Virtual Currency Market Statistics, 2032

The global virtual currency market size was valued at $2.4 billion in 2022, and is projected to reach $9 billion by 2032, growing at a CAGR of 14.3% from 2023 to 2032. Rise in digitalization and tech adoption is a significant driver of the growth of the virtual currency market share. People may now communicate and transact business with one other more easily on a worldwide scale thanks to the digitalization process. Because virtual currencies are digital and decentralized, they can easily cross national borders and provide a borderless and efficient means of transferring capital. Furthermore, surge in interest from institutional investors has driven the demand for the virtual currency market growth.

However, regulatory uncertainty and compliance challenges has hampered the growth of the virtual currency market due to regulatory uncertainty is sometimes the result of a lack of clear rules and regulations governing the use and exchange of virtual money. Due to their confusion over the legal and regulatory position of virtual currencies, businesses, investors, and consumers are becoming cautious. Moreover, security concerns and cybersecurity risks are major factors that hamper the growth of the market. On the contrary, integration of central bank digital currencies (CBDCs) is an opportunity for virtual currency market. By attracting new participants, the introduction of CBDCs holds the potential to expand the virtual currency industry overall. It might convince individuals and organizations to look into digital currencies, especially decentralized ones like Ethereum and Bitcoin, in along with CBDCs.

Virtual currency refers to a type of digital or electronic money that exists solely electronically and does not exist in the actual world as coins or banknotes. Unlike traditional currencies that are issued by central banks and governments, virtual currencies are decentralized and typically based on blockchain technology. Furthermore, virtual currencies are commonly utilized with decentralized technologies like blockchain, a distributed ledger that records every transaction done via a network of computers. Transactions can be checked or tracked without the help of a central authority, like a bank or government, thanks to its decentralized structure.

Moreover, virtual currencies utilize cryptographic techniques to control the creation of new units and ensure the security of transactions. This guarantees the currency's integrity and security. In addition, due to the fact that transactions using some virtual currencies are typically conducted under false identities, consumers do enjoy some anonymity. Nevertheless, the level of privacy may vary depending on the specific virtual currency and the technology behind it. Furthermore, virtual currencies can be accessed and utilized globally without the need for traditional financial infrastructure. This property makes them particularly attractive for international transactions. Moreover, a limited quantity of digital currency market value, like Bitcoin, can only have a maximum number of units produced. This scarcity could have an effect on the currency's value.

The report focuses on growth prospects, restraints, and trends of the virtual currency market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the virtual money market.

Segment Review

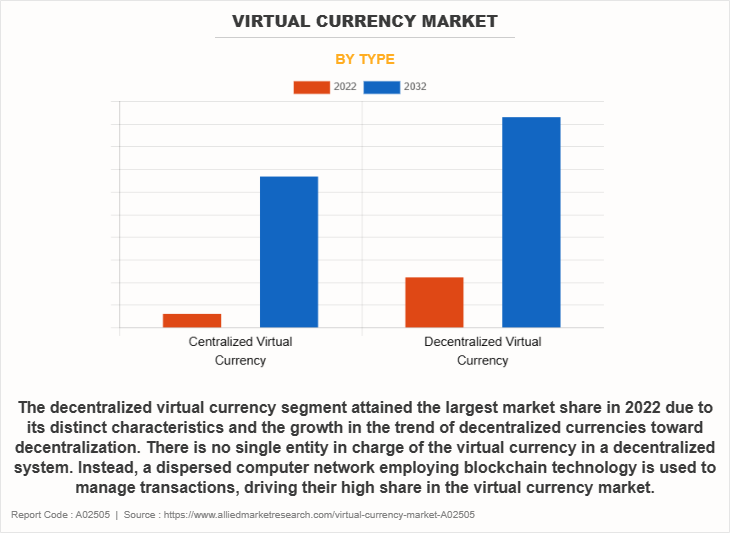

The virtual currency market is segmented on the basis of type, usage, and region. On the basis of type, the market is bifurcated into centralized virtual currency, and decentralized virtual currency. On the basis of usage, it is segmented into trading, e-commerce and retail, remittance, payment, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, the decentralize virtual currency segment attained the highest market share in 2022 in the virtual currency market. This is attributed to the unique traits and the acceleration of the decentralized currency trend toward decentralization. In a decentralized system, the virtual currency is not managed by a single organization. Rather, transactions are handled by a distributed computer network that uses blockchain technology. More security, transparency, and user autonomy are features that make decentralized virtual currencies like Bitcoin desirable.

Meanwhile, the centralize virtual currency segment attained the fastest market share in 2022 in the virtual money market. This can be explained by the fact that, due to its centralized structure, a central authority—such as a financial institution or the government—manages and regulates the virtual currency. Because of its centralized control, consumers feel more trustworthy and secure, making it a popular choice for a range of financial operations. Many businesses and individuals like centralized virtual currencies because of their familiarity, ease of use, and regulatory framework, which provides a certain amount of market security.

