3D Printing Filament Market Research, 2031

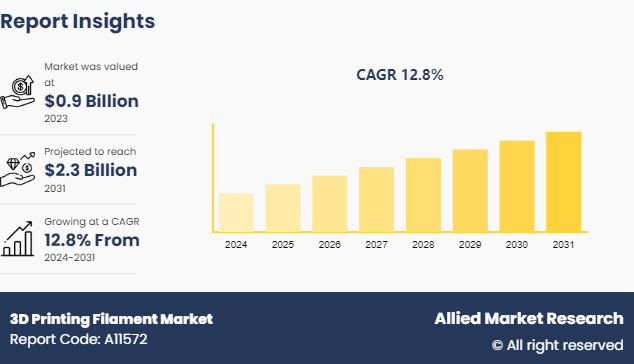

The global 3D printing filament market was valued at $0.9 billion in 2023, and is projected to reach $2.3 billion by 2031, growing at a CAGR of 12.8% from 2024 to 2031.

Market Introduction and Definition

3D printing filament is a thermoplastic material used in fused deposition modeling (FDM) 3D printers. It is typically supplied as a spool of filament that the printer heats and extrudes through a nozzle to build objects layer by layer. Common types of filaments include PLA (polylactic acid) , ABS (acrylonitrile butadiene styrene) , PETG (polyethylene terephthalate glycol) , and more specialized materials like nylon, TPU (thermoplastic polyurethane) , and composites infused with wood or metal.

Applications of 3D printing filament span various fields, including prototyping, manufacturing, medical devices, and consumer goods. It is used to create functional parts, custom tools, educational models, artistic pieces, and even prosthetics, allowing for rapid, customizable, and cost-effective production.

Key Takeaways

- The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

- The 3D printing filament market is fragmented in nature among prominent companies such as American Filament, TREED FILAMENTS, EU3dfuel, Shenzhen ECO Industrial Co., Ltd., Eureka Technologies Inc., Atomic Filament, Precision 3D Filament, Spectrum Filaments, AlmightyFila, DUCHOFILLA, and Namu3d.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities) , public policy analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

- Latest trends in global 3D printing filament market such as undergoing R&D activities, regulatory guidelines, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 2,200 3D printing filament-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global 3D printing filament market.

Key Market Dynamics

Growing population base has led to rapid urbanization in both developed and developing economies such as the U.S., China, India, and others. This has increased government spending on architecture sector to develop various upcoming infrastructure projects. For instance, according to a report published by National Investment Promotion and Facilitation Agency, the infrastructure activities accounted for 13% share of the total foreign direct investment (FDI) inflows in 2021. Furthermore, rapid development of water supply, sanitation, urban transport, schools, and healthcare are aiding the growth of the building & architecture sector. Architects use 3D printing to create detailed scale models of buildings and structures, facilitating better visualization and planning. Moreover, 3D printing is being explored for producing construction components, such as customized bricks and structural elements, potentially reducing construction times and costs. Thus, with growing construction activities, the demand for 3D printing filament is expected to increase, thereby driving the growth of the global market.

Furthermore, rise in severity of diseases have led the healthcare sector in both developed and developing economies such as the U.S., China, India, and others to witness a significant growth. For instance, according to a report published by India Brands Equity in 2023, the Indian healthcare market that was valued at $110 billion in 2016 and is projected to reach $638 billion by 2025. 3D printing is revolutionizing the production of medical devices and implants, offering tailored solutions that improve patient outcomes. Additionally, surgeons use 3D printed anatomical models for pre-surgical planning and training, enhancing the accuracy and success of complex procedures. These factors may surge the demand for 3D printed filament in the growing healthcare sector during the forecast period.

However, many 3D printing filaments, especially common ones like polylactic acid (PLA) and acrylonitrile butadiene styrene (ABS) , often lack the mechanical strength required for industrial applications. This limits their use in producing parts that must withstand significant stress or wear. Moreover, 3D filaments like PLA have low thermal resistance, making them unsuitable for applications involving high temperatures. This restricts their utility in industries such as automotive and aerospace, where parts often operate under extreme conditions. This factor may hamper the growth of the 3D printing filament market during the forecast period.

