Weight Management Market Research, 2033

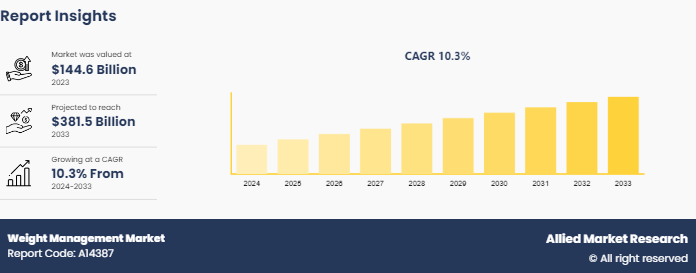

The global weight management market size was valued at $144.6 billion in 2023 and is projected to reach $381.5 billion by 2033, growing at a CAGR of 10.3% from 2023 to 2033.

Market Introduction and Overview

Weight management encompasses a multifaceted approach aimed at maintaining a healthy body weight and composition while reducing the risk of associated health complications. It involves a combination of dietary modifications, physical activity, behavioral changes, and lifestyle adjustments. Obesity, a chronic disease affecting a significant portion of the population, necessitates proactive measures to prevent unwanted weight gain and promote sustained weight loss. Effective weight management strategies often include increased physical activity, tailored exercise programs, dietary interventions, self-monitoring, and behavioral therapy. These aspects will influence the weight management market share during the analysis timeframe.

Key Takeaways

- The weight management market size was analyzed across 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major weight management industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

Weight management is crucial for overall well-being, offering physical, mental, and emotional benefits. It protects against weight-related diseases, such as obesity, diabetes, and other cardiovascular diseases, promotes longevity, and enhances self-esteem. Guided weight management plans provide dietary guidelines, making healthy eating more manageable. Access to tools like dietary supplements, meal plans, and exercise support ensures healthy weight management.

Certain weight management programs encompass dieting which has certain negative impact on the individual's health. For instance, most diets result in long-term weight gain, with up to 95% of individuals regaining lost weight within months to years. Unsustainability, deprivation, and metabolic adaptation contribute to this phenomenon, slowing metabolism and increasing cravings. Chronic dieting further worsens these issues, extending a cycle of weight fluctuations and food obsession. These drawbacks highlight the need for holistic, sustainable solutions in the weight management market, focusing on long-term lifestyle changes rather than short-term fixes. These factors are anticipated to restrain the weight management market growth in the coming years.

Ongoing R&D activities in the weight management industry are anticipated to generate excellent opportunities in the market. For instance, the year 2023 marked a significant turning point in the battle against obesity with groundbreaking advancements in weight management. Among the most noteworthy breakthroughs were the FDA approval of Zepbound (tirzepatide) , a GLP-1 medication originally designed for diabetes treatment, for chronic weight management in individuals with obesity but without diabetes. This approval indicated a new era of pharmacological interventions for obesity, building upon previous successes like liraglutide and semaglutide. These medications, which target appetite and food consumption hormones like GLP-1 and GIP, have shown remarkable efficacy in promoting weight loss. Beyond the scientific progress, these breakthroughs have sparked a cultural shift in the perception and treatment of obesity. They emphasize the medical nature of obesity and highlight the need for comprehensive treatment approaches that combine lifestyle modifications with pharmacotherapy. These factors are anticipated to have positive impact on weight management market opportunity in the coming years.

Global Weight Management Market Analysis

The weight management market encompasses a broad range of products, services, and interventions aimed at helping individuals achieve and maintain a healthy weight. The weight management market offers a diverse array of solutions for achieving and sustaining healthy weight levels. The market is expanding rapidly owing to a rising global awareness regarding obesity-related health risks and a growing emphasis on healthier living. Consumers are increasingly seeking effective strategies to manage weight, driving innovation and competition among providers in the industry. These factors are predicted to drive the weight management market share in the coming years.

