3PL Market Insights, 2031

The global third-party logistics (3PL) market size was valued at $1.3 trillion in 2021, and is projected to reach $2.8 trillion by 2031, growing at a CAGR of 8.8% from 2022 to 2031.

A third-party logistics (3PL) is a partner or service that assists manufacturers specially ecommerce merchants to outsource activities related to logistics and distribution. A third-party logistics company provides specialized services such as inventory management, cross-docking, door-to-door delivery, and packaging of products. This, in turn, aids enterprises in providing a better customer experience, ensuring scalability, mitigating the risks of product damages, promoting business growth and market expansion, and enabling the completion of core business operations. Furthermore, the third-party logistics model delivers greater asset utilization and asset sharing alliances, which increases its demand, and contributes toward the growth of the 3PL market. At present, third-party logistics is commercially available in varying transportation modes and service types, including dedicated contract carriage (DCC), domestic and international transportation management.

Companies that provide international deliveries typically work with two or three dozen delivery partners specializing in different geographic areas. Large e-commerce companies, such as Amazon, have huge in-house teams that act as their third-party logistics. They spend a lot of money and effort managing, controlling, and improving their logistics. Moreover, Kestraa, a Brazilian logistics startup, raised $2.7 million funding from Canary Ventures and various angel investors for logistics software. Kestraa is a cloud-based B2B solution for freight-management, connecting ship-owners, cargo agents, freight forwarders, government systems, and more. The software allows stakeholders to manage their shipments, anticipate delays, and optimize on delivery time. Customers are also able to monitor the delivery process of their goods.

In addition, growth in automotive industry, technological advancement, surge in last-mile connectivity, and rise in cross-border trade activities also boost the growth of the 3PL market. For instance, the Indian government launched Multi-Modal Logistics Parks Policy (MMLPs) to improve the logistics sector of the country. Meanwhile, the Union Minister of Commerce and Industry announced a plan to invest $500 billion in the logistics sector by 2025. The government also launched a National Logistics Portal to serve as a transactional e-marketplace by connecting buyers, logistics service providers, and relevant government agencies.

Similarly, some major players including CEVA Logistics, DB Schenker, DHL, and XPO Logistics Inc. have been showing a willingness to partner with other players to reduce cost and leverage on mutual competitive advantage. The market, hence, observes a high volume of partnerships, mergers, and acquisitions. For instance, in March 2020, XPO Logistics Inc. signed a long-term partnership agreement with Mercedes-Benz Parts Logistics. This agreement is anticipated to allow the company to manage parts distribution in the UK with an integrated and digitally managed transportation network.

The factors such as increase in trading activities due to globalization, growth in manufacturing industry, and development of the e-commerce industry supplement the growth of the third-party logistics (3PL) market. However, lack of control of manufacturers on logistics service and poor infrastructure and higher logistics costs are the factors expected to hamper the growth of the market. In addition, surge in use of IT solutions & software and rising demand for consumer electronics creates market opportunities for the key players operating in the market.

