Second Generation Biofuels Market Research, 2032

The global second generation biofuels market was valued at $8.2 billion in 2022, and is projected to reach $87.5 billion by 2032, growing at a CAGR of 26.8% from 2023 to 2032.

Report Key Highlighters:

- The second generation biofuels market analysis study covers 20 countries. The research includes a segment analysis of each country in terms of value ($million), and volume (Million liters) for the projected period 2023-2032.

- The study incorporated research methodology aims to present a comprehensive outlook on global markets and aid key stakeholders & players in making well-informed decisions to accomplish their ambitious growth goals.

- Over 1,500 product literatures, industry statements, annual reports, and other comparable materials from major second generation biofuels industry participants were reviewed to gain a better understanding of the market.

- The second generation biofuels market is fragmented, with several players including Algenol Biofuels, Clariant AG, International Flavors & Fragrances Inc, Fiberight LLC., GranBio, Ineos Group, Orsted A/S, POET-DSM Advanced Biofuels LLC, Reliance Industries, and Zea2, LLC. Also tracked key strategies such as acquisitions, product launches, developments, partnership, mergers, expansion etc. of the players operating in the second generation biofuels industry.

Biofuels are produced through contemporary biological processes, such as anaerobic digestion rather than a fuel produced by geological processes. Second-generation biofuels are produced from non-food crops such as organic waste, wood, biomass crops, and food crop waste.

Increase in concerns about the hazardous effects of greenhouse gas (GHG) emissions, caused predominantly by the combustion of fossil fuels into the environment, is anticipated to help in the surge in installation of biofuels generation plants or bio-refineries worldwide. Production of biofuels by means of aerobic/anaerobic digestion of biomass assists in limiting the usage of fossil fuels for power generation or fueling automobiles. According to the International Energy Agency (IEA), biofuels are likely to substitute enough petroleum products to avoid carbon dioxide emission each year if produced sustainably as much as net carbon dioxide absorbed by the oceans.

The energy sector has incorporated many opportunities for growth of the market for next generation biofuels. This is expected to emerge as a replacement for traditional fuels, including diesel and petrol. Thus, the second generation biofuel has emerged as a cleaner, greener energy source, in which the number of SOx and NOx in addition to GHG emissions is less when compared to hydrogen as a fuel, thus the inclination of populace as well as government regulations are in its favor. This is one of the major drivers of the second generation biofuels market growth.

The most critical challenge for the growth of second generation biofuels market is acquisition of economical feedstock. Feedstock cost adds 80 to 90% of the ultimate fuel price for many processes and is crucial to the economic feasibility of second generation biofuels. Feedstock costs continue to be high, which is often due to processing (shredding, densifying, pulverizing, and handling) and transportation of the feedstock, and not necessarily due to growing them. The market availability of alternatives and acceptance of alternative fuels are constraints that need to be dealt with that facilitate the market growth of second-generation biofuels.

