Vaults And Vault Doors Market Research, 2033

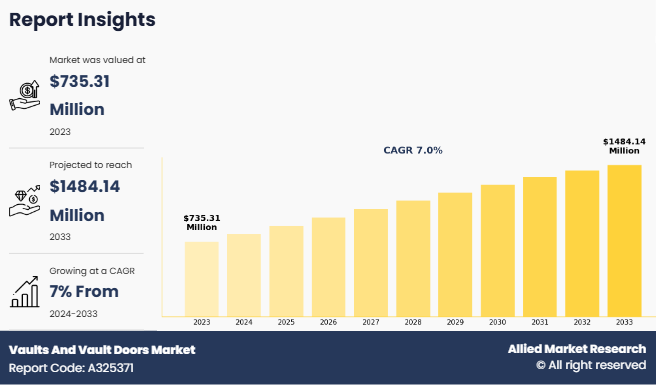

The global vaults and vault doors market was valued at $735.3 million in 2023, and is projected to reach $1,484.14 million by 2033, growing at a CAGR of 7% from 2024 to 2033. The vaults and vault doors encompass the products designed to provide secure storage for valuable assets, sensitive documents, and cash. Vaults and vault doors are made from materials such as steel and concrete, designed to resist unauthorized access, theft, or damage. They are often used by banks, financial institutions, government organizations, and businesses that require high-security storage. Vault doors are essential components of these vaults, engineered to withstand intense physical and technical breaches. They are often equipped with advanced locking mechanisms, such as combination locks, keypads, biometric systems, or multi-factor authentication technologies, to ensure the highest level of security. Vaults and vault doors include both standalone vault systems and customized vault door installations, catering to various industries such as finance, retail, and law enforcement.

Key Takeaways

By type, the vault doors segment held the largest share in the market in 2023.

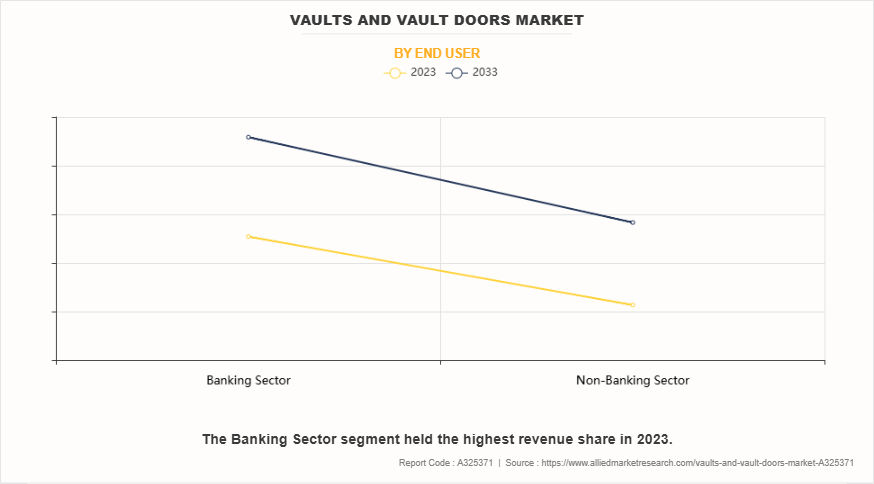

By end user, the banking sector segment held the largest share in the vaults and vault doors market size in 2023.

By lock type, the redundant lock segment is expected to show the fastest market growth during the forecast period.