Prevalence of Overweight and Obesity in the U.S. Among Adults, 2021, (%)

Factor | All (Men and Women) (%) | Men (%) | Women (%) |

Overweight | 30.7 | 34.1 | 27.5 |

Obesity | 42.4 | 43.0 | 41.9 |

Severe Obesity | 9.2 | 6.9 | 11.5 |

According to the data, provided above by the National Institutes of Health, in 2021, nearly 1 in 3 adults (30.7%) are overweight, with more than 1 in 3 men (34.1%) and over 1 in 4 women (27.5%) falling into this category. Also, more than 2 in 5 adults (42.4%) suffer from obesity, including severe cases affecting about 1 in 11 adults (9.2%) . Moreover, the percentage of overweight men surpasses that of women, while women are disproportionately affected by severe obesity, with 11.5% compared to men's 6.9%. These statistics highlight the pressing need for comprehensive strategies to address weight-related health concerns, emphasizing the need for effective weight management strategies.

Market Segmentation

The weight management market is segmented into function and region. On the basis of function, the market is divided into diet, fitness equipment, surgical equipment, and services. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Country Market Outlook

While drugs like Ozempic and Wegovy are gaining traction in the U.S. due to busy lifestyles and limited success with traditional weight loss programs, other regions may exhibit varying levels of acceptance based on cultural attitudes towards pharmaceutical interventions for obesity.

- In the U.S., the weight loss industry was valued at $3.4 billion in 2023, with 80% of adults expressing a desire for healthier lifestyles, indicating potential for further growth.

- Demographically, 52% of individuals aged 18-34 in the U.S. followed a diet within the past year, with a higher percentage among Hispanics (50%) compared to non-Hispanic whites (34%) in 2023.

- Attitudes towards weight loss varied, with only 23% of respondents reporting significant weight loss in the last 3 years, while 95% aimed to lose weight for personal well-being in 2023.

- Motivations for weight loss included improving fitness (84.6%) , self-esteem (73.9%) , and appearance (70.4%) , with professional advice influencing 41% of individuals in 2023.

- Among the U.S. adults, 49% attempted weight loss within a year, with higher rates among women (56.4%) compared to men (41.7%) in 2023. Also, different racial groups showed varying weight loss efforts, with 41.4% of Asian Americans and 49.4% of white Americans attempting weight loss.

- Exercise (62.9%) and reduced food intake (62.9%) were the top weight loss methods, followed by increased fruit and vegetable consumption (50.4%) in the U.S. in 2023. Supplement usage for weight loss was reported by 15% of the U.S. adults, with sales reaching $2.1 billion annually.

Competitive Landscape

The major players operating in the weight management market include Amway, Vitaco Health Limited, Forever Living, Nature's Way Products, LLC, GNC Holdings Inc., Nu Skin Enterprises, Inc., Nature's Sunshine Products, Inc., Arbonne International, LLC, Herbalife Nutrition Ltd, NOW Health Group, INC, Melaleuca Inc., and others.

Recent Key Strategies and Developments

- In April 2024, Herbalife, a leading health & wellness company, signed a sponsorship deal with LA Galaxy midfielder Riqui Puig through the 2025 MLS season. Puig joins Herbalife's extensive roster of over 150 sponsored athletes worldwide, supporting community initiatives, sports nutrition education, and global marketing campaigns like #ImWithYou. As his official sports nutrition partner, Herbalife will provide Puig with access to their Herbalife24 line of NSF Certified for Sport products. This collaboration highlights Herbalife's dedication to promoting healthy, active lifestyles both on and off the field.

- In November 2023, Herbalife's Lifestyle Intervention Program received a recognition from the U.S. Centers for Disease Control and Prevention (CDC) as a Certified Diabetes Prevention Program. As November marks Diabetes Prevention Month, Herbalife emphasized the importance of proactive measures against diabetes. Backed by scientific evidence, this program aimed to mitigate the risk of type 2 diabetes by up to 58%, offering a curriculum-based approach focused on behavior change. Herbalife is the first direct selling company to provide a CDC-recognized lifestyle change program.

