The global urban air mobility(UAM) market size was valued at $2.3 billion in 2021 and is projected to reach $30.7 billion by 2031, growing at a CAGR of 30.2% from 2022 to 2031. Urban air mobility also known as advanced air mobility is a newly developed idea that envisions an accessible, economical, safe, and sustainable air transportation system for delivering cargo, managing emergencies, and moving people throughout metropolitan areas. UAM is a part of a larger ecosystem for on-demand mobility where consumers can dispatch or use urban aviation services, courier services, shared automated vehicles, shared mobility, public transportation, and other cutting-edge and emerging transportation technologies to access mobility and goods delivery services on demand. This could also relieve the pain on many continually overburdened infrastructures such as those in cities with a rapidly growing population. Cities such as Singapore, Dubai, Dallas, and Los Angeles have already been experimenting with Urban Air Mobility projects for some time.

Undoubtedly, traffic congestion causes a significant amount of time to be lost every day around the world. On their commute to work or home, people get caught in traffic, which wastes fuel and reduces productivity. Furthermore, this has an impact on the metropolitan economy. If we don't choose new sustainable solutions, the issue of traffic congestion and its terrible impacts won't be under control. Urban air mobility transportation can help in reducing traffic congestion. Leading transportation businesses are using new technology today and preparing to build intelligent aerial vehicles for urban air mobility. The efficacy and efficiency of transportation will improve with electric aircraft, drones, and flying taxi services. These factors are projected to increase the urban air mobility(UAM) Market demand over the coming years. However, the higher initial investment required for research & development and for developing required infrastructure development for urban air mobility is anticipated to hamper the Urban Air Mobility(UAM) Market Growth.

The industry players are investing a lot of effort in the research and development of smart and unique strategies for sustainable transportation systems. These strategies include product launches, mergers & acquisitions, collaborations, partnerships, and refurbishing of existing technology. In July 2020, Hyundai Motor and Uber has announced a partnership to develop new Uber Air taxis for future urban mobility named SA-1 which is a vertical takeoff and landing vehicle based on electric power. For instance, in May 2022, Volocopter the pioneer in urban air mobility announced a partnership with Microsoft to provide and develop a cloud-based computing system for the company’s eVotel, urban air mobility vehicles, and for autonomous flying vehicles.

The key players profiled in the urban air mobility(UAM) Industry report include Ehang, Lilium Gmbh, Airbus, Wisk Aero LLC., Bell Textron, Volocopter GmbH, Workhorse Group Inc., Joby Aviation., Kitty Hawk, and Archer Aviation.

