Wind Turbine Blades Market Research, 2033

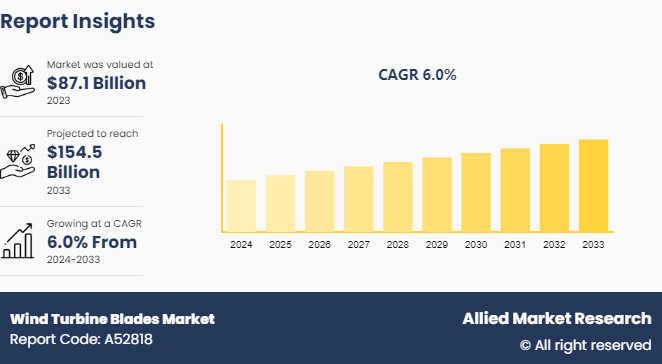

The global wind turbine blades market size was valued at $87.1 billion in 2023, and is projected to reach $154.5 billion by 2033, growing at a CAGR of 6% from 2024 to 2033.

Market Introduction

Wind turbine blades, essential to the renewable energy sector, have undergone significant advancements aimed at improving efficiency and sustainability. A crucial factor in this progress is the polymer additive market, which enhances the performance and durability of these blades. Innovations in polymer additives have led to the creation of lighter, stronger, and more durable wind turbine blades, significantly boosting their ability to capture energy and withstand environmental stressors. By integrating advanced polymer additives, manufacturers can produce blades that are not only more efficient in energy capture but also more resilient against wear and tear caused by harsh weather conditions. These improvements contribute to the overall efficiency and reliability of wind energy systems, promoting the broader adoption of renewable energy sources. As the demand for renewable energy continues to rise, the role of polymer additives in advancing wind turbine technology remains vital, driving further innovations and supporting the global transition to sustainable energy solutions.

Key Takeaways

- The wind turbine blades market forecast study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major wind turbine blades industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and to assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

Government policies focused on reducing carbon emissions and promoting renewable energy sources are important in driving investment in wind energy, significantly boosting the wind turbine blade market. By setting stringent emission reduction targets and offering incentives for renewable energy adoption, these policies create a favorable environment for the expansion of wind power infrastructure. Investments are channelized towards advanced wind turbine technologies, including the development of more efficient and durable blades. Such regulatory support not only fosters innovation in blade materials and design but also enhances the overall competitiveness of wind energy compared to traditional fossil fuels. Consequently, the demand for wind turbine blades is expected to surge, as they are critical components in harnessing wind energy effectively. This regulatory push is essential for achieving global sustainability goals, positioning the wind turbine blades market growth in the coming years.

However, integrating wind power into existing electrical grids poses significant challenges due to the need for substantial infrastructure adjustments and technical limitations. The variability of wind energy demands advanced grid management systems to ensure reliability and stability. Upgrading transmission lines, enhancing energy storage solutions, and implementing smart grid technologies are essential to accommodate fluctuating wind power outputs. Additionally, integrating large-scale wind farms can strain existing grid capacities, requiring coordinated efforts to balance supply and demand efficiently. These technical and infrastructural challenges must be addressed to fully harness the potential of wind energy within current electrical grids.

Moreover, investment and financing from both public and private sectors play a crucial role in advancing the wind energy sector. The availability of funding supports the development and deployment of wind energy projects, which directly influences the demand for wind turbine blades. As financial resources flow into wind energy initiatives, they enable the growth and innovation necessary for expanding blade production and technology. This support not only accelerates project implementation but also fosters advancements in blade design and efficiency, ensuring a robust and sustainable increase in wind turbine blade demand in the coming years.

Global Wind Market Analysis

The global wind market is expected for significant growth in the coming years. According to the Global Wind Energy Council (GWEC) , 2022 was the utmost year, with 78 GW of new capacity added globally, making it the third best year ever. This brought the total installed global capacity to 906 GW, marking a 9% year-on-year growth. For 2023, GWEC market intelligence predicts a landmark achievement, with new capacity additions expected to exceed 100 GW, reflecting a 15% year-on-year growth. Looking ahead, GWEC forecasts the addition of 680 GW of new capacity over the next five years (2023-2027) , averaging 136 GW per year. The outlook remains positive up to 2030, with an additional 143 GW expected by the end of the decade, which is 13% higher than previous forecasts. Initially, GWEC forecasted 1, 078 GW of new capacity to be built from 2022-2030, but this has been revised to 1, 221 GW of new capacity between 2023 and 2030. The growth of the wind energy sector is driving the demand for wind turbine blades, enhancing the offshore support vessels market in the Asia-Pacific region. This expansion necessitates advancements in polymer additives to improve blade performance, reflecting the dynamic and competitive landscape of this burgeoning industry.

Global New Wind Power Capacity Connected to Power Grids, 2019-2022 (GW)

Year | Gigawatt (GW) |

2019 | 60.8 |

2020 | 95.3 |

2021 | 93.6 |

2022 | 77.6 |

Source : GWEC, AMR Analysis, Secondary Research

In 2022, the global new wind power capacity connected to power grids was 77.6 GW, in comparison to 93.6 GW in 2021.