- In December 2022, Amway, established its Singapore Business Innovation Hub, situated in the heart of the Central Business District. This initiative, in collaboration with the Singapore Economic Development Board (EDB) , aims to bolster Amway's global presence by leveraging Singapore's talent pool. With a focus on health & wellness innovation, the hub will foster advancements in scientific discovery, digital technology, and data science, catering to evolving consumer needs in Asia and beyond.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the weight management market forecast from 2024 to 2033 to identify the prevailing weight management market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the weight management market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Apart from the points mentioned above, the report includes the analysis of the regional as well as global weight management market trends, key players, market segments, application areas, and market growth strategies.

Industry Trends

- Recent developments in the weight management have led to an increase in the use of prescription medications like Wegovy and Ozempic, reshaping both the health and fitness industries. These drugs, known as GLP-1 agonists, have shown promising results in aiding weight loss when combined with diet and exercise. However, concerns have been raised about the proliferation of clinics dispensing these medications without sufficient expertise, as well as the high cost and potential side effects associated with them as stated in April 2024, in Hindustan Times, India’s leading news platform.

- On April 29, 2024, the University of Southern Denmark, conducted a breakthrough research in brown fat that has uncovered a protein responsible for switching off brown fat activity, limiting its effectiveness in weight management. Researchers suggest that blocking this ‘off switch’ could offer a promising strategy for safely activating brown fat, potentially aiding in tackling obesity and related health problems. The discovery opens up new avenues for therapeutic interventions aimed at supporting weight loss and improving metabolic health.

- On April 25, 2024, the Francis Crick Institute, a biomedical discovery institute in London, conducted a new research study that suggests a link between vitamin D and improved immunity to cancer in mice by promoting the growth of beneficial gut bacteria. Mice on a vitamin D-rich diet showed enhanced resistance to experimentally transplanted tumors and better responses to immunotherapy. However, more studies are needed to determine if this effect translates to humans. Understanding how vitamin D influences the microbiome could offer insights into cancer prevention and treatment strategies that will also aid in weight management.

- On April 24, 2024, the research study conducted by University of Warwick, recognized as international center of research excellence, highlighted he profound connection between dietary choices and brain health. Published in Nature, the study involving over 180, 000 participants found that a balanced diet is linked to superior cognitive function and mental wellbeing. Gradual dietary modifications, particularly reducing sugar and fat intake, were suggested for fostering healthier food choices that will lead to efficient weight management.

Key Sources Referred

- National Institutes of Health

- Global Weight Management Federation

- Rethink Obesity

- CHARLTON MEDIA GROUP.

- Nexira

- Obesity Medicine Association

- World Obesity Federation

- Department of Health, State Government of Victoria, Australia

Weight Management Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 381.5 Billion |

| Growth Rate | CAGR of 10.3% |

| Forecast period | 2024 - 2033 |

| Report Pages | 320 |

| By Function |

|

| By Region |

|

| Key Market Players | Nu Skin Enterprises, Inc., Arbonne International, LLC, Nature's Way Products, LLC, Melaleuca Inc., Herbalife Nutrition Ltd., Nature's Sunshine Products, Inc., Amway, GNC Holdings Inc., Vitaco Health Limited, NOW Health Group, Inc., Forever Living |

Analyst Review

The trends in weight management market include shift towards personalized nutrition plans, digital health platforms for tracking and coaching, plant-based diets, meal replacements, and the integration of wearable technology for fitness monitoring.

North America is the largest regional market for weight management.

The global weight management market is estimated to reach $381.5 billion by 2033

The top companies to hold majority of the market share in weight management market are Amway, Vitaco Health Limited, Forever Living, Nature's Way Products, LLC, GNC Holdings Inc., Nu Skin Enterprises, Inc., Nature's Sunshine Products, Inc., Arbonne International, LLC, Herbalife Nutrition Ltd, NOW Health Group, INC, and Melaleuca Inc.

Loading Table Of Content...