Unit-Linked Insurance Market Research, 2032

The global unit-linked insurance market size was valued at $906.9 billion in 2023, and is projected to reach $2309.7 billion by 2032, growing at a CAGR of 10.9% from 2024 to 2032. A unit-linked insurance plan (ULIP) is an insurance plan that offers the dual benefit of investment to fulfill the long-term goals, and a life cover to financially protect the family in case of an unfortunate event. The premium paid towards a ULIP is divided into two parts. A part of it is contributed to the life cover, and the remaining is invested in the fund of user choice.

Moreover, unit-linked insurance suppliers encompass a range of financial products and activities provided by unit-linked insurance companies to individuals, businesses, and other entities to manage various risks. These services aim to protect against financial loss or liability arising from unexpected events such as accidents, natural disasters, illness, or death.

Key Takeaways

The unit-linked insurance market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2024-2032.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major unit-linked insurance industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global market and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key market dynamics

The notable factors positively affecting the unit-linked insurance market growth include a rise in the adoption of unit-linked insurance claims among individuals and an increase in development strategies by public and private companies which propel the market growth. However, enforcement of strong rules by banks and financial institutions for providing unit-linked insurance services can hinder the unit-linked insurance market growth. Furthermore, technological advancements in life unit-linked insurance services offer lucrative unit-linked insurance market opportunities for the market players.

The unit-linked insurance market has been gaining significant traction over the past few years due to its increasing applications in the healthcare industry. Moreover, digital technologies such as AI, data analytics, and other technologies are increasingly transforming the life unit-linked insurance industry. By implementing digital technologies, insurers can enhance customer experience and efficiency in client acquisition, underwriting, claims processing, and policy administration, the unit-linked insurance market is expected to register promising growth during the forecast period.

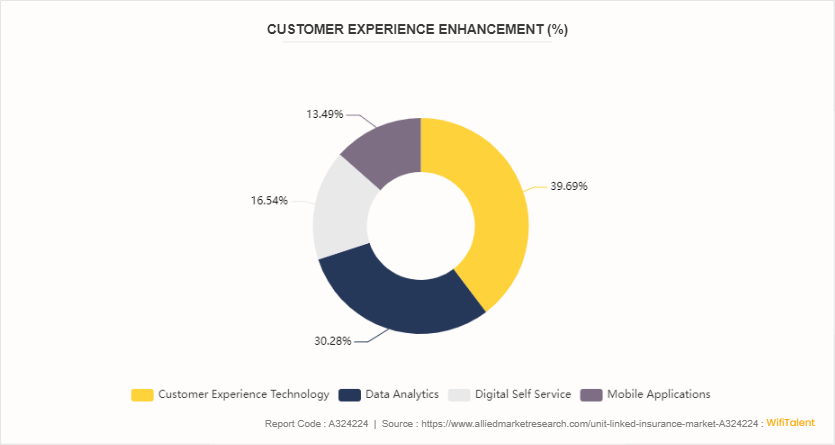

Customer Experience Enhancement using Digital Technologies

According to the article published by WifiTalent, in August 2024, 86% of insurance organizations implemented digital initiatives to improve customer experience. Insurers who invest in customer experience technology could see a 20% increase in customer satisfaction scores. These factors are further expected to fuel the growth of the global unit-linked insurance market. 70% of insurance executives are investing in data analytics to improve customer insights. Insurers that offer digital self-service options experience a 10% increase in customer satisfaction.

FIGURE 1: Customer Experience Enhancement (%)

Market Segmentation

The unit-linked insurance market share is segmented into mode, distribution channel, and region. On the basis of mode, the market is divided into online and offline. On the basis of distribution channel, the unit-linked insurance market is segregated into, direct from insurers, insurance brokers and agencies, banks, and others.

