Video Surveillance Storage Market Research, 2031

The global video surveillance storage market size was valued at $12.3 billion in 2021, and is projected to reach $39.5 billion by 2031, growing at a CAGR of 12.3% from 2022 to 2031.

Increase in installation of video surveillance systems due to growing security concerns is driving the growth of video surveillance storage market. In addition, advances in storage technology and the availability of inexpensive hard disk drives drive the growth of the video surveillance storage market. In addition, increase in government regulations for installing video surveillance systems in certain public places fuels the video surveillance storage market growth.

Many companies around the world are investing millions of dollars to install video surveillance cameras in their offices. Most governments also directed businesses in various industries to install video surveillance cameras to increase the overall security level of these companies.

The video surveillance storage market is segmented on the basis of component, storage media, organization size, industry vertical, and region. By component, it is divided into hardware, software and services. By storage media, it is segregated into hard disk drive (HDD) and solid-state drive (SSD). By organization size, it is categorized into SMEs and large enterprises. By industry vertical, it is classified into BFSI, retail, manufacturing, healthcare & pharmaceutical, government & defense, education, media and entertainment, transportation and logistics and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players that operate in the Video Surveillance Storage Industry are Carbon Black Inc., Cisco Systems, Inc., Crowdstrike Inc., Intel Corporation, McAfee, LLC, Microsoft Corporation, Palo Alto Networks, Inc., RSA Security LLC., Symantec Corporation, and Trend Micro Incorporated. These players have adopted various strategies to increase their market penetration and strengthen their position in the Video Surveillance Storage industry.

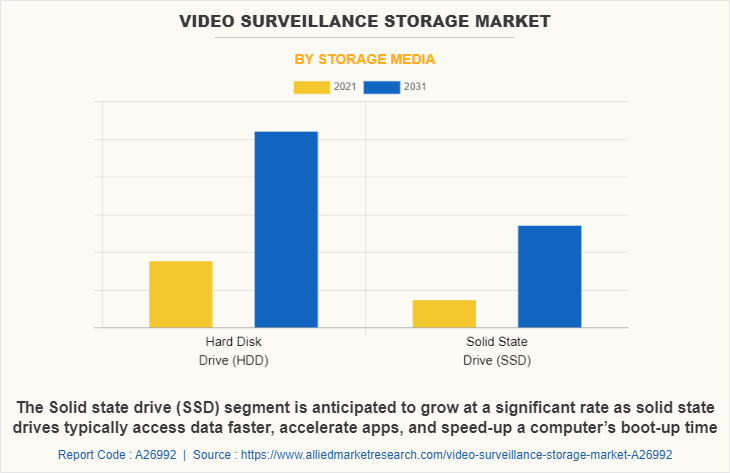

In terms of storage media, the hard disk drive (HDD) segment holds the largest video surveillance storage market share and is expected to remain dominant during the forecast period. This is due to digital video surveillance systems using hard drives are rapidly replacing tape-based systems. However, the solid-state drive (SSD) segment is expected to witness highest growth in the upcoming years as it typically access data faster, accelerate apps, and speed-up a computer’s boot-up time.

Depending on the region, North America dominated the market in 2021due to rise in usage of video surveillance storage in government, commercial, residential and industrial sector for security purposes.

Top Impacting Factors

Rise in demand for highly efficient and AI vision-based surveillance systems

Network video surveillance systems are advancing from being simple monitoring devices to form comprehensive solutions that can be applied in every sector. The AI technology integrated with systems at every level is expected to witness unparalleled growth. Furthermore, the data generated by AI vision solutions using AI cameras as vision sensors creates meaningful business intelligence to help organizations gain a better understanding of their customers and their operations.

Furthermore, cloud-based solutions use people-counting algorithms to help store owners evaluate sales or floor design strategies, or heat-mapping to measure and avoid long checkout lines to increase customer satisfaction. In addition, its applications and benefits can apply to traffic management or smart parking systems, logistics and distribution, or healthcare for critical area monitoring. Such benefits further drive the growth of the market.

Increase adoption of emerging technologies such as cloud computing and IoT

Network technology and the Internet of Things (IoT) are already being embraced widely but they will continue to disrupt the security camera market, enabling new advances in HD video streaming, even on mobile devices. These technologies are projected to expand the potential applications for audio and video analytics and AI in an increasingly connected world. On a broader level, there is a massive upsurge in widespread digital transformation, with the key technologies driving this change including IoT and network as well as cloud computing, intelligent data and AI. The IoT is expected to be positively impacted by developments in network technology, especially in terms of bandwidth and latency.