On the contrary, he development of composite filaments, which incorporate materials such as carbon fiber, glass fiber, or metal, opens new possibilities for producing parts with superior strength, stiffness, and thermal resistance. These materials cater to industries requiring high-performance components. Furthermore, the growing demand for sustainable solutions is driving the development of bio-based and biodegradable filaments. Materials such as PLA (polylactic acid) and PHA (polyhydroxyalkanoate) offer environmentally friendly alternatives to traditional plastics, appealing to eco-conscious consumers and businesses. These factors altogether may create remunerative opportunities for the 3D printing filament market during the forecast period.

Market Segmentation

The 3D printing filament market is segmented on the basis by material type, end-use industry, and region. By material type, the market is classified into metals, plastics, alloys, and ceramics. By end-use industry, the market is classified into automotive, aerospace & aviation, household equipment, petrochemical, medical, electronics, and others. Region-wise the market is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America represents a significant market for 3D printing filament, driven by increasing adoption of 3D printing technology, advancements in filament materials, cost reduction and accessibility, supply chain flexibility, and other factors. The aerospace & aviation sector in the U.S. is witnessing a significant growth owing to rise in technological advancements, increasing defense spendings, rise in space exploration programs, and government support. For instance, according to a report published by Aerospace Industries Association in 2022, the aerospace & defense sector in the U.S. rose by 11.2% and reached a total value of $100.4 billion from 2020 to 2021. The utilization of 3D printing filaments in the growing aerospace & defense sector enables rapid prototyping of various aerospace parts and equipment, allowing for rapid iteration and testing of designs. Furthermore, producing prototypes using 3D printing is often cheaper than traditional manufacturing methods, especially for complex geometries. This factor has led the 3D printing filament market to witness a significant growth in the North America region.

Additionally, Canada has a long history of automotive manufacturing with well-established infrastructure and expertise. Major global automakers such as General Motors, Ford, and Stellantis (formerly Fiat Chrysler) have significant production facilities in Canada. According to a report published by International Trade Administration in 2022, Canada’s automotive industry grew by 23% in 2021 and 15% in 2022 owing to rise in import of passenger vehicles. The use of 3D printing filaments in the Canada’s automotive sector is revolutionizing the industry by providing numerous advantages in terms of design flexibility, cost reduction, and production efficiency. This may further augment the growth of the 3D printing filament market in the North America region during the forecast period.

Competitive Landscape

The major players operating in the 3D printing filament market include American Filament, TREED FILAMENTS, EU3dfuel, Shenzhen ECO Industrial Co., Ltd., Eureka Technologies Inc., Atomic Filament, Precision 3D Filament, Spectrum Filaments, AlmightyFila, DUCHOFILLA, and Namu3d. Other players in the 3D printing filament market include WOL 3D, Solidspace Technology LLP, Manlon Polymers, Dream Polymers, and so on. Recently, in January 2023, Braskem S.A. acquired taulman3D, a leading 3D filament supplier of nylon, recycled PETG, and PET filaments to aerospace, automotive, healthcare, industrial, government and higher education professionals worldwide. This strategic acquisition has enhanced the product portfolio of Braskem S.A. for 3D printing filament.

Industry Trends

- In 2023, National Library of Medicine has developed a high-performance 3D printing filament that uses polymer materials such as polylactic acid (PLA) , and others. The utilization of polymers in 3d printing filament has surged its applications across prototyping, models, DIY projects, artistic objects, household items, low-wear toys, packaging, and biomedical applications.

- In 2024, researchers have developed the first 3D printable ocular resins, marking a significant breakthrough in manufacturing specialist lenses for implantation in the human.

- In May 2024, researchers have developed a technique that allows manufactures of metal machine parts with 3D printing technologies to conduct automated quality control of manufactured parts during the finishing process. The technique allows users to identify potential flaws without having to remove the parts from the manufacturing equipment, making the production time more efficient.

