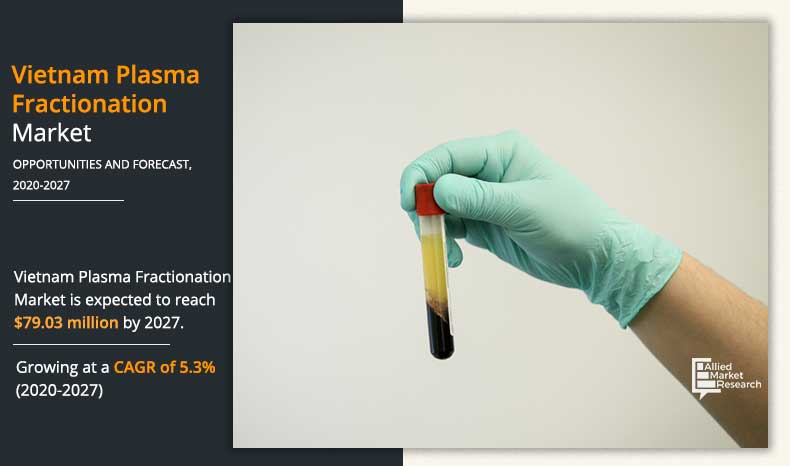

Vietnam Plasma Fractionation Market Overview:

The Vietnam plasma fractionation market size was valued at $56.62 million in 2019, and is expected to reach $79.03 million by 2027, registering a CAGR of 5.3% from 2020 to 2027. Plasma is a vital biological element of blood, which is used as a treatment for a number of medical disorders. Proteins present in plasma are mostly antibodies, coagulation factors, albumin, fibrinogen, and globulins. Each of these proteins can be separated and extracted using different fractionation techniques that produce varied plasma products for treating a diverse portfolio of diseases. Some plasma derivatives obtained from fractionation process are fibrin glue, factor VIII, factor IX, fibrinogen, fraction V, albumin, protein C, and factor XI. These plasma derivatives have major applications in fields of neurology, hematology, immunology, and critical care. In addition, these products find their use in rheumatology, pediatrics, and dermatology. For instance, plasma derivatives such as coagulation factor VIII are used in treating blood related disorders such as hemophilia; and immunoglobulins (IVIG) are used in the treatment of neurological conditions and primary immunodeficiency disorders. Likewise, albumin is one of the key proteins used in the treatment of Alzheimer’s, renal dialysis, sepsis, and sealant in surgeries, medical devices coatings, drug formulation agent, and as a vaccine ingredient. Owing to the wide range of applications in several diseases, the demand for plasma fractionation products is estimated to increase in the future.

Vietnam had a population of approximately 94 million as of 2019. The country had a large pool of population suffering from Parkinson’s disease, brain cancer, epilepsy, hemophilia, and autoimmune disorders, owing to the use of Agent Orange herbicide during the Vietnam War. In addition, the country is expected to become an aged society by 2035, as per data published by the World Bank Group in 2020. The aged population in the country is more vulnerable to severe medical conditions that may involve use of plasma fractionated products. Thus, this predictable change in demographics is projected to surge the onset of different diseases among the Vietnamese population in the future, thereby, resulting in increased demand for novel and innovative plasma therapies. Subsequently, the country provides profitable opportunities to pharmaceutical companies for setting up their plasma fractionation plants to meet the population demand.

Surge in aged population in the country that are vulnerable to serious illnesses along with pre-existing medical disorders are projected to drive the plasma fractionation market in Vietnam. Likewise, rise in use of plasma derivatives across wide-ranging areas of medicine and developing plasma collection centers are expected to drive the growth of the Vietnam plasma fractionation market. On the contrary, stricter regulations for both, high quality standards of plasma derivatives and logistics to source and collect blood plasma along with timely delivery are anticipated to hamper the market growth. However, initiatives such as “Make in Vietnam”, mobile healthcare initiatives, and Vietnam Medi-Pharm Expo are attracting several foreign direct investments and integration of technologically advanced medical services in the country’s healthcare sector for improving quality of life of people. These initiatives create ample opportunities for pharmaceutical companies to provide plasma fractionated products in Vietnam.

On the other hand, COVID-19 pandemic has raised up a critical challenge for the entire healthcare industry, thereby impacting the Vietnam plasma fractionation market growth as well. Owing to the early intervention such as mass lockdown and restricted strategies toward mass gatherings by the Vietnamese government, amidst the COVID-19 pandemic, voluntary blood donation programs and camps have been postponed or suspended. This has resulted in significant decrease in the number of blood plasma donors within the country. Likewise, the major share in supply of blood donations was from schools and colleges that are shut down across Vietnam, further reducing the number of donors and impacting the plasma fractionation market growth negatively in the country. However, the overall impact of COVID-19 pandemic is likely to remain positive for pharmaceutical companies operating in the Vietnam plasma fractionation market. The companies are currently facing a set-back, owing to the lockdown, which has led to a drop in number of blood plasma donors across the Vietnam. Nevertheless, this deleterious impact is being compensated by a rapid demand for newly launched plasma therapy for treating COVID-19 patients.