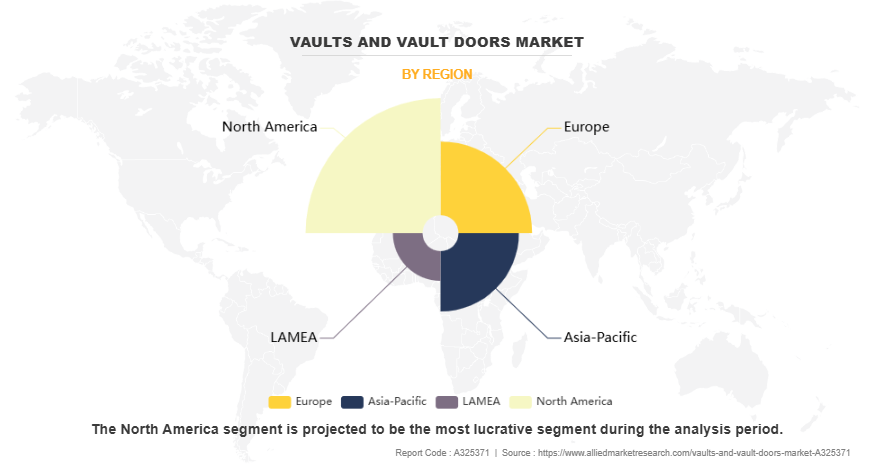

Region-wise, North America held the largest share in market in 2023. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

The market is driven by the growing focus on high-security requirements across various industries. Financial institutions, in particular, are investing heavily in reinforced vaults and secure entry systems to protect cash reserves, sensitive documents, and other critical assets. The rise in sophisticated criminal activities and increased security concerns in both public and private sectors accelerate the demand for highly secure vault doors. Additionally, regulatory changes and compliance standards related to asset protection are further propelling the market growth by encouraging companies to invest in advanced security infrastructure. However, the need for solutions based on specific client requirements, combined with the extended installation timelines, may hamper the widespread adoption of vault systems, especially among smaller businesses that seek cost-effective bank security solutions. On the other hand, the integration of new technologies, such as smart vaults with automated access control systems, provides an opportunity to attract tech-savvy customers who prioritize convenience alongside custom vault solutions, further boosting the market growth.

Segment Review

The global market is segmented into type, end user, lock type, and region. By type, it is classified into vaults and vault door. By end user, the market is bifurcated into banking sector and non-banking sector. By lock type, the market analyzed across electronic, combination, redundant lock and others. By region, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of end user, the global vaults and vault doors market share dominated by the banking sector segment in 2023 and is expected to maintain its dominance in the upcoming years, owing to the high demand for secure storage solutions to safeguard valuable assets, cash reserves, and sensitive documents, which propels the segment growth in the market. However, the non-banking sector segment is expected to exhibit the highest CAGR during the forecast period. This is attributed to the advancements in vault technologies, including fireproofing and customized storage solutions, further boost demand, contributing to the segment's rapid growth during the forecast period.

By region, North America dominated the market share in 2023 for the market. This is attributed to the region’s strong infrastructure development, coupled with stringent regulations related to asset protection. In addition, the increase in investments in the banking and retail sectors, as well as the rise in focus on cybersecurity and physical security integration, contribute to the leading position of the North America market. However, Asia-Pacific is expected to exhibit the highest growth during the vaults and vault doors market forecast period. This is attributed to rapid urbanization, increase in industrialization, and the surge in number of financial institutions and retail businesses in the region.

Competition Analysis

Competitive analysis and profiles of the major players in the market include American Security, Diebold Nixdorf, Inc., Godrej & Boyce Manufacturing Company Limited, Gunnebo AB, Kaso, Kumahira Co., Ltd, Wilson Safe Company, Smith Security Safes, Inc, Pentagon Safes, Fort Knox, Safegaurd Safes, Brown Safe Manufacturing, Inc., Vault Pro, Fichet Group, Overly Door Company, Vanguard International, Inc, Safe and Vault Company Limited, Hebei Yingbo Safe Boxes Co., Ltd. and Seico Inc.. These players have adopted various strategies to increase their market penetration and strengthen their position in the vaults and vault doors industry.

Recent News in the Vaults and Vault Doors Industry

In September 2024, Gunnebo Safe Storage launched Origo, a new electronic safe lock tailored for safes, strong rooms, and vault doors, to secure against burglary risks.

In October 2024, Gunnebo Safe Storage AB acquired Primat Group, a company with over a century of expertise in the manufacturing and sales of high-quality security products.

