3D Printing Gases Market Research, 2033

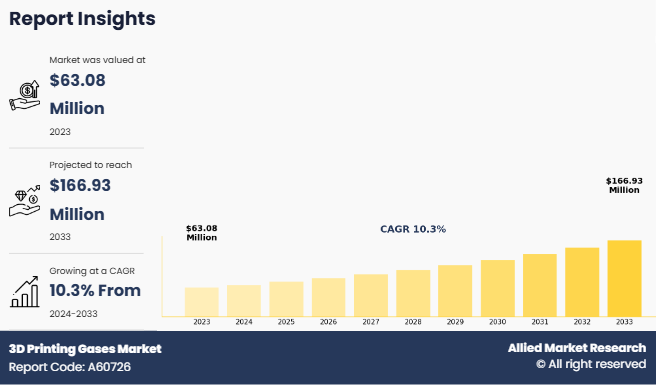

The global 3d printing gases market was valued at $63.1 million in 2023, and is projected to reach $166.9 million by 2033, growing at a CAGR of 10.3% from 2024 to 2033. 3D printing gases refer to a range of industrial gases used in additive manufacturing (AM) processes to enhance the efficiency, precision, and quality of printed components. These gases help in controlling the printing environment by preventing oxidation, improving material fusion, and enhancing mechanical properties. Commonly used 3D printing gases include argon, nitrogen, helium, hydrogen, and carbon dioxide. Their selection depends on the material being printed and the specific requirements of the 3D printing technology in use, such as Selective Laser Sintering (SLS), Direct Metal Laser Sintering (DMLS), and Stereolithography (SLA).

Introduction

3D printing gases play a vital role in various applications across the additive manufacturing process. One of the most critical applications is inert atmosphere control, where gases like argon and nitrogen create oxygen-free environments that prevent oxidation and contamination of metal powders. This is particularly crucial in metal 3D printing, ensuring the integrity and strength of components. Another important application is material sintering and melting, where laser-based 3D printing techniques rely on these gases to facilitate efficient sintering and fusion of metal powders. This improves the mechanical properties of printed parts, reducing porosity and increasing durability.

In high-temperature 3D printing, gases such as helium and nitrogen are used for cooling and heat dissipation. These gases help regulate temperature fluctuations, thereby reducing residual stress in printed parts and preventing warping or cracking. In addition, during post-processing, gases like carbon dioxide and nitrogen assist in support material removal, enabling the efficient elimination of excess materials and improving the surface finish of printed objects. This is especially beneficial in intricate and detailed prints that require a clean final product.

In the automotive industry, 3D printing is widely used for prototyping, designing, and producing end-use parts. Gases such as argon and helium play a crucial role in maintaining the stability of materials like titanium and aluminum during printing. These gases improve the mechanical integrity of printed car parts, such as exhaust components, brackets, and engine parts, thereby enhancing fuel efficiency and vehicle performance.

Key Takeaways

- The 3D printing gases market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global 3D printing gases markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The key players in the 3D printing gases market are Linde plc, Air Products and Chemicals, Inc., Airgas, Inc., Messer Group GmbH, TAIYO NIPPON SANSO CORPORATION, Air Liquide, Gaztron Engineering Private Limited, Matheson Tri-Gas, Inc., Coregas Pty Ltd., and Universal Industrial Gases. They have adopted strategies such as acquisition, product launch, merger, and expansion to gain an edge in the market.

Market Dynamics

Growing demand for metal 3D printing is expected to drive the growth of the market. Rise in adoption of metal 3D printing is driving demand for high-purity inert gases like argon and nitrogen, essential for maintaining controlled environments in additive manufacturing (AM) processes such as DMLS, EBM, and SLM. These gases prevent oxidation and ensure high-quality, defect-free prints. Industries such as aerospace, automotive, and medical are increasingly using metal AM for complex, high-performance components. In aerospace, high-purity argon is crucial for producing lightweight, durable parts, while the automotive sector leverages AM for engine components and battery housings. In August 2024, Australian company SPEE3D deployed 10 WarpSPEE3D metal 3D printers to Ukraine for rapid on-site production of vehicle parts using cold spray technology. Also, in June 2022, IIT Jodhpur developed an indigenous metal 3D printer based on DED technology, aiming to lower costs and expand accessibility across industries.

However, high cost of specialty gases is expected to hinder the growth of the 3D printing gases market. High cost of specialty gases like helium and argon remains a barrier to their widespread use in 3D printing, particularly in cost[1]sensitive industries. These gases are essential for maintaining controlled environments, preventing oxidation, and ensuring structural integrity. Helium’s limited global reserves and extraction challenges drive its fluctuating prices, while argon’s energy-intensive separation process adds to its cost. Ultra-high purity (UHP) gases (≥99.995% purity) are even more expensive due to complex production processes. While sectors like aerospace and medical justify these costs for precision and reliability, general manufacturing often seeks cost-effective alternatives such as gas recycling, optimized usage, and innovative gas mixtures to reduce expenses.