On the basis of region, Asia-Pacific attained the highest market share in 2022 and emerged as the leading region in the virtual currency market. This is explained by the robust fintech environment in the Asia-Pacific area, where several startups and well-established financial institutions are investigating blockchain and virtual currency solutions. The growth and integration of virtual currencies are supported by this ecosystem.

On the other hand, the Asia-Pacific region is projected to be the fastest-growing region for the virtual money market during the forecast period. The Asia-Pacific region's vast and diverse population is seen to offer a substantial market opportunity for virtual currencies, which explains this increase. Countries including South Korea, Japan, China, and India have shown a great deal of interest in and acceptance of digital currencies.

Top Impacting Factors

Rise in Digitalization and Tech Adoption

The need for digital financial solutions has increased as businesses and individuals undergo digital transformation. When it comes to carrying out transactions, virtual currencies provide a decentralized and usually more effective approach than traditional financial institutions. Furthermore, Innovation in the realm of virtual currencies has been aided by the growth of fintech, or financial technology. Fintech businesses are creating new financial services and products, such as tokenized assets, smart contracts, and decentralized financing (DeFi) platforms, using blockchain technology and virtual currency. Moreover, virtual currencies offer a faster, more seamless solution for cross-border transactions. Traditional international transfers can be expensive and time-consuming. Cryptocurrencies enable faster and more cost-effective cross-border payments.

In addition, more businesses are accepting virtual currency as payment. The necessity to serve a tech-savvy clientele and reduce transaction costs has led to the popularity of this approach by both small and large businesses. moreover, there has been a rise in institutional investor activity in virtual currency exchanges. This group includes investment funds, asset managers, and even traditional financial organizations. Their involvement boosts demand and lends legitimacy to the industry. The market for virtual currencies has been fueled by the increase in digitization and ICT use.

Surge in Interest from Institutional Investors

Virtual money particularly Bitcoin are now acknowledged as legitimate assets. Hedge funds, family offices, and investment organizations are among the institutional investors who have included cryptocurrency investments in their diverse investment portfolios. Furthermore, because of concerns about inflation and economic uncertainty, institutional investors have looked for alternative assets. Some people view virtual currencies like Bitcoin as potential inflation hedges and gold-like stores of value. Moreover, the infrastructure supporting the virtual currency market has evolved over time. The introduction of regulated cryptocurrency exchanges, custody options, and financial products like Bitcoin futures contracts has made it more appealing to institutional investors.

Furthermore, a more organized regulatory framework and enhanced regulatory clarity have made institutional investors feel more comfortable. A clearer set of regulations helps ease concerns about potential legal ramifications and adherence to laws governing virtual currencies. In addition, because of the improved regulatory environment and better clarity of regulations, institutional investors now feel more secure. An increase in regulatory clarity might allay concerns about potential legal ramifications and adherence to laws governing virtual currencies. Therefore, the market for virtual currencies has grown as a result of a spike in interest from institutional investors.

Regulatory Uncertainty and Compliance Challenges

Lack of clear norms and regulations is a major source of regulatory ambiguity in the virtual currency space. The rapid advancement of virtual currencies and blockchain technology has created difficulties for many countries and regulatory bodies. Because there are no clear limitations, investors, businesses, and users are left in the dark, which prevents widespread adoption. In addition, because of regulatory uncertainty, investors and traditional financial institutions frequently exhibit risk aversion. Organizations may be hesitant to use virtual currencies out of concern for unfavorable legal and regulatory repercussions. This risk aversion could hinder the assimilation of virtual currencies into the larger financial ecosystem.

Moreover, it can be costly and challenging for businesses operating in the virtual currency market to comply with rules. Compliance often requires the establishment of robust know your customer (KYC) and anti-money laundering (AML) procedures. The complexity and increasing operating costs arise from the need to adhere to many regulatory standards in various jurisdictions. In addition, in the absence of internationally accepted regulation, various countries and regions may adopt distinct approaches to regulating virtual currencies. This fragmentation may hinder the emergence of a single and integrated virtual currency market, which may result in anomalies and challenges for businesses that transact business globally. Consequently, the development of the virtual money industry has been impeded by regulatory uncertainties and compliance issues.

Integration of Central Bank Digital Currencies (CBDCs)

The public and commercial sectors stand to gain greatly from the integration of Central Bank Digital Currencies (CBDCs), which presents a substantial opportunity for the virtual currency market. As central banks around the globe look into the development and use of CBDCs, a new era of collaboration and cohabitation might be ushered in by the synergy between these digital versions of national currencies and already-existing virtual currencies. Furthermore, improving the legitimacy and lucidity of regulations is a significant avenue for consideration. As government-backed digital currencies, CBDCs can provide some regulatory certainty to the virtual currency industry. In order to allay long-standing worries about regulatory uncertainty, the integration of CBDCs may lead to the development of clearer rules and standards for the larger digital currency ecosystem. As a result, this might encourage businesses, people, and institutional investors to participate in the virtual currency market forecast with greater confidence, which would increase its acceptability.

