Video Game Market Research, 2032

The global video game market size was valued at $231.4 billion in 2022, and is projected to reach $446.4 billion by 2032, growing at a CAGR of 6.5% from 2023 to 2032.The video game business is a strong and rapidly increasing sector that has seen great expansion as well as creativity over time. It has a tremendous impact on global entertainment because of its diverse range of platforms for playing games, classifications, and gaming audiences. Customers today are presented with greater alternatives than ever previously, owing to the introduction of sophisticated consoles for video games like the PlayStation 4, Xbox One, and Nintendo Switch, in addition to the ongoing popularity of PC gaming.

Mobile gaming has‐¯revolutionized‐¯the business by allowing for swift and simple gameplay on portable devices and smartphones. With the emergence of internet-based gaming services, users are able to have access to high-quality games without having to spend money on expensive equipment.

Esports, or professional‐¯organized‐¯competitive gaming, is gaining popularity and garnering enormous crowds as well as important sponsorships. Twitch and YouTube Gaming have grown into vital venues for gaming and content creators to connect with their fans. As a result, the video game industry maintains a dynamic ecosystem, recruiting participants from every corner of the globe and introducing new technology regularly. Interactive gaming, augmented reality (AR), and virtual reality's future potential predict that these advancements will continue to alter how we play and engage with digital media.

Market Dynamics

Recent years have seen the video game market continue to develop and grow as a result of numerous important phenomena. First off, the emergence of cloud gaming services has made high-quality gaming more accessible than ever before, allowing users to stream games straight to their devices.

Examples include Google Stadia and Microsoft's Project xCloud. As a result of this trend, the distinctions between gaming on consoles, personal computers, and mobile devices are becoming less clear. Second, the popularity of eSports has elevated competitive gaming to a popular culture phenomenon. Major eSports competitions now have sizeable prize pools, and professional gaming leagues have a lot of viewers, making eSports a successful business.

Third, advances in virtual reality (VR) and augmented reality (AR) gaming experiences have opened up new possibilities for immersive gameplay. The Oculus Quest VR headset and Pokémon GO AR game have generated a lot of interest, suggesting that these technologies have a bright future.

Furthermore, the free-to-play model continues to dominate the mobile gaming market, with in-app microtransactions providing considerable income. Finally, independent games are becoming increasingly popular as tiny firms create innovative and distinctive experiences that are appealing to a wide spectrum of gamers. As a whole, the video game business is positioned for ongoing growth and diversity as new innovations in technology and business models are introduced.

With the advent of digital distribution methods like as Steam and mobile app stores, the acceptance of privately owned game makers has grown. Their cutting-edge, frequently specialized games have increased the variety of gaming experiences accessible to gamers and competed with established AAA titles.‐¯Within the gaming industry, esports has grown to be a sizable subculture with professional athletes, competitions, and devoted fans. By transforming gamers into influencers and content producers, live streaming services like Twitch have increased gaming's appeal.

The old paradigm of buying games upfront has developed into a variety of monetization schemes, including free-to-play games with in-game purchases, season passes, and subscription services like Xbox Game Pass and PlayStation Now. This change has an effect on game design and income creation.¯

There are now more than a few significant regions where video games are sold. With more players, markets, and game development companies opening up globally, it has grown to be a global phenomenon. Success now depends heavily on localization and cultural sensitivity.

The industry is continually at odds with problems like loot boxes, gambling, and addiction. To safeguard gamers, governments, and other organizations are progressively regulating video game content and monetization.

Governments have banned certain games or developer companies due to the fast development of cloud gaming technology, causing data breaches and cyber security threats that adversely impact consumer behavior, hindering market expansion.

For instance, in July 2022, the Indian Government banned Battleground Mobile India (BGMI) due to concerns about security breaches and asked for it to be taken down by Apple and Play Store. In countries such as Brazil, Venezuela, and South Korea, violence is a reason to ban video games. Owing to the restriction of government censorship, developers need to develop a custom version, which would lead to increased development and maintenance costs. For example, a new Call of Duty & Cold War trailer was pulled from the market in August 2020 on account of its content not being approved by the government. This is why a short version was to be released later by the company.