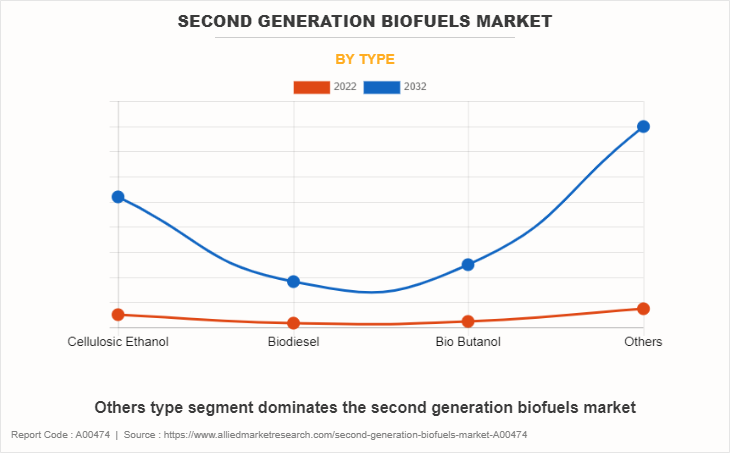

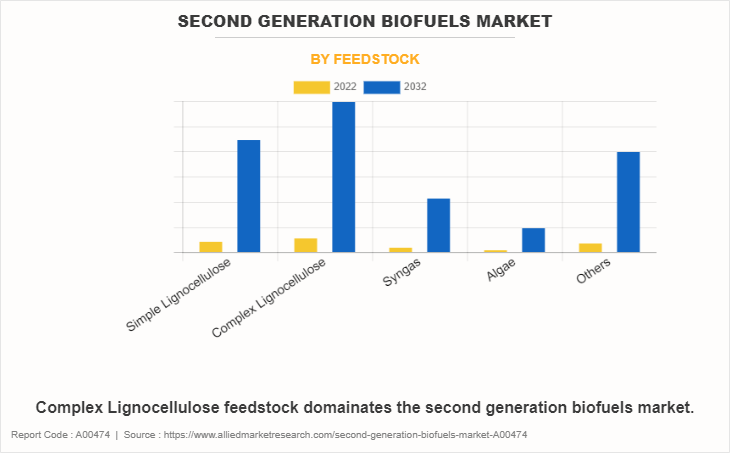

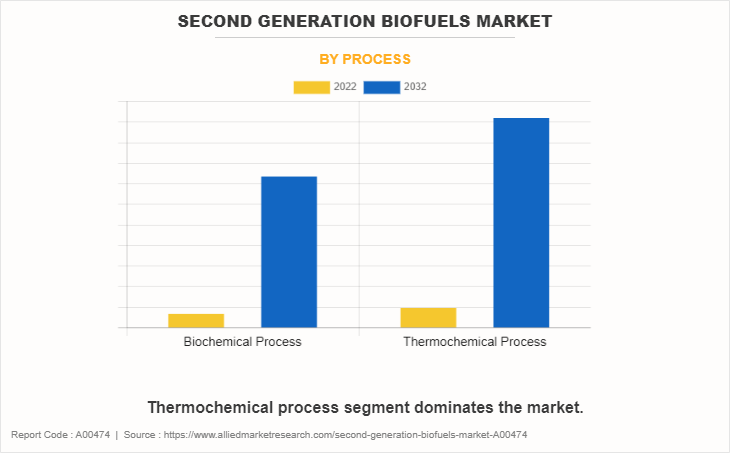

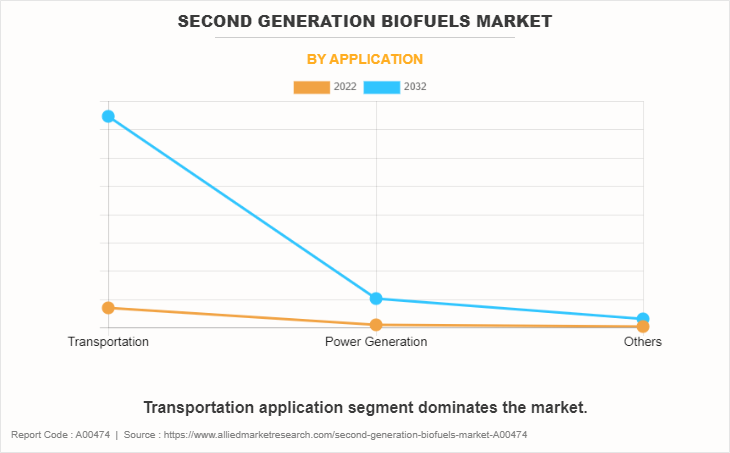

The second generation biofuels market scope is segmented into feedstock, type, process, application, and region. On the basis of feedstock, the second generation biofuels market is categorized into simple lignocellulose, complex lignocellulose, syngas, algae, and others. By type, the second generation biofuels market is classified into cellulosic ethanol, biodiesel, bio butanol, and others. By process, the second generation biofuels market is segregated into biochemical process and thermochemical process. On the basis of application, the second generation biofuels market is divided into transportation, power generation, and others.

Based on type, the other segment such as algal biofuel, and biojet fuels held the highest market share in 2022, accounting for more than two-fifths of the global market revenue, and is estimated to maintain its leadership status throughout the second generation biofuels market forecast period. Growth factors for algal biofuels include advancements in cultivation techniques, genetic engineering for higher lipid content, and innovative extraction methods. In addition, the scalability of algae production and its potential for carbon capture make it an attractive option which have significant positive impact on the market.

Based on feedstock, the complex lignocellulose segment held the highest second generation biofuels market share in 2022, accounting for more than one-third of the global market revenue, and is estimated to maintain its leadership status throughout the forecast period. Moreover, the syngas segment is projected to manifest highest CAGR% growth from 2023 to 2032. The use of syngas as a feedstock for second-generation biofuels is experiencing notable growth owing to its adaptability and potential to utilize a wide array of feedstock sources. The rising interest in advanced biofuels, driven by environmental concerns and regulatory support, fuels the market expansion for syngas-derived biofuels.

Based on process, the thermochemical process segment held the highest market share in 2022, accounting for nearly three-fifths of the global second generation biofuels market revenue, and is estimated to maintain its leadership status throughout the forecast period. Moreover, the biochemical process segment is projected to manifest a highest CAGR growth from 2023 to 2032. Advancements in biotechnology and enzyme engineering are enhancing the efficiency and cost-effectiveness of biochemical conversion methods, driving market expansion.

Based on application, transportation segment held the highest market share in 2022, accounting for more than four-fifths of the global second generation biofuels market revenue, and is estimated to maintain its leadership status throughout the forecast period. Moreover, power generation segment is projected to manifest a highest CAGR growth from 2023 to 2032. The increasing focus on reducing carbon emissions and achieving energy sustainability has spurred interest in cleaner power generation options.

Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for the largest share of the market in 2022 with Asia-Pacific being the fastest growing region.