Segments Overview

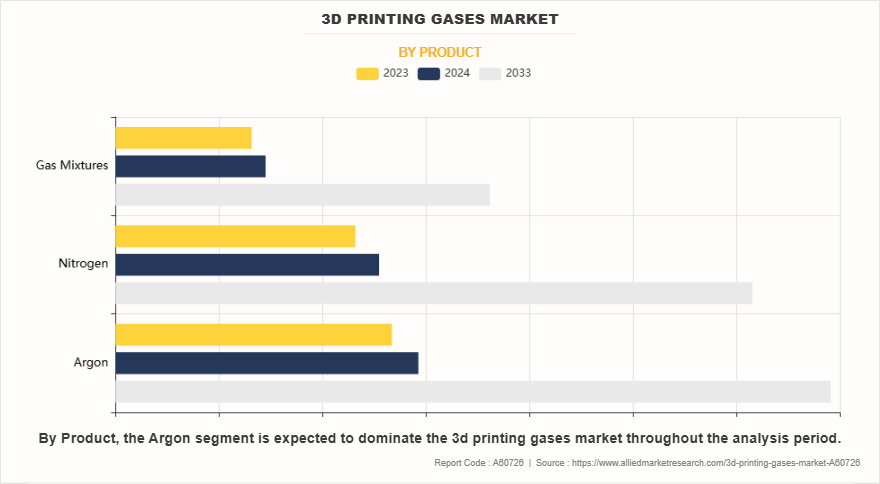

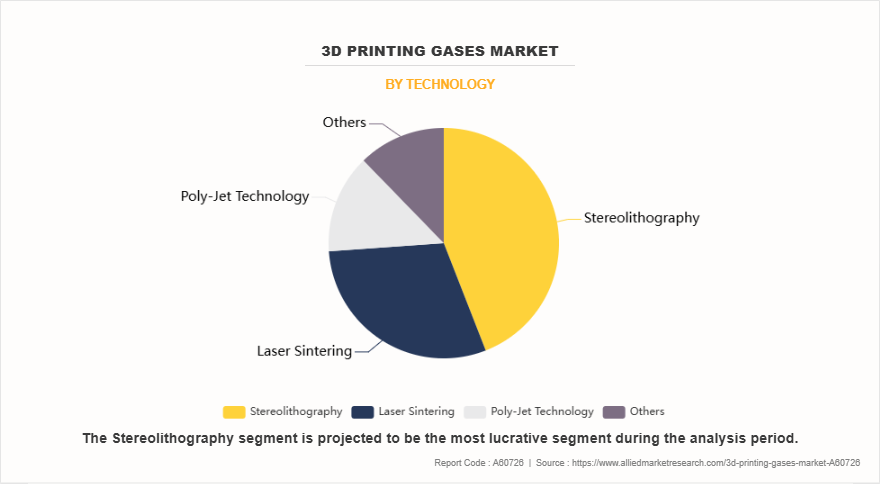

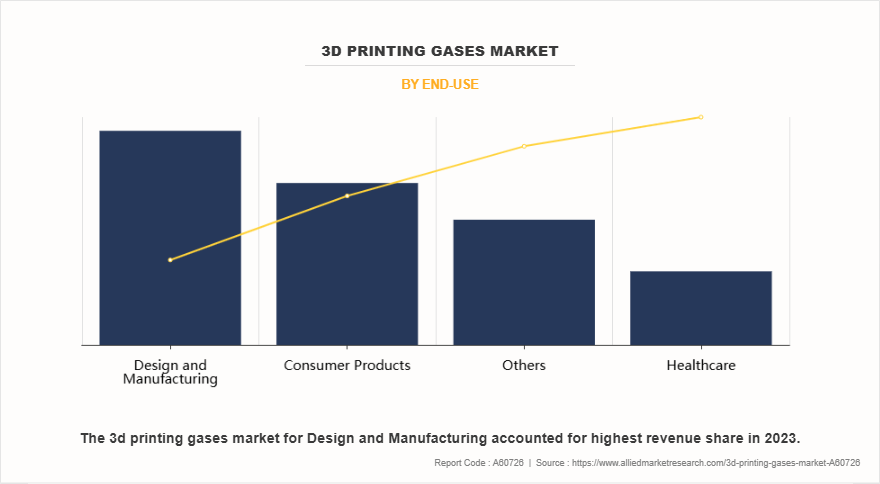

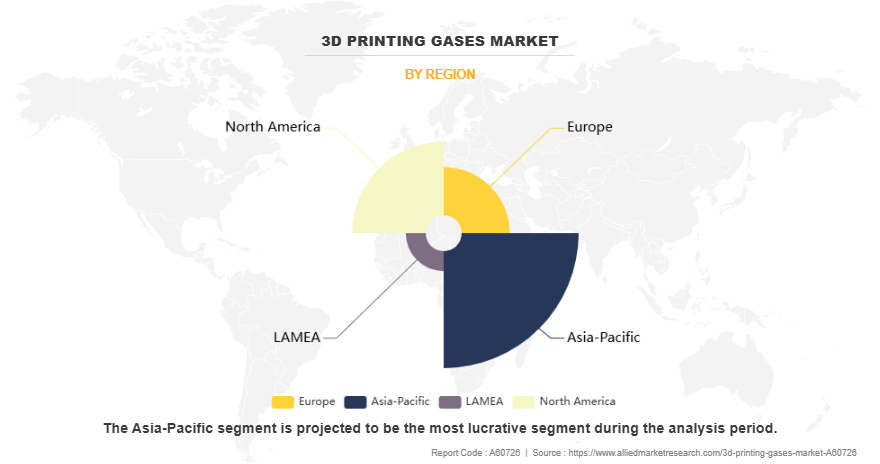

The 3D printing gases market is segmented into product, technology, end-use, and region. On the basis of product, the market is divided into argon, nitrogen, and gas mixtures. On the basis of technology, the 3D printing gases market is categorized into stereolithography, laser sintering, poly-jet technology, and others. On the basis of end[1]use, the market is classified into design and manufacturing, healthcare, consumer products, and others. Region-wise, the market is divided into North America, Europe, Asia-Pacific, and LAMEA.

On the basis of product, the argon segment dominated the market in 2023. Argon plays a crucial role in 3D printing, particularly in metal additive manufacturing (AM) processes such as Selective Laser Melting (SLM), Electron Beam Melting (EBM), and Direct Metal Laser Sintering (DMLS). As an inert gas, argon creates a protective atmosphere within the build chamber, preventing oxidation and unwanted chemical reactions during the high-temperature melting and solidification of metal powders. In May 2023, INOX Air Products, a leading industrial and medical gases manufacturer in India, announced plans to invest approximately $360 million (3,000 crore) by 2025. This investment aims to establish ten new sites across the country to meet the growing demand for industrial gases, including argon.

On the basis of technology, the stereolithography segment dominated the market in 2023. In stereolithography (SLA), 3D printing process utilizes ultraviolet (UV) light to solidify liquid photopolymer resins layer by layer, and gases play a vital role in maintaining print quality and enhancing material performance. While SLA does not rely on gases as directly as some additive manufacturing processes like selective laser sintering (SLS) or direct metal laser sintering (DMLS), certain gases are still utilized to create a controlled environment for printing and post-processing. Nitrogen is commonly employed to create an inert atmosphere during printing or post-curing processes, preventing unwanted oxidation and degradation of the resin. Exposure to oxygen can interfere with the polymerization process, leading to incomplete curing, weaker mechanical properties, or surface defects.