- In May 2024, a new technique for 3D printing medication has been developed that enables the printing of multiple drugs in a single tablet, paving the way for personalized pills that can deliver timed doses.

Public Policies

Several acts and regulations have been set-up to safeguard the use of 3D printing filament across various end-use sectors. For instance:

In U.S. :

- Consumer Product Safety Improvement Act (CPSIA) (Public Law 110-314) regulates the safety of consumer products, including those made with 3D printing materials. It mandates testing for harmful substances such as lead and phthalates in products intended for children.

- Federal Food, Drug, and Cosmetic Act (FD&C Act) (21 U.S.C. 301 et seq) regulates materials that come into contact with food, drugs, or cosmetics. For 3D printed items used in these areas, compliance with FDA guidelines is required.

- Toxic Substances Control Act (TSCA) (15 U.S.C. 2601 et seq) governs the use of chemical substances in the U.S. including materials used in 3D printing filaments to ensure they do not pose unreasonable risks to health or the environment.

In Europe:

- Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) (EC 1907/2006) mandates companies in Europe to register and assess the chemicals used in 3D printing filaments to ensure they do not harm human health or the environment.

- The General Product Safety Directive (GPSD) (2001/95/EC) ensures that products placed on the market are safe. It applies to 3D printed products and their materials, requiring manufacturers to ensure safety before the product is marketed.

- The Food Contact Materials Regulation (EC 1935/2004) governs materials that come into contact with food, including 3D printed items. It sets requirements to ensure these materials do not endanger human health or alter food composition.

In Asia-Pacific:

- Regulations on the Administration of Chemicals (Order No. 591) oversees the safety and environmental impact of chemicals, including those used in 3D printing filaments.

- Chemical Substances Control Law (CSCL) (Act No. 117 of 1973) regulates the manufacture and import of chemical substances in Japan to prevent environmental pollution and protect human health, applicable to 3D printing materials.

- Industrial Chemicals Act 2019 (Act No. 23 of 2019) oversees the regulation and assessment of industrial chemicals, including those used in 3D printing filaments, to ensure they do not pose undue risks to human health or the environment.

These regulations ensure the safe production, use, and disposal of 3D printing filaments, protecting consumers, workers, and the environment across different regions.

Key Sources Referred

- National Promotion and Facilitation Agency

- U.S. Development Authority

- East West Bank

- Science Direct

- International Trade Administration

- Invest In India

- Press Information Bureau

- U.S. Environmental Protection Agency

- European Union (EU) Regulations

- Aerospace Industries Association

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the 3d printing filament market analysis from 2024 to 2031 to identify the prevailing 3d printing filament market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the 3d printing filament market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global 3d printing filament market trends, key players, market segments, application areas, and market growth strategies.

3D Printing Filament Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 2.3 Billion |

| Growth Rate | CAGR of 12.8% |

| Forecast period | 2024 - 2031 |

| Report Pages | 350 |

| By Material Type |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Spectrum Filaments, DUCHOFILLA,, EU3dfuel, Eureka Technologies Inc., Precision 3D Filament, Atomic Filament, TREED FILAMENTS, AlmightyFila, Shenzhen ECO Industrial Co.,Ltd., American Filament |

Escalating demand from architecture sector, rise in demand from healthcare sector, and robust demand from electronics sector are the upcoming trends of 3D printing filament market in the globe.

Aerospace is the leading application of 3D printing filament market.

North America is the largest regional market for 3D printing filament.

The 3D printing filament market was valued at $0.9 billion in 2023, and is projected to reach $2.3 billion by 2031, growing at a CAGR of 12.8% from 2024 to 2031.

American Filament, TREED FILAMENTS, EU3dfuel, Shenzhen ECO Industrial Co.,Ltd., Eureka Technologies Inc., Atomic Filament, Precision 3D Filament, Spectrum Filaments, AlmightyFila, DUCHOFILLA, and Namu3d are the top companies to hold the market share in the 3D Printing Filament market.

Loading Table Of Content...