Wireless Infrastructure Market Research, 2031

The global wireless infrastructure market size was valued at $152.3 billion in 2021, and is projected to reach $386.5 billion by 2031, growing at a CAGR of 10% from 2022 to 2031. Wireless infrastructure is a collection of various communication devices, connectivity standards, and connectivity solutions that work together to provide wireless networks to users. This network focuses on improving overall connectivity and connection performance while eliminating the need for wire connections between different devices and components. Moreover, wireless networking is a method of communicating between homes, telecommunications networks, and enterprise (business) installations that keep away from the costly process of introducing cables into a building or as a connection between various equipment locations.

The major driver for the market growth is rise in the investments by market players to deploy high-speed networks. This is anticipated to propel the growth of wireless infrastructure market during the forecast period. In addition, the rise in internet penetration globally, rise in use of satellite data in development of smart cities and connected vehicles, and increase in demand for connected cars are some other drivers which support the market expansion during the forecast period.

However, high updating cost, and lack of wireless infrastructure in developing and underdeveloped countries are anticipated to hamper the market growth during the forecast period. Moreover, consumer inclined toward wireless connectivity, and expansion of wireless communication networks in various applications are expected to offer lucrative opportunities for the market players during the forecast period.

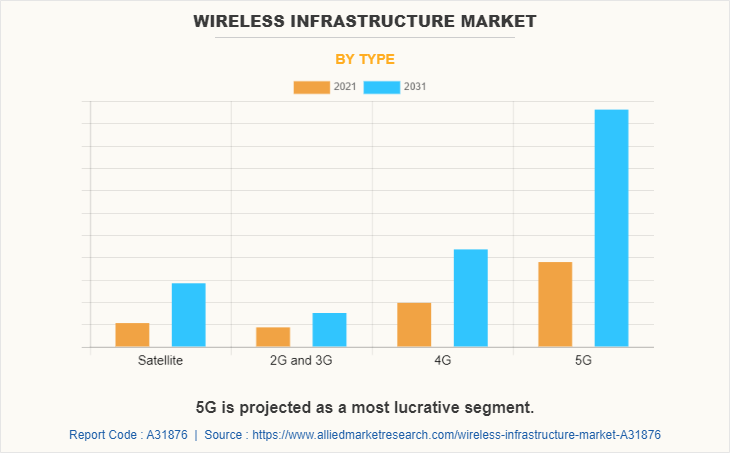

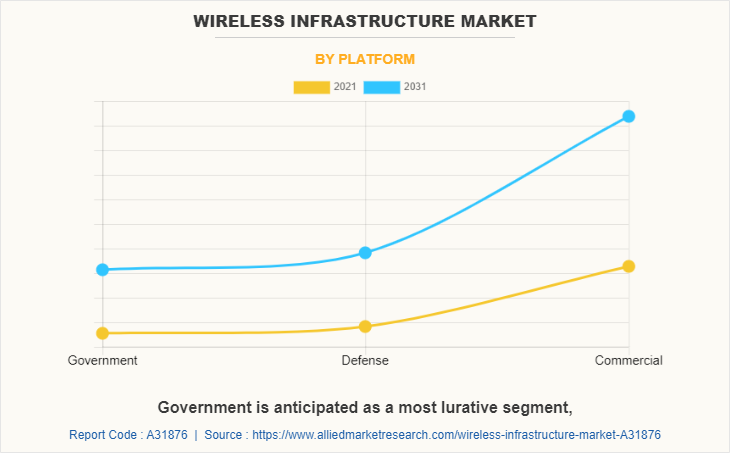

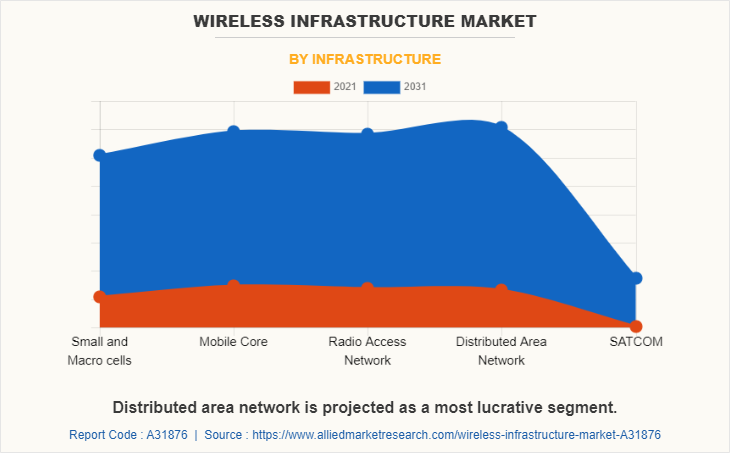

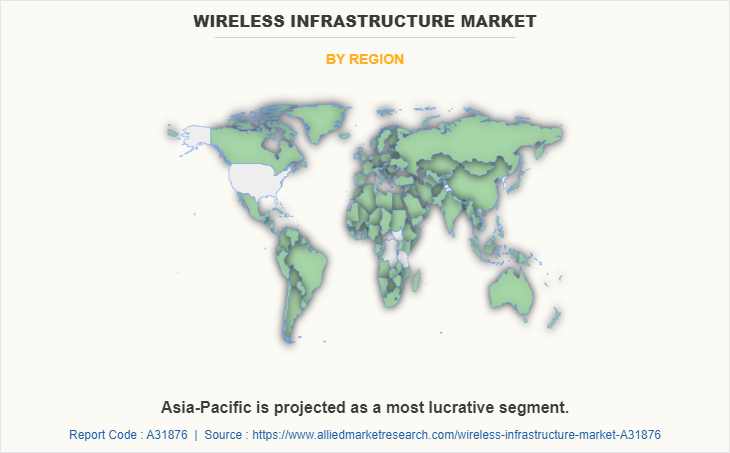

The wireless infrastructure market is segmented into type, platform, infrastructure, and region. By type, the market is categorized into satellite, 3G, 4G, and 5G. By platform, it is segregated into government, defense, and commercial. Based on the infrastructure the market is divided into Small and Macro cells, Mobile Core, Radio Access Network, Distributed Area Network, and SATCOM. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players operating in the global wireless infrastructure market include Capgemini Engineering, Ciena Corporation, Cisco Systems, Inc., D-Link Corporation, Fujitsu, Huawei Technologies co., Ltd., NEC Corporation, NXP Semiconductor, Qualcomm Technologies Inc., ZTE Corporation, and others.

Rise In Use Of Satellite Data In Development Of Smart Cities And Connected Vehicles

Satellite images are used for urban management or planning and for smart city development using satellite imagery datasets containing useful information regarding annotated objects. Urban planners are using such data to understand settlement trends and ensure efficient infrastructure management.

In addition, rise in use of remote sensing technology for zoning and city infrastructure modelling has helped in meeting incrementing demands from city-based populations toward better management of sustainable urban development. Further, growth in urban agglomeration and monitoring urbanization of adjoining areas to enable smart city planning and implementation is further propelling satellite imagery adoption.