On the basis of end-use, the design and manufacturing segment dominated the market in 2023. The use of gases in 3D printing plays a crucial role in enhancing print quality, improving material properties, and ensuring a controlled environment during the additive manufacturing process. In metal 3D printing, particularly in powder bed fusion processes, argon and nitrogen are used to prevent oxidation and unwanted chemical reactions. Argon, being a highly inert gas, is preferred when working with reactive metals such as titanium and aluminum alloys, ensuring the final product retains its intended material properties. Similarly, nitrogen is used in some polymer and metal applications to prevent discoloration and degradation during sintering or fusion.

Based-on region, Asia-Pacific dominated the 3D printing gases market in 2023. The Asia-Pacific region is witnessing surge in adoption of 3D printing gases, driven by rapid industrialization, advancements in additive manufacturing, and growing emphasis on precision engineering. Gases such as argon, nitrogen, and helium play a critical role in ensuring the quality and stability of metal and polymer-based 3D printing processes. Countries such as China, Japan, South Korea, and India are driving demand for additive manufacturing technologies, fueled by the rapid growth of their aerospace, automotive, and healthcare industries.

Competitive Analysis

The major prominent players operating in the 3D printing gases market include Linde plc, Air Products and Chemicals, Inc., Airgas, Inc., Messer Group GmbH, TAIYO NIPPON SANSO CORPORATION, Air Liquide, Gaztron Engineering Private Limited, Matheson Tri-Gas, Inc., Coregas Pty Ltd., and Universal Industrial Gases.

In February 2023, the International Organization for Standardization (ISO) and ASTM International published the ISO/ASTM 52931 standard, focusing on safety in additive manufacturing. This standard addresses safety considerations from the receipt of raw materials to the final output of parts, ensuring comprehensive safety protocols in 3D printing processes. The development of this standard was led by France, with contributions from various international experts, including the National Institute for Research and Safety (INRS). Building on this, in March 2023, efforts commenced to transpose these safety standards to polymer additive manufacturing, with an expected completion by the end of 2024.