In addition, including CBDCs can serve as a bridge connecting traditional financial institutions with the world of decentralized virtual currencies. To help those who might have been hesitant to adopt virtual currencies, CBDCs provide a recognizable and officially sanctioned digital equivalent of fiat currencies. People may adopt digital currencies more widely as a result of this integration as they become used to the idea of centralized, digital money. Thus, the need for the virtual currencies market has been fueled by the integration of central bank digital currencies (CBDCs).

Recent Devlopments in the Virtual Currency Market

- In December 2023, Tokensoft partners with Chainwire to enhance crypto public relation outreach. Through this partnership, the innovativepublic relation platform of Chainwire is expected to be utilized to enhance visibility of Tokensoft within the cryptocurrency community. The alliance is a calculated step that is anticipated to improve outreach and communication of Tokensoft with international cryptocurrency communities.

- In October 2022, Google partners with Coinbase to bring crypto payments to cloud services to allow users to pay for cloud services using crypto. A select group of customers are now be able to make payments with Bitcoin, Ether, and Dogecoin. In response to the news, stock of Coinbase rose over 7%. This partnership is anticipated to cause Coinbase to switch from Amazon Web services to cloud infrastructure of Google for hosting its data-related applications. Google is projected to also use custody service of Coinbase, Coinbase Prime.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the digital currency market analysis from 2022 to 2032 to identify the prevailing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the virtual currency market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global virtual currencies market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global virtual currency market trends, key players, market segments, application areas, and market growth strategies.

Virtual currency Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 9 billion |

| Growth Rate | CAGR of 14.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 316 |

| By Type |

|

| By Usage |

|

| By Region |

|

| Key Market Players | Payward, Inc., Bitstamp, Binance, Gemini, Cointelegraph, HTX Global, Block.one, Coinbase, iFinex Inc., Robinhood |

Analyst Review

Many virtual currencies are not governed by a single entity, as they function on decentralized blockchain technology. More security, openness, and censorship resistance may result from this. Furthermore, people that are underbanked or unbanked can receive financial services through virtual currencies, particularly in areas with lack access to traditional banking infrastructure. Moreover, when comparing virtual currency transactions with regular financial systems, fees are frequently lower, particularly when transferring money internationally. Cross-border transactions and micropayments may become more economica due to this. In addition, anyone with an internet connection can access virtual currencies, enabling global financial inclusion. Users are able to engage in the financial system without depending on the infrastructure of traditional banks. Furthermore, the virtual currency markets are open throughout the day, giving consumers constant access to trade and transactions. In comparison, traditional financial markets could have set hours of operation. In addition, cryptographic methods are used by blockchain technology, which powers a lot of virtual currencies, to safeguard transactions. In comparison to conventional banking systems, this can lower the risk of fraud and hacking. Moreover, over their virtual currency holdings, users have more control. People may handle and safeguard their possessions without depending on middlemen with the use of private keys and wallets. In addition, smart contracts, which allow for the construction of self-executing contracts with predetermined rules, are supported by some virtual currencies, such as Ethereum. This creates opportunities for financial applications that are automated and programmable.

Furthermore, market players have adopted various strategies for enhancing their services in the market and improving customer satisfaction. For instance, in November 2023, Coinbase expanded its virtual currency service by strengthening commerce products with on-chain payment protocol. The protocol currently supports Ethereum, Polygon, and base ecosystems. The coinbase commerce product is now based on our recently developed open-source on-chain payment protocol, which provides quick settlement, inexpensive fees, and extensive asset support to enhance the payment experience for both consumers and businesses. Moreover, In December 2023, Robinhood launched crypto trading service in the EUROPE Union, allowing users to buy and sell a range of over 25 digital currencies. Including bitcoin, ether, ripple, cardano, solana, and polkadot. The company hopes to offer more tokens, as well as the ability to transfer and “stake,” or earn rewards from, crypto. These strategies by the market players operating at a global and regional level are expected to help the market to grow significantly during the forecast period.

Some of the key players profiled in the report include Binance, Bitstamp, Block.one., Coinbase, Cointelegraph, Gemini Space Station, HTX Global, iFinex Inc., Payward, Inc., and Robinhood. These players have adopted various strategies to increase their market penetration and strengthen their position in banking-as-a-service.

Institutional involvement continues to grow, with major financial players investing in and integrating digital assets. The rise of central bank digital currencies (CBDCs) is gaining momentum as governments explore and develop their own digital currencies. The decentralized finance (DeFi) sector is expanding rapidly, offering decentralized lending, borrowing, and trading platforms. Non-fungible tokens (NFTs) are making a significant impact, transforming digital ownership and representing unique assets across various industries. Sustainability considerations are driving a shift toward eco-friendly blockchain solutions are the upcoming trends of Virtual currency Market in the world.

Decentralized Virtual Currency is the leading application of Virtual currency Market.

Asia-Pacific is the largest regional market for Virtual currency

$8,963.84 Million is the estimated industry size of Virtual currency.

Binance, Bitstamp, Block.one., Coinbase, Cointelegraph, Gemini Space Station, HTX Global, iFinex Inc., Payward, Inc., and Robinhood. are the top companies to hold the market share in Virtual currency

Loading Table Of Content...

Loading Research Methodology...