The global undersea warfare systems market was valued at $15.8 billion in 2021, and is projected to reach $24.8 billion by 2031, growing at a CAGR of 4.7% from 2022 to 2031.

Undersea warfare refers to combat and C4ISR (command, control, communications, computers, intelligence, surveillance, and reconnaissance) activities conducted under the surface of water to address security threats and maintain battlespace dominance in underwater environments. Undersea warfare systems are both offensive system & defensive systems, and are intended to monitor, detect, categorize, track, localize, and identify underwater threats and neutralize them. Undersea warfare systems include sensors, weapon systems, unmanned underwater vehicles, countermeasure systems, and communication systems. Moreover, these systems can be operated manually, autonomously, and remotely.

Rise in demand for stealth undersea warfare systems, advent of underwater drones for undersea warfare, and government support for strengthening undersea warfare capabilities act as the key driving forces of the global undersea warfare systems market. However, operational complexities associated with undersea unmanned systems and high upfront and operational costs of attack submarines hinder the market growth. On the contrary, development of lightweight torpedoes and rise in defense spending are expected to create lucrative market opportunities for the expansion of the global market during the forecast period.

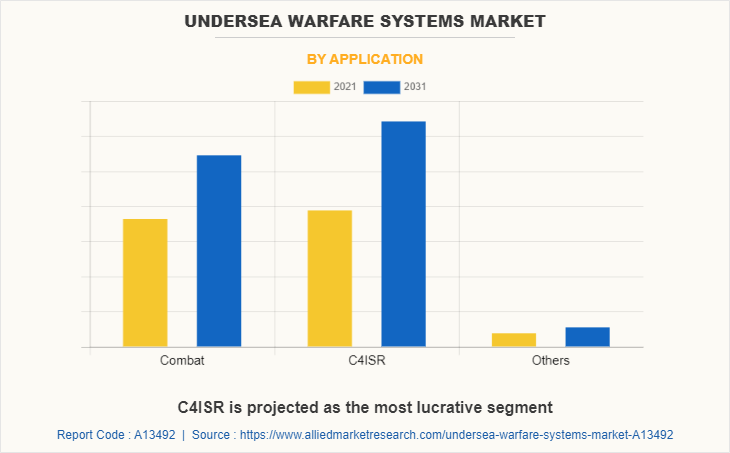

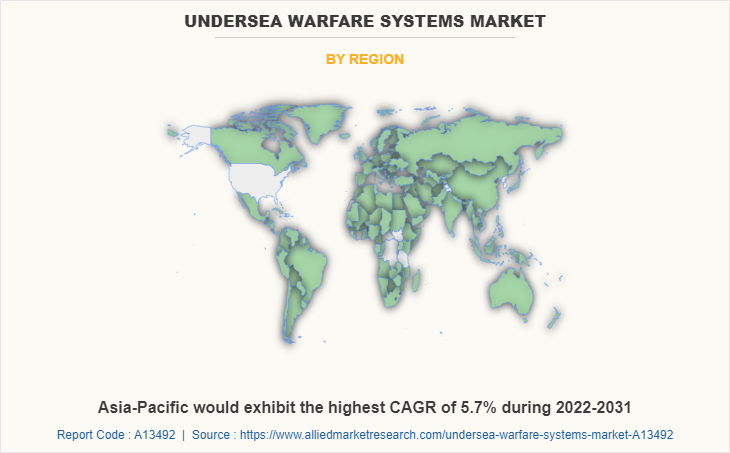

The global undersea warfare systems industry is segmented into type, mode of operation, application, and region. By type, the market is classified into weapon systems, communication & surveillance systems, sensors & computation systems, countermeasure systems & payload, and unmanned underwater vehicles. According to mode of operation, it is fragmented into manned operations, autonomous operations, and remote operations. On the basis of application, it is categorized into combat, C4ISR, and others (training & transport and special missions). Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Type

Communication and Surveillance Systems is projected as the most lucrative segment

The key players profiled in this undersea warfare systems market report include BAE Systems Plc., General Dynamic Corporation, Kongsberg Gruppen, L3Harris Technologies Inc., Leonardo S.p.A., Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, SAAB AB, and Thales Group.

Rise in demand for stealth undersea warfare systems

Submarines are valuable operational assets, which make a substantial contribution to three key aspects of marine operational warfare, including sea denial, maritime power projection, and sea control. Submarines have vital operational features such as stealth, flexibility, lethality, and endurance. They substantially enhance the mission advantage and sea strength, and is almost undetectable while fully submerged.

As countries construct regional/global maritime surveillance systems, the operational stealth of submarines is becoming increasingly important. For instance, under Project 75, the Indian Navy commissioned its 4th stealth Scorpene-class submarine in November 2021. The Project involves six submarines of Scorpene design. Among these, the three submarines, including Khanderi, Kalvari, and Karanj have already been commissioned in the Navy. Furthermore, the Russian Navy received three nuclear-powered, stealth submarines in the last quarter of 2021to boost the country’s seaborne deterrence forces. Hence, rise in demand for modern stealth submarines is anticipated to fuel the growth of the unmanned warfare systems market during the forecast period.