In December 2023, Immensa, a digital inventory platform specializing in additive manufacturing for the energy sector, collaborated with Det Norske Veritas (DNV) to launch a global guideline for digitizing spare parts in the energy industry. This initiative aims to address the $30 billion annual losses related to inventory management in the energy sector by providing a structured approach to assess, digitize, and manufacture spare parts on-demand using additive manufacturing. The guideline outlines a threefold structure: evaluating parts for digital inventory viability, integrating viable parts into a digital platform, and manufacturing these parts as needed.

In February 2022, the Indian Ministry of Electronics and Information Technology (MeitY) unveiled the National Strategy for Additive Manufacturing. This policy aims to position India as a significant player in the global additive manufacturing sector by targeting the development of 50 India-specific technologies related to materials, machines, and software by 2025. Additionally, the strategy seeks to establish 100 new startups and introduce 500 new products in the additive manufacturing domain, potentially generating employment for at least 100,000 skilled workers over the next three years

Key Regulations for 3D printing gases

United States (EPA)

Clean Air Act (CAA): This act regulates emissions of air pollutants, including volatile organic compounds (VOCs) commonly found in 3D printing applications.

Resource Conservation and Recovery Act (RCRA): This act oversees the proper disposal of hazardous gases to prevent environmental contamination.

European Union (ECHA)

Industrial Emissions Directive (IED): This act establishes emission limits for gases released during industrial processes to minimize environmental impact.

F-Gas Regulation: This act restricts the use of fluorinated gases with high global warming potential to mitigate climate change effects.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the 3d printing gases market analysis from 2023 to 2033 to identify the prevailing 3d printing gases market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the 3d printing gases market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global 3d printing gases market trends, key players, market segments, application areas, and market growth strategies.

3D Printing Gases Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 166.9 million |

| Growth Rate | CAGR of 10.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 406 |

| By End-Use |

|

| By Product |

|

| By Technology |

|

| By Region |

|

| Key Market Players | TAIYO NIPPON SANSO CORPORATION, Airgas, Inc., Coregas Pty Ltd., Linde PLC, Air Products and Chemicals, Inc., Gaztron Engineering Private Limited, Universal Industrial Gases, Matheson Tri-Gas, Inc., Messer Group GmbH, Air Liquide |

Analyst Review

According to the opinions of various CXOs of leading companies, advancements in materials & printing technologies is expected to drive the growth of market. Rapid development of new materials in additive manufacturing is significantly driving the demand for process-specific gases. As industries increasingly adopt advanced metal alloys, high-performance polymers, and composite materials for 3D printing, the role of gases in ensuring print quality, material integrity, and process efficiency becomes more critical. In metal additive manufacturing, for instance, materials such as titanium, aluminum, and nickel-based superalloys require inert gases like argon and nitrogen to create controlled atmospheres that prevent oxidation and contamination. In February 2025, Ireland witnessed the completion of its first 3D-printed homes in Dundalk, Co Louth. These two-storey, three[1]bedroom houses were built using automated concrete printing technology, reducing construction time and costs. The project, completed in six months with just 12 days of printing, demonstrated a 60% faster completion rate as compared to traditional methods.

However, regulatory and safety concerns are expected to hamper the growth of 3D printing gases market. Strict regulations governing the handling, storage, and transportation of industrial gases present a significant challenge to the growth of the 3D printing gases market. Since gases such as argon, nitrogen, helium, and specialty gas mixtures are classified as hazardous materials, they are subject to stringent safety and environmental regulations imposed by organizations such as the Occupational Safety and Health Administration (OSHA), the Environmental Protection Agency (EPA), and the Department of Transportation (DOT) in the U.S., as well as similar regulatory bodies worldwide. Compliance with these regulations requires businesses to invest in specialized storage solutions, monitoring equipment, and trained personnel, adding to operational costs and logistical complexities. All these factors are expected to hamper the growth of the market in future.

The global 3D printing gases market was valued at $63.1 million in 2023, and is projected to reach $166.9 million by 2033, growing at a CAGR of 10.3% from 2024 to 2033.

The key players operating in the 3D printing gases market include Linde plc, Air Products and Chemicals, Inc., Airgas, Inc., Messer Group GmbH, TAIYO NIPPON SANSO CORPORATION, Air Liquide, Gaztron Engineering Private Limited, Matheson Tri-Gas, Inc., Coregas Pty Ltd., and Universal Industrial Gases.

Asia-Pacific is the largest region for the 3D printing gases

Stereolithography is the leading technology of 3D printing gases market.

Customization in gas mixtures are the upcoming trends of 3D printing gases market.

Loading Table Of Content...

Loading Research Methodology...