Top Impacting Factors

Driver

Increased Demand in Emerging Markets

The growing demand for vaults and vault doors in emerging markets is a significant factor driving the growth of the market. The need for enhanced security measures in financial institutions, commercial spaces, and residential properties has intensified as emerging economies experience rapid industrialization, urbanization, and rise in disposable incomes. This shift is leading to an increased adoption of advanced vault solutions. One of the key factors fueling this growth is the expansion of banking and financial services in emerging economies. The demand for robust security infrastructure, including vaults and vault doors, increases as banks and financial institutions establish new branches to cater to a larger customer base. For example, the rapid expansion of the banking sector in countries like India and Brazil has necessitated the installation of high-security vault systems to safeguard cash, documents, and valuables.

In addition, the rise in wealth accumulation in emerging economies also contributes to the growth of the vaults and vault market. Wealthy individuals and families are investing in home vaults to protect personal assets such as jewelry, luxury watches, and important documents. The luxury residential sector in markets such as UAE and China are witnessing a surge in demand for premium, technologically advanced vault systems. Further, rise in technological advancements support this growth, with modern vaults equipped with biometric access control, fire resistance, and advanced locking mechanisms. Companies are catering to this demand by offering custom-built, high-security vaults designed to meet the specific needs of clients in emerging markets. Overall, the increased demand for safety and security, driven by economic development and wealth accumulation in emerging markets, is propelling the growth of the global vaults and vault doors market.

Rise in Demand for Security

The rise in demand for security is a major factor propelling the growth of the vaults and vault doors market. Businesses, financial institutions, and individuals are prioritizing the protection of valuable assets owing to increasing concerns over theft, burglary, and data breaches. This growing emphasis on security is driving the adoption of advanced vault systems with superior protection features. One of the key drivers is the expansion of the banking and financial services sector. As banks store large volumes of cash, confidential documents, and customer assets, they require secure vaults to mitigate theft and ensure compliance with regulatory standards. For instance, financial institutions in regions like Southeast Asia and Latin America are significantly investing in high-tech vault doors with features like biometric access and multi-layer locking mechanisms. The corporate sector is also witnessing increased adoption of vaults and vault doors, especially in industries like jewelry, luxury retail, and data centers. Retailers are using vaults to secure high-value inventory, while data centers are implementing physical security measures to protect sensitive digital assets. For example, luxury retailers in Europe are installing customized vault systems to safeguard high-value jewelry and luxury watches.

Residential demand for home safes and vaults has also surged, driven by the rise in wealth accumulation. High-networth individuals are opting for residential vaults to protect valuable possessions, such as cash, legal documents, and collectibles. Manufacturers are meeting this demand by offering fire-resistant, biometric-enabled home vaults that blend security with convenience. Technological advancements have further enhanced security standards, with modern vaults featuring tamper-proof designs, smart access control, and real-time monitoring. The growing demand for physical and digital asset protection is expected to sustain the growth of the vaults and vault doors market globally.

Restraints

High Initial Investment Costs

The high initial investment costs associated with vaults and vault doors act as a significant restraint on market growth. These costs include expenses for raw materials, manufacturing, advanced security technologies, and customization, which make vaults and vault doors expensive for certain customer segments. This financial barrier limits adoption, particularly among small and medium-sized enterprises (SMEs) and residential users. One of the primary reasons for high costs is the use of premium materials like reinforced steel and concrete, which ensure durability, fire resistance, and tamper-proof features.

In addition, modern vaults incorporate advanced security technologies such as biometric authentication, smart locking systems, and remote monitoring, further increasing production and installation costs. For example, small retail stores or emerging financial institutions in developing economies may find it difficult to invest in high-security vaults due to budget constraints. The cost of installation, regular maintenance, and potential upgrading, also restrain the market growth. As a result, many small-scale businesses and residential users opt for less expensive security alternatives, such as safes, instead of full-scale vaults. These high initial investment costs also impact the residential market, where consumers may perceive vaults as luxury items rather than essential security solutions. This limits demand from middle-income households, affecting overall market growth. Without cost-effective options or financing solutions, the adoption of vaults and vault doors may remain confined to large corporations, financial institutions, and high-net-worth individuals.