Market Segmentation

The wind turbine blades market share is segmented into material, size, capacity, application, and region. On the basis of material, the market is segregated into glass fiber and carbon fiber. By size, the market is segmented into up to 27 meters, 28-37 meters, 38-50 meters, and more than 50 meters. Based on capacity the market is segmented into less than 3 MW, 3 – 5 MW, and greater than 5 MW. On the basis of application, the market is segregated into onshore and offshore. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

North America region is expected to experience progressive demand for wind turbine blades due to significant advancements and support from government associations. Governments across North America are actively promoting renewable energy initiatives, including wind power, to achieve sustainability goals and reduce carbon emissions. This support is manifested through favorable policies, subsidies, and investments in wind energy infrastructure. As a result, the wind turbine industry is witnessing a surge in demand for high-quality blades to enhance efficiency and performance. The collaborative efforts between public and private sectors are driving technological innovations and production enhancements in wind turbine blades, further fueling market growth. This progressive development underscores North America's commitment to expanding its renewable energy capacity and underscores the crucial role of government associations in fostering a robust wind energy sector.

- In April 2024, Italian independent power producer ERG SpA entered the U.S. renewables market by acquiring a 75% stake in a 317-MW solar and wind portfolio. The company finalized the purchase from US renewables developer Apex Clean Energy Holdings LLC for USD 270 million (EUR 252.1 million) . This acquisition includes part ownership of the 92.4-MW Mulligan Solar plant in Illinois and the 224.4-MW Great Pathfinder Wind asset in Iowa. The deal aligns with the terms announced in December 2023, marking ERG SpA's strategic expansion into the American renewable energy sector.

Competitive Landscape

The major players operating in the wind turbine blades market include Siemens AG, Acciona S.A., Vestas Wind Systems, EnBW, TPI Composites SA, LM Wind Power, Nordex SE, Sinoma wind power blade Co. Ltd., and MFG Wind. Other players include Aeris Energy, Suzlon Energy Ltd, and Enercon GmbH.

Recent Key Strategies and Developments

In September 2021, Siemens Gamesa introduced the world's first recyclable wind turbine blade for commercial offshore use, marking a significant advancement in sustainability. This innovation addresses a key challenge in wind power: the disposal of composite materials used in turbine blades. Previously, these materials were largely sent to landfills, with 10% of Europe’s fibre-reinforced composite (FRP) waste coming from wind turbines. As many European countries now ban landfilling such waste, Siemens' RecyclableBlade technology represents a major milestone. The company notes that 85% of a wind turbine’s components are recyclable, supporting the goal of reducing environmental impact and enhancing the sustainability of wind power.

Industry Trends

- In June 2024, AkzoNobel inaugurated the world's first purpose-built wind turbine blade testing facility at its Felling plant in the UK. This cutting-edge facility, representing a multi-million investment, supports the development of AkzoNobel's International protective coatings brand, which serves wind farms worldwide. The facility is capable of running simulations at speeds up to 176 meters per second, or half the speed of sound, to replicate harsh weather conditions from around the globe. This technological advancement allows researchers to triple the number of rain erosion tests conducted weekly, significantly enhancing the company's testing capabilities. The new facility highlights AkzoNobel's commitment to innovation and excellence in the wind energy sector, ensuring that their protective coatings can withstand the most extreme environmental challenges.

- In December 2023, The ZEBRA (Zero wastE Blade ReseArch) consortium successfully completed full-scale validation testing of the first recyclable blade and produced a second 77-meter recyclable thermoplastic blade. Manufactured at LM Wind Power's plant in Castellón, Spain, this blade utilizes Arkema's recyclable thermoplastic liquid resin Elium and Owens Corning's high-performance glass fabrics. It features a new Carbon-Elium resin spar cap technology and a novel adhesive from Bostik, an Arkema subsidiary specializing in adhesive solutions. This achievement marks significant progress in the wind industry's commitment to a circular economy.

Key Sources Referred

- Global Wind Energy Council

- American Wind Energy Association

- European Wind Energy Association

- International Energy Agency

- Siemens Gamesa

- ERG SpA

- AkzoNobel

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the wind turbine blades market analysis from 2024 to 2033 to identify the prevailing wind turbine blades market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the wind turbine blades market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global wind turbine blades market trends, key players, market segments, application areas, and market growth strategies.

Wind Turbine Blades Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 154.5 Billion |

| Growth Rate | CAGR of 6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 325 |

| By Material |

|

| By Size |

|

| By Capacity |

|

| By Application |

|

| By Region |

|

| Key Market Players | Nordex SE, Siemens AG, EnBW, Aeris Energy, Sinoma wind power blade Co. Ltd., TPI Composites SA, Acciona S.A., LM Wind Power, Vestas Wind Systems, MFG Wind |

The wind turbine blades market is estimated to reach $154.46 billion by 2033, exhibiting a CAGR of 6.0% from 2024 to 2033.

Government policies focused on reducing carbon emissions and promoting renewable energy sources are important trends in the wind energy market.

North America is expected to maintain its dominance in the wind turbine blades market throughout the forecast period, particularly driven by the U.S. The country’s strong emphasis on renewable energy and advancements in wind turbine technology play a crucial role in this growth.

The offshore sub-segment is anticipated to lead the wind turbine blades market throughout the forecast period.

The major players operating in the wind turbine blades market include Siemens AG, Acciona S.A., Vestas Wind Systems, EnBW, TPI Composites SA, LM Wind Power, Nordex SE, Sinoma wind power blade Co. Ltd., and MFG Wind.

Loading Table Of Content...