The gaming business has a significant influence on the economies of Western countries such as the U.S. The gaming business in the U.S. employs approximately two million people and generates millions of dollars in tax receipts. The government's attempts to encourage the gaming sector have expanded individual engagement and have contributed to improving the industry's market worth. The governments of emerging nations, such as India, have incorporated Esports into traditional sporting disciplines.

The government has urged the Ministry of Electronics and Information Technology and the Sports Ministry to include e-sports in multi-sport events using the authority provided by clause (3) of Article 77 of the Constitution. The expanding endeavors by developing-nation governments to encourage electronic gaming are expected to give a chance for the gaming sector to grow at an exponential rate and generate higher valuation.

The technology that allows players to stream games over the internet without needing a high-quality gaming computer or console is cloud gaming, also known as game streaming on video game market demand and game streaming. The use of cloud gaming, which enables games to be played on remote servers with a real-time transmission into the player's device, allows rapid and responsive play.

Moreover, there are several benefits offered by cloud gaming for players, such as greater accessibility, convenience, performance, and cost-effectiveness. Google Sadia, Amazon Luna, GeForceNow, and Microsoft xCloud are some of the most popular cloud gaming platforms. These platforms offer a wide range of games, from indie titles to AAA releases, and allow players to play them on different devices. The possibility of cloud gaming to change the market by enabling more accessible, enjoyable, and cost-efficient games for players therefore exists.

Segmnetal Overview

The video game market is segmented on the basis of device, age group, platform type, and region. On the basis of devices, the market is classified into smartphones, PCs, and consoles. On the basis of age group, the market is categorized into Generation Z, generation Y, and Generation X. On the basis of platform type, the video game market is bifurcated into online and offline.

On the basis of region, the market is analyzed across North America (U.S., Canada, Mexico), Europe (UK, Germany, France, Russia, Italy, Spain, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and Rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, Argentina, and rest of LAMEA).

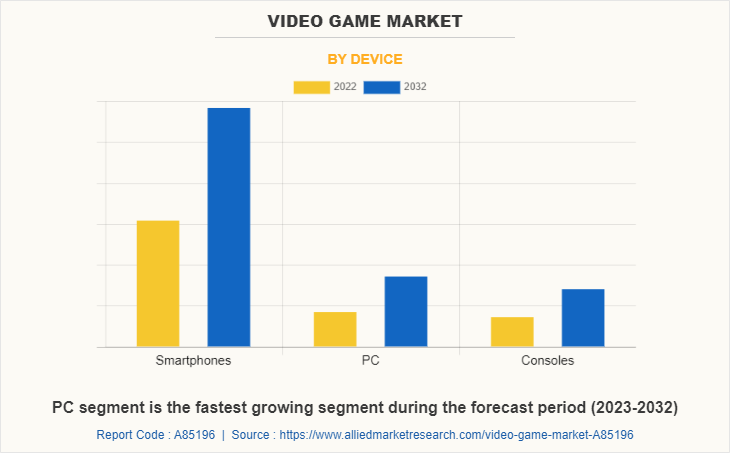

By Device

On the basis of device, the video game market is segmented into smartphones, PCs, and consoles. The smartphone segment dominated the market in 2022 and is expected to witness the highest growth during the video game market forecast period since mobile games often have simple controls and are designed to be played in short bursts. In addition, mobile devices now represent the majority of aspects of a person's everyday routine, and this has made smartphones an important source of entertainment due to their ability to access high-speed internet.

