simulation solutions. As UAVs become indispensable tools for surveillance, reconnaissance, and data collection, the need for proficient operators escalates. Military agencies increasingly rely on UAVs for reconnaissance missions, driving demand for specialized training programs. Moreover, in agriculture, UAVs optimize crop monitoring and spraying, necessitating tailored training for operators. Similarly, the logistics sector harnesses UAVs for efficient parcel delivery, underscoring the importance of comprehensive training to ensure safe and effective operations. This multi-sectoral adoption highlights the pivotal role of UAV Flight Training and Simulation opportunity in meeting evolving industry demands.

The relentless advancements in simulation technologies are poised to revolutionize the UAV flight training and simulation market size, catalyzing increased sales. Innovations in virtual reality (VR) , augmented reality (AR) , and artificial intelligence (AI) are enhancing the effectiveness of training programs. These technologies offer immersive and interactive training experiences, enabling trainees to simulate diverse scenarios and environments. Moreover, AI-driven simulations can replicate real-world complexities and adapt training scenarios dynamically, providing a more dynamic and responsive learning environment. Such advancements not only improve the quality of training but also reduce the reliance on costly and resource-intensive live training exercises. Consequently, organizations are increasingly investing in state-of-the-art simulation solutions, driving the UAV flight training and simulation market growth.

Key Takeaways

- The UAV flight training and simulation industry study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major UAV flight training and simulation industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

- In October 2021, Kratos Defense & Security Solutions, Inc. announced that it has secured a $17, 677, 612, 12-month cost-plus-fixed-fee contract to design and develop an Off Board Sensing Station (OBSS) Unmanned Aerial System (UAS) for the Air Force Research Laboratory’s Autonomous Collaborative Platforms (ACP) technology maturation portfolio. The work will be conducted at Kratos' secure engineering and technology facilities in Texas, California, and Oklahoma over the next year. The OBSS program also includes an optional subsequent 15-month manufacturing and demonstration phase. If both the base and optional awards are exercised, the total contract value for Kratos would reach $49 million.

- In April 2021, Elbit Systems announced that it secured a contract worth approximately $1.65 billion (€1.375 billion) to establish and operate the Hellenic Air Force's International Flight Training Center. This contract is part of an agreement between the Israeli Ministry of Defense and the Hellenic Ministry of National Defense. The project will span around 20 years and will include price indexation.

Key Market Dynamics

The global UAV flight training and simulation market is experiencing growth due to increase in demand for UAVs, advancements in simulation technologies, and growth in commercial applications. However, complexity of simulation systems and limited access to training facilities hinder the market growth. Moreover, customized training solutions and integration with UAV operations offer lucrative opportunities for the expansion of the global UAV flight training and simulation market share.

Technological innovations in unmanned aerial vehicles (UAVs) are expected to significantly boost sales in the UAV flight training and simulation sector. Advancements such as increased autonomy, enhanced sensor capabilities, and improved payload capacities are driving the need for comprehensive training programs. These innovations necessitate training solutions that can adequately prepare operators to leverage the full potential of modern UAVs. As UAVs become more sophisticated and versatile, the demand for realistic and high-fidelity simulation training increases. Consequently, training providers are innovating to offer cutting-edge simulation technologies that mirror the complexities of contemporary UAV operations, driving growth in the market.

The increasing trend in defense budgets across the world offers a significant opportunity for UAV flight training and simulation. The rising defense expenditures by governments globally emphasize a strong growth in upgrading military capabilities, particularly through the incorporation of unmanned aerial vehicles (UAVs) . As defense agencies allocate significant resources to strengthen their UAV fleets, the demand for training and simulation solutions is on the rise. These solutions are crucial for maintaining operational readiness, proficiency, and safety among military personnel operating UAVs. Therefore, the trend in defense budgets acts as a driving force for increased investment and sales in the UAV training and simulation sector.

The emergence of training as a service (TaaS) presents a significant UAV flight training and simulation market opportunity to augment sales. TaaS offers a flexible and scalable solution for organizations seeking comprehensive training without the burden of investing in infrastructure or specialized personnel. By outsourcing training needs to experienced providers, businesses can access tailored training programs on-demand, optimizing resources and reducing operational costs. This model enables companies to adapt quickly to changing training requirements and scale their operations efficiently. Consequently, TaaS fosters a dynamic and accessible training ecosystem, creating avenues for increased sales and market growth within the UAV training industry.

Parent Market Overview of Global UAV Flight Training and Simulation Market

The unmanned aerial vehicles (UAVs) market is expected to witness substantial growth driven by a convergence of factors. Forecasts indicate a steady rise in sales attributed to the increasing adoption of UAVs across diverse sectors, including defense, agriculture, and logistics. This surge in demand is propelled by the versatility and cost-effectiveness of UAVs in various applications, such as surveillance, mapping, and delivery services.