Government support for strengthening undersea warfare capabilities

Various nations across the world are finding ways to gain supremacy in naval operations to enhance their defense capabilities. As water covers more than 3/4th of the Earth’s surface, strengthening the naval forces is imperative to effectively defend the national borders. In April 2022, Officials of the U.S. Naval Undersea Warfare Center (NUWC) Division awarded contracts worth $49 million to 13 companies (including key players such as Booz Allen Hamilton Inc., L3Harris Technologies, and nine other players) for the Sensors and Sonar C15 Rapid Prototyping Development project. These 13 companies are to develop research models for applications on surface warships, submarines, surveillance, autonomous vehicles, submerged cables, distributed networks, irregular warfare, and aircraft. Furthermore, in May 2022, the Australian Defense Minister Peter Dutton announced a $1.44 billion investment in developing leading-edge unmanned submarine technology to strengthen Australia’s undersea warfare capabilities amidst growing regional tensions. Such developments are expected to propel the growth of the global undersea warfare systems market.

Advent of underwater drones for undersea warfare

Unmanned aerial vehicles, commonly known as drones, are being developed and deployed as unmanned underwater vessels (UUVs) or underwater drones to gain a strategic edge in oceans. The countries such as the U.S., China, Russia, and the UK are all developing and deploying the vessels. UK, which is escalating its military existence in the Pacific region, is expected to deploy its first extra-large underwater drone to supplement its Astute-class submarines already present in the region. Furthermore, the Navy of the UK is developing Manta—an underwater drone—which is an unmanned version of the existing S201 manned submersible developed by a British manufacturer MSubs.

U.S. is working on Orca, an extra-large unmanned undersea vehicle (XLUUV). In 2019, the U.S. Navy awarded Boeing contracts worth a total of $274.4 million to produce five Orca XLUUVs. Orca can be used for various operations such as anti-submarine warfare, anti-surface warfare, mine countermeasures, strike missions, and electronic warfare. To catch up with rise in defense capabilities of its neighbors, the Indian Defence Public Sector Shipyard Garden Reach Shipbuilders & Engineers Limited (GRSE), in September 2020, bought four HUGIN autonomous underwater vehicle (AUV) systems developed by Kongsberg Maritime.

The undersea warfare systems market is segmented into By Type, Mode of Operation and Application.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the undersea warfare systems market analysis from 2021 to 2031 to identify the prevailing undersea warfare systems market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the undersea warfare systems market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global undersea warfare systems market trends, key players, market segments, application areas, and market growth strategies.

Undersea Warfare Systems Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Mode of Operation |

|

| By Application |

|

| By Region |

|

| Key Market Players | Lockheed Martin Corporation, Saab AB, Northrop Grumman Corporation, L3Harris Technologies, Inc., Thales Group, Kongsberg Gruppen, General Dynamics Corporation, Leonardo S.p.A., BAE Systems Plc, Raytheon Technologies Corporation |

Analyst Review

The undersea warfare systems market is anticipated exhibit growth potential in the coming years, owing to numerous developments carried out by top players. In addition, companies operating in the industry have received funding and contracts from government and defense organizations, which has strengthened the growth of the market across the globe.

There has been increasing focus on reducing costs associated with undersea warfare systems to offer communication, surveillance, and countermeasure systems. The leading players in the market are developing customized solutions and applications to cater to the customers’ growing needs, in addition to exploring novel technologies and applications through scientific research and technology demonstration.

Moreover, rise in threats in the underwater environment has increased the need to maintain superiority in undersea environments. Thus, many countries have started adopting advanced underwater warfare systems. For instance, in February 2022, the U.S. Navy ordered AN/SQQ-89A(V)15 anti-submarine warfare (ASW) systems from Lockheed Martin Corp.

Various programs and partnerships have been developed by defense forces to support the development of undersea warfare systems. For instance, in September 2021, Australia, the UK, and the U.S. collaboratively established AUKUS partnership to pursue the acquisition of nuclear-powered submarines (SSNs). Through the AUKUS Undersea Robotics Autonomous Systems (AURAS) project, these nations are further collaborating on development of autonomous underwater vehicles, which will be a significant enhancement for naval forces. Initial trials and experimentation of this capability are planned for 2023.

The upcoming trends of undersea warfare systems market include development of autonomous systems, and greater adoption of unmanned underwater vehicles.

The leading application of undersea warfare systems market is C4ISR.

North America is the largest regional market for undersea warfare systems.

The global undersea warfare systems market was valued $15,835.0 million in 2021 and is projected to reach $24,777.7 million in 2031, registering a CAGR of 4.7%.

The top companies to hold the market share in undersea warfare systems include BAE Systems Plc., General Dynamic Corporation, Kongsberg Gruppen, L3Harris Technologies Inc., Leonardo S.p.A., Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, SAAB AB, and Thales Group.

Loading Table Of Content...