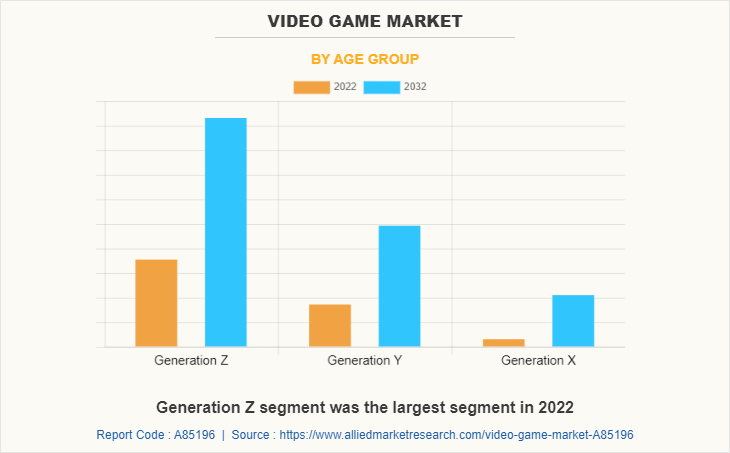

By Age Group

On the basis of age group, the video game industry‐¯is categorized into Generation Z, generation Y, and Generation X. Generation Z grew up in an increasingly sophisticated technological environment with the rise of mobile phones and laptops. As a result, they are more technologically advanced than their predecessors.

Even though Generation Y is more digitally sound as they saw the innovations and advancements, including the launch of the World Wide Web, they are more inclined toward consoles and other gaming moods as major consoles occurred between 1970 to 2010. On the other hand, generation Z is fond of smartphones and gaming devices, which is expected to boost the demand for the segment.

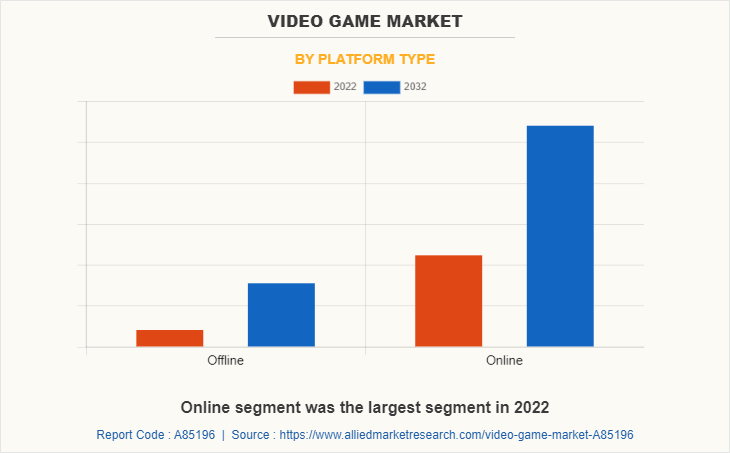

By Platform Type

On the basis of platform type, the video game market is bifurcated into online and offline. The online segment is expected to grow at the fastest CAGR due to numerous causes such as technological improvements, a rise in internet penetration, and development in the smartphone market with the debut of new gaming handsets. In addition, there are different genres of this online section such as the first shooter games, RealTime Strategy RTS Games, Massive Multiplay Online MMO FPS Games, and Multiplayer Battle Royales. For instance, in June 2022, Tencent announced the launch of its XR division to develop its Benchmark VR product further.

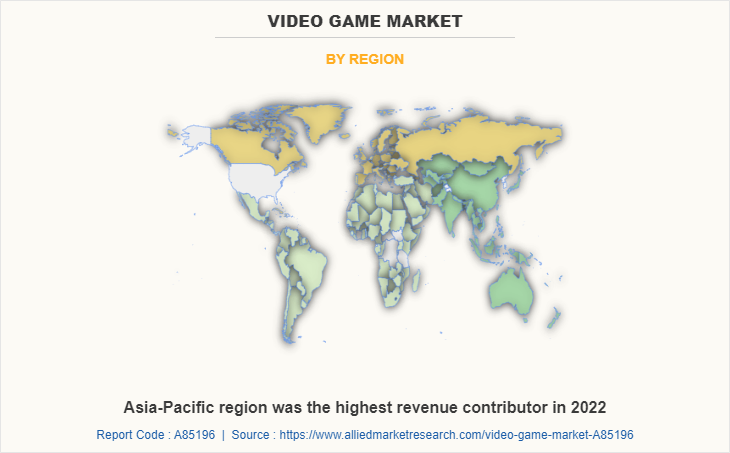

By Region

On the basis of region, the video game industry‐¯is analyzed across North America (U.S., Canada, Mexico), Europe (UK, Germany, France, Russia, Italy, Spain, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and Rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, Argentina, and rest of LAMEA).