Second Generation Biofuels Developments With Respect To Countries:

U.S.:

Investment: The U.S. government has allocated substantial funding for biofuel research and development. For instance, the Department of Energy (DOE) invested over $1 billion in grants and loan guarantees for cellulosic biofuels between 2007 and 2015.

Generation Capacity: As of recent data, the capacity for cellulosic biofuel production in the U.S. has been growing steadily. In 2020, the production capacity for cellulosic biofuels was estimated to be around 20-25 million gallons per year.

Brazil:

Investment: Brazil has a well-established biofuel industry, primarily focused on first-generation ethanol from sugarcane. Second-generation biofuels have seen investments from companies such as Raízen and GranBio.

Generation Capacity: In Brazil, the focus on second-generation biofuels is visible, with the country having the potential to produce over 50 billion liters of cellulosic ethanol annually from agricultural residues, especially sugarcane bagasse.

European Union:

Investment: The EU has committed to substantial funding through programs such as Horizon 2020 for biofuel research. Investments have reached billion euros for second-generation biofuel projects.

Generation Capacity: The EU's capacity for second-generation biofuels is expected to increase significantly. Countries such as Germany and Sweden have operational or planned facilities capable of producing million liters of cellulosic ethanol annually.

China:

Investment: China has been investing heavily in renewable energy, including biofuels. The Chinese government has invested over $1.2 billion, supporting R&D in this sector.

Generation Capacity: In China, the cellulosic ethanol production capacity is growing, with several demonstration plants and pilot projects aiming for commercial-scale production. Production capacity is expected to be in the millions of liters annually.

India:

Investment: India has been focusing on second-generation biofuels and has allocated significant funds for research and development in this area.

Generation Capacity: In India, generation capacity is in the developmental stage, with plans for establishing multiple commercial-scale plants producing cellulosic ethanol from agricultural residues.

The major companies profiled in this report include Algenol Biofuels, Clariant AG, International Flavors & Fragrances Inc, Fiberight LLC., GranBio, Ineos Group, Orsted A/S, POET-DSM Advanced Biofuels LLC, Reliance Industries, and Zea2, LLC. The abovementioned companies' unique services and innovative approaches contribute to the advancement of the second generation biofuels market, enabling more efficient, sustainable, and environmentally friendly practices for corporates to move toward sustainability.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the second generation biofuels market analysis from 2022 to 2032 to identify the prevailing second generation biofuels market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the second generation biofuels market size segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global second generation biofuels market trends, key players, market segments, application areas, and market growth strategies.

Second Generation Biofuels Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 87.5 billion |

| Growth Rate | CAGR of 26.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 414 |

| By Type |

|

| By Feedstock |

|

| By Process |

|

| By Application |

|

| By Region |

|

| Key Market Players | International Flavors & Fragrances Inc., Fiberight, Orsted A/S, GranBio Investimentos S.A., Clariant AG., POET-DSM Advanced Biofuels LLC, Zea2, Algenol Biotech LLC, INEOS Group, Reliance Industries Limited |

Analyst Review

The global second generation biofuels market is likely to gain traction during the forecast period as a result of government regulations and policies aimed at developing potentially underutilized waste agricultural resources.

Increase in demand for safe, sustainable, and clean energy supplies drive the demand for second-generation biofuels across the globe. Global consumption of biofuels is expected to increase significantly during the forecast period due to tighter regulations on mixing biofuels with vehicle fuels and increased government support for eco- friendly alternative fuels. According to International Electrochemical Commission (IEC) estimates, global energy consumption is expected to increase by 15% by 2050 compared to 2020. The increase in demand for biofuels is due to the increase in energy demand for road transport. For example, the IEA Tracing Transport reported that biofuel production for transport increased by more than 6% year-on-year in 2019 and is projected to increase by 3% each year over the next few years.

The CXOs further added that the outbreak of the novel coronavirus led to the investment of governments in developing countries toward the development of alternative for fossil fuels to strengthen national security related to energy. The presence of the government and private institute support to develop these refineries led to an increase in the demand for second generation biofuels equipment. The government policies toward zero carbon emission and the presence of ambitious mandates set by various countries to blend biofuels with conventional fuels, to reduce the dependency on fossil fuels has boosted the demand for second generation biofuels market across the globe.

Technological Advancements, Diversification of Feedstock, Focus on Waste-to-Energy Processes, Increasing Government Support, Rising Investments in Research & Development, Environmental Sustainability, and Market Expansion in Emerging Economies are the upcoming trends of Second Generation Biofuels Market in the world.

North America is the largest regional market for Second Generation Biofuels.

Transportation is the leading application of Second Generation Biofuels Market.

$87.5 billion is the estimated industry size of Second Generation Biofuels market in 2032.

Algenol Biofuels, Clariant AG, International Flavors & Fragrances Inc, Fiberight LLC., GranBio, Ineos Group, Orsted A/S, POET-DSM Advanced Biofuels LLC, Reliance Industries, and Zea2, LLC are the top companies to hold the market share in Second Generation Biofuels.

Loading Table Of Content...

Loading Research Methodology...