Moreover, connected as well as autonomous vehicles to leverage high-definition (HD) maps, seamless internet access, and road-side assistance during an emergency from space using commercial satellite imaging boost the market growth. Therefore, increase in use of satellite data used in the development of smart cities and connected vehicles is anticipated to support the growth of the commercial satellite imaging market.

For instance, in April 2019, Maxar Technologies Inc., announced a collaboration with Toyota Research Institute-Advanced Development, Inc. (TRI-AD) and a leading IT services provider NTT DATA Corporation to create an automated HD maps of the Tokyo metropolitan region for autonomous vehicles using high-resolution satellite imagery data. Furthermore, governments and companies are taking positive initiatives to support the development of self-driving technologies.

For instance, in 2020, Japan approved Honda to sell the world’s first level 3 autonomous vehicles, with other countries and manufacturers targeting to follow the applications. This is strengthened by governmental support, developing commercial demand and enhancements in technology.

Rising Demand For Connected Car Devices

A connected car is a vehicle that is connected to a smartphone and tablet, has Internet access, and can optimize its performance at regular intervals. Network connectivity solutions such as Vehicle-2-Vehicle (V2V) and Vehicle-to-Infrastructure (V2I) systems can be used to share content with a variety of devices inside and outside the vehicle. In a vehicle connected to various devices, the driver receives real-time data around the vehicle to increase safety. The main goals of connected car adoption are to avoid collisions, reduce fatalities and increase fleet management efficiency.

In addition, by strengthening collaboration with solution providers and partners, automotive OEMs are optimizing R&D spending to prioritize connected car programs. For instance, in 2021, Ford and Google have announced their unique strategic partnership to accelerate Ford's transformation and reinvent the connected car experience with embedded Google apps and services.

Similarly, in 2019, Airbiquity announced that it has become a member of the Japan Automotive Software Platform and Architecture (JASPAR), an organization that promotes the standardization of automotive software and networks to improve development efficiency and stability. Thus, the rising adoption of connected car devices by manufacturers it is expected that during the forecasting years it will rise the demand of wireless communication devices which support the market growth during the forecast period.

High Updating Cost

In current scenario, the autonomous vehicles are available at reasonable cost as the OTA update cost is much higher. There are many types of cost such as cloud-to-vehicle communication and data transmission costs, endpoint update technology integration costs, cloud storage costs, and others which are paid by the consumers. For instance, if a manufacturer owns 10 million vehicles that require an OTA update. The annual cost of data transfer can easily reach hundreds of millions of dollars when completed the image file will be transferred. This security update example uses a single 500MB binary image file. Vehicle infotainment system "IVI" sent to the fleet once a quarter at 21.5 PB and above, it costs more than USD 108.3 million annually.