Moreover, adding advanced network technology to cameras supports remote real-time video surveillance, the expanded use of mobile applications and legacy network management. Artificial Intelligence Internet of Things (AIoT) can enable an almost unlimited array of potential opportunities, from open and integrated system/platforms to expanded device connectivity. Such advancements are anticipated to provide lucrative growth opportunities for the market during the forecast period.

COVID-19 Impact Analysis

The global COVID-19 pandemic has positively impacted adoption of video surveillance storage system, owing to lockdowns imposed by governments of different countries. Moreover, post COVID-19 situation, companies are focusing on emerging technology such as AI, cloud computing, Internet of Things (IoT), data analytics, and edge-based solutions that reduce processing time and resource-efficient across industries such as BFSI, healthcare, and government to perform contactless operation. Thus, drive adoption of the video surveillance storage market globally.

Furthermore, COVID-19 has prompted the increased use of touchless solutions such as facial recognition access control and the use of solutions such as license plate recognition could become more popular in the video surveillance system in the upcoming year as customers look to minimize physical contact risk. Such benefits will provide numerous opportunities for the market growth during the forecast period.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the Video Surveillance Storage Market Forecast, current trends, estimations, and dynamics of the video surveillance storage market analysis from 2021 to 2031 to identify the prevailing video surveillance storage market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the video surveillance storage market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global video surveillance storage market trends, key players, market segments, application areas, and market growth strategies.

Video Surveillance Storage Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Storage Media |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Amazon Web Services |

Analyst Review

In accordance with insights by CXOs of leading companies, the global video surveillance storage market is projected to witness prominent growth, especially in Asia-Pacific and North America. This growth is attributed to increased investments by organizations and governments for security and adoption of cloud-based video surveillance storage solutions. Moreover, increase in consumer awareness of the importance of video surveillance for security and continuous monitoring drives the market growth. In addition, rise in use of high-definition cameras have increased the demand for video surveillance storage solutions and continuous advancement in storage technology, development of smart cities and increase in CCTV installation in industries such as BFSI, retail, hospitality and healthcare will complement the growth of the indoor video surveillance storage market. Furthermore, due to COVID-19, the video surveillance technology is being increasingly adopted by many countries and region to fight pandemic as it provides useful insights about the spread of pandemic and area of mass gathering. On the other hand, countries such as Singapore Israel, and South Korea used a combination of location data, video camera footage and credit card information, to track COVID-19 infected in their countries. For instance, in Singapore, the government rolled out an app named “TraceTogether”. It uses Bluetooth signals between mobile phones to see if potential carriers of the coronavirus have been in close contact with other people.

Furthermore, increased investments from organizations in products including video surveillance storage, owing to increasing security needs, expansion of public infrastructure, as well as increasing IT spending and surge in awareness among people to deploy CCTV cameras is expected to provide lucrative opportunities for the market growth. In addition, key strategies such as partnership and product launch adopted by key market players for video surveillance storage technology is also boosting the market growth. For instance, In May 2019, NetApp launched NetApp ONTAP 9.6. NetApp ONTAP 9.6 is a cloud-based flash solution. ONTAP is capable of storing high-quality video surveillance footages.

Increase in installation of video surveillance systems due to growing security concerns is driving the growth of video surveillance storage market. In addition, advances in storage technology and the availability of inexpensive hard disk drives drive the growth of the video surveillance storage market. In addition, increase in government regulations for installing video surveillance systems in certain public places fuels the market growth.

Depending on the region, North America dominated the market in 2021due to rise in usage of video surveillance storage in government, commercial, residential and industrial sector for security purposes.

The global video surveillance storage market size was valued at $12,296.00 million in 2021, and is projected to reach at $39,532.90 million by 2031, growing at a CAGR of 12.3%. from 2022 to 2031.

The key players that operate in the video surveillance storage market are Carbon Black Inc., Cisco Systems, Inc., Crowdstrike Inc., Intel Corporation, McAfee, LLC, Microsoft Corporation, Palo Alto Networks, Inc., RSA Security LLC., Symantec Corporation, and Trend Micro Incorporated. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loading Table Of Content...