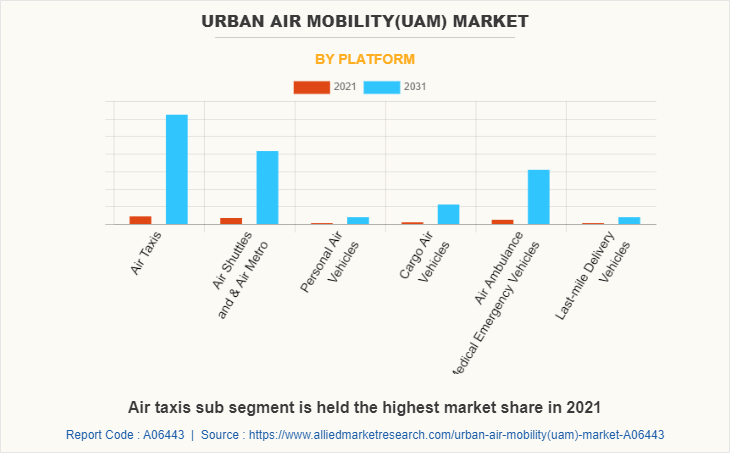

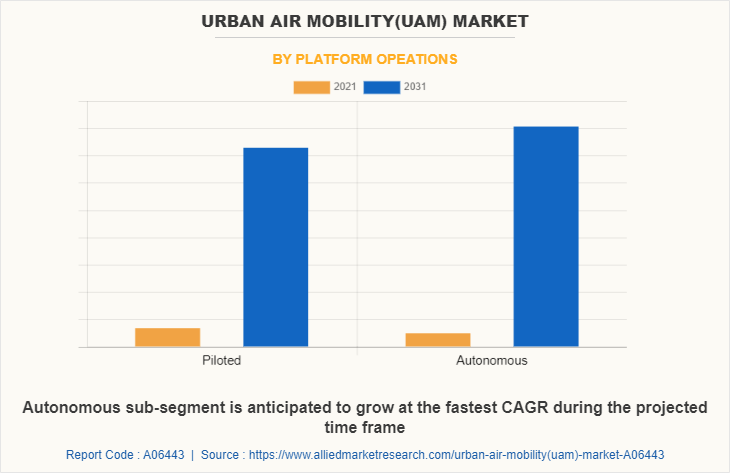

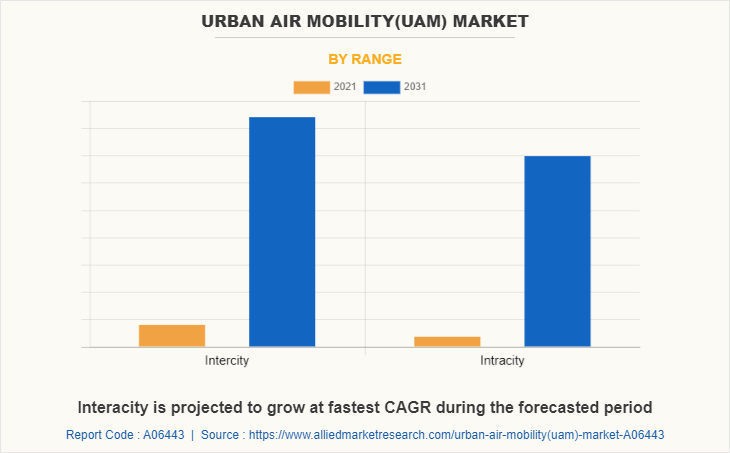

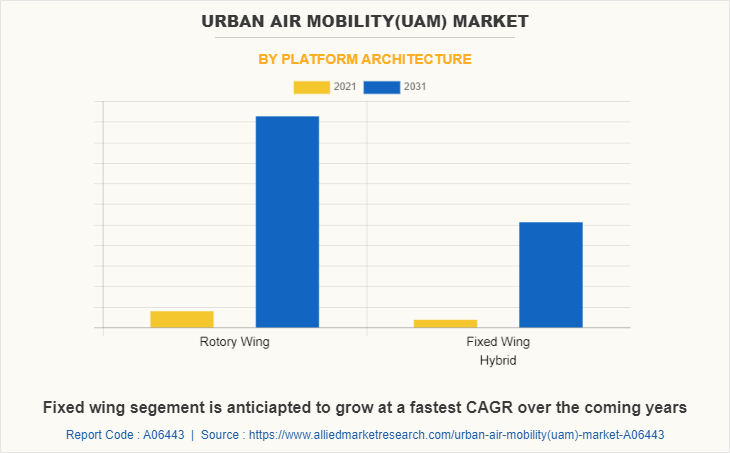

The global urban air mobility market is segmented on the basis of platform, platform operations, range, platform architecture, and region. By platform, the market is sub-segmented into air taxis, air shuttles & air metro, personal air vehicles, cargo air vehicles, air ambulance & medical emergency vehicles, and last-mile delivery vehicles. By platform operations, the market is classified into piloted and autonomous. By range, the market is classified into intercity and intracity. By platform architecture, the market is sub-segmented into rotary wings and fixed wings hybrid. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The urban air mobility (UAM) market is segmented into Platform, Platform Opeations, Range and Platform Architecture.

By platform, the air taxi sub-segment dominated the market in 2021. A small aircraft or an electric flying vehicle used for on-demand trips is an air taxi. It is also known as an urban air mobility vehicle and is regarded as an alternative for travel in urban areas with congested roadways. Also, the air taxi has the capability to serve as a transportation system in rural areas. For instance, Jaunt air mobility has decided to set up eVTOL assembly plant in India for air taxis. These are predicted to be the major factors affecting the urban air mobility market size during the forecast period too.

By platform, the last mile delivery sub-segment is anticipated to show the fastest growth in 2021. The employment of aerial delivery drones to complete the final mile delivery of the goods is a result of the growing need to increase delivery efficiency and reduce delivery time. Additionally, the global market for last-mile delivery vehicles is expanding due to the introduction of superior UAM vehicles. As a result, multinational logistics firms like DHL International GmbH are forming successful alliances to expand their presence in the market.

By platform operations, the autonomous sub-segment dominated the global urban air mobility market share in 2021. The growth in urban air mobility technology is creating a huge potential for a convenient and efficient mode of transportation for people in urban areas. Urban Air Mobility (UAM) is a vision for transportation that could revolutionize social mobility. To realize the UAM goal, it will be essential to increase vehicle automation and autonomous vehicle operations. An economically feasible transportation system that can support the significant anticipated demand will require autonomy. While autonomous systems might be useful for many different aspects of a developed UAM ecosystem, they are crucial for the actual cars. Thousands of flights above a major city are expected to take place simultaneously under a mature system. Vehicles may need response times and degrees of decision-making and control that are beyond the capability of even highly trained human operators because they will operate in practically all weather situations and in close proximity to people, property, and other vehicles. These factors is anticipated to drive the urban air mobility(UAM) Market Share over the coming years.

By range, the intercity sub-segment dominated the global urban air mobility market share in 2021. The development of technology has made urban air travel a viable alternative. Additionally, these cars are outfitted with technology that enables them to carry 2 to 4 passengers over distances between 50 and 250 kilometers. These intercity aircraft also reduce travel times between two cities in half. These aircraft are the only high-speed transportation options that do not necessitate significant infrastructure. As a result of these factors the demand for intercity urban air mobility market share in the forecasted period.