The video game business in Asia Pacific is robust and diverse, spanning many countries and cultures. Considering an expanding middle class and greater use of smartphones, the region has established itself as an across-the-globe gaming powerhouse. China, Japan, and the Republic of Korea are among the key players, with a concentration on PCs, handheld devices, and electronic‐¯sports.

Furthermore, Southeast Asian nations such as Thailand as well as Indonesia are growing in importance as online market places. The market is expanding due to a variety of causes, including a younger demographic, greater resources accessible, and an appreciation of video games. In this dynamic market, both domestic and foreign game publishers and creators may succeed.

Some of the Strategic Developments are: -

In July 2022, Asus expanded its ROG gaming smartphone line with the introduction of the ROG Phone 6 and ROG Phone 6 Pro. The phone features the newest Snapdragon 8+ Gen 1 system-on-chip, IPX4 grade, 165Hz refresh rate AMOLED screen, up to 18GB RAM, and 512GB onboard storage.

In August 2022, Philips increased its gaming monitor lineup in India with the introduction of two new premium gaming monitors, the 27M1N3200ZA and the 24M1N3200ZA.

In January 2023, Nintendo introduced its popular franchise Fire Emblem, including character enhancements and developments, as well as new features that made the game more engaging.

In April 2022, NFL teamed with sports technology startup StatusPRO to create NFL Pro Era, a football video game for Meta Quest and PlayStation.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the video game market share, market segments, current trends, estimations, and dynamics of the video game market analysis from 2022 to 2032 to identify the prevailing video game market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the video game market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global video game market trends, key players, market segments, application areas, and market growth strategies.

Video Game Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 446.4 billion |

| Growth Rate | CAGR of 6.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Age Group |

|

| By Platform Type |

|

| By Device |

|

| By Region |

|

| Key Market Players | Take-Two Interactive Software, Inc., Electronic Arts Inc., Activision Blizzard, Inc., Lucid Games, Bandai Namco Entertainment America Inc., Epic Games, Inc, Nintendo of America Inc.,, Ubisoft Entertainment., Sony Interactive Entertainment Inc., Microsoft Corporation |

Analyst Review

The games industry revolves around creativity. New technology, services, and experiences propel the market forward. The industry's future appears promising as more individuals play games, they would generate demand for engaging entertainment and desire simpler access to games. The initiative made by many companies and associations to invest in the gaming business and hold esports events is likely to inspire people to pursue gaming as a career, which is expected to fuel the growth of the video games market. Technological advancements in the field of gaming and gaming devices provide lucrative opportunities for growth in the market.

Exponential growth has occurred in mobile gaming, leading to new opportunities in the market. In October 2022, India's Prime Minister, Narendra Modi announced that in the 6th edition of MIPc2022, 5G services are expected to be launched in India. Reliance Jio and Bharti Airtel are the two companies that introduced 5G in India in October 2022, making the service available within eight cities.

By region, Asia-Pacific accounted for the largest Video Game Market share.

Key Players in Video Game Market - Microsoft Corporation, Bandai Namco Entertainment America Inc., Electronic Arts Inc., Sony Interactive Entertainment Inc., Epic Games, Inc, Ubisoft Entertainment., Activision Blizzard, Inc., Nintendo of America Inc.,, Take-Two Interactive Software, Inc., Lucid Games

The video game market to register at a CAGR of 6.5% During 2023-2032.

The video game market was valued at $231.4 billion in 2022 and is expected to reach $446.5 billion by 2032 registering a CAGR of 6.5%.

Loading Table Of Content...

Loading Research Methodology...