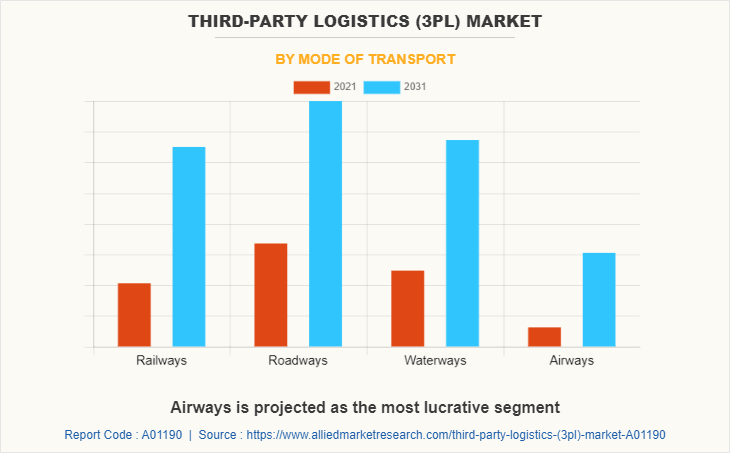

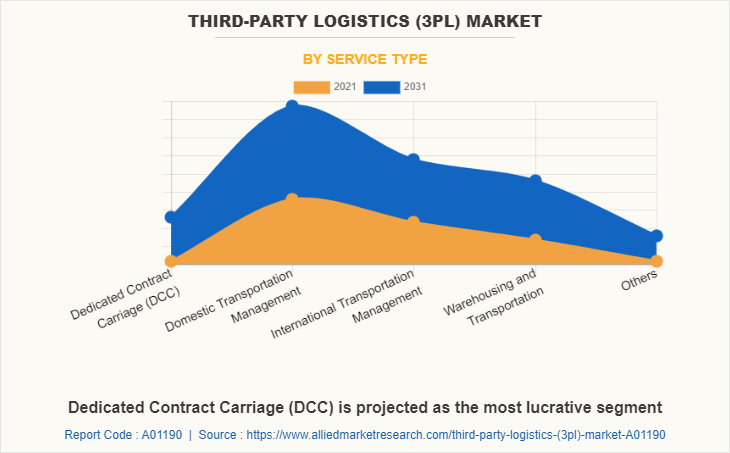

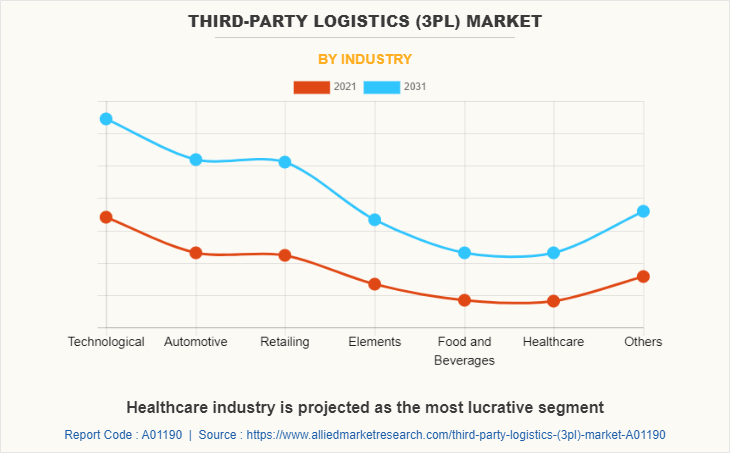

The global third-party logistics (3PL) market is segmented into mode of transport, service type, industry, and region. On the basis of mode of transport, the market is categorized into railways, roadways, waterways, and airways. On the basis of service type, it is segregated into dedicated contract carriage (DCC), domestic transportation management, international transportation management, warehousing & distribution, and others. On the basis of industry, it is fragmented into technological, automotive, retailing, elements, food & beverages, healthcare, and others. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading players operating in the global third-party logistics (3PL) market are A.P. Moller – Maersk, C.H. Robinson Worldwide, Inc., DB Schenker, DHL International GmbH, DSV, FedEx Corporation, GEODIS, Kuehne+Nagel Inc., UPS, and XPO Logistics Inc.

Top Impacting Factors:

Growth in manufacturing industry

Industries that deal with the transformation of goods or materials into new products are called manufacturing industries. The growth rate of the manufacturing industry of the country is an indicator of its economic strength. The largest European nations such as Germany, the UK, France, and Italy usually dominate the manufacturing sector presently. However, the manufacturing sector saw large losses, with manufacturing industries relocating and general employment in the sector decreasing, as these countries became increasingly service oriented. Luckily, for Europe, instead of moving abroad, much of the manufacturing has just moved over to Central and Eastern Europe. Countries such as Poland, Slovakia, and the Czech Republic have taken up the mantle of manufacturing in Europe. These countries and their neighbors have seen tremendous growth in the manufacturing sector, and they are helping reaffirm Europe as a global manufacturing center. As of 2020, the program called ‘Move to 4.0’ was launched to support the transformation of existing manufacturing companies in Europe by diversifying or transforming their businesses through innovative technologies and new business models. Such marvelous growth in the manufacturing industry is expected to drive the third-party logistics market.

Increase in trading activities due to globalization

Dynamic market conditions and improvement in the global economy are the key factors that drive globalization. Furthermore, various activities related to trade have been witnessed to increase, owing to rise in globalization. Hence, manufacturers or retailers find it difficult to keep a track of these activities in an efficient manner, third-party logistics companies help these manufacturers to keep track of and control these activities. This factor is expected to drive the growth of the third-party logistics market. For instance, in 2019, Nepal and China signed the Protocol on Implementing Agreement on Transit and Transport along with 6 other agreements to enable Nepal to access Chinese sea and land ports. China has agreed to let Nepal use Tianjin, Shenzhen, Lianyungang, and Zhanjiang open seaports; and Lanzhou, Lhasa, and Xigatse dry ports for trading with other countries.

Moreover, development of the overseas market is a significant factor that fuels the growth of the industry. third-party logistics services are extremely vital for price-sensitive customers who require a wider choice of high-quality products with timely delivery. Increase in trading activities due to globalization fuels the growth of the global third-party logistics market.

Poor infrastructure and higher logistics costs

Third-party logistics providers demand for good infrastructure, supply chain, and trade facilitation. Without these, firms have to build up more stock reserves and working capital, which can strongly affect national and regional competitiveness due to high financial costs. In addition, lack of infrastructure hinders the contract logistics market as it increases costs and reduces supply chain reliability. These include significant inefficiencies in transport, poor condition of storage infrastructure, complex tax structure, low rate of technology adoption, and poor skills of logistics professionals. For instance, according to a report by the Economist, an international newspaper, Latin America lacks adequate infrastructure. More than 60% of the roads of the region are unpaved. Firms need high inventories to account for contingencies, due to poor transport infrastructure, which can result in higher overall logistics costs. Poor infrastructure, high inventory prices, and insufficient warehousing space are thus expected to hamper the third-party logistics market growth.