By platform architecture, the rotary wings sub-segment dominated the global urban air mobility market share in 2021. The rotary wings are majorly used in urban air mobility vehicles due to the stability provided by the rotary wings. Also, the load-carrying capacity of rotary wings is good and provides better stability in order to provide a safe and secure passenger experience. The rotary wings vehicle are capable to take off and land vertically which means it’s eliminated the requirement of a runway for flying purpose. These factors are anticipated to boost the rotary wings urban air mobility market opportunity in the forecasted time.

By region, Asia-Pacific dominated the global market in 2021 and is projected to remain the fastest-growing sub-segment during the forecast period. Urban traffic congestion and the need for quick transit have caused the Asia-Pacific market for urban air mobility to rise at an exponential rate in recent years. The Asia-Pacific urban air mobility market is anticipated to be driven by increasing R&D spending as well as a growing focus on improving air mobility over the coming years. For instance, in June 2022, Ehang Holdings limited which is world’s leading autonomous vehicle technology platform company and Tianxingjian Cultural Tourism Investment and Development LLC the enterprise of Hunan province government in china has signed the contract of 25 units of EH216 urban air mobility vehicles to promote aerial tourism in Aizhai wonder tourist area in Jishou, Hunan, China.

Impact of COVID-19 on the Global Urban Air Mobility Market Industry

- COVID-19 has negatively impacted various industries and business around the globe that has led to a drastic decline in investment by business in future technology such as urban air mobility.

- China is the leading producer and exporter of urban air mobility vehicles. However, China being the epicentre of the coronavirus pandemic, its export was affected, leading to a decline in urban air mobility production.

- Sales of urban air mobility are directly proportional to the demand from end-use industries namely automotive, taxi services, supply chain, and others. However, the demand for air mobility vehicles was greatly affected owing to import-export restrictions, closed borders, and supply chain disruptions due to the outbreak of the COVID-19 pandemic.

- Economic slowdown has affected the setup of new urban air mobility projects across the world as majority of government funding were diverted towards healthcare sector owing to rapid spread of the COVID-19 virus, impacting the market to the great extent.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the urban air mobility(UAM) market forecast, segments, current trends, estimations, and dynamics of the urban air mobility(uam) market analysis from 2021 to 2031 to identify the prevailing urban air mobility(uam) market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the urban air mobility(uam) market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global urban air mobility(uam) market trends, key players, market segments, application areas, and market growth strategies.

Urban Air Mobility(UAM) Market Report Highlights

| Aspects | Details |

| By Platform |

|

| By Platform Opeations |

|

| By Range |

|

| By Platform Architecture |

|

| By Region |

|

| Key Market Players | Airbus, Kitty Hawk, Volocopter GmbH, Neva Aerospace, Workhorse Group Inc., EHang, The Boeing Company, Opener, Lilium, Pipistrel Group |

Analyst Review

An increase in traffic conjunction in urban areas around the globe is the key factor that is projected to drive the growth of the global urban air mobility market during the forecast period. In addition, an increase in demand for a sustainable transportation system that is efficient, environment-friendly, safe, and secure transportation system around the world is anticipated to increase the demand for urban air mobility. Also, the advancement of technology in the field of urban air mobility in a particular sector such as transport, healthcare, and emergency services is estimated to boost urban air mobility market growth. However, high initial investments associated with urban air mobility are the key factors expected to hamper the market growth during the forecast period. On the contrary, the rapid growth of the use of urban air mobility in air taxi services and the rise in investment in urban air mobility is anticipated to provide remunerative opportunities for key players to maintain the pace of the urban air mobility market in the upcoming years.

Among the analyzed regions, Asia-Pacific is expected to account for the highest revenue in the market by the end of 2031, followed by Europe, North America, and LAMEA. Rapid industrialization and urbanization are the key factors responsible for the leading position of Europe and Asia-Pacific in the global urban air mobility market.

The diverse applications of urban air mobility across tourism, medical equipment transport, and other use such as use as personal vehicles, air taxis, or airbus to travel people between two destinations is the major market driver. In addition, the use of urban air mobility vehicles in medical services is estimated to generate excellent opportunities in the urban air mobility market.

Fixed wings platform architecture sub-segment of the industry acquired the maximum share of the global urban air mobility market in 2021.

The use of air mobility to travel people at low altitudes safely without any traffic conjunction and use to provide medical services is estimated to drive the adoption of urban air mobility.

The growing application of urban air mobility as an air taxi or airbus is anticipated to boost the urban air mobility market in the upcoming years.

Asia-Pacific will provide more business opportunities for the global urban air mobility market in future.

Ehang, Lilium Gmbh, Airbus, Wisk Aero LLC., Bell Textron, Volocopter GmbH, Workhorse Group Inc., Joby Aviation., Kitty Hawk, and Archer Aviation are the major players in the urban air mobility market.

The major growth strategies adopted by urban air mobility players are investment and agreement.

Government, airline, taxi operators and hospitals are the major customers in the global urban air mobility market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global urban air mobility market from 2021 to 2031 to determine the prevailing opportunities.

Loading Table Of Content...