Reduced update file size from 90% to 50MB With binary differential updates, the annual cost drops to USD 10.83 million while the Line-of-Code updates. As small as 15 MB, consumer can reduce its annual costs to just USD 3.25 million. This is only 3% of full image updates.

Similarly, the cloud provider also charges for the output of files from the platform. For the same 3 providers the average initial cost is USD 0.099 per GB. In addition, there are data transmission costs via cellular. In this case, the exit fee for a 500MB file would be USD 1.98 million annually. Reducing the update size to 50MB reduces the cost to USD 198,000 and the file size to USD 59,400. It's reduced to 15 MB, a 97% reduction. There are things that can reduce the exit fee from the cloud provider although it uses a content delivery network, this approach adds its own cost and complexity to the process. Thus, the high cost of updating automotive OTA services restraint the market growth during the forecasting years.

Expansion Of Wireless Communication Network In Various Applications

Market players have introduced many technologies to improve communication infrastructures across various industries including connectivity and transportation, storage and processing, services and applications, and terminals and devices of the countries such as increasing number of towers, antennas, and other equipment's that can be controlled through a core network. For instance, in April 2019, long‐‘term institutional investor Caisse de dépôt et placement du Québec (CDPQ) announced that it acquired 30% share holdings in the main operating subsidiary of Vertical Bridge Holdings, LLC, which is one of the largest private company and operator of communications infrastructure in the United States.

Vertical Bridge used the investment from CDPQ to continue to expand its portfolio of broadband and broadcast towers, small cells, real estate and other wireless infrastructure equipment's forwards of 5G deployment. Thus, the growing connectivity options by various equipment's such as satellites, drones, towers, and others are expected to act as one of the opportunities for the growth of the wireless infrastructure market during the forecast period.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the wireless infrastructure market analysis from 2021 to 2031 to identify the prevailing wireless infrastructure market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the wireless infrastructure market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global wireless infrastructure market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global wireless infrastructure market trends, key players, market segments, application areas, and market growth strategies.

Wireless Infrastructure Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 386.5 billion |

| Growth Rate | CAGR of 10% |

| Forecast period | 2021 - 2031 |

| Report Pages | 245 |

| By Type |

|

| By Platform |

|

| By Infrastructure |

|

| By Region |

|

| Key Market Players | NXP Semiconductors, Huawei Technologies Co., Ltd., Fujitsu Ltd., D-Link Corporation, Cisco Systems, Inc., ZTE Corporation, Capgemini, NEC CORPORATION, Qualcomm Technologies Inc., Ciena Corporation |

Analyst Review

The global market has a promising future for existing market players. Increase in applications of wireless communication services such as geospatial mapping, disaster mapping, urban planning, and energy management is expected to drive the growth of the market. The major players in the market have developed and launched new technologies and equipment's to cater to a wider customer base across various nations globally.

Furthermore, increase in satellite launches from various countries such as the U.S., Russia, India, Japan, the UK, Germany, and others as a result of growing security concerns is expected to develop new applications during the forecast period. Moreover, incorporation of newly launched technologies such as remote sensor sensing technology and LiDAR technology is anticipated to provide lucrative growth opportunities for the market.

Moreover, the wireless infrastructure market is projected to witness considerable growth, especially in North America, owing to the presence of sophisticated infrastructure to undertake research programs and the earliest & highest adoption of latest wireless communication services across various industries. Commercial and government organizations are adopting various innovative techniques to provide customers with advanced and innovative feature offerings.

In addition, increase in adoption of artificial intelligence (AI), machine learning (ML), and cloud computing in the industrial sector; rise in use of satellite data in the development of smart cities and connected vehicles are some factors expected to offer lucrative opportunities for the market growth. The commercial platform segment dominates the wireless infrastructure market in terms of growth rate and is expected to maintain its dominance throughout the forecast period.

Also, the demand for wireless communication services is expected to grow significantly in various sectors such as agriculture, real estate, civil engineering, energy, and government. Therefore, decrease in prices of communication services are expected to boost the adoption of wireless infrastructure. The market players have adopted product launch, acquisition, and partnership strategies to enhance their product portfolios and expand their geographical reach. Furthermore, the emerging economies are projected to provide lucrative growth opportunities to the market players during the forecast period.

The wireless infrastructure market was valued at $152.3 billion in 2021, and is estimated to reach $386.5 billion by 2031, growing at a CAGR of 10% from 2022 to 2031

The wireless infrastructure market to grow at a CAGR of 10% from 2022 to 2031

The key market players in the wireless infrastructure market are Capgemini Engineering, Ciena Corporation, Cisco Systems, Inc., D-Link Corporation, Fujitsu, Huawei Technologies co., Ltd., NEC Corporation, NXP Semiconductor, Qualcomm Technologies Inc., ZTE Corporation, and others.

Asia Pacific is anticipated to exhibit the highest CAGR during the forecast period.

Rising adoption of latest technologies by corporates and individuals are the factors driving the wireless infrastructure market.

Loading Table Of Content...