Surge in use of IT solutions and software

Adoption of IT solutions in logistics service is extremely essential for smooth and efficient flow of the entire supply chain. IT solution adds economic value to the supply chain. IT solution plays a vital role for timely delivery and tracing goods in supply chain. Various software, such as warehouse management system, Electronic Data Interchange (EDI), and cloud computing, help contract logistics service providers to enhance their real-time monitoring and tracking capabilities. Increase in adoption of IT solutions and software is anticipated to increase the efficiency and smoothen the flow of supply chain, providing a remarkable growth opportunity for the key players operating in the market. For instance, in January 2021, DB Schenker collaborated with Microsoft to develop solutions for enhanced supply chain performance on the Azure platform. This made the supply chains solution offerings more efficient & data driven, and consequently resulted in a better experience for its customers. For instance, Kestraa, a Brazilian logistics startup, raised $2.7 million funding from Canary Ventures and various angel investors for logistics software. Kestraa is a cloud-based B2B solution for freight-management, connecting ship-owners, cargo agents, freight forwarders, government systems, and more. The software allows stakeholders to manage their shipments, anticipate delays, and optimize on delivery time. Customers are also able to monitor the delivery process of their goods. Thus, surge in use of information technologies (IT) solutions & software is expected to create lucrative opportunities in the market during the forecast period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the third-party logistics (3pl) market analysis from 2021 to 2031 to identify the prevailing third-party logistics (3pl) market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the third-party logistics (3pl) market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global third-party logistics (3pl) market trends, key players, market segments, application areas, and market growth strategies.

Third-party Logistics (3PL) Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 2.8 trillion |

| Growth Rate | CAGR of 8.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 290 |

| By Mode of Transport |

|

| By Service Type |

|

| By Industry |

|

| By Region |

|

| Key Market Players | C.H. Robinson Worldwide, Inc., XPO Logistics Inc., United Parcel Service of America, Inc., DHL International GmbH, Kuehne+Nagel Inc., db schenker, Geodis, a.p. moller - maersk, DSV, FedEx Corporation |

Analyst Review

The development of logistics infrastructure in the Asia and Middle East regions, rapid growth of the e-commerce sector, and the development of new technologies are expected to significantly contribute to the market growth. Shippers focus on outsourcing the logistics activity to enhance their operations and cost-effectiveness. Furthermore, global shift toward dynamic logistics, especially in consumer goods, food and beverage, and medical equipment, presents a large-scale opportunity for the third-party logistics market. For instance, in March 2021, XPO Logistics Inc. & Nestlé, the largest food and beverage company of the world, announced their flagship distribution center & technology hub in the UK to deliver the high volume of retail products associated with Nestlé's food, dairy, nutrition, beverage, and confectionery ranges. Sustainability with advanced technology is the core consideration to accommodate the highest throughput of any warehouse in Nestlé's global network.

Similarly, the change in global supply chain to become more customer-centric enables the companies to outsource their supply chain activities to focus on adaptability and responsiveness. In the interim, omni-channel operation demands reliable, fast, and free shipping services, which has resulted in companies adopting a new business model to provide low-cost and on-demand delivery services. For instance, in October 2020, CEVA Logistics AG signed a three-year contract with largest toy retailer of Brazil, Ri-Happy Group. This contract includes warehousing, logistics, and e-commerce services. It supports all omnichannel capabilities of Ri-Happy Group in the coming years.

In addition, increase in investments by prominent vendors in product capabilities and business expansion is expected to fuel the market during the forecast period. For instance, in February 2022, GEODIS planned to open a new multi-user logistics facility in Coswig, Germany, to offer customers a wide range of services. These include inbound & outbound logistics, value-added services, after-sales, and return logistics, as well as high-tech services. Similarly, many market players are finding lucrative opportunities in emerging economies like China, Japan, and India, where the large populations are coupled with new innovations in numerous industries. For instance, in April 2020, Japanese logistics giant Yamato Holdings and Tokyo-based value chain firm Global Brain raised a $46.5 million fund to promote digital transformation in the logistics industry in

Japan. The fund focuses on investing in Japanese & foreign startups with technologies and business models evolving logistics & supply chain management. Hence, the digitization of infrastructure & improved customer service propels the third-party logistics market growth across the globe.

Among the analyzed regions, Asia-Pacific is the highest revenue contributor, followed by North America, Europe, and LAMEA. On the basis of forecast analysis, Europe is expected to lead during the forecast period, owing to the growing technology adoption in the logistics field, increasing food & groceries industry in Europe, and rise in e-commerce market

The global third-party logistics (3PL) market was valued at $1.3 trillion in 2021, and is projected to reach $2.8 trillion by 2031, growing at a CAGR of 8.8% from 2022 to 2031.

A.P. Moller – Maersk, C.H. Robinson Worldwide, Inc., DB Schenker, DHL International GmbH, DSV, FedEx Corporation, GEODIS, Kuehne+Nagel Inc., UPS, and XPO Logistics Inc. are the top companies that holds the market share in third-party logistics (3PL).

Domestic transportation management is the leading application of third-party logistics (3PL) market.

Asia-Pacific is the largest regional market for third-party logistics (3PL).

Increase in trading activities due to globalization and development of the e-commerce industry are the upcoming trends of third-party logistics (3PL) market in the world.

Loading Table Of Content...