The Vietnam plasma fractionation market is segmented on the basis of product, application, and end user. By product, the market is classified into albumin, immunoglobulins, coagulation factor VIII, and Coagulation factor IX. By application, it is categorized into neurology, hematology, immunology, critical care, and others. By end user, it is bifurcated into hospitals and clinical research laboratories.

Product Segment Review

By product, the market is classified into albumin, immunoglobulins, coagulation factor VIII, and Coagulation factor IX. Under immunoglobulin segment, the Vietnam plasma fractionation market is further bifurcated in to Intravenous immunoglobulin (IVIG) and subcutaneous immunoglobulin (SCIG). The immunoglobulin segment is expected to dominate the Vietnam plasma fractionation market throughout the forecast period, owing to diversified use in various disorders such as primary and secondary immune deficiencies, autoimmune diseases, and inflammatory diseases.

By Product

Immunoglobulins segment holds a dominant position in 2019 and would continue to maintain the lead over the forecast period.

Application Segment Review

By application, the neurology segment acquired the largest share of the Vietnam plasma fractionation market in 2019, and it is expected to be the fastest growing segment during the forecast period. This is attributable to the surge in neurological disorders that involve use of plasma fractionated products for treatment. Prevalence of hydrocephalus, Parkinson’s disease, epilepsy, traumatic brain injuries, and cerebrovascular diseases particularly in non-urban communities, owing to lack of resources in the country drive the growth of the market for the neurology segment.

By Application

Neurology segment is projected as one of the most lucrative segment.

End User Segment Review

By end user, the hospital segment was the major contributor to the market in 2019, and is also expected to register fastest growth during the forecast period, owing to rise in number of hospitals in the country. Furthermore, plasma derivatives are employed in medical fields such as critical care and hematology. Treatments for these medical conditions are performed by skilled professional in hospitals, thereby boosting the growth of the market for the end user segment.

By End User

Hospitals segment holds a dominant position in 2019 and would continue to maintain the lead over the forecast period.

Key Benefits For Stakeholders

This report provides a detailed quantitative analysis of the current Vietnam plasma fractionation market trends and forecast estimations from 2020 to 2027, which assists to identify the prevailing market opportunities.

An in-depth Vietnam plasma fractionation market analysis includes analysis of various regions, which is anticipated to provide a detailed understanding of the current trends to enable stakeholders formulate region-specific plans.

A comprehensive analysis of factors that drive and restrain the growth of the global is provided.

The projections in this report are made by analyzing the current trends and future market potential from 2020 to 2027, in terms of value.

An extensive analysis of various regions provides insights that are expected to allow companies to strategically plan their business moves.

Key market players within the Vietnam plasma fractionation market are profiled in this report and their strategies are analyzed thoroughly, which helps in understanding competitive outlook of the market.

Vietnam Plasma Fractionation Market Report Highlights

| Aspects | Details |

| By Product |

|

| By Application |

|

| By End User |

|

| Key Market Players | NOVO NORDISK, TAKEDA PHARMACEUTICAL COMPANY LIMITED, BIO PRODUCTS LABORATORY LTD., SANQUIN BLOOD SUPPLY FOUNDATION, BAXTER INTERNATIONAL INC., KEDRION BIOPHARMA, BIOTEST AG, GETZ HEALTHCARE, SANOVA HEALTHCARE, OCTAPHARMA, GRIFOLS SA |

Analyst Review

The plasma fractionation products are expected to witness high adoption in the near future, owing to increase in applications of these products to treat varied range of diseases. The market is exhibiting high growth rate, owing to surge in awareness about use of the plasma fractionation products in various medical aspects.

Moreover, surge in geriatric population across Vietnam, which is predisposed to rare diseases that require plasma products for treatment also fuels the growth of the market. Factors, such as improvement in healthcare facilities, rise in disposable income, and rapidly evolving economic conditions are awaited to offer beneficial opportunities for the growth of the Vietnam plasma fractionation market. However, stricter regulations hinder the growth of the market.

The total market value of Vietnam Plasma Fractionation Market is $79.03 Million

The forecast period in the report is from 2020 to 2027

The market value of Vietnam Plasma Fractionation Market in 2019 was $52.21 Million

The base year for the report is 2019

Yes, Vietnam Plasma Fractionation companies are profiled in the report

The top companies that hold the market share in Vietnam Plasma Fractionation Market are Baxter International Inc., Bio Product Laboratory, Biotest AG, Csl ltd., Grifols SA, and Kedrion.

No, there is no value chain analysis provided in the Vietnam Plasma Fractionation Market report

The key trends in the Vietnam Plasma Fractionation Market are prevailing diseased conditions in the population coupled with the growth in geriatric individuals vulnerable to many diseases.

Loading Table Of Content...