Regional/Country Market Outlook

The adoption of insurance solutions varies across different countries, influenced by factors such as technological infrastructure, industry needs, regulatory frameworks, and investment in research and development. Developed countries like the U.S., China, Japan, and South Korea have been at the forefront of insurance solutions adoption, particularly in industries such as the healthcare industry. These countries possess advanced technological capabilities, robust research institutions, and a strong focus on innovation, driving widespread adoption of unit-linked insurance requirements across individuals. In emerging economies such as China, India, Brazil, and Russia, there is a growing interest in investment-linked insurance solutions fueled by rapid industrialization, increasing healthcare expenditures, and government initiatives to promote digitalization and innovation.

In March 2024, China initiated an extensive campaign to curb the aggressive strategies employed by its insurance sector. This government initiative primarily targeted insurers linked with private conglomerates, which used their extensive finance sector connections to embark on high-risk growth strategies.

In March 2024, the U.S. Department of the Treasury’s Federal Insurance Office (FIO) advanced its efforts to collect insurance data to better understand the impacts of climate-related financial risks on the insurance sector, by launching a first-of-its kind collaboration with state insurance regulators and the National Association of Insurance Commissioners (NAIC) .

In August 2022, the Government of Canada created the task force on flood insurance and relocation with the mandate to explore solutions for low-cost flood insurance for residents of high-risk areas and consider strategic relocation in areas at the highest risk of recurrent flooding. This interdisciplinary task force brought together experts from across the country in both the public and private sectors.

Competitive Landscape

The major players operating in the unit-linked insurance market outlook include Aviva, Kotak Life, ICICI Prudential Life Insurance, HDFC Life Insurance, AXA S.A., Allianz SE, SBI Life Insurance, Progressive Corporation, Talanx, Zurich Ins Group and PNB MetLife.

Recent Key Strategies and Developments

In March 2024, Future Generali India Insurance launched a new product called ‘Health PowHER’ designed to address women’s healthcare needs at various stages of their lives. The product offers a range of coverage, including increased limits for Female Cancer treatments, coverage for disorders related to Puberty and Menopause, and an emphasis on Outpatient Department (OPD) services for both physical and mental well-being, with a mental illness benefit of 200%.

In February 2024, The Life Insurance Corporation of India (LIC) launched a non-participating product. The plan is designed to meet the higher education and other needs of the child.

In December 2023, Everest Insurance launched a fixed indemnity insurance product. As a way to grow its accident and health portfolio, the Group Fixed Indemnity insurance will be geared towards companies and association groups that are looking for non-ACA health insurance.

Key Sources Referred

Insurance Solutions Incorporated.

United Insurance Solutions

Insurance Regulatory and Development Authority of India

CSC e-Governance Services

Postal Life Insurance

Key Benefits For Stakeholders

This report provides a quantitative analysis of the unit-linked insurance market forecast segments, current trends, estimations, and dynamics of the unit-linked insurance market analysis from 2023 to 2032 to identify the prevailing unit-linked insurance market opportunities.

The unit-linked insurance market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the unit-linked insurance market segmentation assists to determine the prevailing unit-linked insurance market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global unit-linked insurance market Statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global unit-linked insurance market trends, key players, market segments, application areas, and market growth strategies.

Unit-Linked Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2309.7 Billion |

| Growth Rate | CAGR of 10.9% |

| Forecast period | 2024 - 2032 |

| Report Pages | 350 |

| By Mode |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Allianz SE, ICICI Prudential Life Insurance, Talanx, HDFC Life Insurance, Zurich Ins Group, Progressive Corporation, AXA S.A., PNB MetLife, Aviva, Kotak Life, SBI Life Insurance |

The Unit-Linked Insurance Market is experiencing several upcoming trends that reflect changes in consumer preferences, technological advancements, and regulatory shifts.

Banks is the leading distribution channel of Unit-Linked Insurance Market.

North America is the largest regional market for Unit-Linked Insurance in 2023.

$2,309.7 billion is the estimated industry size of Unit-Linked Insurance in 2032.

Aviva, Kotak Life, ICICI Prudential Life Insurance, HDFC Life Insurance, AXA S.A., Allianz SE, SBI Life Insurance, Progressive Corporation, Talanx, Zurich Ins Group and PNB MetLife are the top companies to hold the market share in Unit-Linked Insurance.

Loading Table Of Content...