Opportunities

Technological Advancements in Vaults and Vault Doors

Technological advancements in vaults and vault doors are unlocking new growth opportunities for the market. Innovations in materials, access control systems, and smart security technologies are driving demand for next generation vaults across financial institutions, commercial enterprises, and residential spaces. These advancements not only improve security but also enhance user convenience and operational efficiency.

One major technological leap is the integration of biometric access control systems, such as fingerprint and facial recognition technology. Unlike traditional key or code-based systems, biometric access provides a higher level of security and eliminates the risk of unauthorized access. Financial institutions and luxury retailers are increasingly adopting these vaults to protect cash, valuables, and sensitive information. For example, banks in regions like North America and Europe are equipping their vaults with multi-biometric access controls to enhance security and comply with stringent regulatory standards.

Smart vaults with IoT-enabled features is another transformative innovation, which further propels the market growth. These vaults offer real-time monitoring, remote access control, and instant alerts in case of tampering or unauthorized entry. Businesses, such as jewelry stores, now have the ability to track vault activity through mobile apps, reducing the risk of theft and improving response times. Smart vaults also support predictive maintenance, minimizing operational downtime. Moreover, the development of lightweight, fire-resistant materials has created an opportunity for portable home vaults. Advanced materials, like high-strength composites, offer the same level of protection as traditional steel vaults but at a reduced weight. This innovation has made residential vaults more accessible to consumers, especially high-net-worth individuals seeking convenient yet secure storage solutions.

Overall, technological advancements are transforming the vaults and vault doors market by offering smarter, more secure, and user-friendly products. This trend is driving demand across various sectors, fostering market growth in both developed and emerging economies.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the vaults and vault doors market analysis from 2023 to 2033 to identify the prevailing vaults and vault doors market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network and vaults and vault doors market outlook

In-depth analysis of the vaults and vault doors market segmentation assists to determine the prevailing vaults and vault doors market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global vaults and vault doors market trends, key players, market segments, application areas, and vaults and vault doors market growth strategies.

Vaults And Vault Doors Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1.5 billion |

| Growth Rate | CAGR of 7% |

| Forecast period | 2023 - 2033 |

| Report Pages | 348 |

| By Type |

|

| By End User |

|

| By Lock Type |

|

| By Region |

|

Analyst Review

The vaults and vault doors market is witnessing substantial growth driven by increasing demand for secure storage solutions across various sectors, such as banking, retail, and residential spaces. Surge in financial transactions, rise in concerns over asset safety, and stringent regulations around secure storage fuel the adoption of advanced vault technologies. This is expected to drive the market growth. In addition, innovations in vault design, such as biometric access control systems and IoT-enabled vaults, further enhance market growth.

However, the vaults and vault doors market expansion is hampered by the high costs associated with manufacturing and installing advanced vault systems. Small and medium-sized enterprises (SMEs) and residential users often find the upfront investment prohibitive, limiting adoption rates. The availability of security systems in some regions creates challenges for established players, which may restrain market growth.

Furthermore, the rise in adoption of digital and smart vault solutions, creates opportunity for market growth. These advanced solutions integrate technologies such as biometric access, IoT connectivity, and real-time monitoring, addressing the rising demand for secure accessible storage in various sectors. Financial institutions are leveraging these solutions for enhanced security and operational efficiency. Retailers and e-commerce businesses use them for cash and inventory management. This is expected to drive the market growth. Innovations such as AI-powered vaults, capable of detecting anomalies and providing predictive maintenance alerts, further drive adoption of vaults and vault doors market. Moreover, the governments in developing regions are also focusing on secure infrastructure, further boosting the demand for vault installations.

The forecast period for the vaults and vault doors market is 2024 to 2033.

The base year is 2023 in the vaults and vault doors market.

The total value of the vaults and vault doors market was $735.3 million in 2023.

The market value of the vaults and vault doors market is projected to reach $1,484.14 million by 2033.

Vaults and vault doors are primarily used for securing valuables, sensitive documents, and cash in banking institutions, government facilities, museums, and private residences. They provide high protection against theft, fire, and natural disasters.

Loading Table Of Content...

Loading Research Methodology...