Furthermore, technological advancements, such as improved battery life and enhanced payload capacities, are expanding the capabilities of UAVs, further fueling market expansion. As industries recognize the operational efficiencies and strategic advantages offered by UAVs, their demand continues to soar, driving robust sales growth in the market. In June 2023, Airbus initiated a drone pilot training program in India. This course, approved by the Directorate General of Civil Aviation (DGCA) , was expected to begin on June 26, 2023, at the Airbus Training Centre in Bengaluru. Tailored for micro and small category drones, the five-day program encompasses theoretical lessons alongside practical flying sessions. Its objective is to enhance the skills and knowledge of aspiring drone pilots, fostering their capabilities within India's rapidly evolving drone sector.

Market Segmentation

The UAV flight training and simulation market is segmented into type, application, and region. On the basis of type, the market is divided into HALE UAV, MALE UAV, and SUAV. As per application, the market is segregated into civil & commercial, defense & military, and homeland security. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The demand for UAV flight training and simulation in the U.S. is on a steady rise, fueled by several factors that highlight the nation's robust aviation industry. With over 5, 000 public airports and around 14, 500 registered unmanned aerial systems (UAS) operators, the need for comprehensive training programs is paramount. Additionally, the Federal Aviation Administration (FAA) projects significant growth in commercial drone operations, with estimates suggesting that the number of commercial drones to surpass 1 million by 2030. This surge in drone activities, coupled with evolving regulations and safety requirements, highlights the critical role of training and simulation solutions in ensuring the proficiency and safety of UAV operators. As a result, there's a growing demand for advanced training facilities, simulation technologies, and qualified instructors across the country, driving sales growth in the UAV flight training and simulation market forecast.

- In May 2022, FlightSafety partners with Dronamics for drone pilot training. This agreement marks FlightSafety's commitment to crafting and providing cutting-edge training for Dronamics pilots. Additionally, it opens avenues for potential training initiatives tailored for Dronamics' maintenance and dispatch staff in the future.

- In April 2024, Kratos Defense & Security Solutions, Inc. and Shield AI, Inc. announced the successful completion of the initial phase of AI-piloted flight testing on the Kratos Tactical Firejet. This collaboration marks a significant milestone as the two companies advance towards integrating Shield AI's cutting-edge AI pilot technology into Kratos' high-performance, jet-powered unmanned aerial systems (UAS) . The achievement underscores their commitment to pioneering innovative UAS solutions for defense and security applications.

Competitive Landscape

The major players operating in the UAV flight training and simulation market include CAE Inc., L3Harris Technologies, Inc., Boeing, Textron Inc., Thales Group, Lockheed Martin Corporation, General Atomics Aeronautical Systems, Inc., Northrop Grumman Corporation, Elbit Systems Ltd., and Kratos Defense & Security Solutions, Inc.

Other players in the UAV flight training and simulation market include Israel Aerospace Industries Ltd. (IAI) , FlightSafety International, Collins Aerospace, and so on.

Industry Trends:

- In February 2024, IIT Guwahati inaugurated India’s most extensive drone pilot training organization, marking a significant leap in technological progress and innovation. In partnership with EduRade, the Indian Institute of Technology Guwahati unveiled the country's largest Remote Pilot Training Organization (RPTO) . Spanning 18 acres, this initiative can accommodate the simultaneous operation of nine medium-class drones, solidifying its position as a leader in drone technology education and training.

- In March 2024, DroneAcharya Aerial Innovations Limited announced its recent accreditation as a DGCA certified Medium Category Drone Pilot Training Organization, marking a significant milestone in the industry. This recognition positions DroneAcharya as one of the pioneering entities to attain such esteemed accreditation. The certification provides legal authorization for flying drones weighing between 25 kg to 150 kg, crucial for sectors like agricultural spraying and delivery drones.

Key Sources Referred

- Federal Aviation Administration (FAA)

- European Union Aviation Safety Agency (EASA)

- International Civil Aviation Organization (ICAO)

- IATA (International Air Transport Association)

- GAMA (General Aviation Manufacturers Association)

- Aerospace Industries Association (AIA)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the uav flight training and simulation market analysis from 2024 to 2033 to identify the prevailing uav flight training and simulation market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the uav flight training and simulation market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global uav flight training and simulation market trends, key players, market segments, application areas, and market growth strategies.

UAV Flight Training and Simulation Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 5.2 Billion |

| Growth Rate | CAGR of 12.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Thales Group, Textron Inc., General Atomics Aeronautical Systems, Inc., Northrop Grumman Corporation, ELBIT SYSTEMS LTD., Boeing, Kratos Defense & Security Solutions, Inc., Lockheed Martin Corporation, L3Harris Technologies, Inc., CAE Inc. |

Incorporation of Virtual Reality (VR) and Augmented Reality (AR) Technologies, Advancement in AI and Machine Learning for Training Programs, and Growing Demand for Commercial Drone Pilot Training are the upcoming trends of UAV Flight Training and Simulation Market in the globe

Defense & Military is the leading application of UAV Flight Training and Simulation Market

North America s the largest regional market for UAV Flight Training and Simulation

The estimated industry size of UAV Flight Training and Simulation is $ 5.20 billion in 2033

HALE UAV is the leading type of UAV Flight Training and Simulation Market

Loading Table Of Content...